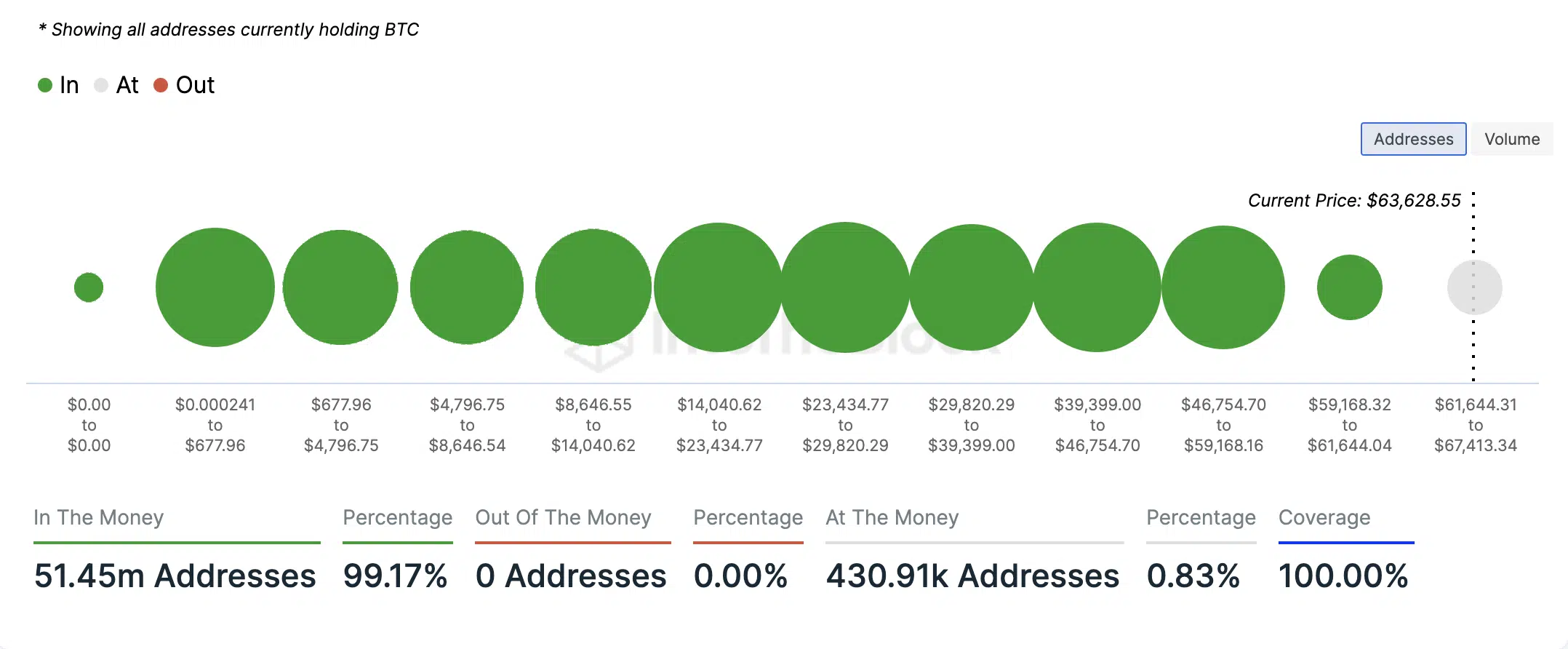

- 99% of addresses holding BTC did so at a profit at press time.

- BTC’s MVRV ratio sat at its highest level since 2021.

Bitcoin’s [BTC] recent surge to a three-year high has triggered a wave of profitability for its investors, with a remarkable 99.17% of holders sitting on profits at press time, data from IntoTheBlock showed.

According to the on-chain data analytics platform, this represented 51.45 million of all addresses that held the leading crypto asset. At its press time value of $63,215, no BTC holder is deemed to be “out of money.”

Source: IntoTheBlock

While some profit-taking activity may be underway, this was bullish for BTC, as there remained a general decline in selling pressure from holders attempting to break even on their positions.

Commenting on the possibility of a rally above its current price mark, crypto analyst Ali_Charts, in a recent post on X (formerly Twitter), noted that BTC has a major “support wall” between $54,300 and $56,200.

There is literally no resistance ahead of #Bitcoin. All we see is a major support wall between $54,300 and $56,200 where 903,540 addresses bought nearly 500,000 $BTC. pic.twitter.com/ZMeVkWyS4A

— Ali (@ali_charts) February 28, 2024

This means many addresses (903,540) had accumulated the coin when it traded within that price range.

Hence, there is a “support wall” which could potentially prevent the price from dropping significantly if it approaches that level.

Ali added that these addresses collectively held nearly 500,000 BTC, reinforcing the idea that BTC had significant support within the $54,300 and $56,200 and no resistance ahead of it.

Bitcoin prints green

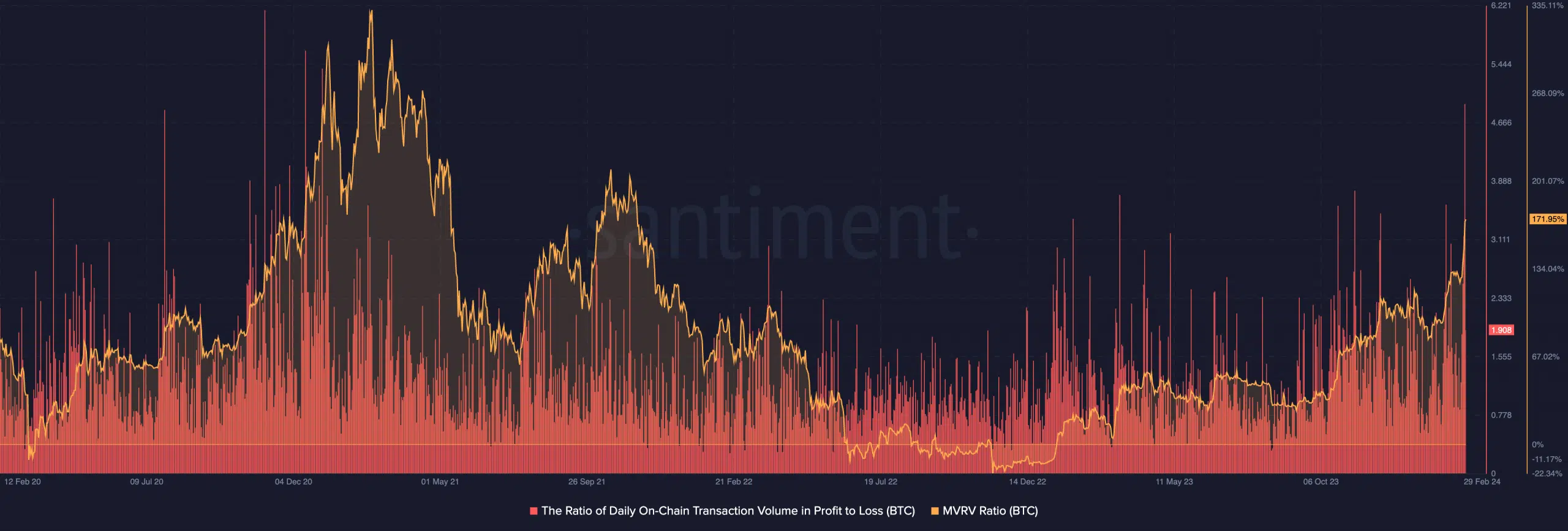

AMBCrypto found that BTC’s rally above $63,000 on the 28th of February caused its daily ratio of transaction volume in profit to loss to surge to its highest level in four years.

According to data from Santiment, this ratio was 4.91, suggesting that for every transaction involving BTC that ended in a loss on that day, 4.91 transactions returned a profit.

The last time this ratio was this high was on the 17th of December 2020.

Similarly, the coin’s Market Value to Realized Value (MVRV) ratio, was spotted at a three-year high of 171.95% at press time.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The MVRV Ratio is used to assess whether an asset is overvalued or undervalued relative to its historical price movements.

Source: Santiment

This suggested that most coin holders were guaranteed an average of 172% profit on their investments if they sold their BTCs at the press time market value.