- Despite its recent price hike, the number of TON’s long-term investors dropped on the charts

- In case of a sustained bull rally, TON might hit $6.85 soon

The crypto market has once again fallen victim to a correction, as most crypto price charts were red at press time. However, Toncoin [TON] had other plans, as it was among the handful of cryptos that managed to remain bullish.

Hence, it’s worth taking a look at what helped TON and whether this bull rally would continue.

Toncoin takes the lead

CoinMarketCap’s data revealed that top cryptos like Bitcoin [BTC] and Ethereum [ETH] were struggling to push their prices up. Meanwhile, TON behaved differently as its price hiked by more than 6% in the last 24 hours.

At the time of writing, Toncoin was trading at $6.70 with a market capitalization of over $16.8 billion, making it the 8th largest crypto.

AMBCrypto reported earlier that Binance, one of the world’s largest exchanges, listed TON. This major development played a major role in turning TON bullish. However, the recent hike didn’t push many addresses into profit as IntoTheBlock’s data revealed that only 35% of investors were “in money.”

Notably, investors holding TON for more than 1 year have also been declining, suggesting that they were selling the coin for profit.

Source: IntoTheBlock

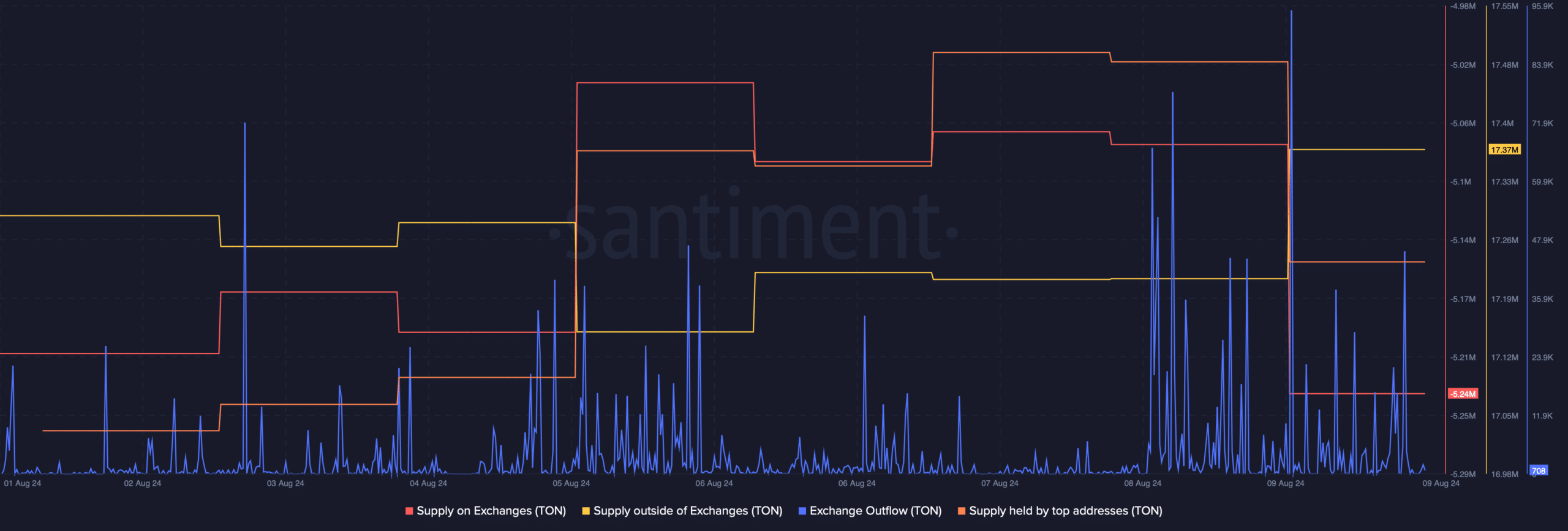

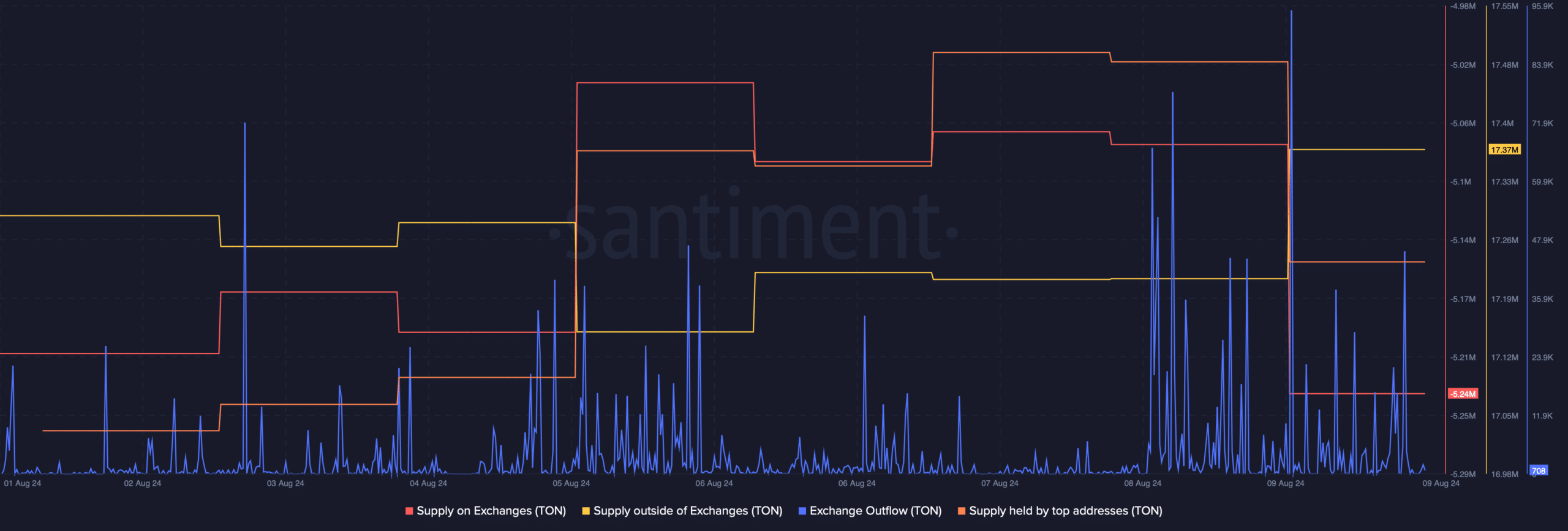

AMBCrypto then analyzed Santiment’s data to better understand investor behavior.

We found that buying pressure on the token appreciated over the last few days. This was evidenced by the drop in its supply on exchanges and a rise in its supply outside of exchanges.

Additionally, TON’s exchange outflows also spiked, further indicating a rise in buying pressure. However, after a sharp spike, Toncoin’s supply held by top addresses dropped. This indicated that the top players in the crypto space were selling, possibly hinting at a price correction in the coming days.

Source: Santiment

Will TON’s bull rally continue?

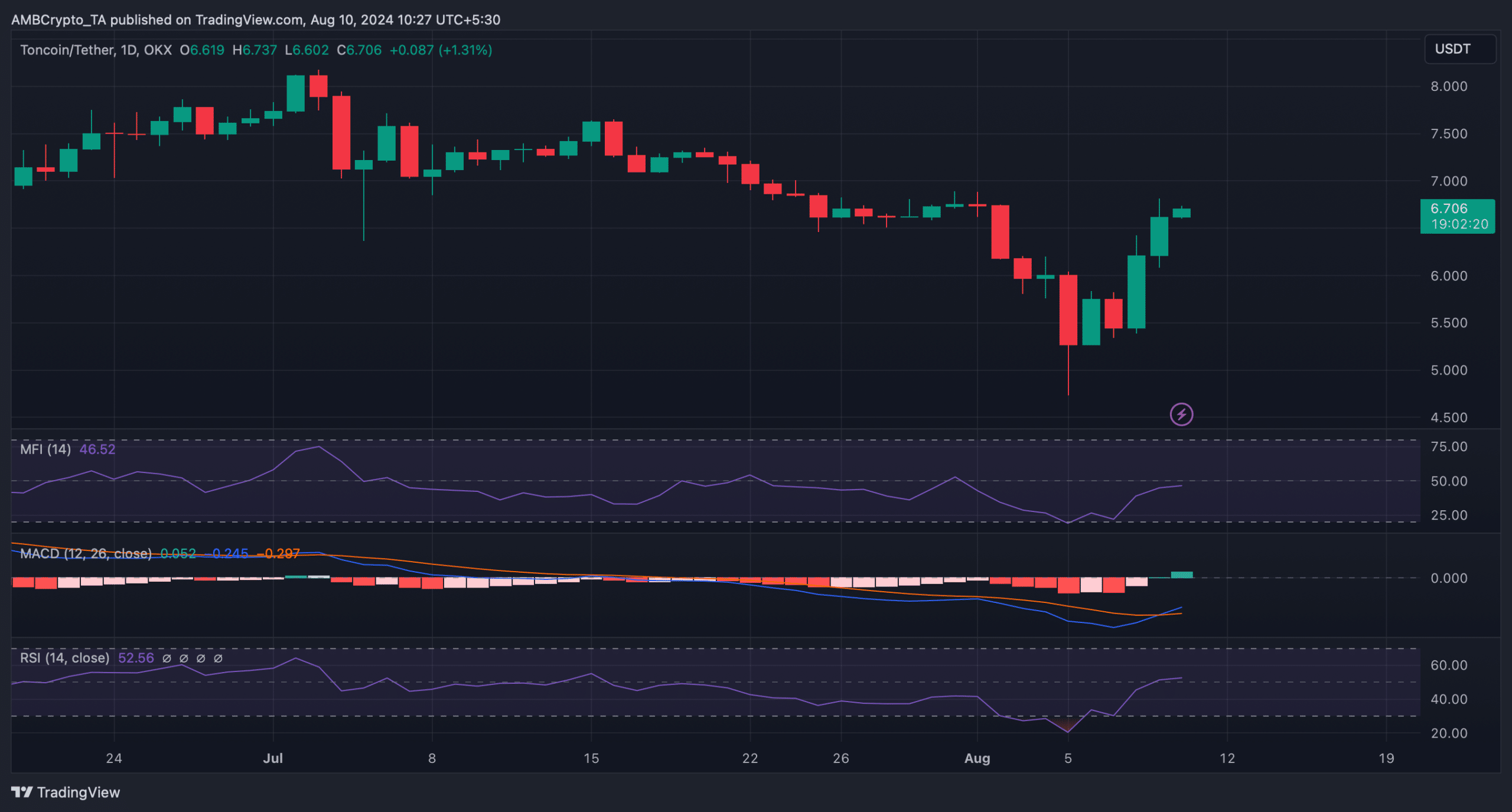

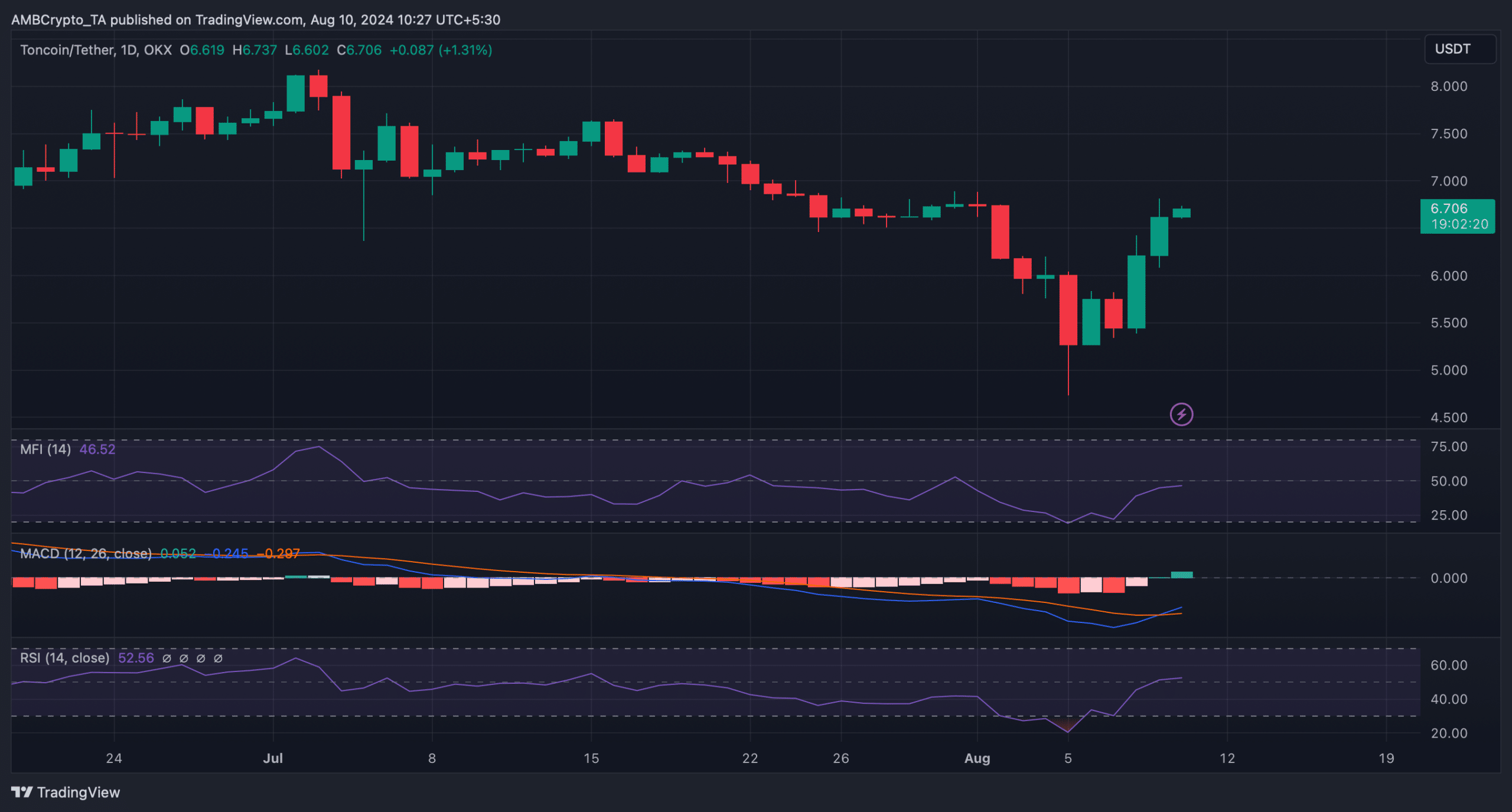

We then took a look at Toncoin’s daily chart. While a few metrics were bearish, most market indicators remained bullish. For example, the technical indicator MACD displayed a bullish crossover.

Its Relative Strength Index (RSI) registered an uptick too. TON’s Money Flow Index (MFI) also followed a similar trend, further suggesting that the chances of a sustained price hike were high.

Source: TradingView

Is your portfolio green? Check out the TON Profit Calculator

Finally, AMBCrypto’s look at Hyblock Capital’s data revealed that TON would face a massive rise in liquidation at $6.85.

Therefore, it would be crucial for Toncoin to go above that market in order to continue its bull rally. In the event of a bearish takeover, then investors might see TON dropping to $6.02.

Source: Hyblock Capital