- Avalanche was in a long-term downtrend but appeared likely to reach the $30 level soon.

- Sustained gains beyond that region could be difficult and could see a retracement and consolidation phase.

Avalanche [AVAX] was trending higher in the lower timeframes. Its price drop to $20 was followed by a consolidation phase that lasted almost two weeks.

A recent report highlighted the bullish enthusiasm behind the token.

Since the 16th of August, Avalanche crypto has surged by just over 30%. Technical analysis showed that these gains could continue for a few more days.

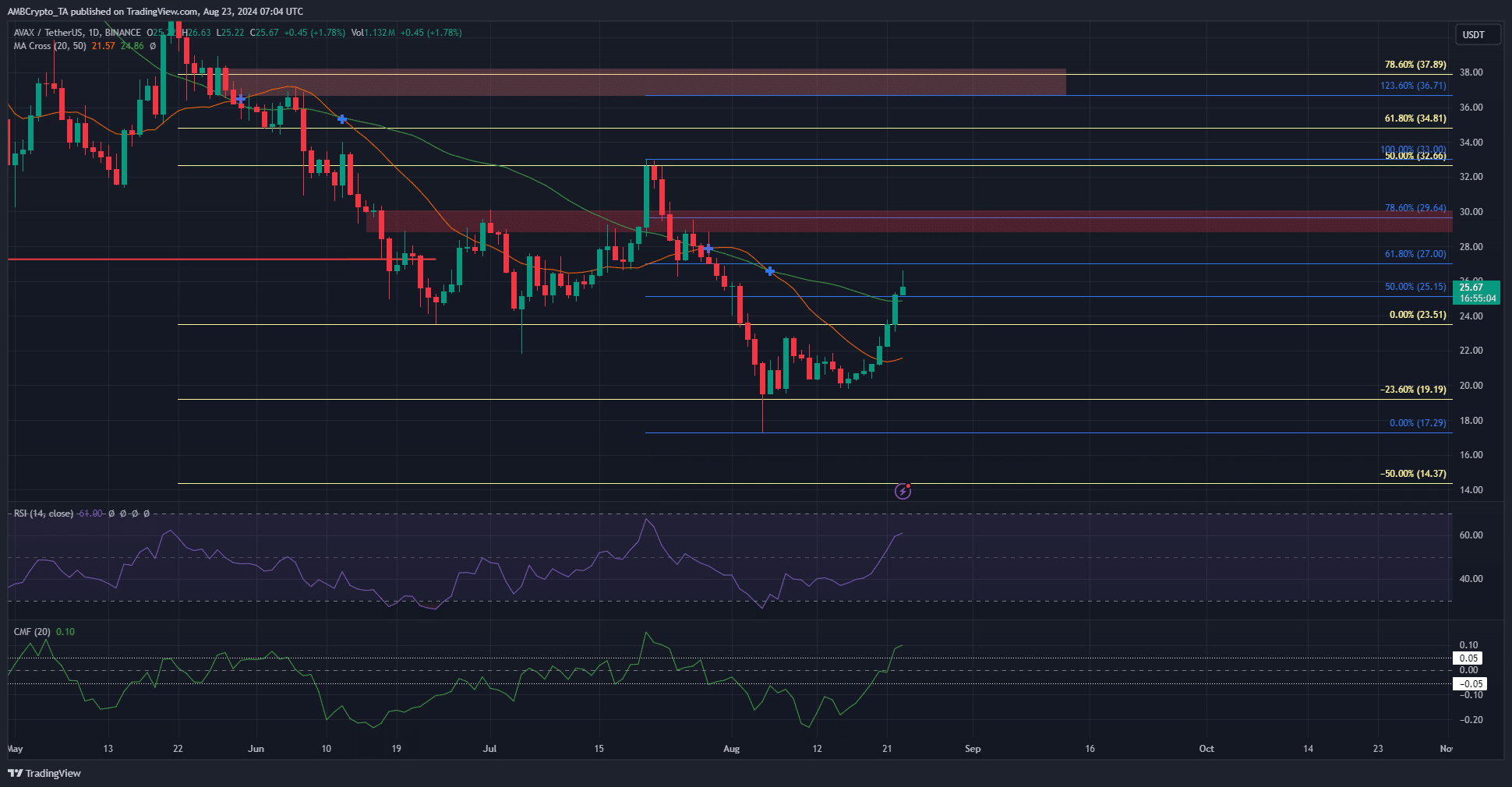

Two sets of Fibonacci levels to tell the AVAX price action tale

Source: AVAX/USDT on TradingView

The price drop in May and June from $41.8 to $23.51 was used to plot a set of Fibonacci levels (yellow) while the drop from $33 to $17.29 was used to plot another (blue).

The more recent drop highlighted $29.64 as a key resistance level.

This coincided with an area that Avalanche crypto bounced from in April, but flipped to resistance in June. Beyond it, the $37.5 area is also an important resistance zone.

The price move above $24 after testing the 23.6% extension level was encouraging in the near term. While it promised a move toward the $30 resistance, traders have to curtail any further bullish expectations.

The CMF was above +0.05 to indicate strong buying pressure. The bullish momentum was reflected in the daily RSI and the price move above the moving averages.

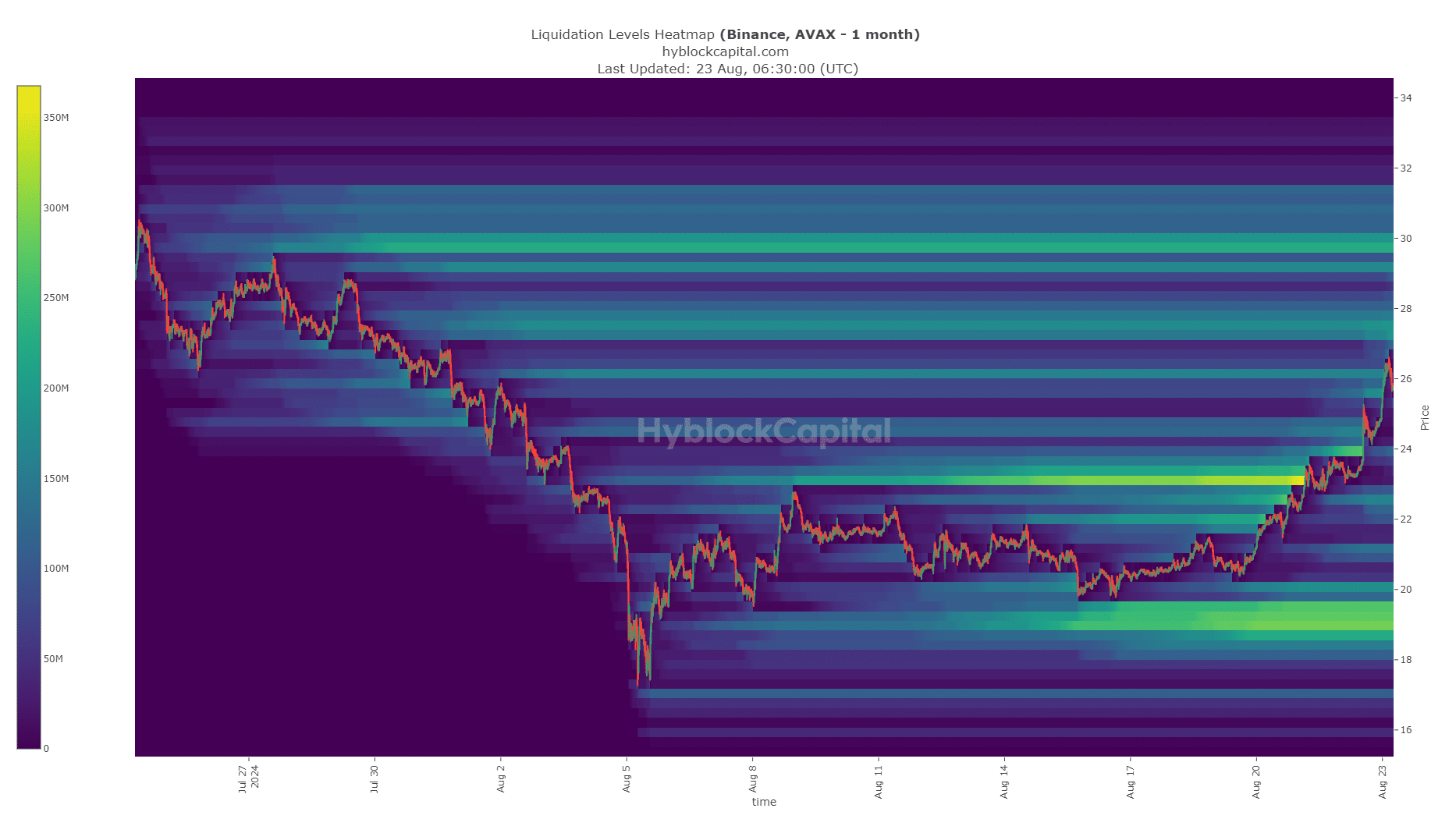

Evidence corroborates the $30 target for Avalanche crypto

Source: Hyblock Capital

Is your portfolio green? Check out the AVAX Profit Calculator

The liquidation heatmap showed a concentration of liquidity just below $28 and around the $30 level. Combined with the momentum and demand for AVAX, it was likely that the price would move higher.

The magnetic liquidity zones attract price, and if Bitcoin [BTC] decides to move past $66k, Avalanche might also see a sustained rally higher due to the bullish market-wide sentiment.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion