- XRP could skyrocket as a potential ETF launch and key levels set the stage for a bull run.

- Analysts suggest XRP may soon break out, offering a last chance to accumulate below $1.

XRP stood at $0.5511 at press time, having declined 1.38% in the last 24 hours and 7.88% over the past week.

With a trading volume of $887.67 million over the last 24 hours, XRP’s market cap is valued at approximately $31.01 billion.

Despite recent price fluctuations, XRP has shown stability around the $0.55 level, but traders should be aware of potential movements as the market reacts to evolving conditions.

Technical indicators suggested that XRP was trading near a key support level of $0.53860, with additional support at $0.50000. Resistance was observed at $0.61686, which, if breached, could indicate a bullish trend.

The Bollinger Bands showed a period of low volatility, while the RSI was signaling a neutral to slightly bearish sentiment in the market.

The MACD indicator for XRP was slightly negative, with the MACD line at -0.00326 and the signal line at 0.00213. This suggested a bearish crossover, though the histogram’s proximity to the zero line indicated that momentum could shift in either direction.

Source: TradingView

Market participants should monitor these indicators closely, as they may provide insights into future price movements.

The RSI, at 43.53 at press time, indicated that XRP was neither overbought nor oversold.

A drop below 30 could signal an oversold condition, potentially leading to a price rebound, while a rise above 50 could suggest increasing bullish momentum.

Analyst forecasts and market sentiment

According to crypto analyst BarriC, XRP could experience a significant price increase starting in October 2024.

BarriC suggested that there was still an opportunity to accumulate XRP below $1, but this window may close by November or December 2024, as the analyst predicted that the price could rise above $3.

The potential launch of an XRP ETF in early 2025 could further contribute to price increases, according to BarriC’s analysis.

Despite these bullish predictions, market conditions remained uncertain. XRP’s recent price performance has been marked by declines, with the market displaying cautious sentiment.

Market volatility

Coinglass derivatives data revealed that XRP’s trading volume increased by 60.31%, reaching $794.55 million. However, Open Interest decreased by 1.72%, now standing at $602.71 million.

Options volume saw a 39.10% decline to $263.03K, while options Open Interest grew by 2.39% to $599.33K.

These figures suggested mixed market sentiment, with fluctuations in trading activity indicating ongoing uncertainty.

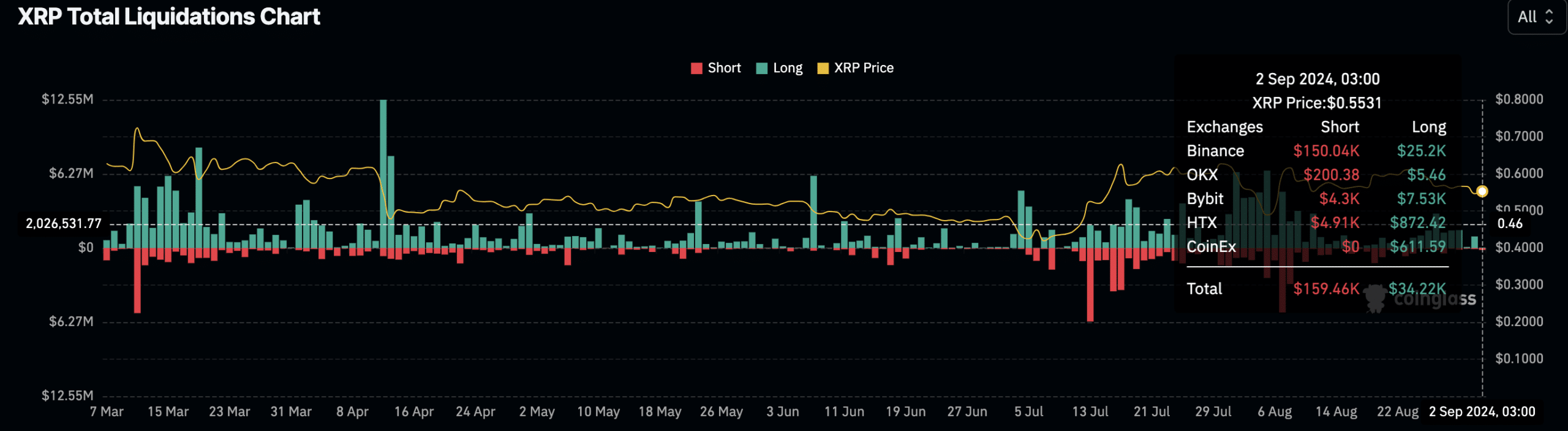

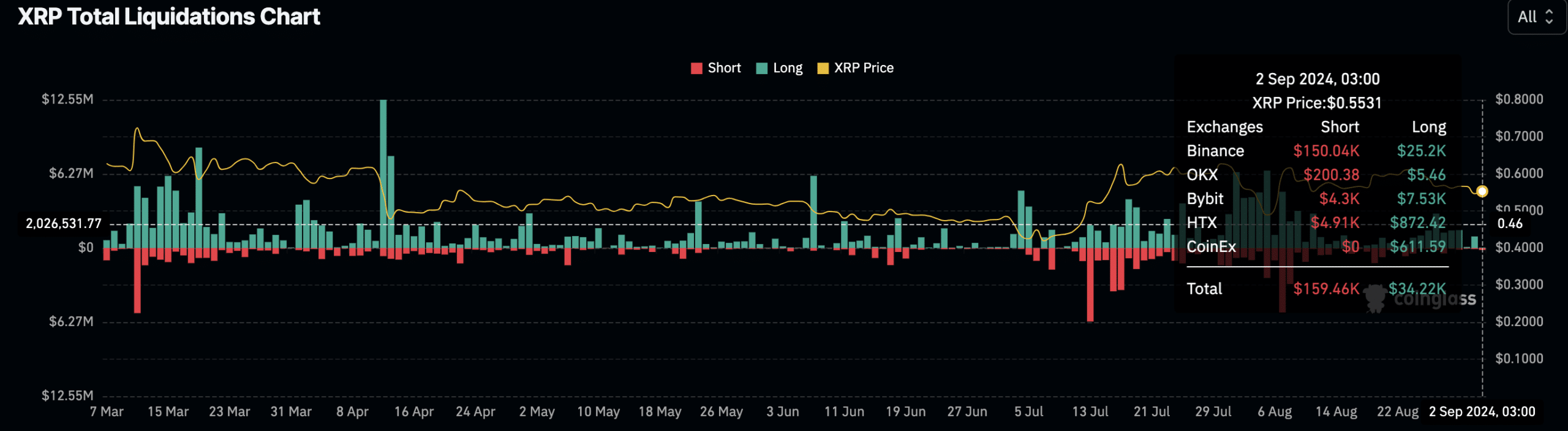

Also, $159.46K in short positions and $34.22K in long positions were liquidated on the 2nd of September.

Read Ripple’s [XRP] Price Prediction 2024–2025

The majority of short liquidations occurred on Binance [BNB] and OKX, reflecting the current market volatility.

Source: Coinglass

As XRP continues to trade near the $0.55 level, traders should be mindful of the potential for further liquidations, particularly if the price moves sharply in either direction.