- Bitcoin profitability warrants an assessment of the probability of sell pressure.

- BTC’s recent data demonstrates a resurgence of confidence in its potential to push back above $70,000.

Bitcoin [BTC] bulls have dominated for almost three weeks now, pushing its price above $64,000. This comes on the backdrop of renewed optimism, but should you consider taking profits at this level?

While Bitcoin bulls have performed commendably, the price is now in a zone that previously yielded sell pressure.

There was evident of some resistance building up above the $64,000 price level in the last three days. On top of that, an overwhelming majority of Bitcoin holders, 84% above $63,000, are now in profit.

This suggests that BTC could be sensitive to significant downside in case of another bearish event. On the other hand, a series of events have yielded expectations and hopes that Bitcoin may soar as high as $80,000 this time.

Many are now wondering which choice would be easier; to continue HODLing BTC or to take profits?

Are long term holders still optimistic?

A recent CryptoQuant analysis suggests that many long term Bitcoin holders are opting not to move their coins. This suggests that they are not taking profits yet, and this could shield BTC from sell pressure.

It may also allow it to extend its recent upside in the coming days or weeks if there is demand to drive up the price.

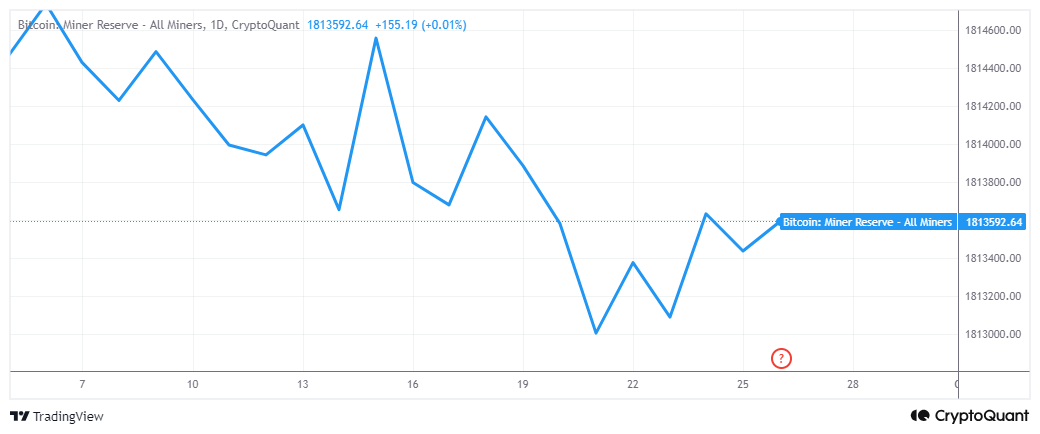

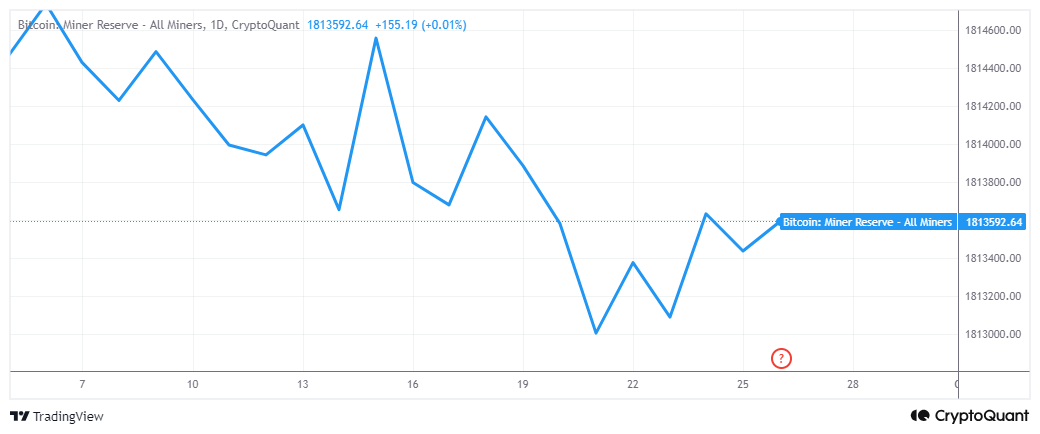

The CryptoQuant analysis also suggests that miner capitulation would be a reason for long term Bitcoin holders to sell. However, on-chain data revealed that miner reserves have been on an overall uptrend in the last five days.

Source: CryptoQuant

The miner reserves uptick suggests that miners are also opting HODL their coins in anticipation of higher prices.

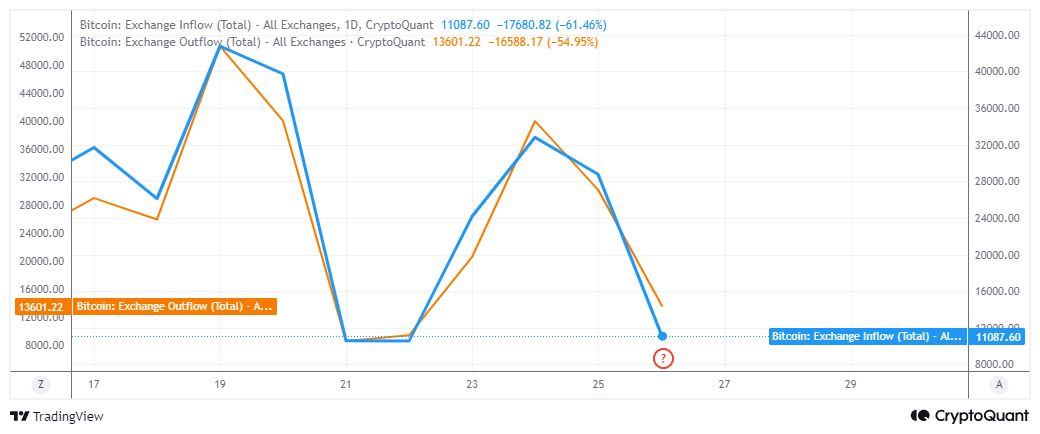

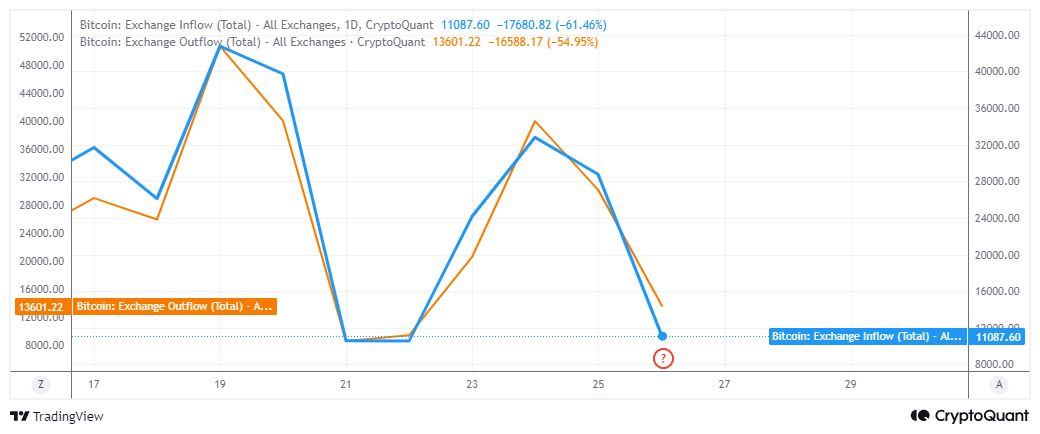

But what about the prospects of sell pressure in the short term? Well, despite the current price level yielding some resistance, exchange flow data revealed that demand still outweighed sell pressure.

Bitcoin exchange outflows were higher in the last 24 hours at 13,601 BTC compared to 11,087 BTC flowing out of exchanges.

Source: CryptoQuant

However, it is worth noting that exchange flows have been slowing down in the last 3 days. Also, they had slowed down to levels where they previously pivoted, suggesting that there could be a shift in the coming days.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In conclusion, Bitcoin price action previously demonstrated robust sell pressure above $60,000. That does not appear to the case with its latest push above the same level.

This suggests growing levels of confidence, boosted by recent prospects of liquidity flowing into the market.