- LINK’s Long/Short ratio currently stands at 1.031, indicating a bullish market sentiment among traders.

- LINK’s OI-weighted funding rate is positive at 0.0087%, further signaling bullish sentiment.

Chainlink [LINK] is poised for a massive upside rally after recently breaking out of a bullish price action pattern.

Meanwhile, the overall crypto market sentiment remains stable with no major rally witnessed in top cryptocurrencies, including Bitcoin[BTC], Ethereum [ETH], and Solana [SOL].

Chainlink technical analysis and key levels

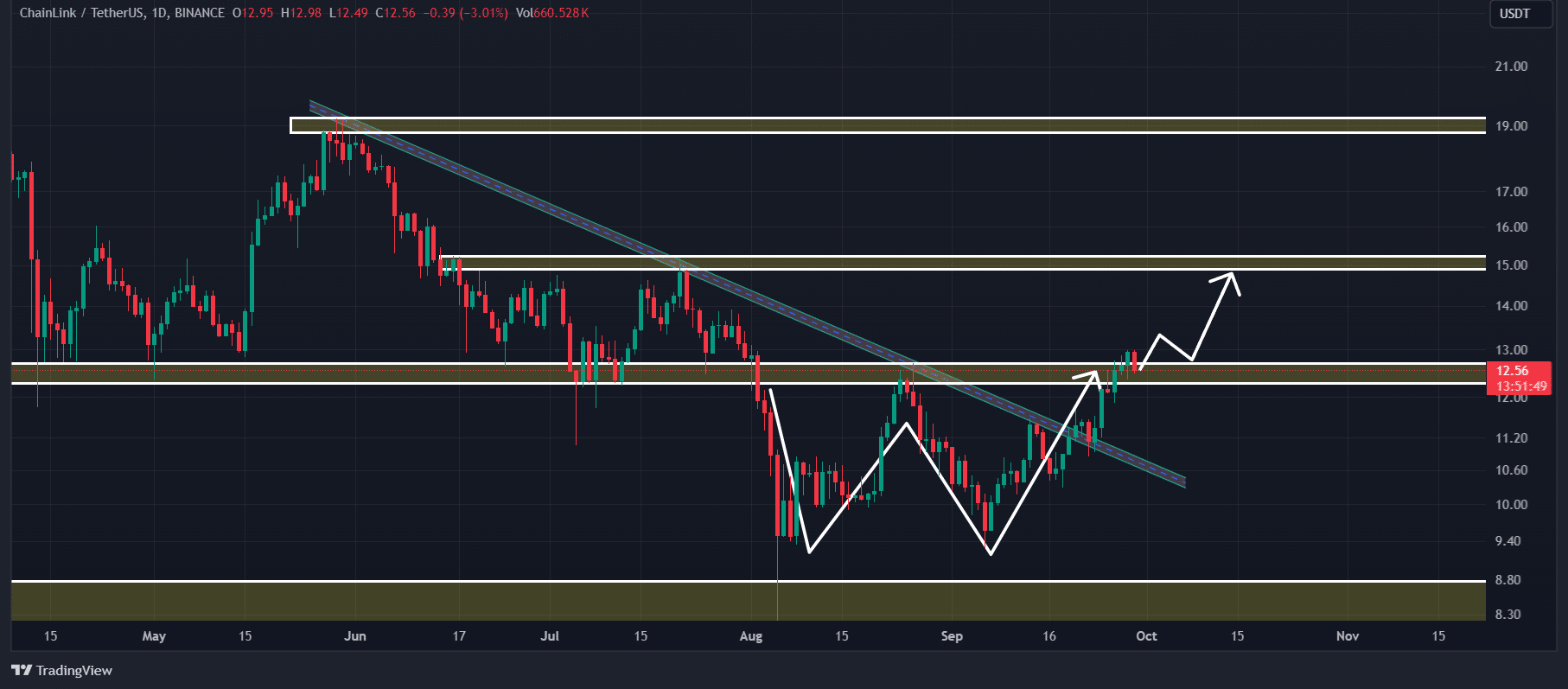

According to AMBCrypto’s technical analysis, LINK turned bullish following the breakout of the much-anticipated double-bottom price action pattern which is formed on the daily time frame.

Investors and traders often view this pattern as a bullish signal and often prefer it when going long.

Source: TradingView

Based on the recent price performance, if LINK closes its daily candle above the $13.10 level, there is a strong possibility that it could soar by 20% to reach the $15 level in the coming days.

Despite this bullish outlook, LINK’s Relative Strength Index (RSI) signals that the asset is in a downtrend.

In trading and investing, RSI is one of the crucial technical indicators that helps users determine whether an asset is in an uptrend or downtrend.

Mixed sentiment from on-chain metrics

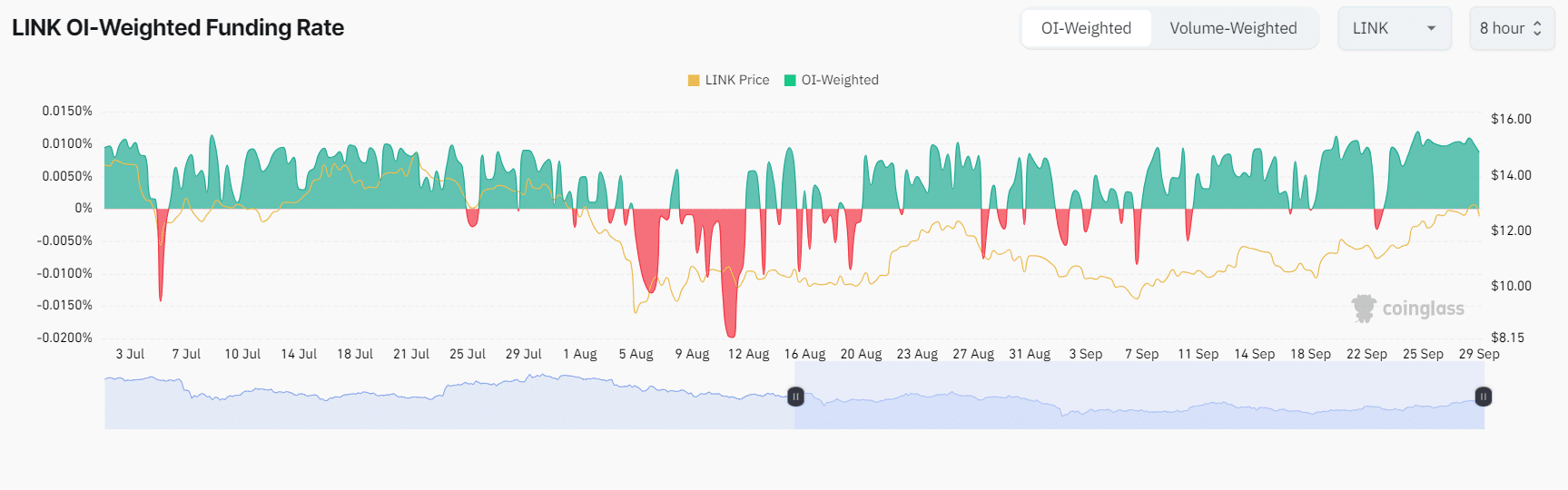

In addition to the technical analysis, LINK’s on-chain metrics reflect mixed sentiment. According to on-chain analytics firm Coinglass, LINK’s Long/Short ratio currently stands at 1.031, indicating a bullish market sentiment among traders.

Additionally, the LINK OI-weighted funding rate is positive at 0.0087%, further signaling bullish sentiment.

Source: Coinglass

Meanwhile, LINK’s future open interest has remained unchanged over the past 24 hours, indicating that traders’ positions have not been liquidated nor have they built any new positions, potentially due to concerns about a potential price correction.

Read Chainlink’s [LINK] Price Prediction 2024–2025

According to Coinglass data, the major liquidation levels are currently at $12.12 on the lower side and $13.16 on the upper side, as traders are over-leveraged at these levels.

At press time, LINK was trading near $12.65 and has experienced a price surge of over 1.2% in the past 24 hours. Additionally, its trading volume has also declined by 25%, indicating lower participation from traders and investors.