- XRP bulls had market leverage, according to key chart indicators

- There was no market froth, which could embolden bulls to push XRP higher

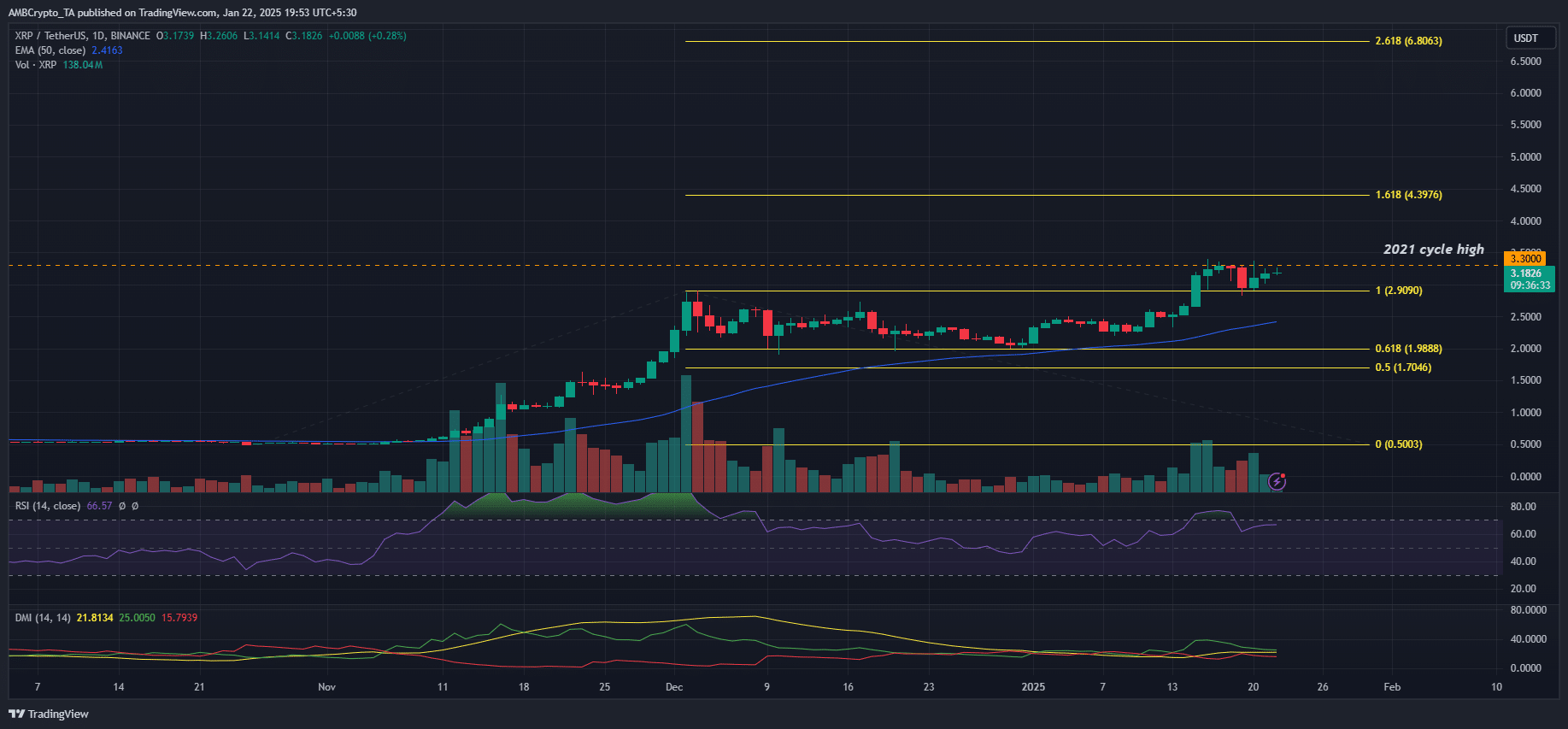

XRP has held on to its gains on the price charts so far, with the same extending to 550% since November after tapping last cycle’s high of $3.3.

In fact, over the last few days, the altcoin has been tightly consolidating between its December peak of $2.9 and its 2021 high.

XRP bulls dominate

Despite concerns about the whale sell-offs, the price chart reinforced market leverage to bulls, at least at the time of writing. Notably, the 12-hour chart RSI was above 60, underscoring strong buying pressure at its press time levels.

Source: XRP/USDT, TradingView

Additionally, the Directional Movement Index (DMI) revealed that the uptrend eased slightly, but bulls still had the upper hand. Taken together, chart indicators primed bulls to drive the market.

That being said, based on the Trend-based Fibonacci Extension tool, the next key level for the uptrend that began in November was $4.3 (1.618 Fib level). Should a FOMO rally blast above $4.3, then $6.8 could be the next medium-term target.

Here, it’s worth noting that the main catalyst for the latter could be an XRP ETF approval. At press time, Polymarket’s odds for ETF approval stood at 79% – A sign that the market has partly priced in the outcome.

A healthy market for XRP bulls

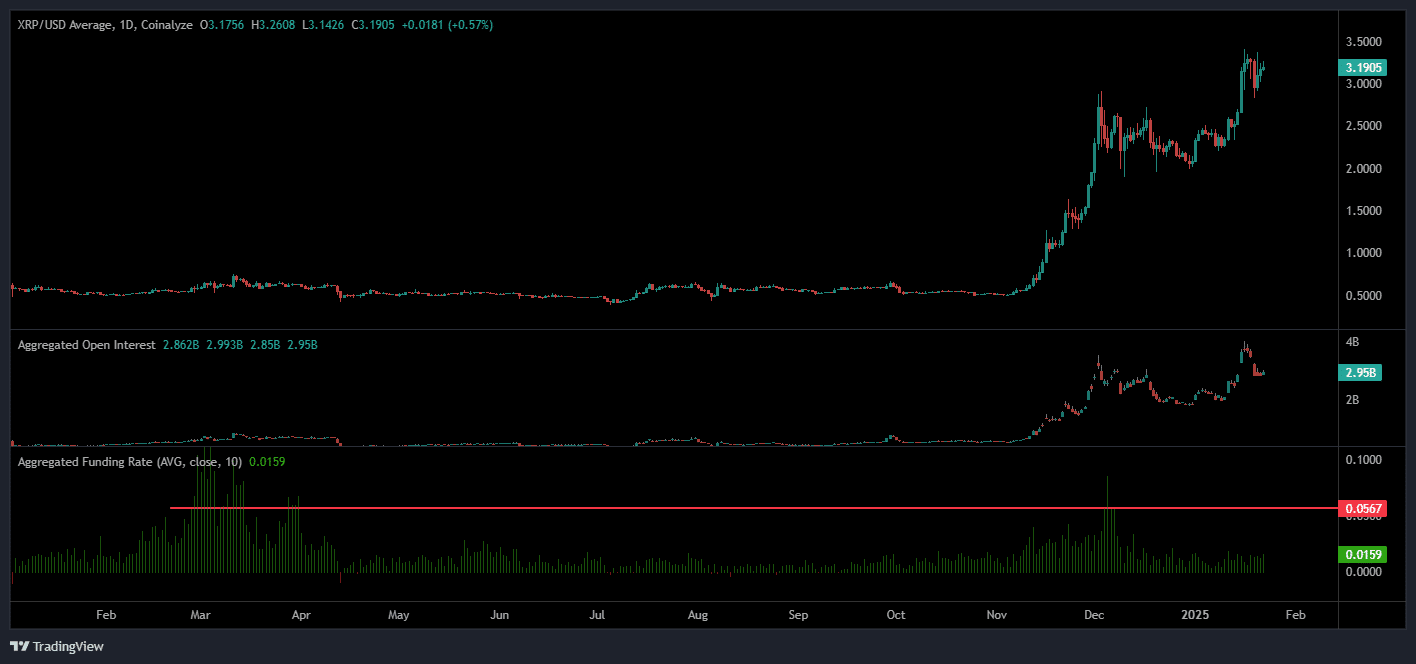

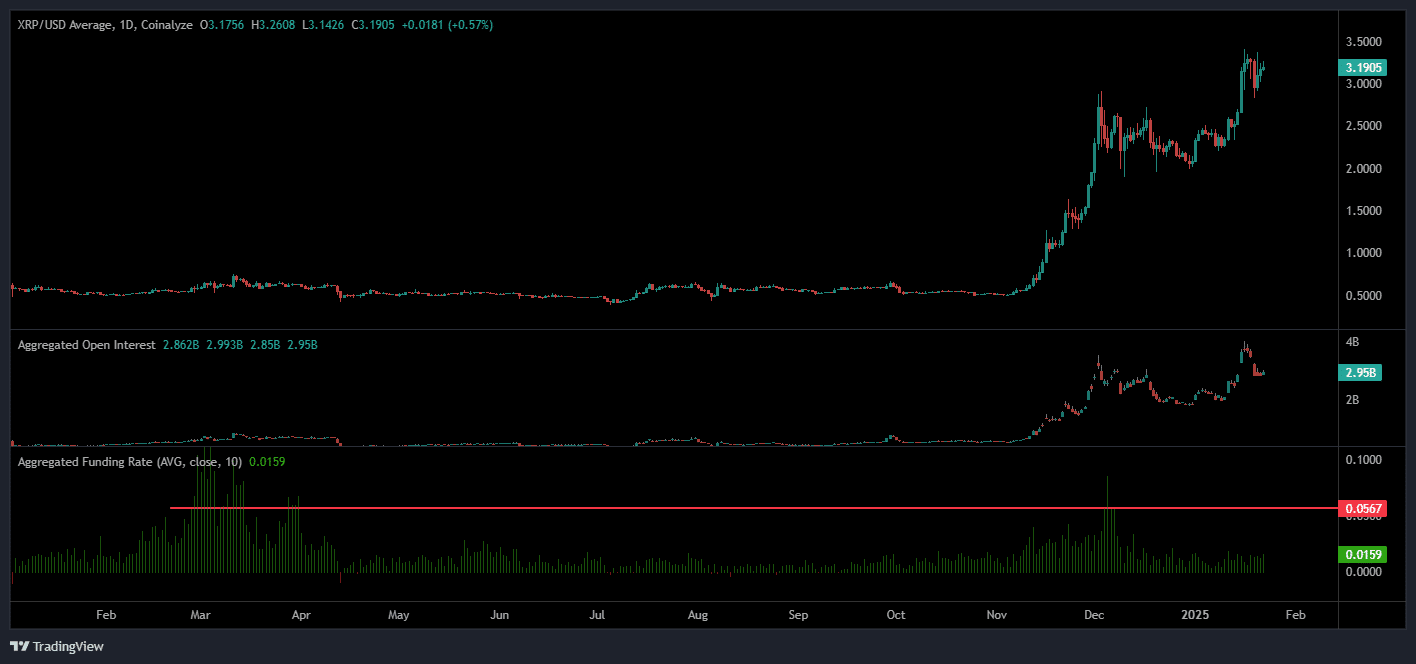

Source: Coinalyze

Another interesting factor worth pointing out is the healthy XRP market. Despite hitting a 7-year high, the market had no excessive froth, as illustrated by nearly flat funding rates. For context, a spike in funding rates above 0.05 in March and December 2024 coincided with XRP’s local peaks. Especially as speculative interest and leveraged trading went overboard.

This resulted in sharp corrections and stalled the rallies. Simply put, the lack of froth could allow XRP bulls to push higher on the charts.

That being said, a drop below the 50-day moving average of $2.4 could embolden short-term sellers to regain market momentum and drag the altcoin lower.