- Sonic whales have been selling the asset for weeks, causing the asset to drop.

- Spot traders in the market are beginning to counter the whales’ moves as they change the narrative.

Sonic [S] has been on a downturn for an extended period, with a weekly loss of 27.11% as market participants turn bearish.

The bearish wave appears to have continued to intensify as the asset has dropped by 9.53%, with whale’s mounting pressure. AMBCrypto has since found that spot traders could play a role in preventing further price declines.

Whales continue to sell Sonic

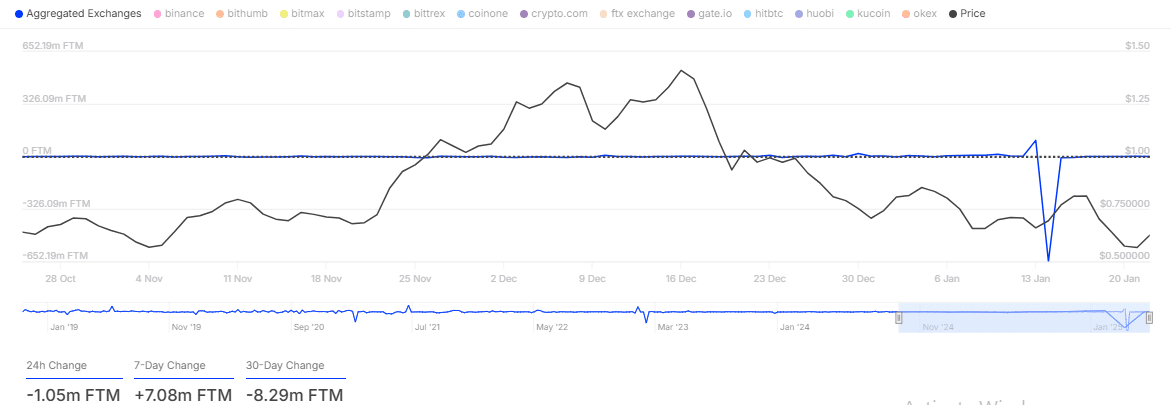

Large investors, otherwise known as whales—who control a sizable amount of an asset between 0.1% to 1%—have continued to sell S.

In the past 24 hours alone, IntoTheBlock recorded that this cohort sold 8.66 million S tokens worth $5.41 million at the time, contributing to the recent price decline.

Source: IntoTheBlock

This current sell-off is a considerable drop from the 65.17 million S tokens sold on the 21st of January, which suggests that whales could be approaching a point of exhaustion.

However, for now, there are still more bearish whales in the market than bullish ones. Over the past week, there were 131 bears and 114 bulls in the market, meaning there are 6.94% more bears.

While whales continue to sell and could be heading for exhaustion, AMBCrypto found that a supply squeeze could be near as spot traders make their move.

Spot traders counter whales

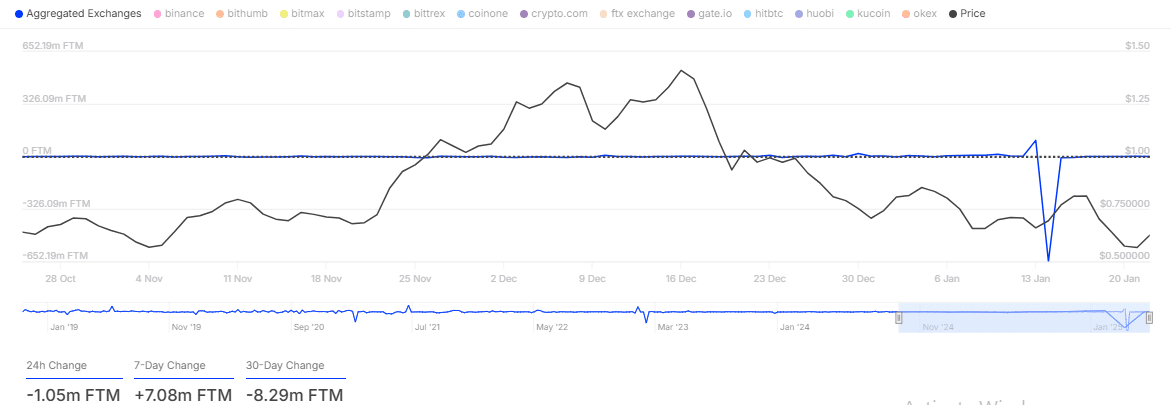

While whales continue to sell, spot traders have begun to gradually reduce their holdings on exchanges in the past 24 hours.

The exchange netflow shows that a total of 1.05 million worth of Sonic was removed from exchanges. When this happens, it indicates that traders are willing to hold the asset for an extended period.

Source: IntoTheBlock

A move like this tends to gradually cause a supply squeeze as the available Sonic tokens begins to reduce, potentially not matching demand.

This would depend on whether spot traders continue moving their holdings into private wallets, turning the current weekly netflow from a positive $7.08 million to a negative figure.

Should this movement away from exchanges continue, and if whales’ sell-offs finally hit peak exhaustion, it’s likely that S could see a rebound to the upside.

Gradual volume surge

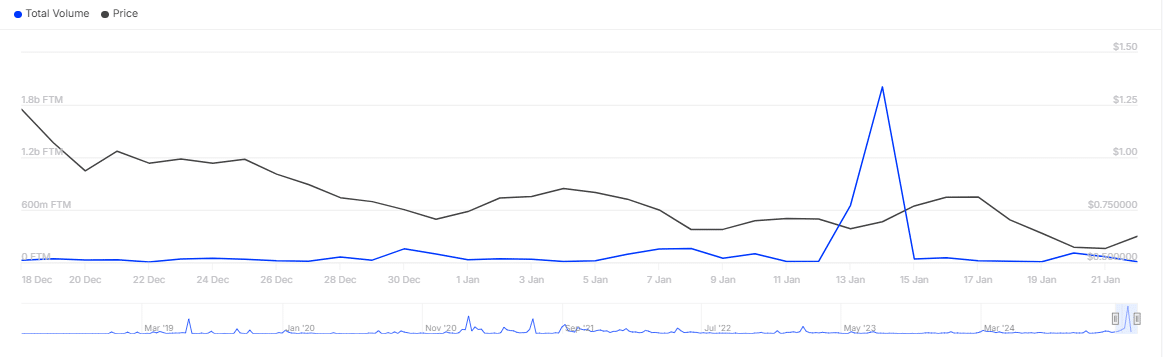

The overall Sonic volume has continued to surge since the 1st of January, starting with an opening volume of approximately $890,000 and reaching $15.47 million, according to DeFiLlama.

Read Sonic’s [S] Price Prediction 2025–2026

Typically, growing volume doesn’t indicate a bullish or bearish scenario as a stand-alone metric. However, should the price direction change as sentiment potentially skews in favor of the bulls, then S could see a quick rise.

This is because simultaneous growth in price and volume shows that there’s high buying momentum in the market, leading the asset to a faster upswing.