- Canary Capital has filed for a staked TRX ETF with the SEC.

- Despite the ETF filing, Tron is facing strong bearish sentiment.

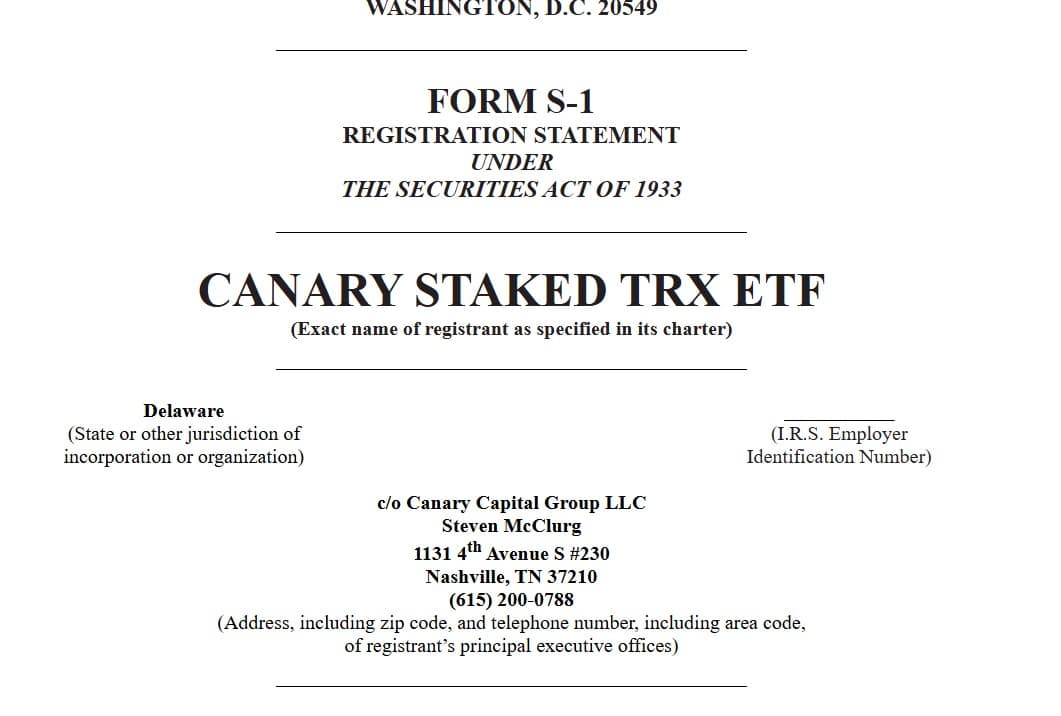

As per reports, Canary Capital, a United States asset manager, has filed to list an ETF holding Tron’s native token TRX. According to the firm, the proposed product is called Canary Staked TRX ETF.

As per the filing, the said funds aim to hold spot TRX and stake it to generate added yield. Through the ETF, investors will have regulated access to staking rewards and market exposure.

If approved, Canary Capital will manage the ETF operations and oversee its overall performance.

Source: Sec.Gov

Over the past four months, in an attempt to capitalize on a pro-crypto SEC in the United States, there has been an outpouring of submissions aimed at listing ETFs.

Since the start of the Trump administration, U.S. regulators have received multiple filings.

Amidst this ETF frenzy, Canary has filed for various altcoin ETFs including Litecoin [LTC], XRP, Hedera [HBAR], Sui [SUI], and Pudgy Penguins [PENGU].

Is an ETF the boost that TRX needs for recovery?

While it’s expected for such good news to have a positive impact on price movement, this is yet to be reflected. Inasmuch, Tron remains in a strong downtrend.

In fact, at the time of writing, Tron was trading at $0.24. This marked a 1.28% drop on daily charts. On weekly charts, the altcoin has declined by 2.8%.

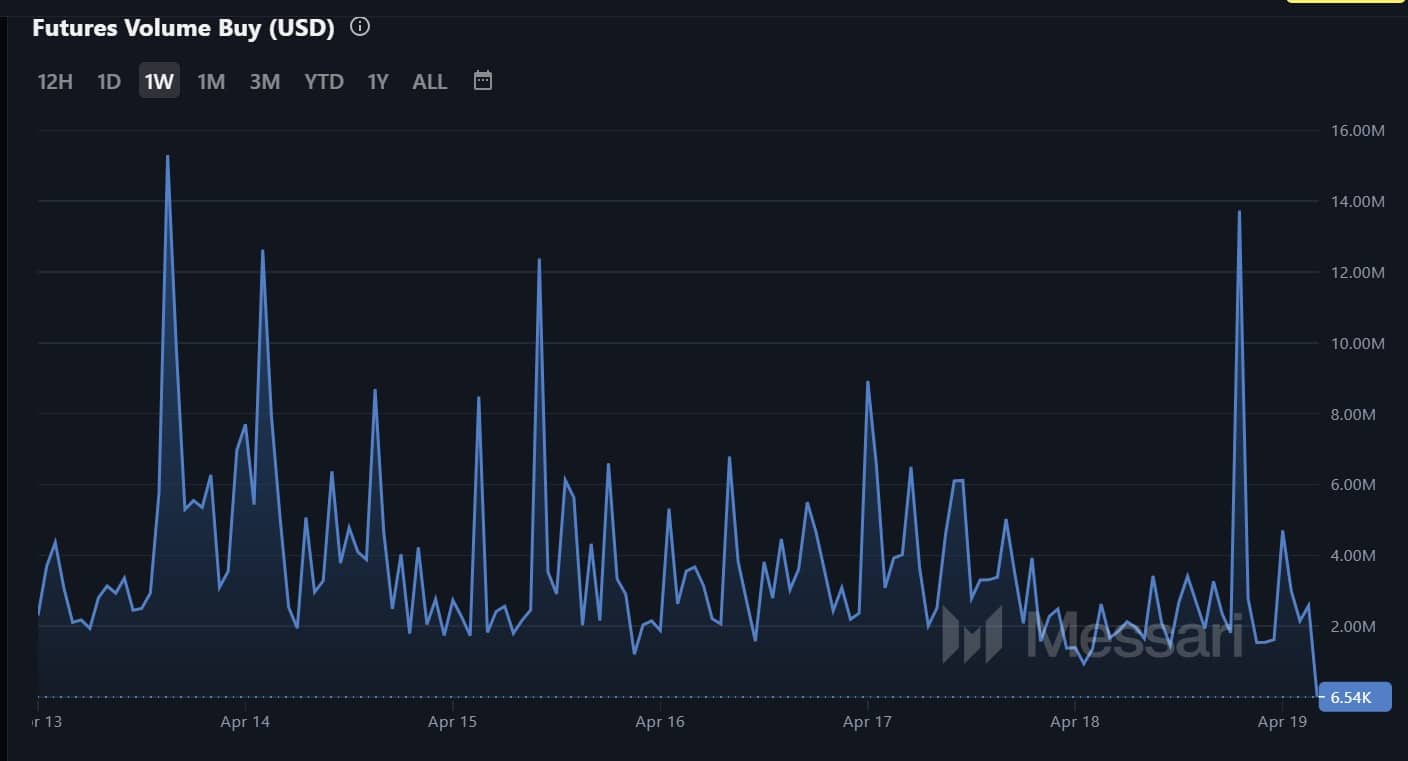

Amidst these losses is slowing demand and mounting bearish sentiments. For starters, Tron buyers have almost disappeared from the market. Futures buy volume too has declined to a weekly low of $6.5k.

Such a drop suggests that investors currently lack the motivation to believe in a potential uptrend. As such, there’s weak bullish conviction in the market.

Source: Messari

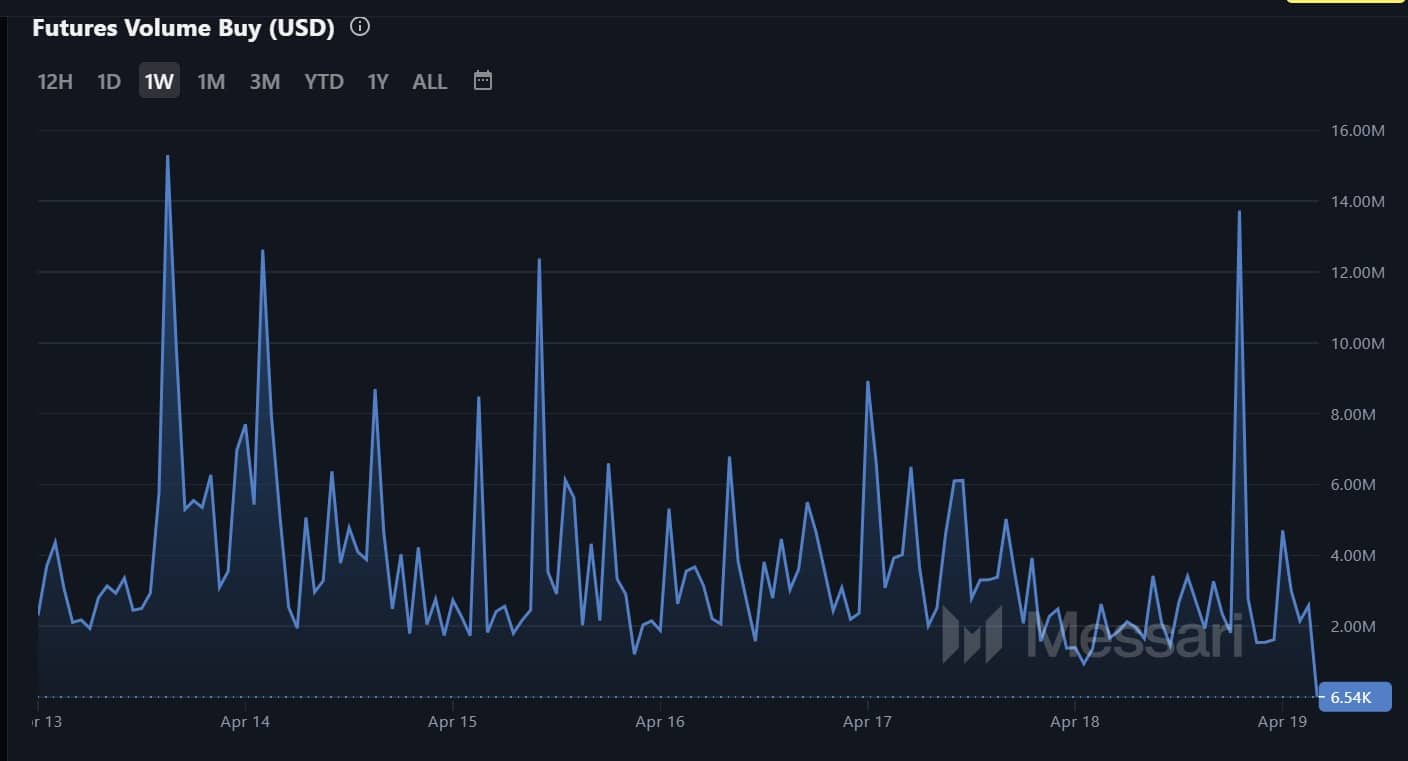

Per the Funding Rate (Volume Weighted), there has been a decline in demand for long positions, with the Funding Rate holding at a monthly low within negative territory.

When the metric is set like this, it suggests that investors are aggressively shorting Tron as they expect prices to decline.

Source: Messari

Therefore, an ETF would be a game changer for Tron and its native token. An ETF will create room for more adoption as institutional investors enter the market, leading to a higher demand.

As of now, the filing has not positively impacted TRX’s price action. If the development is felt in the market, we could see TRX reclaim $0.259.

However, if the prevailing market sentiment holds, a drop to $0.23 is inevitable.