- On the chart, COMP is at a critical level that could lead to an intense price drop in the coming days.

- Sentiment indicates that sellers are not holding back, continuing to offload COMP as confidence weakens.

Market sentiment for Internet Computer [COMP] has remained bearish, as sellers have consistently sold the asset over the past week and month, leading to declines of 12.31% and 24.92%, respectively.

AMBCrypto analysis found COMP at a critical position, trading at a support level. If this support fails, a major decline could follow. At the same time, market activity has been dominated by selling.

Comp at a critical zone—what could happen?

At the time of writing, COMP was trading at the bottom of the consolidation channel it has been within since as far back as July 2023.

If this support level fails to hold and COMP breaches its lower boundary, it would begin the final leg of a bearish flag pattern.

This pattern forms when a price experiences a sharp decline, consolidates, and then continues its downward trend.

Source: TradingView

On the chart, the next support level below this breach is at $23.27, implying a 50% decline. If this support fails, COMP could drop even further, potentially trading below the $20 range.

Decline potential is high

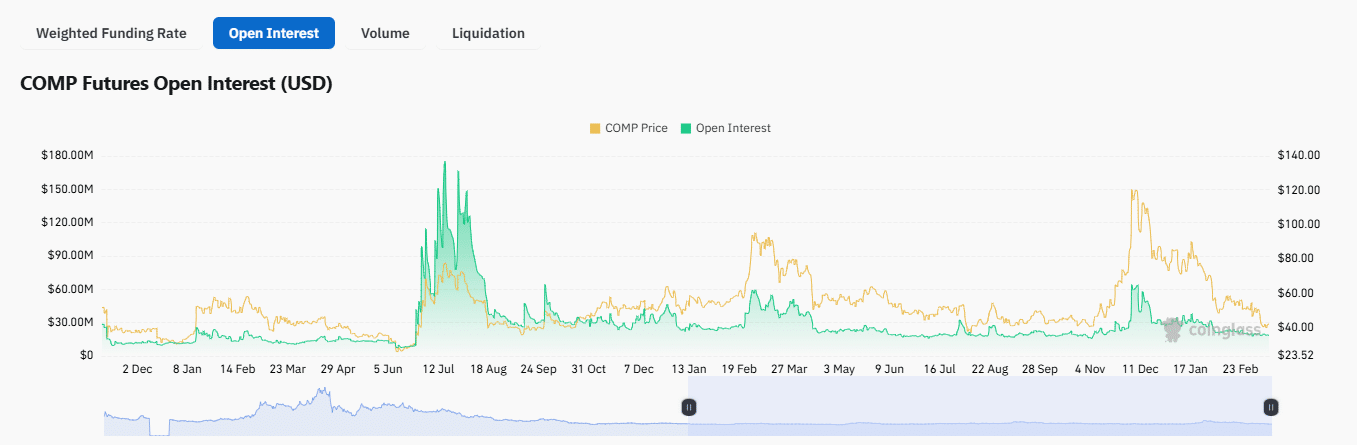

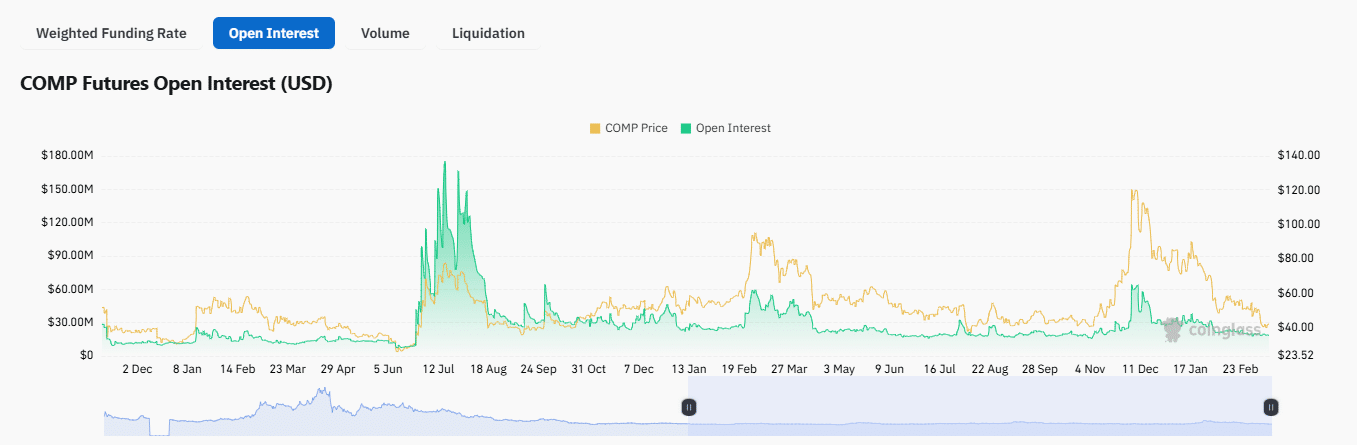

Currently, the derivatives market shows a high potential for COMP to drop further below this key support, as seller indicators suggest.

One of these bearish indicators is the declining open interest, which has dropped 1.83%, reaching $18.08 million in the past 24 hours. This decline has been accompanied by a Taker Buy Sell Ratio reading of 0.9242.

Source: Coinglass

In a scenario like this, when the ratio is below 1, it suggests that selling volume exceeds buying volume, indicating more sellers in the market.

Additionally, the Funding Rate, which tracks which segment of the market is paying the premium to determine trend direction, was negative at -0.0065 at press time.

A negative reading signals a downtrend favoring sellers, whereas a positive reading would indicate an uptrend favoring buyers.

If selling pressure continues to rise, COMP could break below its current support level and trend lower, reaching the $23 target.

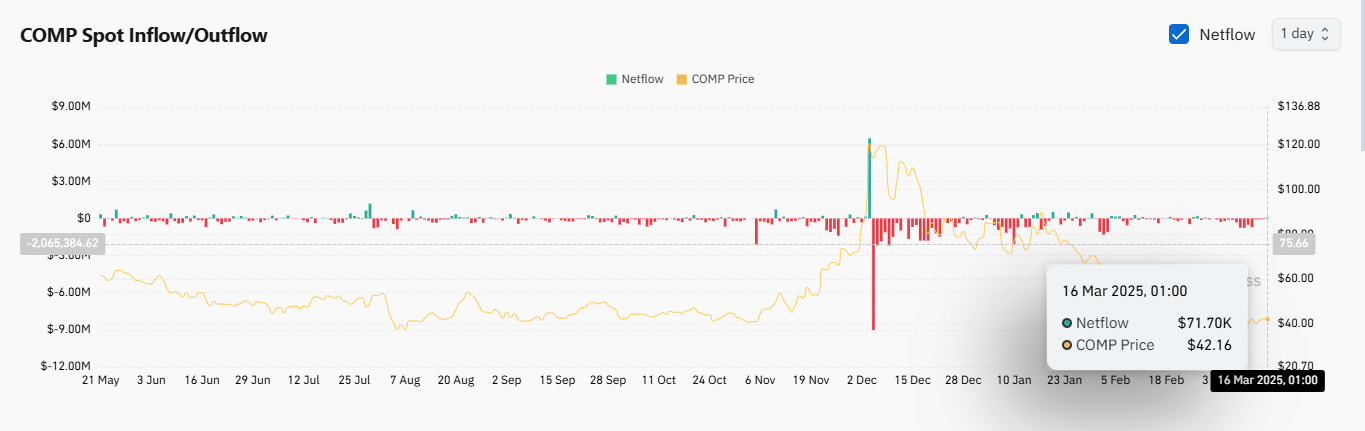

Source: Coinglass

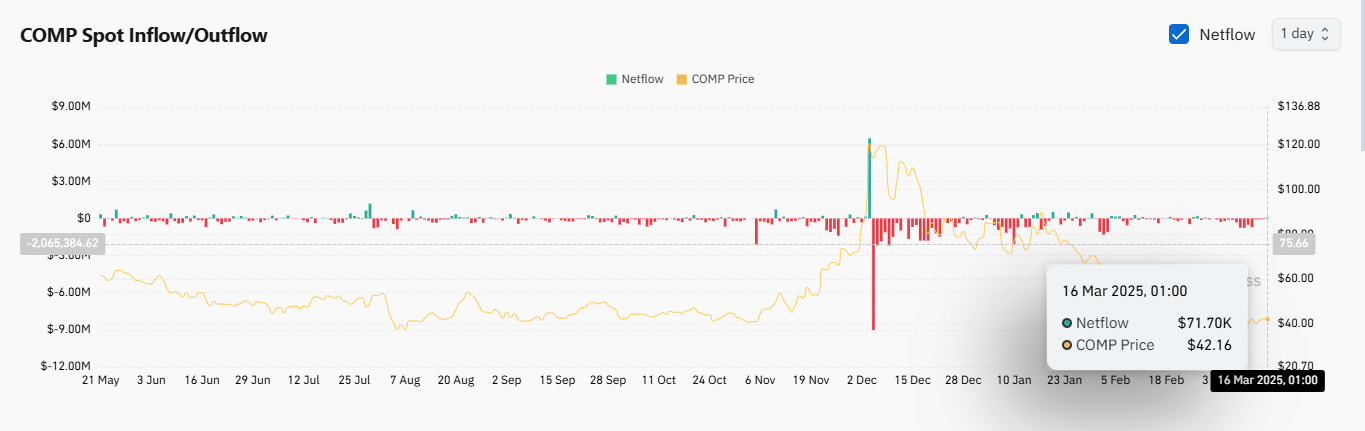

In the spot market, traders have begun selling for the first time since March started, whereas earlier in the month, investors were accumulating COMP in small amounts.

Currently, its daily exchange netflow is positive, indicating increased selling activity.

So far, approximately $71,000 worth of COMP has been sold into the market. If this selling continues, combined with the bearish sentiment in the derivatives market, COMP could see a major price drop as predicted.