- ALGO could be poised for a potential bullish breakout after a rebound from the correction.

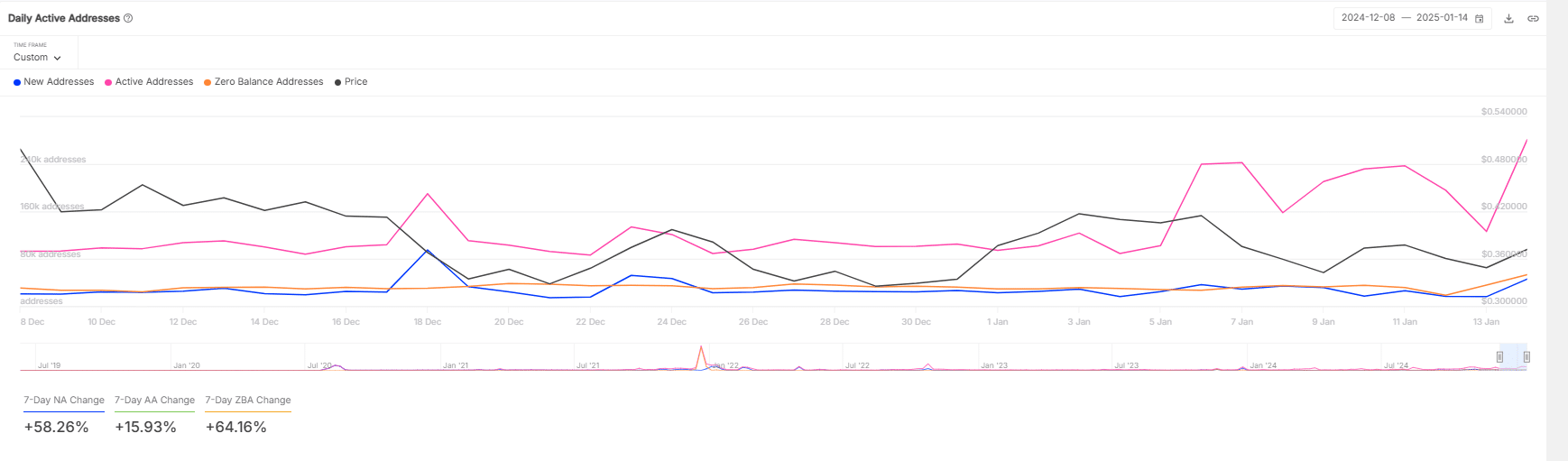

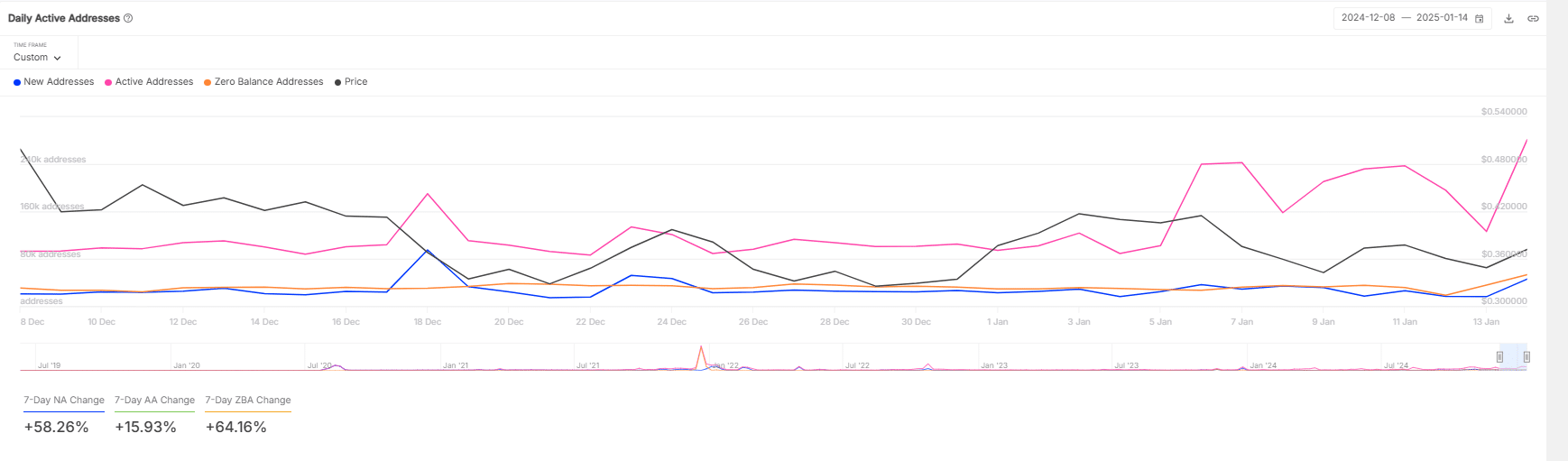

- Daily active addresses starting to rise again steadily after being flat since July 2024.

Algorand [ALGO] gained more than 14% while its daily trading volume rose by equal measure as per CoinMarketCap, aligning with the current bullish momentum in the altcoin.

ALGO has been consolidating tightly within a crucial range of $0.39 to $0.32. In recent weeks, ALGO repeatedly tested both the upper and lower boundaries of this range, indicating a tense equilibrium between buyers and sellers.

This pattern suggests that ALGO is setting up for a significant move.

A definitive breakout above the $0.39 resistance could potentially lead to a rapid 60% increase in price, aiming for higher valuations in line with past momentum reactions observed under similar conditions.

Source: Ali/X

Conversely, a fall below $0.32 could set a bearish trend, leading to further declines. These movements could decisively influence ALGO’s market direction in the short to midterm, offering strategic entry and exit points for traders.

This poised state reflected a market on the cusp of choosing its next substantial move, dictated by its ability to either sustain above $0.39 or fall beneath $0.32.

ALGO’s active addresses and their profitability

Supporting this bullish outlook is the notable uptick in daily active addresses for ALGO, increasing by 15.93% in the last week, following a flat period since July 2024.

New addresses rose by more than 58%, coinciding with a 64.16% rise in zero-balance addresses. This suggests growing interest and possibly speculative movements in the market. The surge in these metrics needs to hold for ALGO’s potential gains to materialize.

Source: IntoTheBlock

The price of ALGO, which had been hovering around $0.30, responded positively in the past two days, reaching up to $0.48.

This activity indicates a potential shift in market sentiment, where increased address activity could lay the groundwork for further price appreciation.

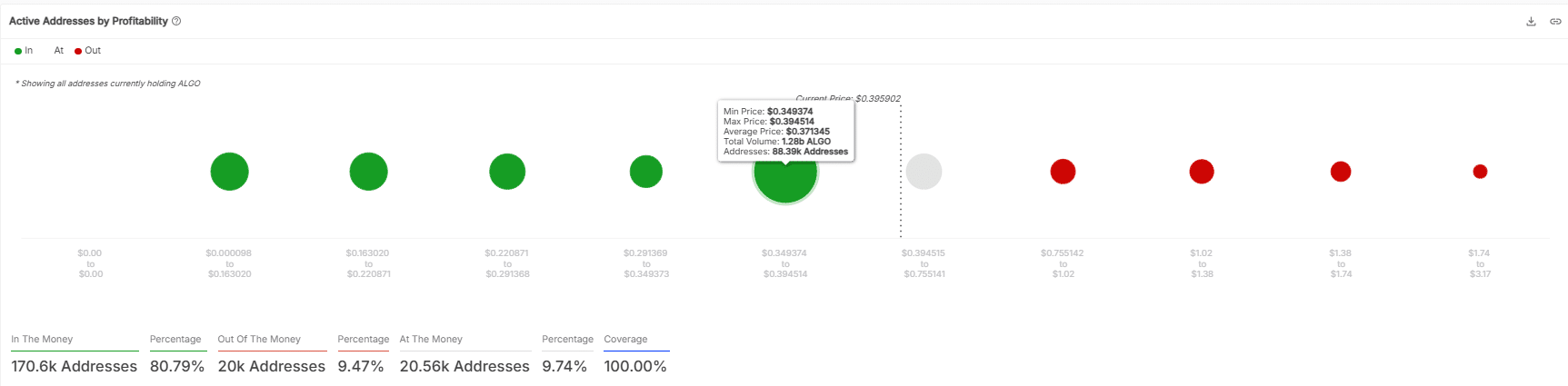

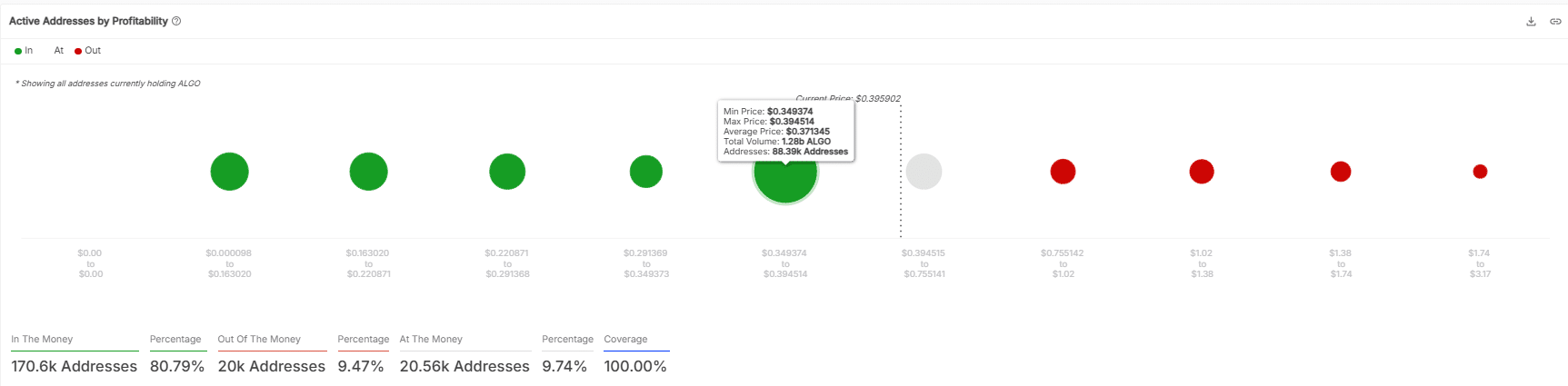

Further analysis of ALGO’s active addresses by profitability reveals that 80.79% of addresses are “in the money,” with investments now worth more than their purchase price, compared to 9.47% “out of the money.”

The remaining 9.74% are at break-even. As of press time, the price of ALGO has risen from $0.34 to $0.395902 over the last two days, confirming this positive shift.

Source: IntoTheBlock

Is your portfolio green? Check the Algorand Profit Calculator

Such a high percentage of profitable addresses typically signals a strong holder base that can resist selling pressure and support the price. This further supports the possibility of ALGO breaking out and surging over 60%.

However, profit-taking could occur if ALGO continues to rise, potentially causing short-term volatility. Despite this, the upward trend is likely to sustain if buyer momentum persists.