- The number of long positions in the Bitcoin market increased.

- The Rainbow Chart pointed out that BTC’s price was considerably less than it should be.

Bitcoin [BTC] remained bearish, as the king coin was trading under $57k at press time. While this initially looked disastrous, for savvy investors, this might as well be a right opportunity to buy the dip.

According to CoinMarketCap, BTC’s price dropped by more than 3% in the last seven days. In the last 24 hours alone, the king coin witnessed a nearly 4% price fall.

At the time of writing, BTC was trading at $56,760.06, with a market capitalization of over $1.12 trillion.

Should you buy Bitcoion’s dip?

Meanwhile, Ali, a popular crypto analyst, posted a tweet revealing a bullish development. Top BTC traders on Binance showed a slight bullish tilt, with 51.79% investors holding long positions on BTC.

Generally, a rise in the number of long positions in the market hint at an increase in bullish sentiment around an asset.

Therefore, AMBCrypto planned to have a deep look at BTC’s state to find out whether investors should consider buying the dip.

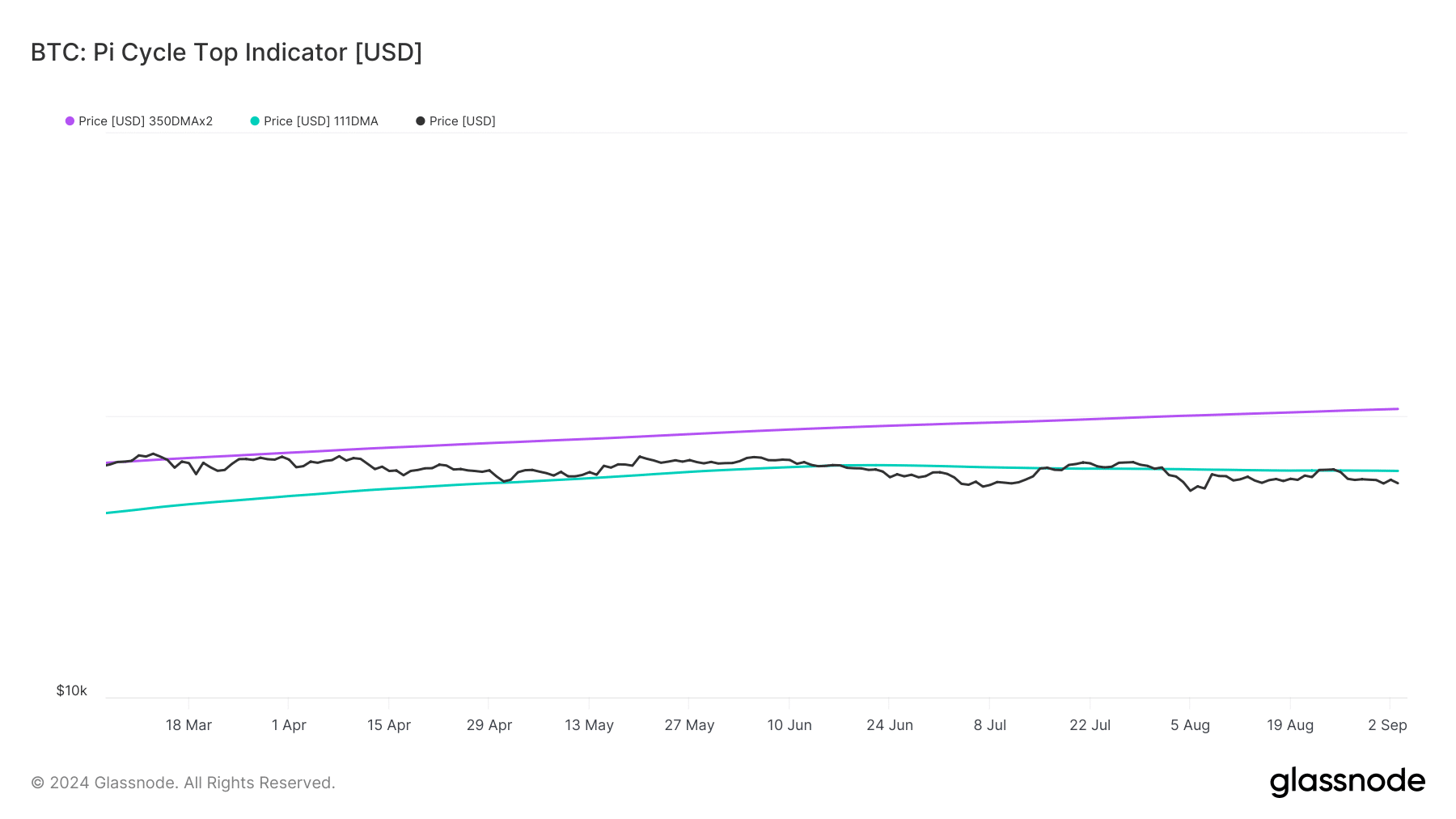

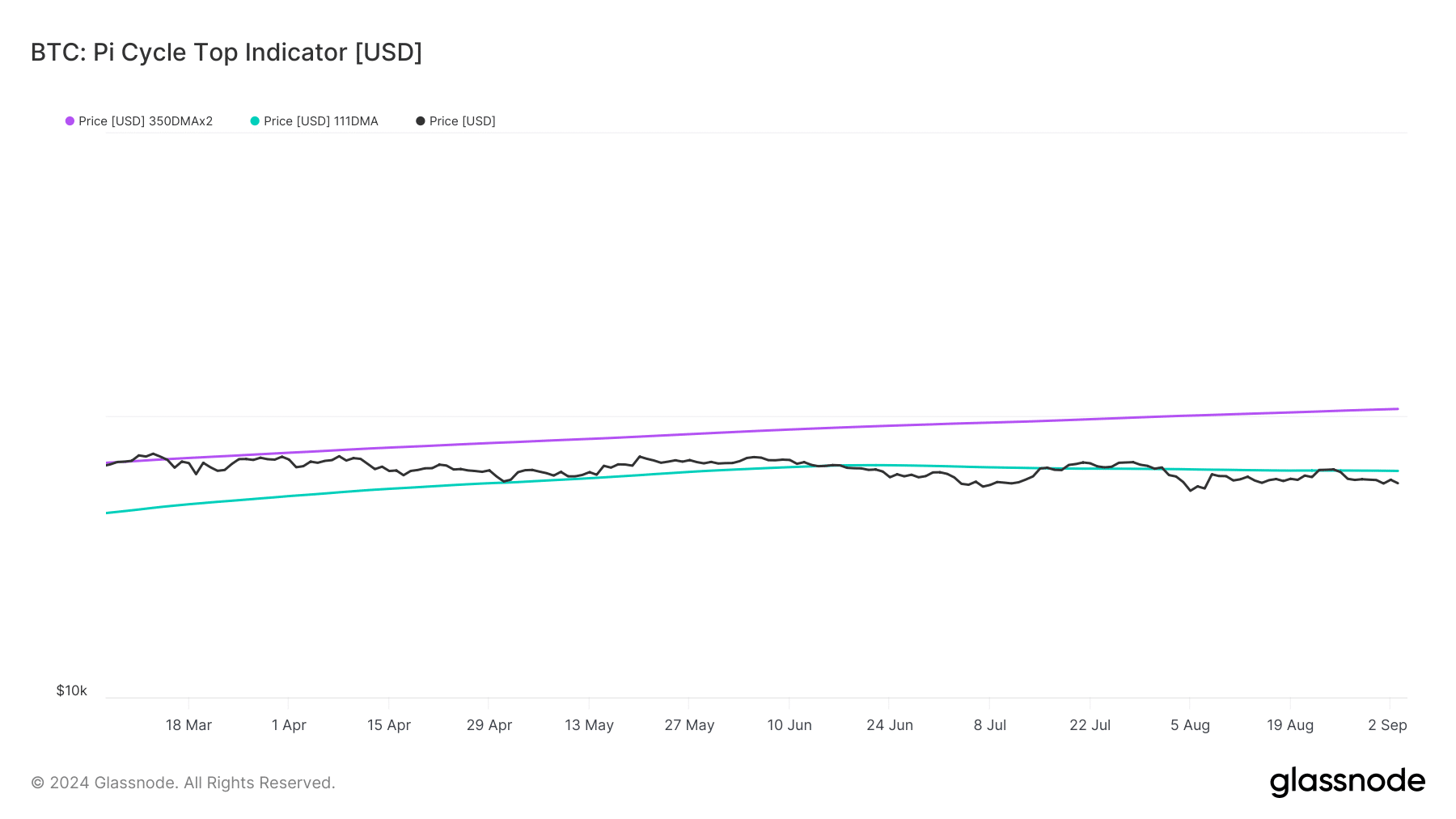

Our look at Glassnode’s data revealed that BTC was trading well below its possible market bottom. As per the Pi Cycle Top indicator, BTC’s possible market bottom was at $58.9k.

This suggested that BTC could move towards $58.9k in the coming days.

Source: Glassnode

Assessing BTC’s road ahead

Since BTC was trading well below its market bottom, AMBCrypto checked other datasets to find out whether this was the right time to accumulate.

According to the Bitcoin Rainbow Chart, BTC’s price was in the “Basically a Fire Sale” zone. This meant that BTC’s current price was considerably lower than what it should be, revealing a great opportunity for accumulation.

Source: Blockchaincenter

AMBCrypto then checked CryptoQuant’s data to see whether investors have already started to buy more BTC. We found that the king coin’s Exchange Reserve was dropping, signaling a rise in buying pressure.

Its Korea Premium was also green, meaning that buying sentiment was dominant among Korean investors. However, its Coinbase Premium turned red. This suggested that U.S. investors were considering selling BTC.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024–2025

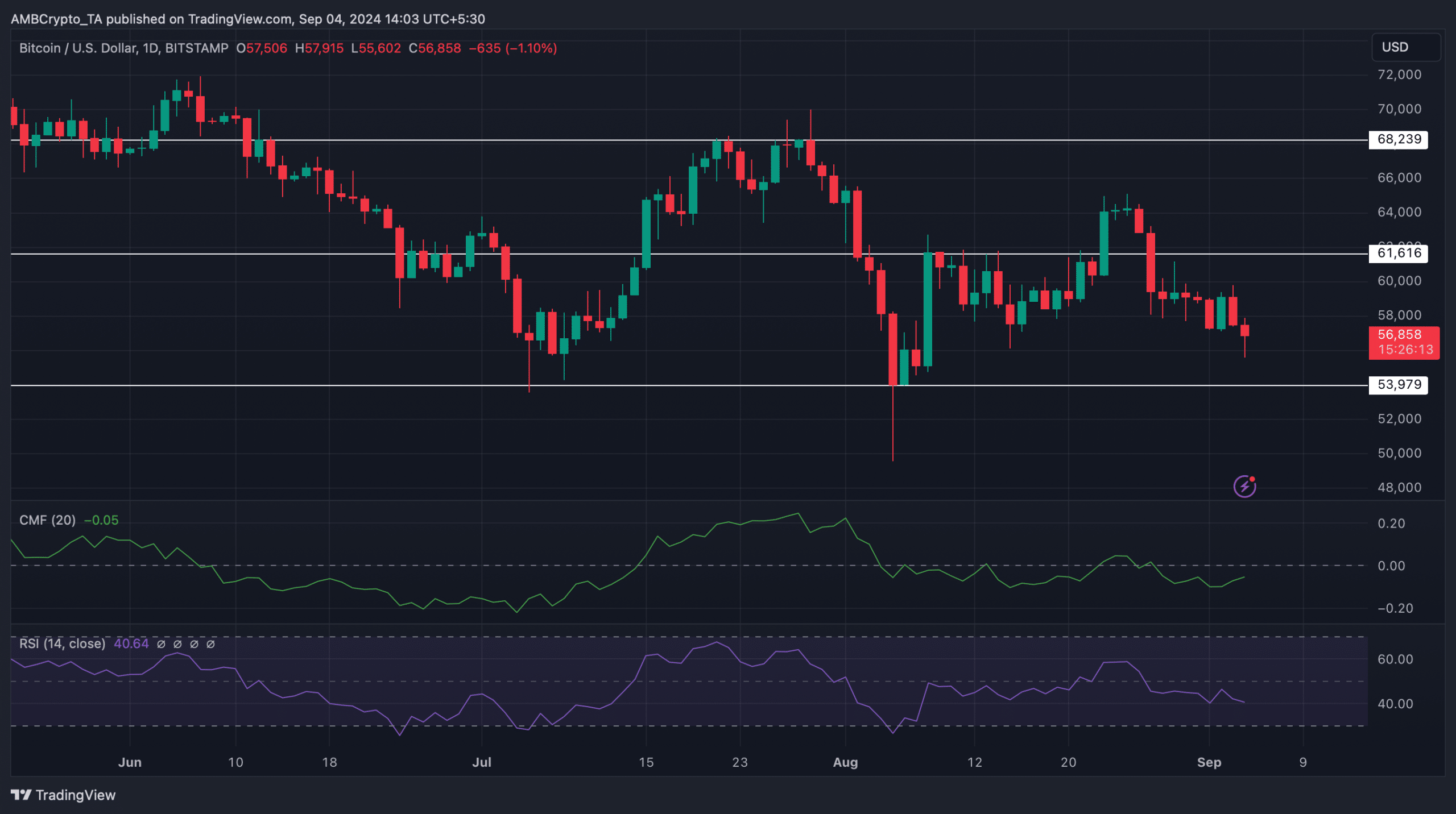

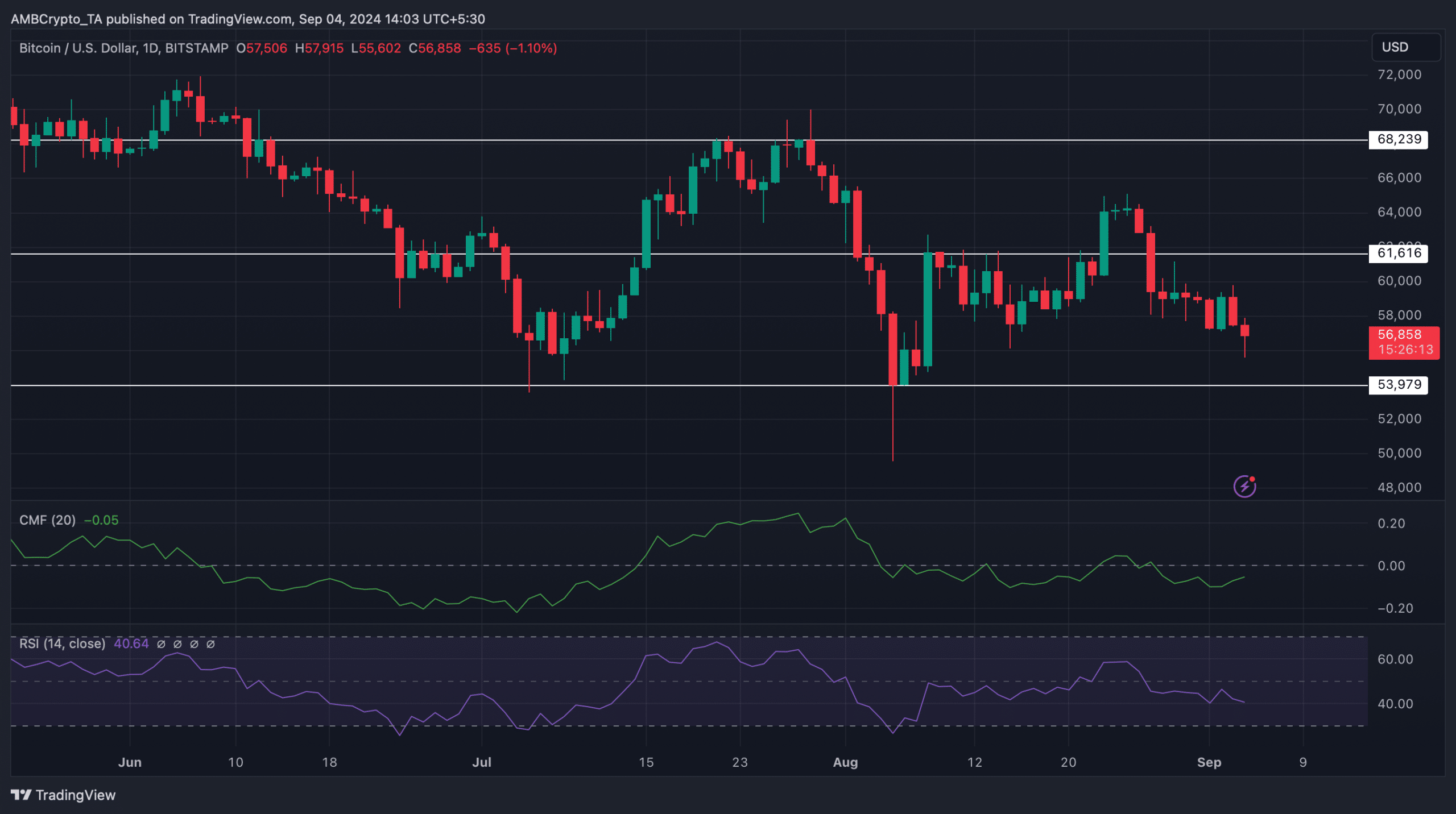

The Chaikin Money Flow (CMF) registered an uptick. This indicated that BTC’s bearish price action might end soon.

However, the Relative Strength Index (RSI) moved southwards, meaning that the possibility of BTC falling further can’t be ruled out yet.

Source: TradingView