- Bitcoin’s price targets $90,000 as a triangle pattern signaled a potential breakout.

- Whale activity and miner flows drive market speculation and influence price trends.

Bitcoin [BTC] has experienced notable price movements over the past week, fluctuating between $80,380 and $84,000. Despite volatility, BTC maintained an upward trend, trading at $83,100, at press time.

Over the past week, BTC gained 3.5%, though it saw a minor dip of 0.29% in the last 24 hours. With a market cap of $1.64 trillion, Bitcoin continued to display strong market activity as it tested key resistance levels.

Bitcoin’s triangle pattern points to…

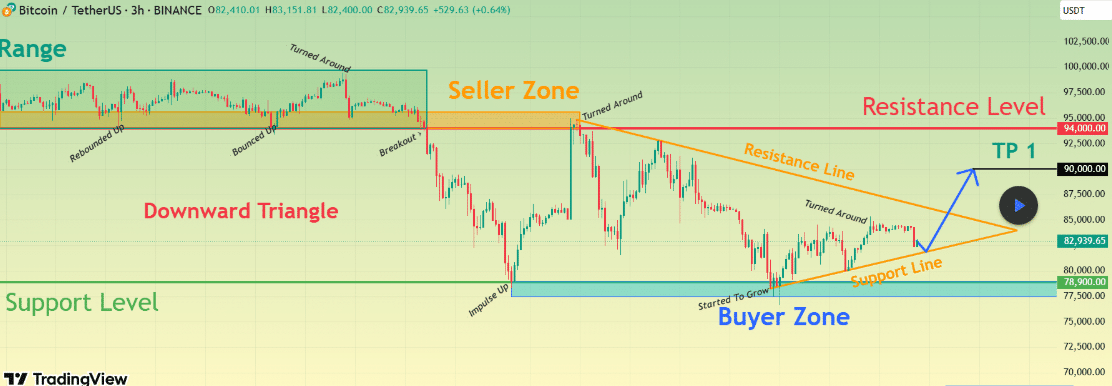

Bitcoin’s 3-hour chart reveals a downward triangle pattern with support at $82,939.65 and resistance near $94,000.

At the time of writing, BTC was trading within a buyer zone, where previous price action showed upward movement, marked by “Impulse Up” and “Started to Grow” points.

Source: TradingView

Therefore, Bitcoin’s price is nearing a crucial resistance level. A breakout could drive BTC to a target of $90,000, signaling sustained bullish momentum.

If this happens, Bitcoin may achieve further gains and potentially set new all-time highs.

Impact of large transactions and miner flows

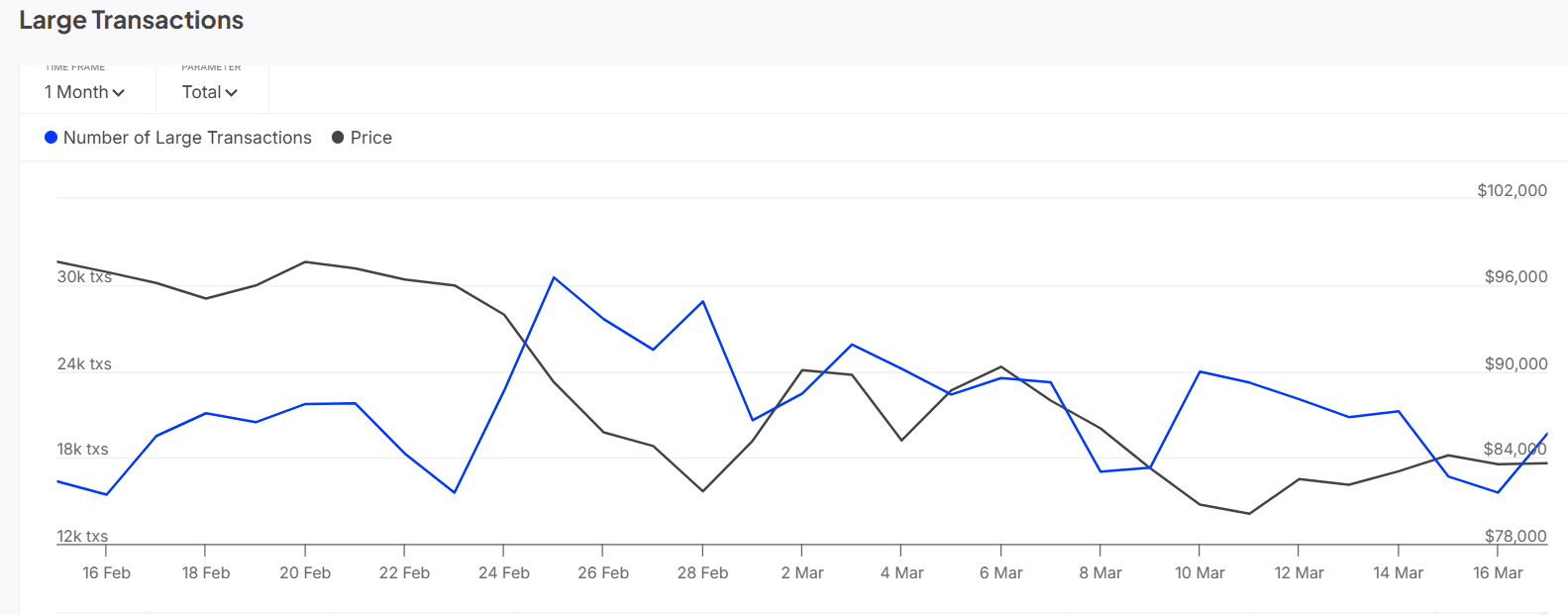

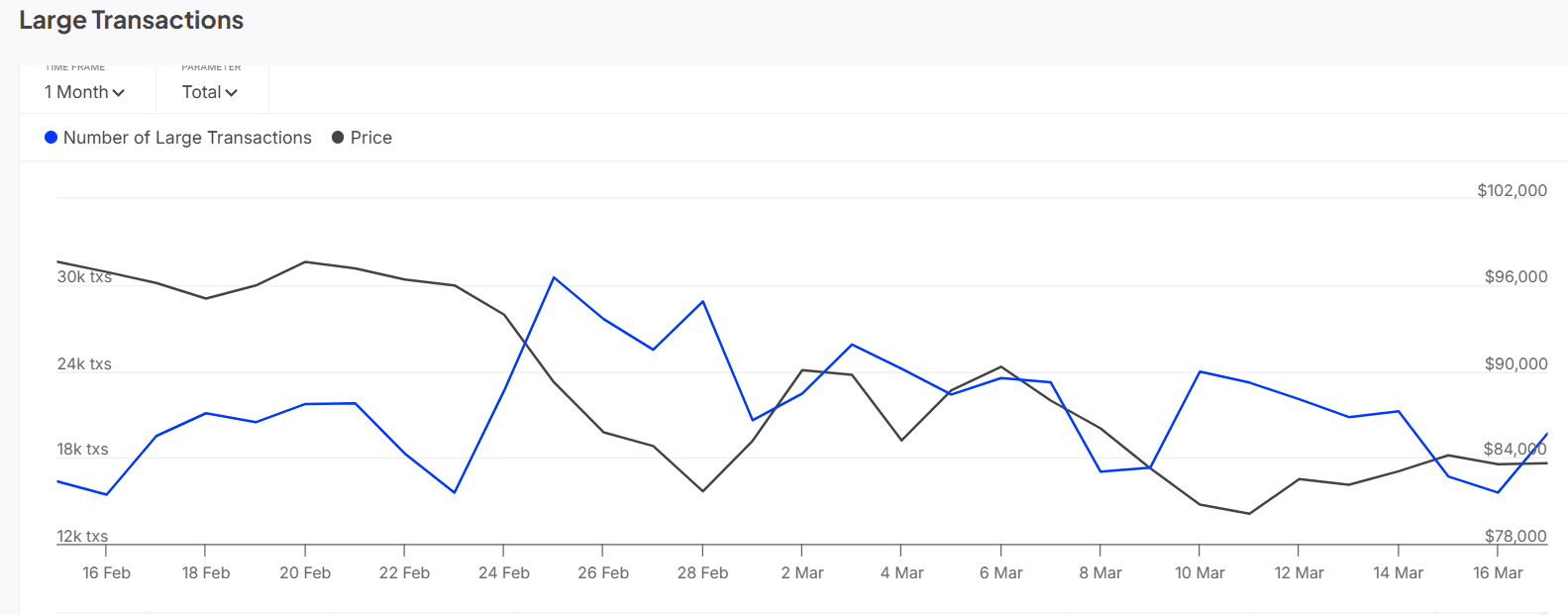

Between the 15th of February and the 17th of March 2025, Bitcoin’s price ranged from $78,000 to $84,000. Large transactions increased during price surges but declined during dips, particularly on the 22nd of February and the 6th of March.

When Bitcoin hit $84,000 on the 16th of March, large transactions spiked, reflecting growing investor confidence.

Source: IntoTheBlock

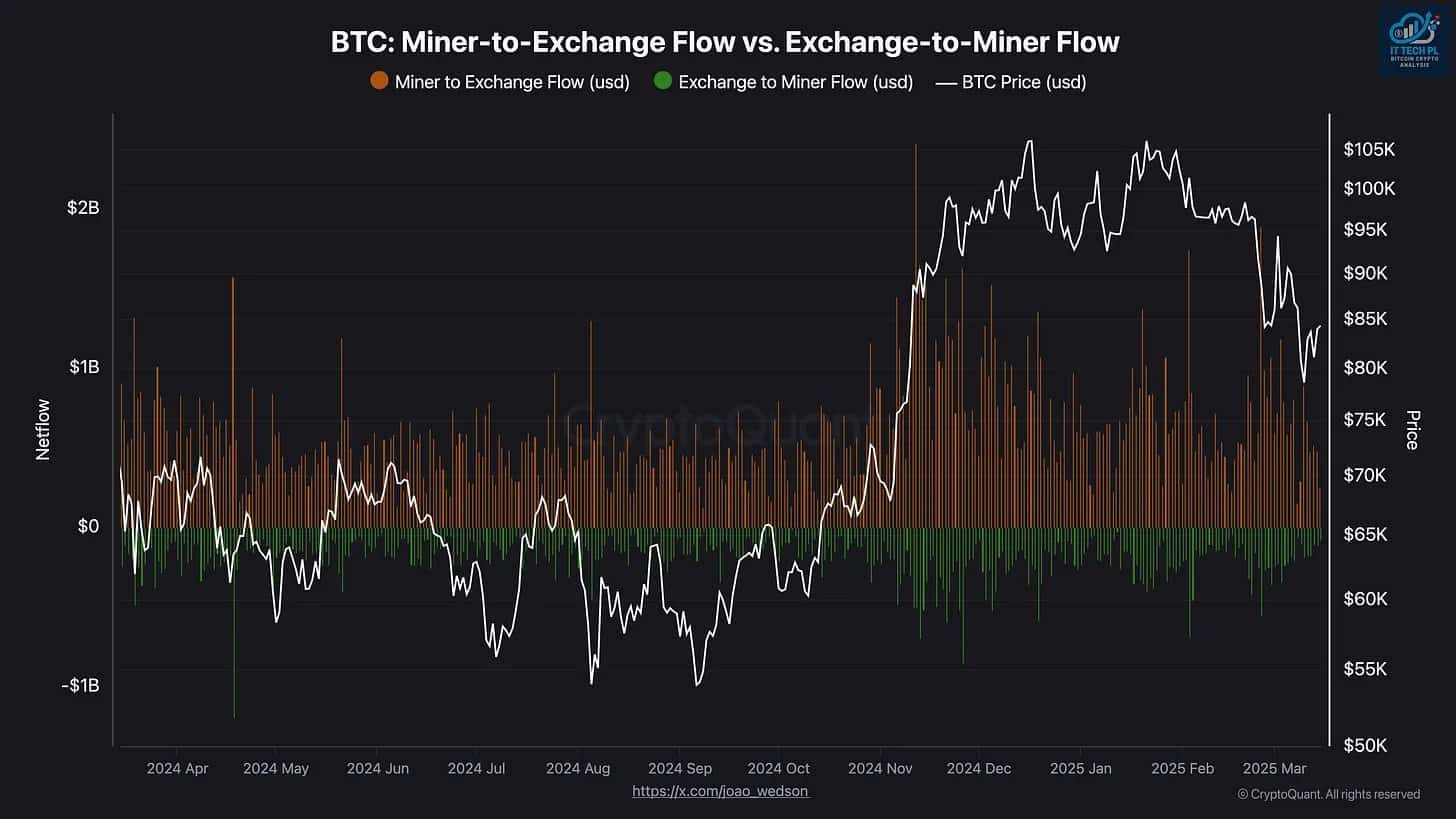

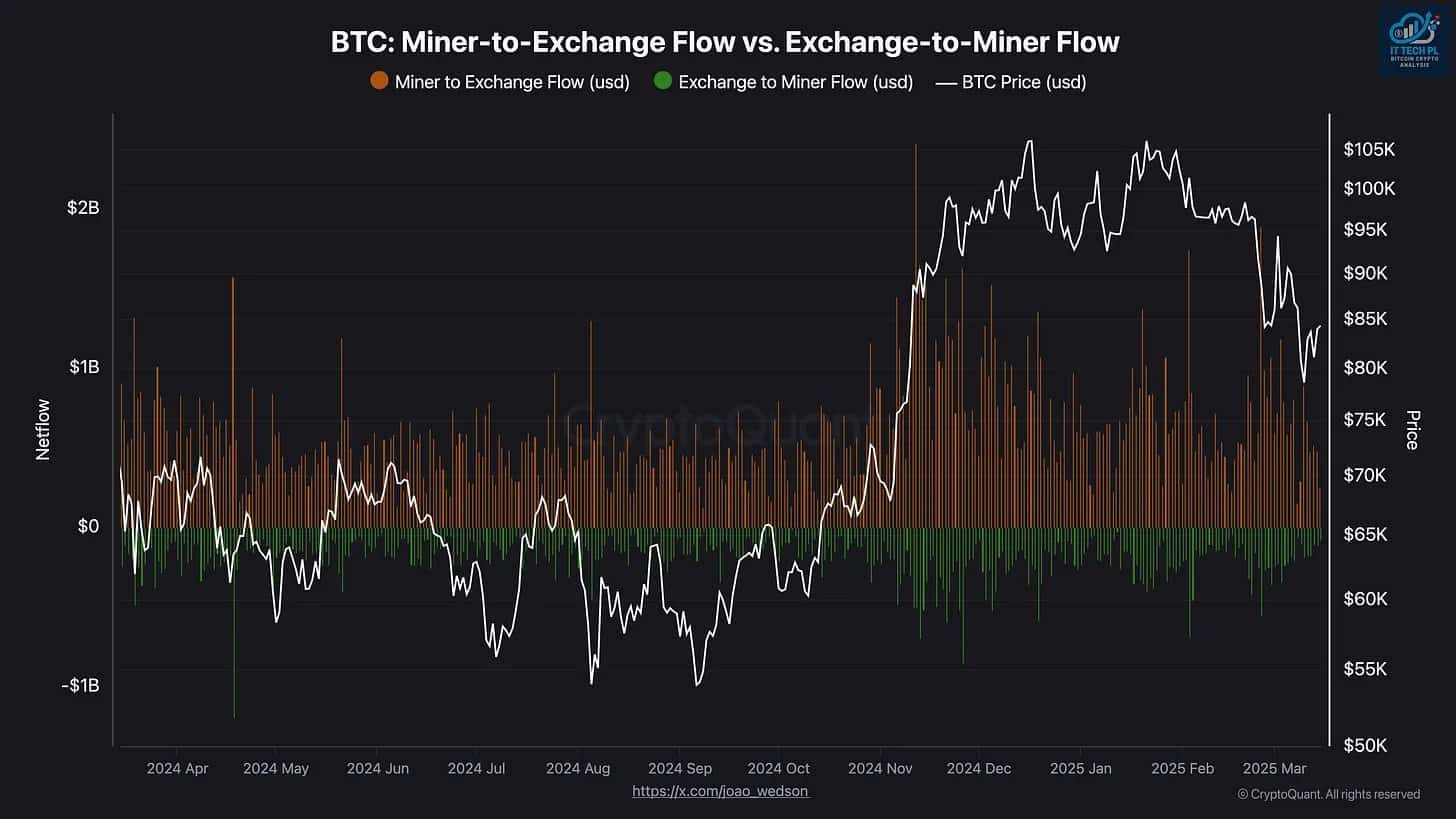

CryptoQuant author IT Tech pointed out that from April 2024 to March 2025 miner-to-exchange and exchange-to-miner flows directly impact Bitcoin’s price movements.

Between late February and March 2025, as Bitcoin rose from $80,000 to over $90,000, miner-to-exchange transfers increased.

This indicates miners were selling Bitcoin, likely expecting higher prices, which impacted market sentiment and potential price movements.

Source: CryptoQuant

Whale activity raises market speculation

A Bitcoin whale recently transferred $25.1 million in BTC to FalconX after holding it dormant for 1.5 years. The transaction followed 300 Bitcoin movements, sparking discussions on its potential market impact.

The whale originally acquired 1,500 BTC for $39.5 million in August 2023, at an average price of $26,353 per Bitcoin.

Following Bitcoin’s recent surge, the whale has achieved an estimated profit of $85.7 million, reflecting a 219% return. A total of 1,050 BTC, valued at $87.2 million, was transferred to two new wallets, while 150 BTC, worth $12.5 million, remains untouched.

This significant activity has sparked concerns about its potential impact on Bitcoin’s price trends and market movements.

Bitcoin’s price continues to be heavily influenced by large transactions, miner activity, and market sentiment, making its next move a crucial area of focus for traders and investors.