- BTC exchange reserves have dropped to the lowest level this year.

- Bitcoin, leaving exchanges’ reserves, stood at 2.6 million BTC.

Bitcoin [BTC] has once again broken through a key resistance level, rising above $65K, a level it had struggled to surpass for over eight months.

This recent surge has triggered bullish momentum, meaning BTC is gaining strength.

A significant sign of this positive outlook is the drop in Bitcoin exchange reserves, which have hit their lowest levels of the year.

The reserves stood at approximately 2.6 million BTC. This decline suggests that both short-term and long-term holders are increasingly unwilling to sell. It has fueled expectations of further price gains.

Historically, lower exchange reserves are associated with bullish market sentiment, as they indicate a reduced likelihood of selling pressure in the near term.

Source: CryptoQuant

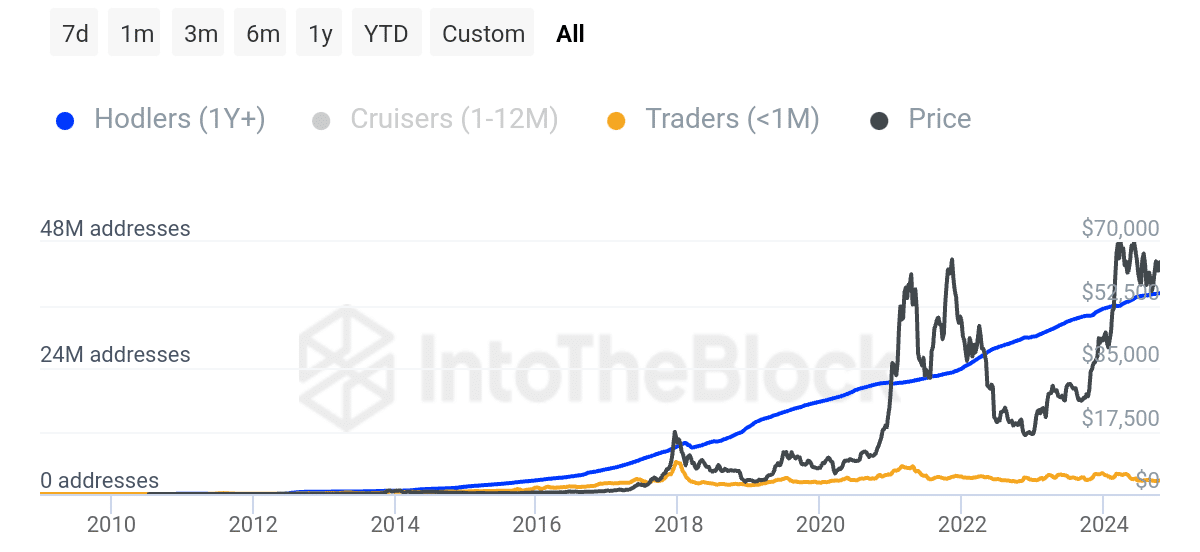

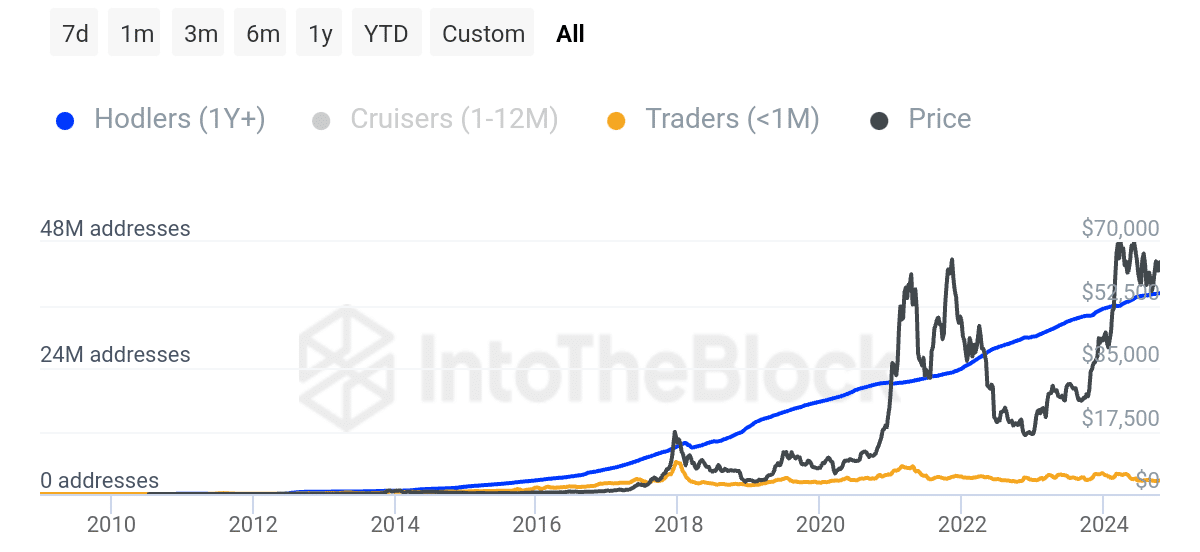

Bitcoin’s accumulation trend among long-term holders has been steadily rising since 2014, and the number of addresses holding BTC for over a year is now at an all-time high.

This strong accumulation by long-term investors supports a higher price trajectory for Bitcoin.

According to data from IntoTheBlock, the number of addresses holding BTC for more than a year has increased by 0.35% over the past month.

Currently, over 38 million addresses have retained Bitcoin for more than a year, while 13 million addresses have been held for one to twelve months.

Source: IntoTheBlock

Only 2 million addresses have held BTC for less than a month, underscoring the dominance of long-term holders.

This long-term accumulation trend is a bullish signal. This indicated that more investors are confident in Bitcoin’s future growth and are holding onto their positions for potential gains.

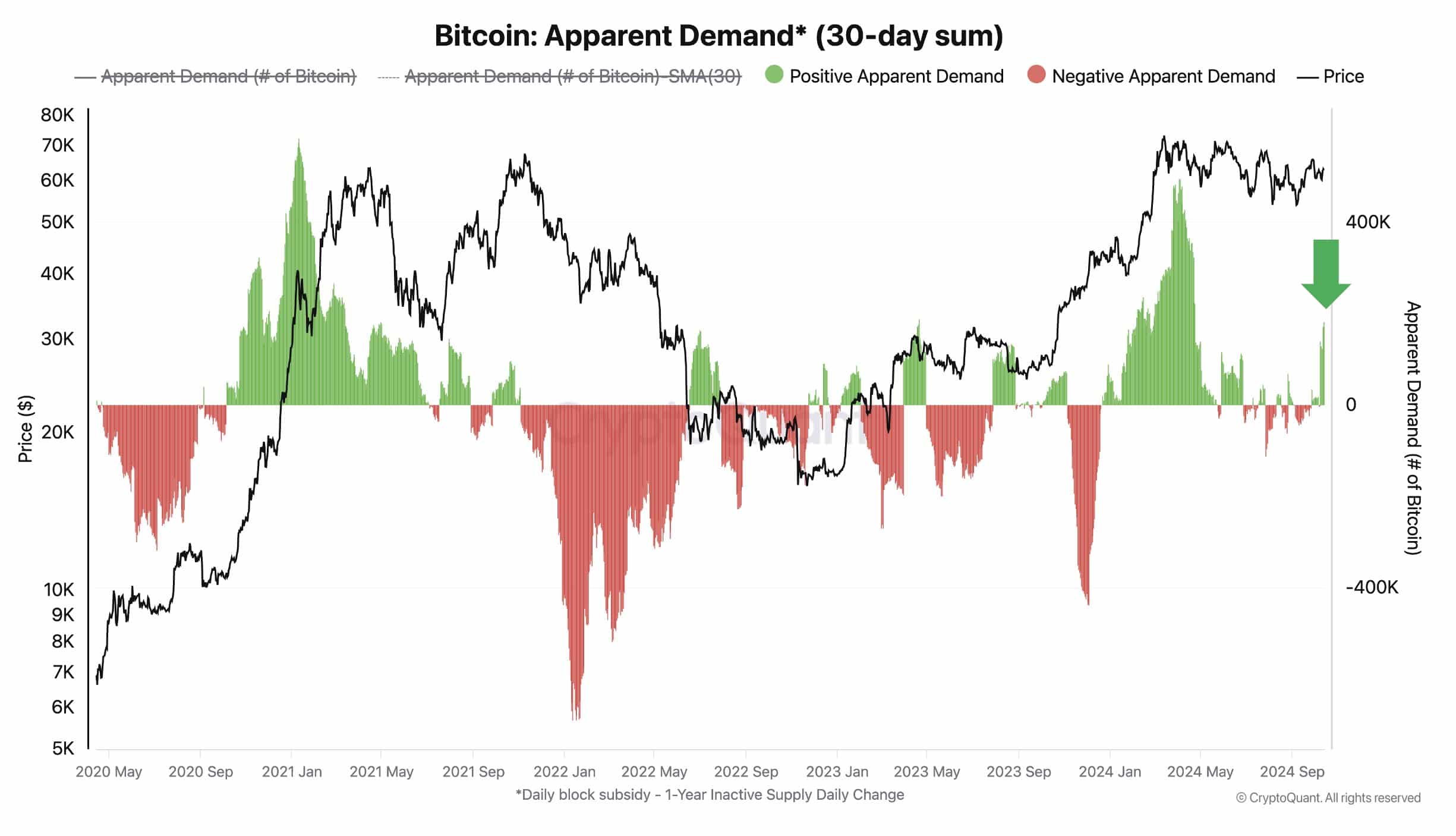

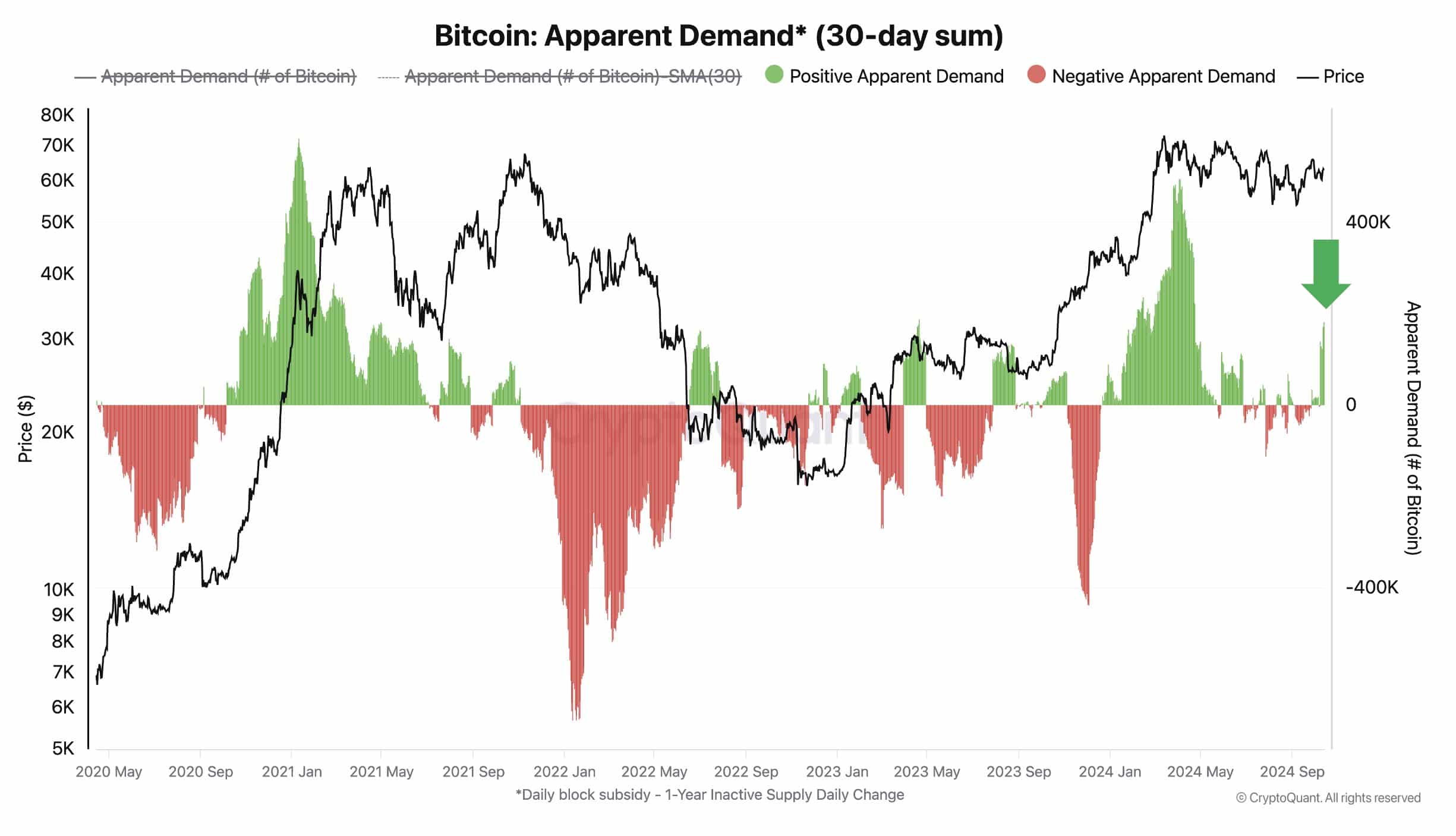

BTC’s apparent demand

Another positive indicator for Bitcoin’s price is the apparent demand, which measures the difference between production and changes in inventory.

In the context of Bitcoin, production refers to the issuance of new BTC through mining, while inventory refers to the supply of Bitcoin that has been inactive for over a year.

When the inventory reduction outpaces new production, it signals increasing demand for Bitcoin.

Source: CryptoQuant

This increased demand, combined with a limited supply, typically drives prices higher.

Given the recent trends, the demand for Bitcoin appears to be on the rise, further supporting the case for continued price increases.

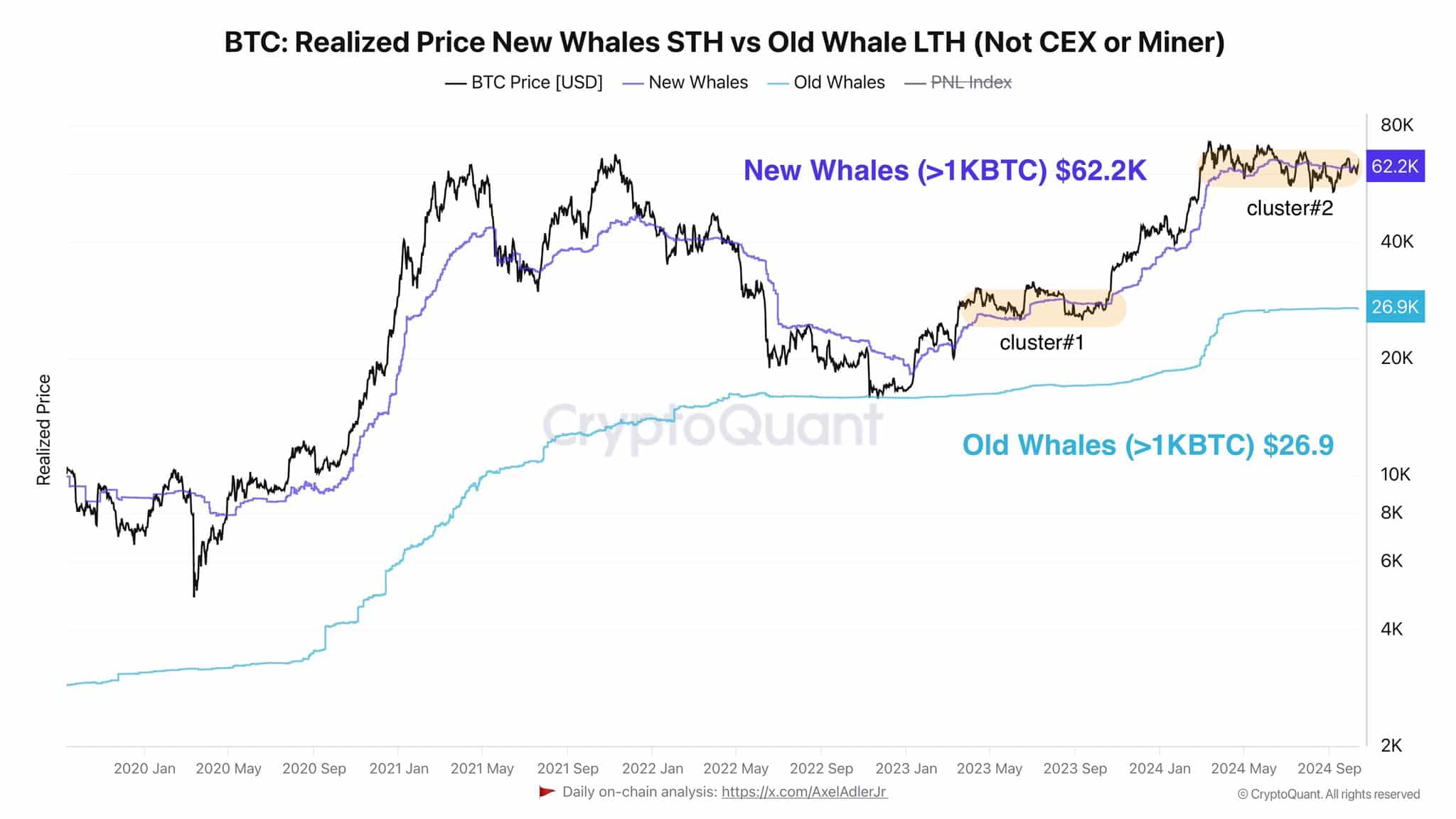

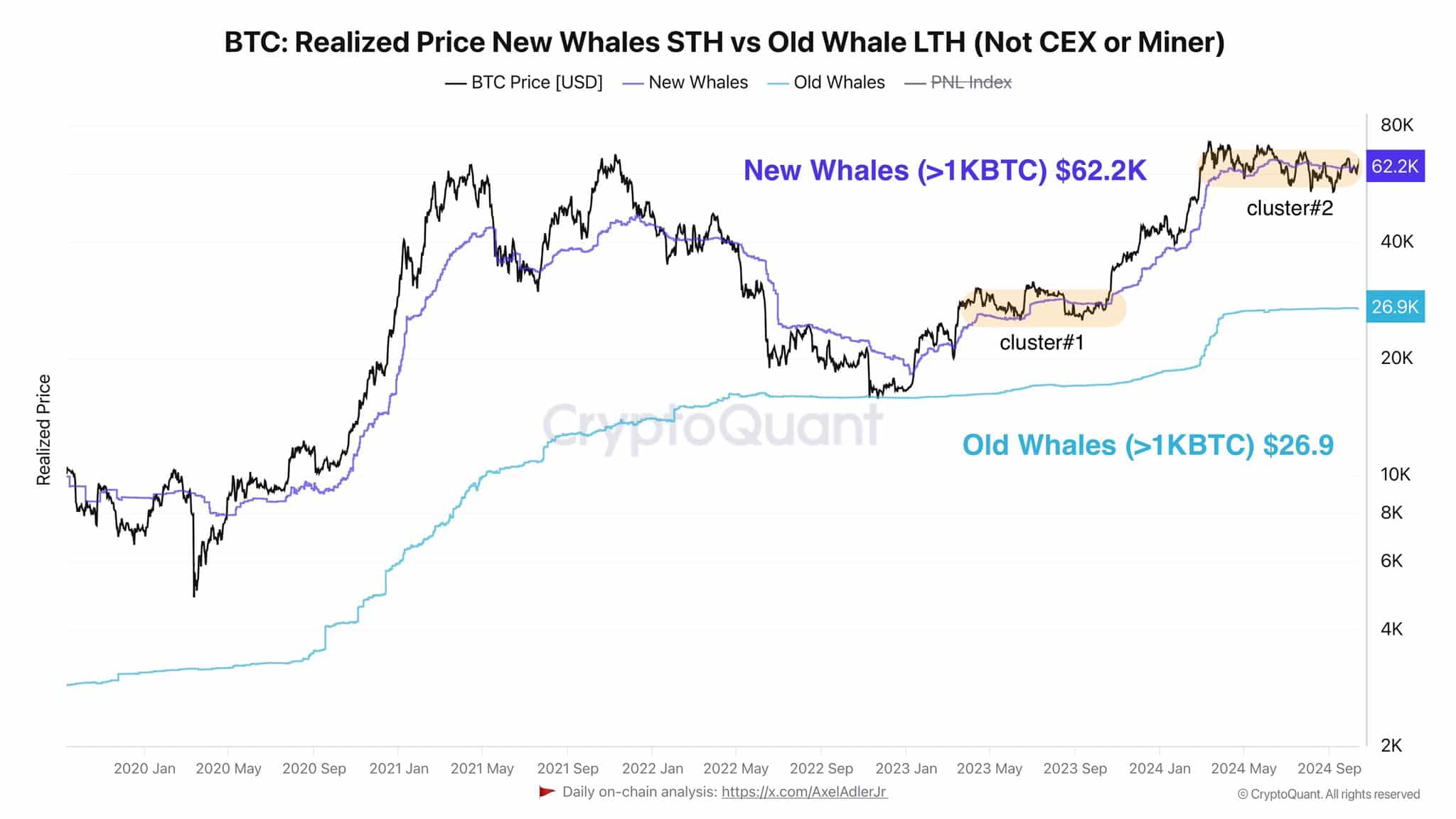

Realized price of new vs. old whales

The average purchase price of new whale investors is currently around $62.2K, while more experienced whales have an average purchase price of $26.9K.

With Bitcoin now trading above these key price levels, it becomes less likely that whales will sell their holdings until the market cycle peaks.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

This consolidation of whale purchases around the current levels reinforces the belief that Bitcoin’s price is poised to move higher.

Large investors typically hold onto their positions during an uptrend, adding further stability and confidence to the market.