- Bitcoin battles volatility amid Trump tariffs, with prices dipping below $90K.

- The market is divided as CZ predicts $1 million for Bitcoin while Schiff foresees a global sell-off.

The crypto landscape in 2025 has been anything but stable, with Bitcoin [BTC] riding a wave of dramatic highs and lows.

After briefly soaring past the $109,000 milestone in the wake of Donald Trump’s return as the 47th U.S. President, the flagship cryptocurrency now finds itself struggling to stay above the $90,000 threshold.

Market sentiment took a further hit as Trump’s aggressive tariff agenda added pressure on global trade and investor confidence, casting fresh uncertainty over BTC’s near-term momentum.

Execs optimistic about Bitcoin

However, despite the turmoil, analyst Bitcoin educator Dan Held noted,

“It’s in these bearish moments where you might start to question your belief in Bitcoin.That pit in your stomach. The anxiety. The fear. But you didn’t feel this way when Bitcoin was going up, you’re feeling it now.

He further added,

As animals, we’re highly emotional. That’s why people fomo buy and panic sell. Don’t panic. HODL.”

Other joins the fray…

Echoing the broader optimism within the crypto community, Binance founder Changpeng Zhao (CZ), recently appointed as a Strategic Advisor to Pakistan’s Crypto Council, reaffirmed his bold stance on Bitcoin’s long-term trajectory.

In a declaration, CZ stated that Bitcoin is “definitely going to $1 million,” signaling his unwavering belief in the digital asset’s potential despite the current market turbulence.

Zhao added,

“WE ARE JUST AT THE BEGINNING”

His comments come at a time when Pakistan is actively embracing blockchain innovation, adding further weight to his prediction.

This also coincided with Cardano’s Charles Hoskinson suggesting Bitcoin could reach $250,000 this year, especially with tech titans like Apple and Microsoft joining in.

Schiff continues with his Bitcoin criticism

However, not everyone shared similar views, as noted by Peter Schiff, who said,

“Bitcoin is currently 24% below its January high in U.S. dollars, but it’s 30% below its high in Japanese yen and 31% below its high in euros.”

He further added,

“So Bitcoin HODLers in Europe and Japan are taking an even bigger beating than those in the U.S. and will likely throw in the towel first.”

Despite the polarizing forecasts from industry leaders, Bitcoin’s short-term trajectory remains clouded by volatility.

What’s lies ahead for BTC?

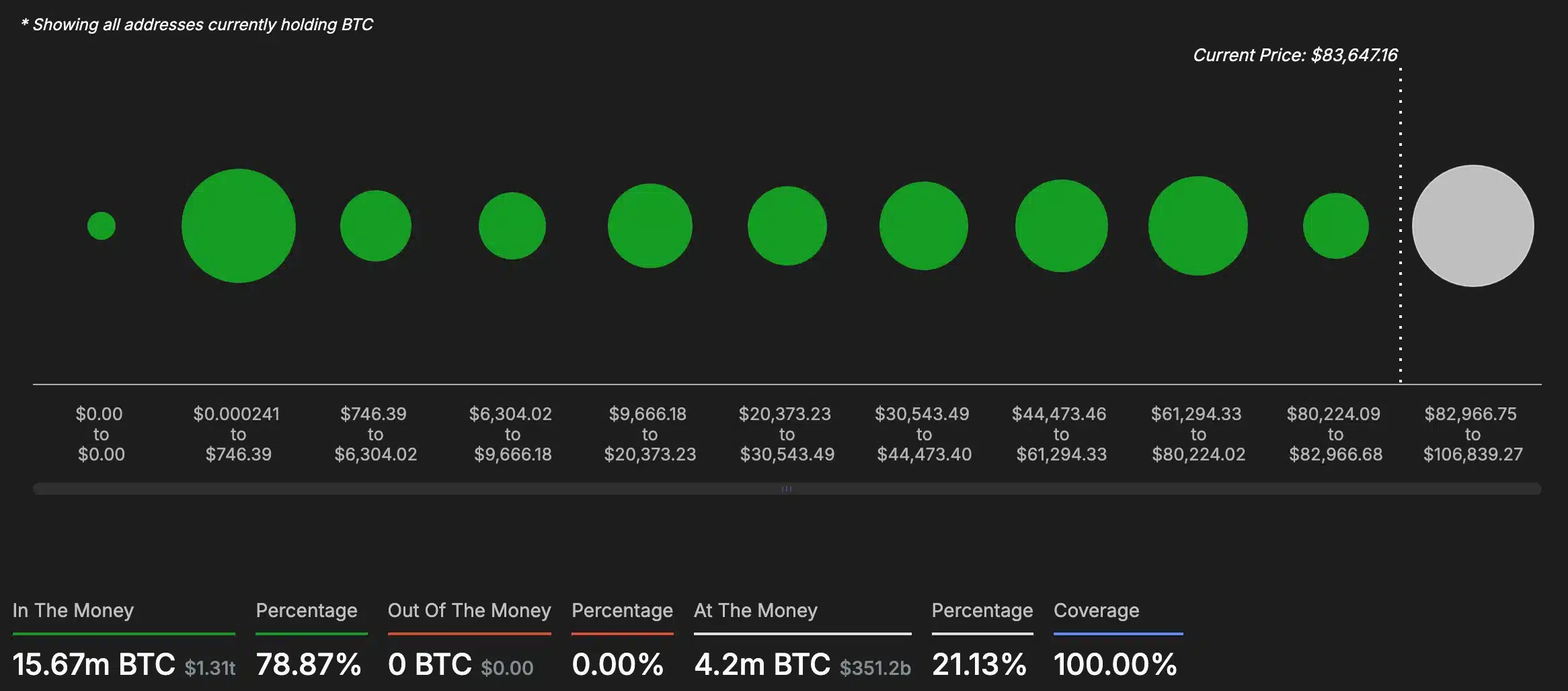

While on-chain data from IntoTheBlock paints an optimistic picture, with nearly 79% of holders currently “in the money,” technical indicators offer a more balanced outlook.

Source: IntoTheBlock

BTC’s recent uptick to $83,757.72, at press time, backed by a positive CMF reading of 0.06, hinted at growing bullish momentum, yet the RSI hovering around 50 shows hesitation.

Source: Trading View

If momentum builds, analysts suggest the next key resistance could emerge near the $94,500 mark, potentially setting the stage for Bitcoin’s next major breakout.