- BTC’s market structure showed signs of a potential shift for the better.

- Users who opted for the BTC holding strategy hit new highs.

Bitcoin’s [BTC] downtrend and subsequent consolidation since peaking in March could end soon.

According to blockchain analytic firm Glassnode, last week’s relief rally to $66K presented a first higher high since June.

Source: Glassnode

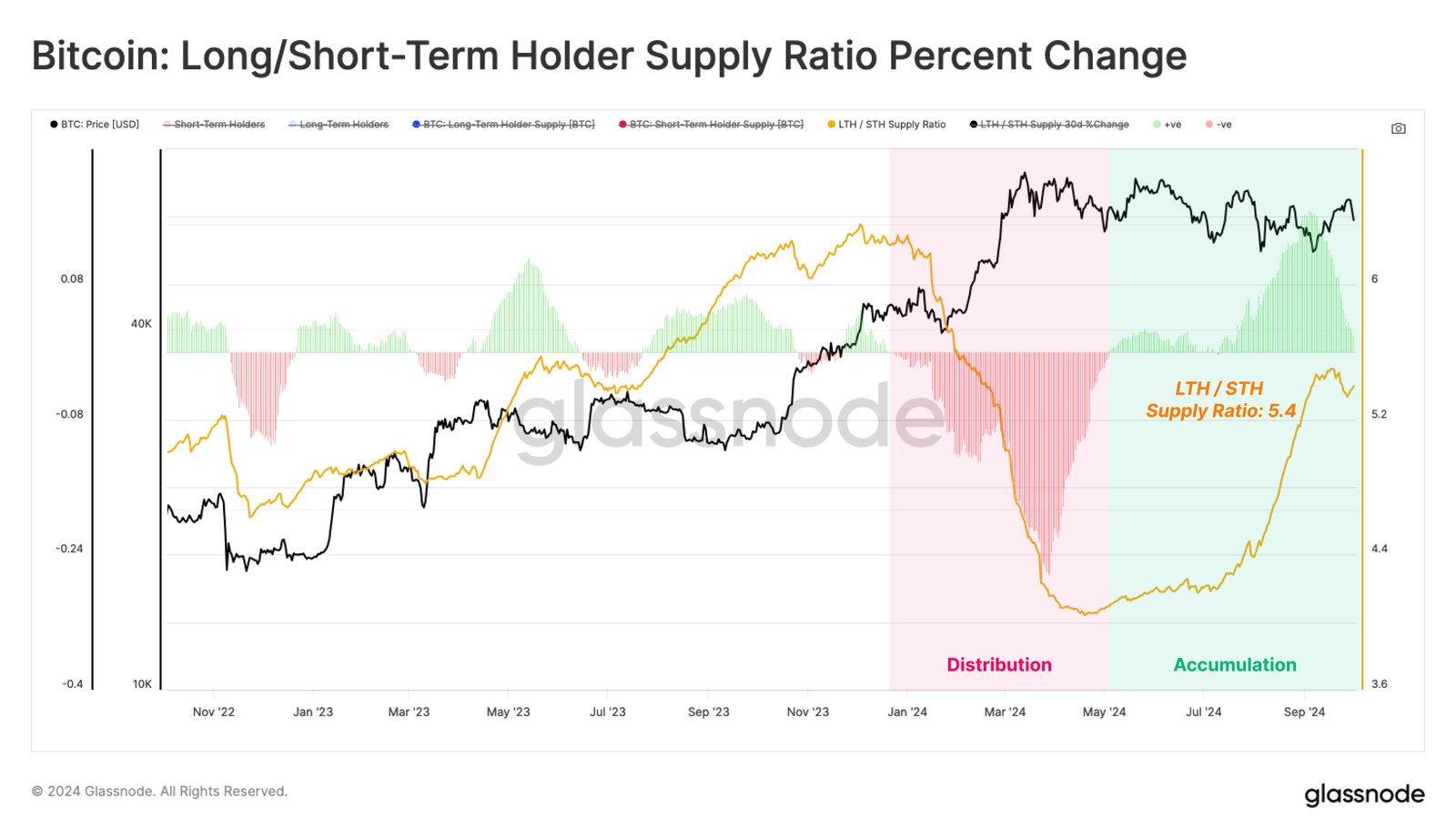

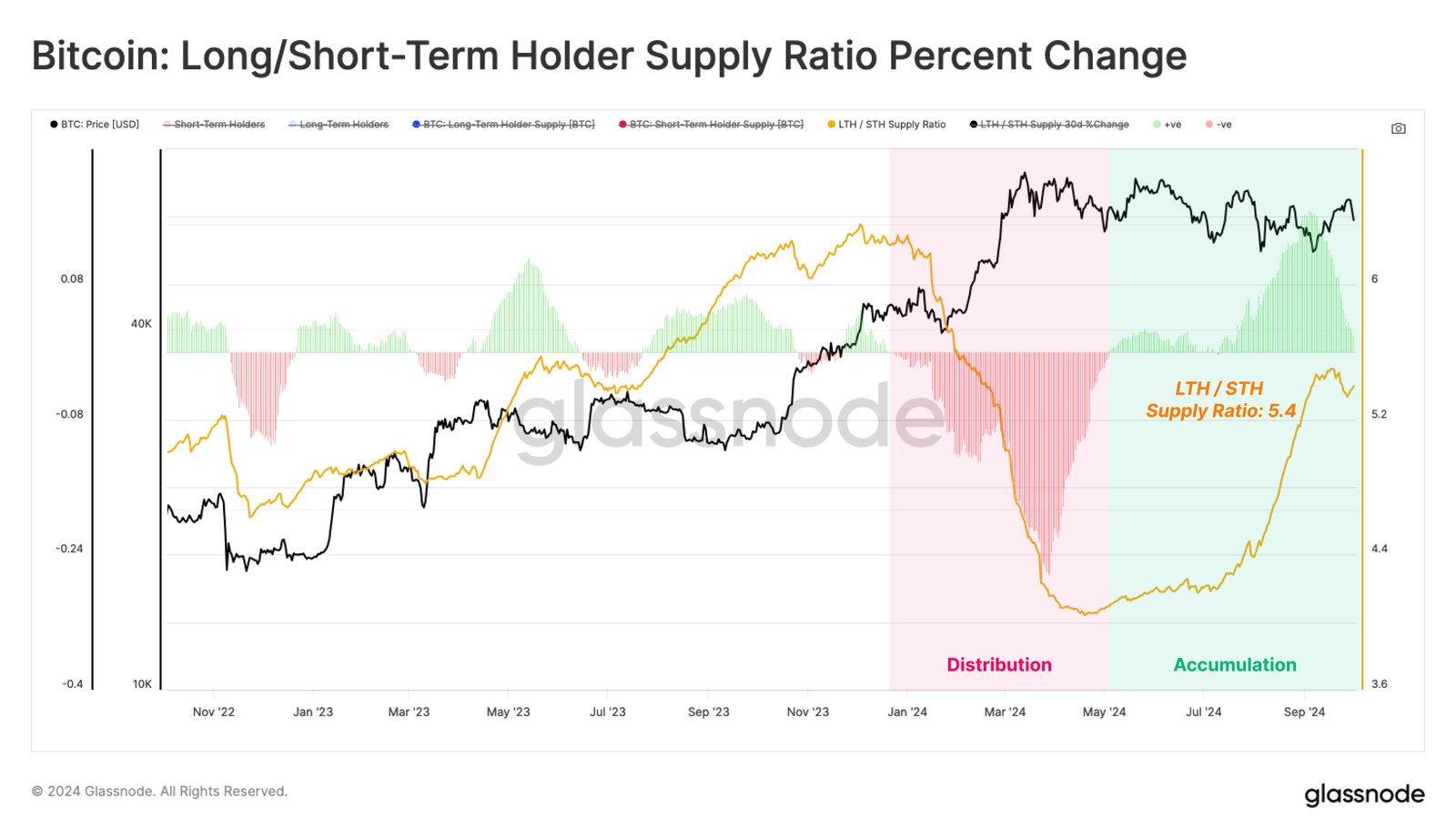

Additionally, a couple of on-chain metrics also printed new highs. The analytics firm noted that these were increasing signs of a market structure shift, which could mark the potential end of the ongoing Bitcoin re-accumulation phase seen since March.

“This price action provides the first inclinations that the structured downtrend may be approaching a phase shift.”

Bitcoin cycle aligns with past trends

Source: Glassnode

Despite the prolonged consolidation, BTC was at the same level as in past market cycles after cycle lows. It was up over 300% from its cycle lows, further reinforcing that BTC price still had more room for growth.

The bullish prospect was also illustrated by the rising number of users and whales adopting the BTC holding strategy. Since May, the Long/Short-Term Holder Supply Ratio has increased to 5.4, underscoring that users held rather than sold their BTC.

“This suggests that HODLing persists as the dominant behaviour of Bitcoin investors.”

Source: Glassnode

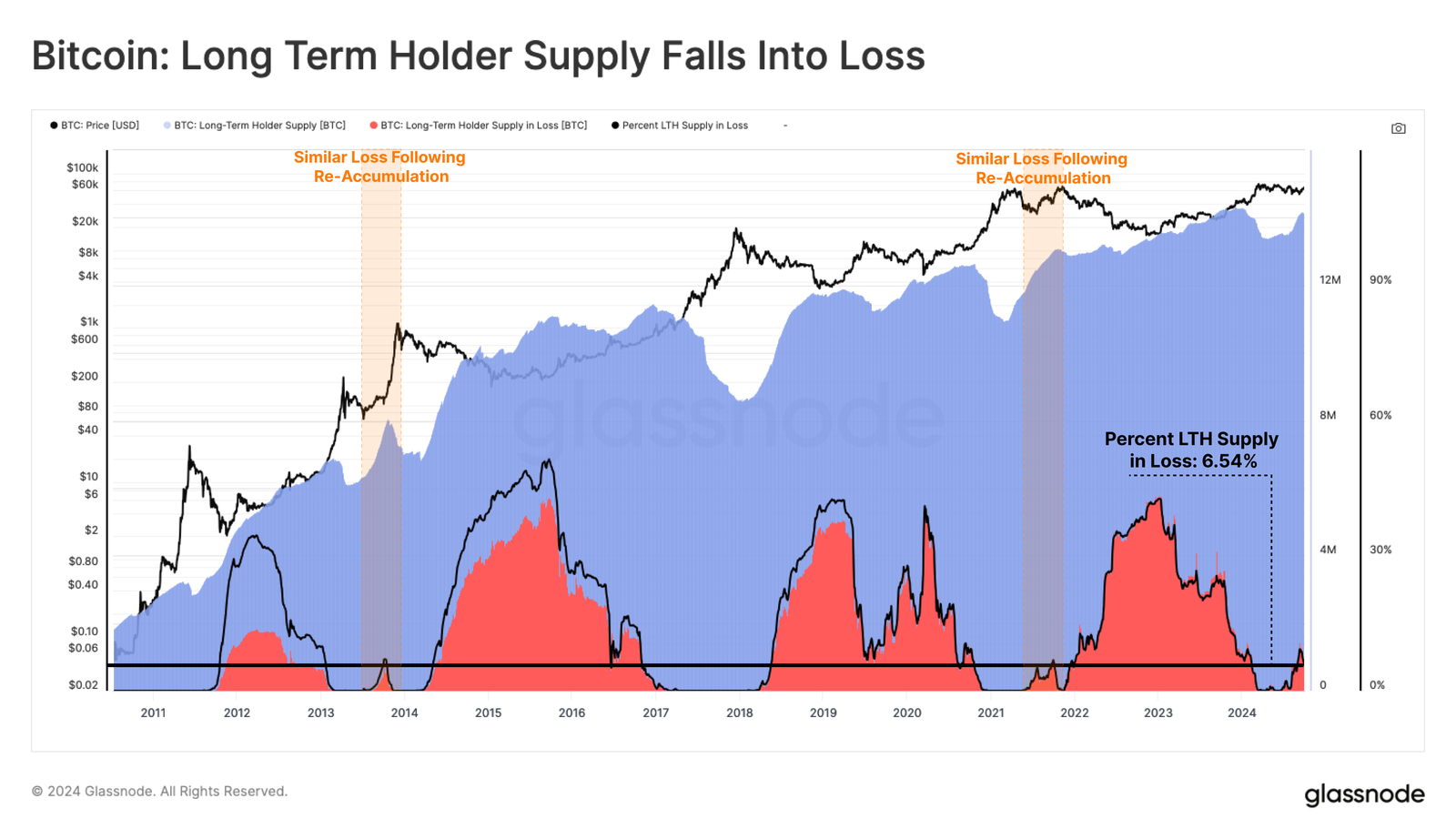

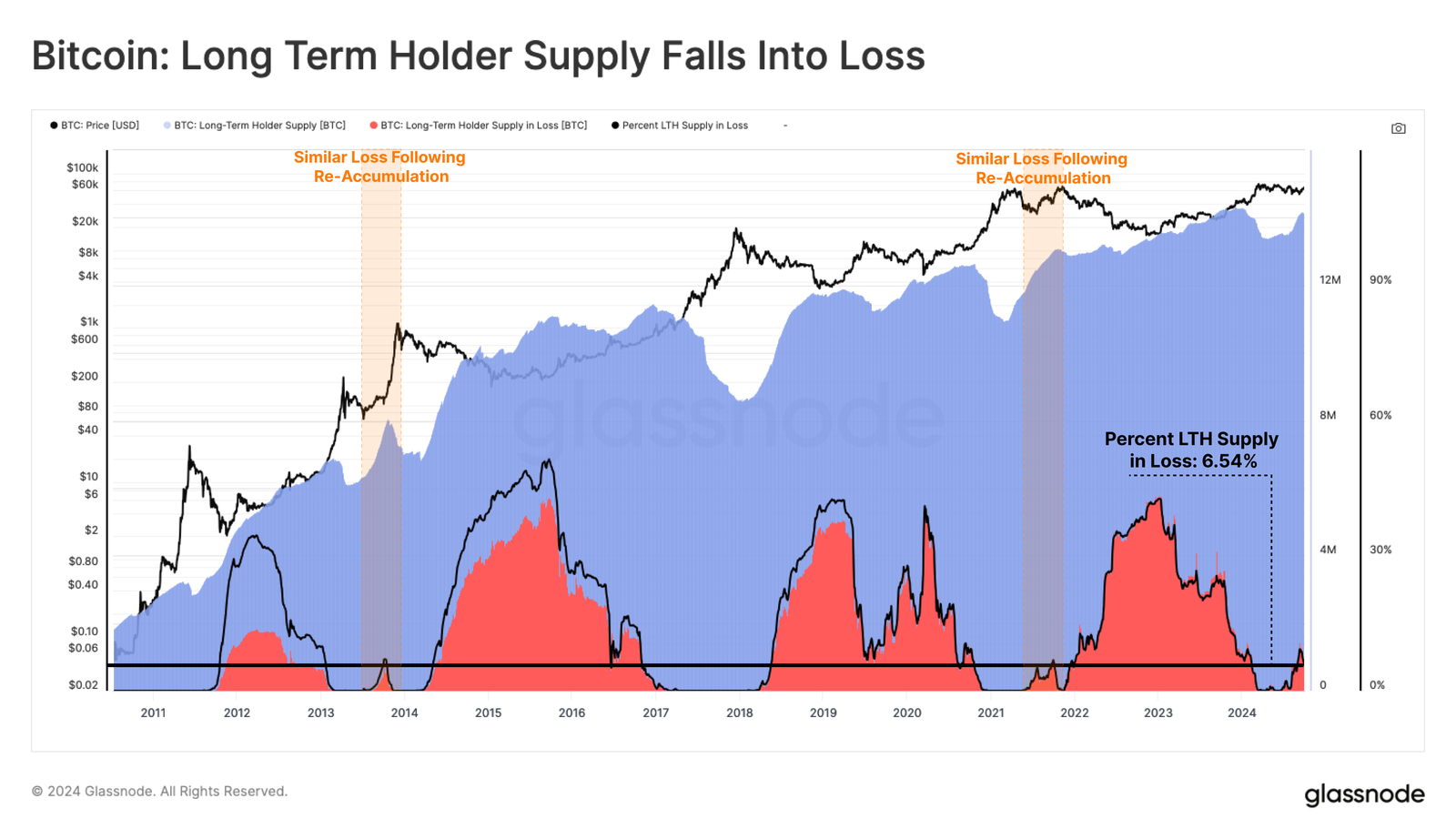

That being said, about 6.5% of Long-Term Holders (LTH) were in loss as of the 1st of October.

However, Glassnode stated that the unrealized losses across the LTH cohort were relatively small but were consistent with past re-accumulation phases.

Source: Glassnode

The analytics firm added that the recent relief rally boosted STH into profits, a different scenario from the previous few weeks.

Collectively, these reinforced the idea of a potential market structure shift to extend the re-accumulation period.

However, Peter Brandt believed the market structure shift could only happen if BTC surged above $71K.

At press time, BTC weakly held the psychological level of $60K after a recent sell-off.