[ad_1]

- Curve has experienced a significant price surge, driven by heightened developer activity.

- In the derivatives market, there has been a notable uptick in bets predicting that CRV will climb higher.

Over the past week, Curve [CRV] has maintained its upward trajectory.

Following a remarkable 123.49% gain in its previous week rally, the token recorded an additional 44.13% increase in the last 24 hours, positioning it among the top-performing assets in the market.

AMBCrypto examines the factors behind CRV’s recent price surge and evaluates whether this momentum is likely to persist.

Investors show renewed interest in CRV

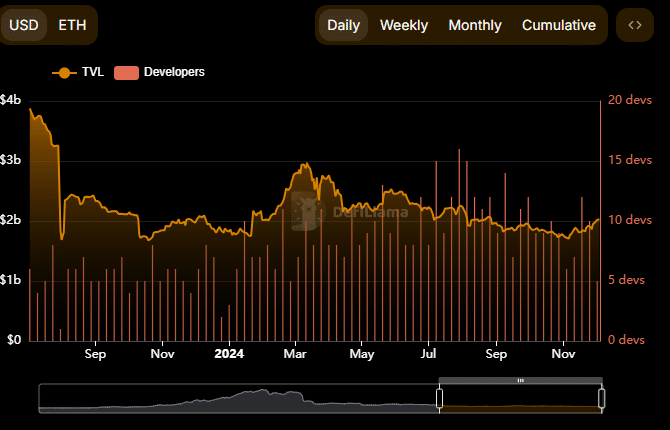

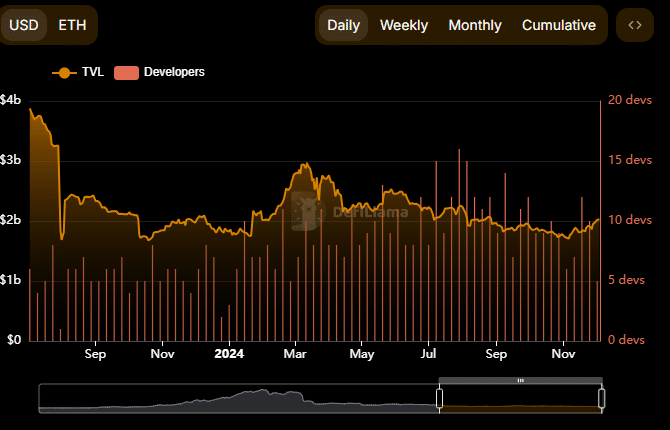

CRV has seen a notable uptick in both developer activity and total value locked (TVL), showing renewed investor confidence.

The total value locked (TVL) serves as a key indicator of investor activity within a blockchain ecosystem. It reflects the volume of assets deposited and staked to support development and operations.

After months of decline since September, CRV’s TVL has rebounded significantly, reaching $2.03 billion. This recovery marks a return to pre-decline levels and suggests growing bullish sentiment in the market.

The rise in TVL aligns with a surge in developer activity, as reported by DeFiLlama.

Increased developer engagement indicates ongoing improvements and innovation within the CRV ecosystem, which may be driving positive price momentum.

Source: DeFiLlama

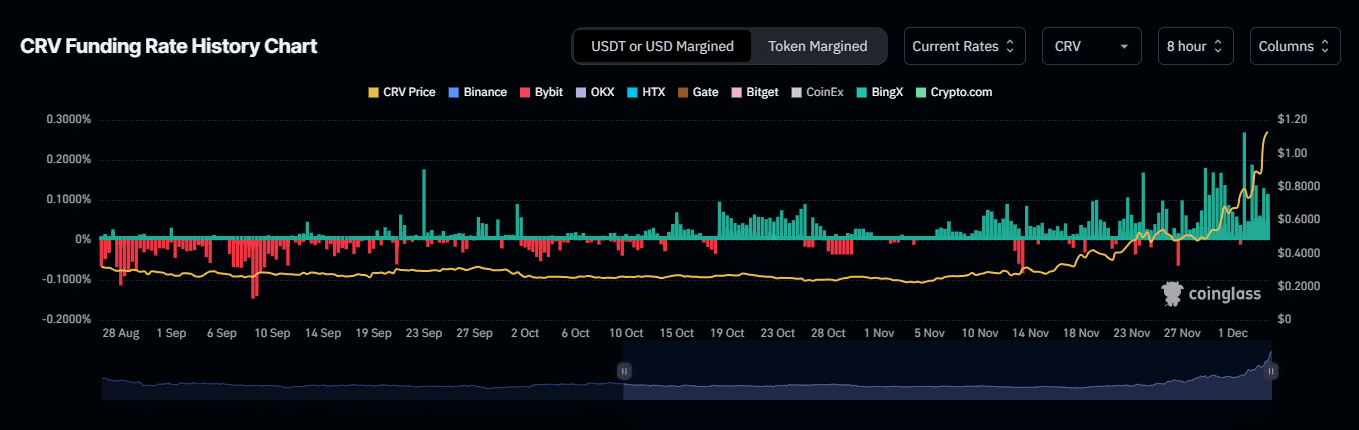

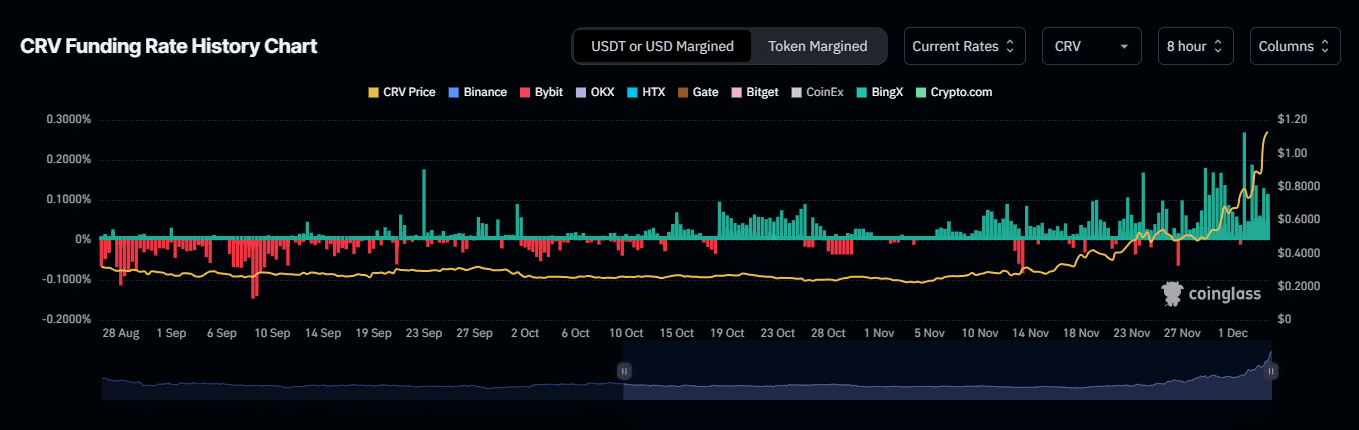

This wave of buying activity is evident not only among ecosystem investors but also in the derivatives market, where traders are increasingly bullish on CRV’s prospects.

Derivative traders push CRV’s momentum higher

Derivative traders are mirroring the actions of investors by opening long positions on CRV showing strong bullish sentiment.

In the past 24 hours, the Funding Rate has seen a major rise, reaching 0.0820% at press time. This predominantly bullish figure indicates a growing presence of long traders in the market.

The Funding Rate plays a key role in balancing the disparity between an asset’s spot price and Futures price. A rising Funding Rate, as observed here, suggests that buyers (long traders) are dominating market activity.

Source: Coinglass

Open Interest has also surged, recording a 30.42% increase to $270.33 million.

This growth reflected a higher number of active buyers in the market, with open contracts and sustained positions further driving the bullish outlook for CRV.

Increasing long positions on CRV

Data from Coinglass indicated a rise in long positions being opened in the market, reflecting growing optimism among traders.

Read Curve’s [CRV] Price Prediction 2024–2025

At press time, the Long/Short Ratio had climbed to 0.9739, pointing to a heightened interest in CRV.

If this ratio surpasses 1, it could further support CRV’s ongoing price surge, especially if investor and derivative trader activity continues to strengthen.

[ad_2]

Source link