- Dogecoin’s DeFi TVL drops to $2.79M, showing a loss of confidence in meme-based assets.

- Global market panic accelerates Dogecoin’s decline, raising doubts about the future of meme-driven DeFi.

Dogecoin [DOGE] just hit a new low — not in price, but in utility. The network’s TVL has plunged deep, marking its weakest DeFi presence since 2023.

The drop comes in the wake of crypto’s “Black Monday” sell-off, where market-wide panic wiped billions in value.

But Dogecoin’s decline goes beyond market sentiment — this sharp DeFi unraveling signals a deeper crisis of confidence in meme-based financial infrastructure. Is Dogecoin’s ecosystem quietly collapsing beneath the surface?

TVL collapse erases months of growth

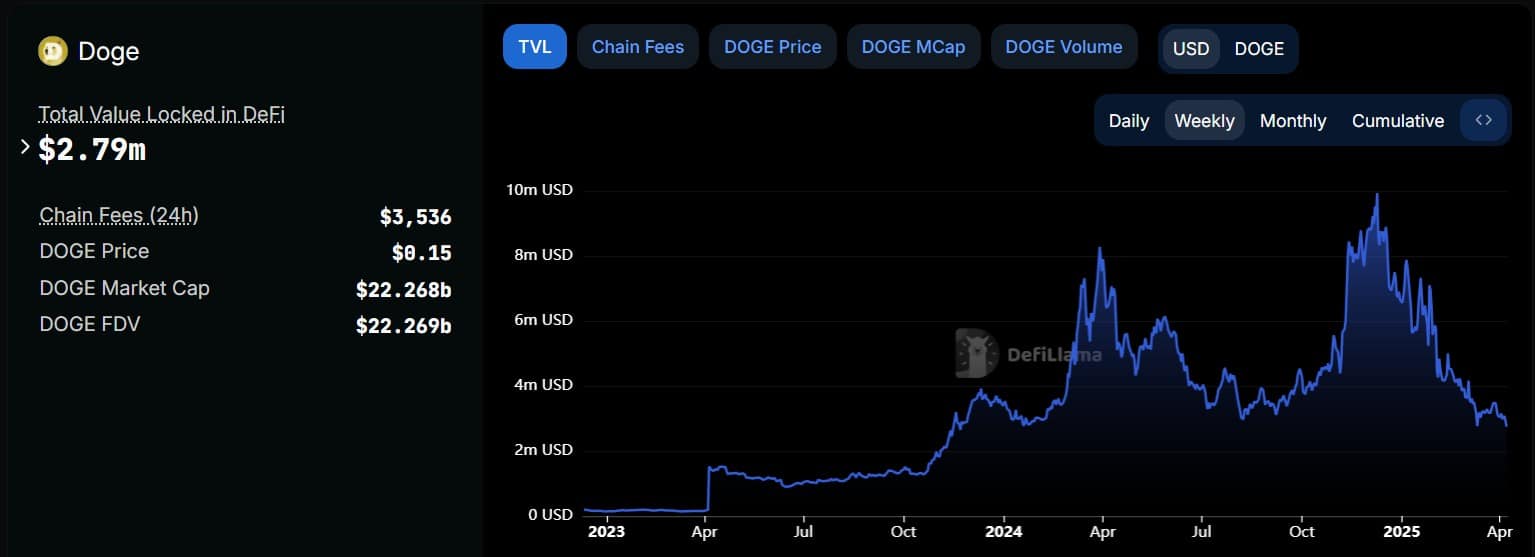

Dogecoin’s DeFi footprint has rapidly eroded, with TVL plunging to just $2.79 million — the lowest since early 2023.

After peaking above $10 million in late 2024, DOGE’s DeFi capital has been in freefall, shedding over 70% in a matter of weeks.

Source: DeFiLlama

The data highlights a steady build-up through 2023, followed by volatile spikes and abrupt drawdowns through early 2025.

The most aggressive decline began mid-February and accelerated in April, aligning with broader market capitulation.

For a token once celebrated as a gateway for retail adoption, this reversal marks a sobering retreat from on-chain engagement.

Global jitters hit Dogecoin hard

Dogecoin’s DeFi unwinding coincides with a broader market panic triggered by President Trump’s “Liberation Day” tariff announcement.

Echoes of 1987’s Black Monday are surfacing as global investors react to fears of a recession sparked by sweeping trade levies.

Source: X

Market commentator Jim Cramer warned that the lack of a clear economic plan could lead to another historic crash, with risk sentiment evaporating fast.

For meme-driven assets like DOGE, which already walk a speculative tightrope, the shock has been especially severe — acting as a catalyst for capital flight and deepening doubts about its durability.