- ETH reserves spiked by over 100,000 in the last 24 hours alone

- On the price charts, the altcoin climbed to over $2,400

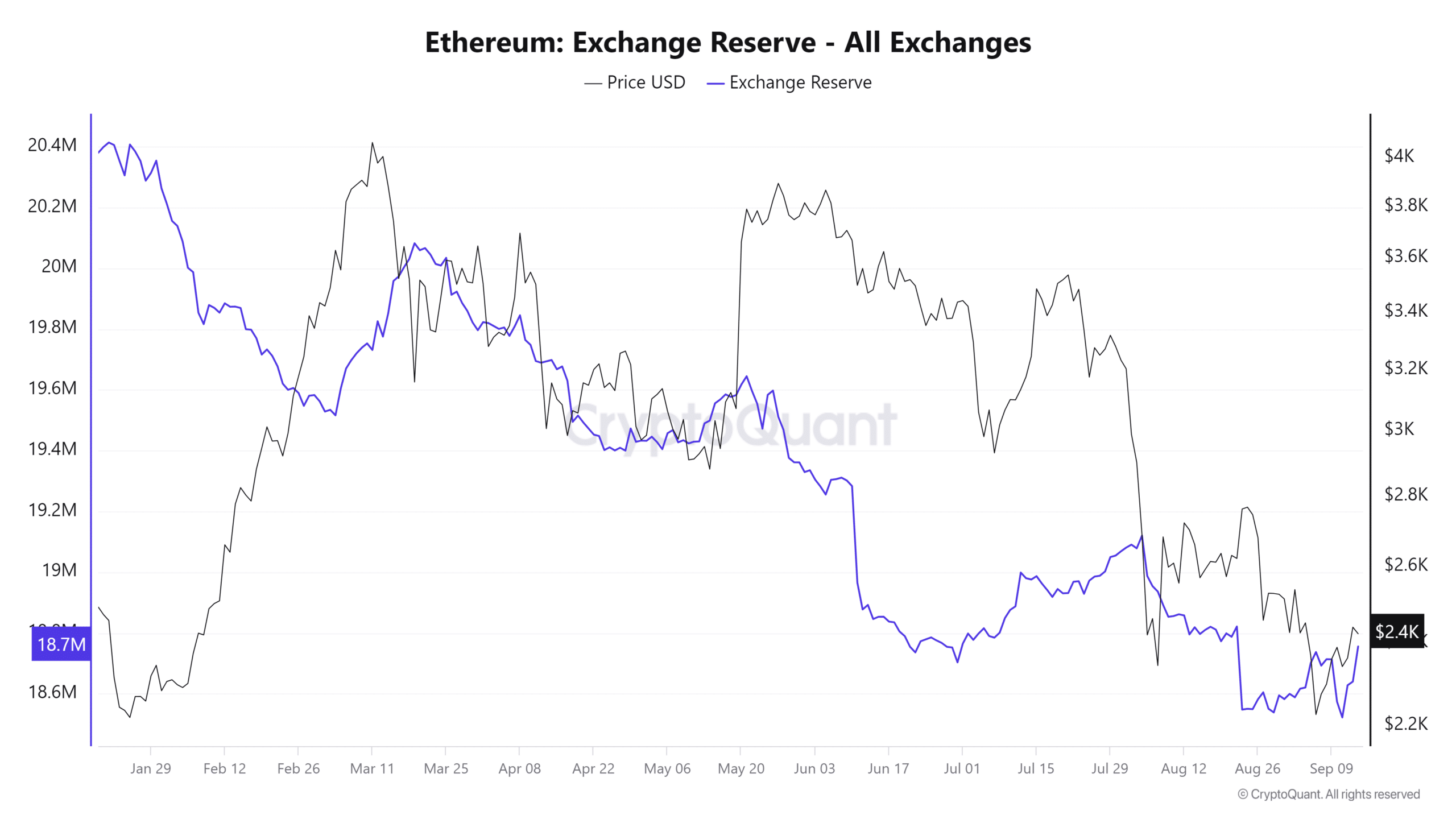

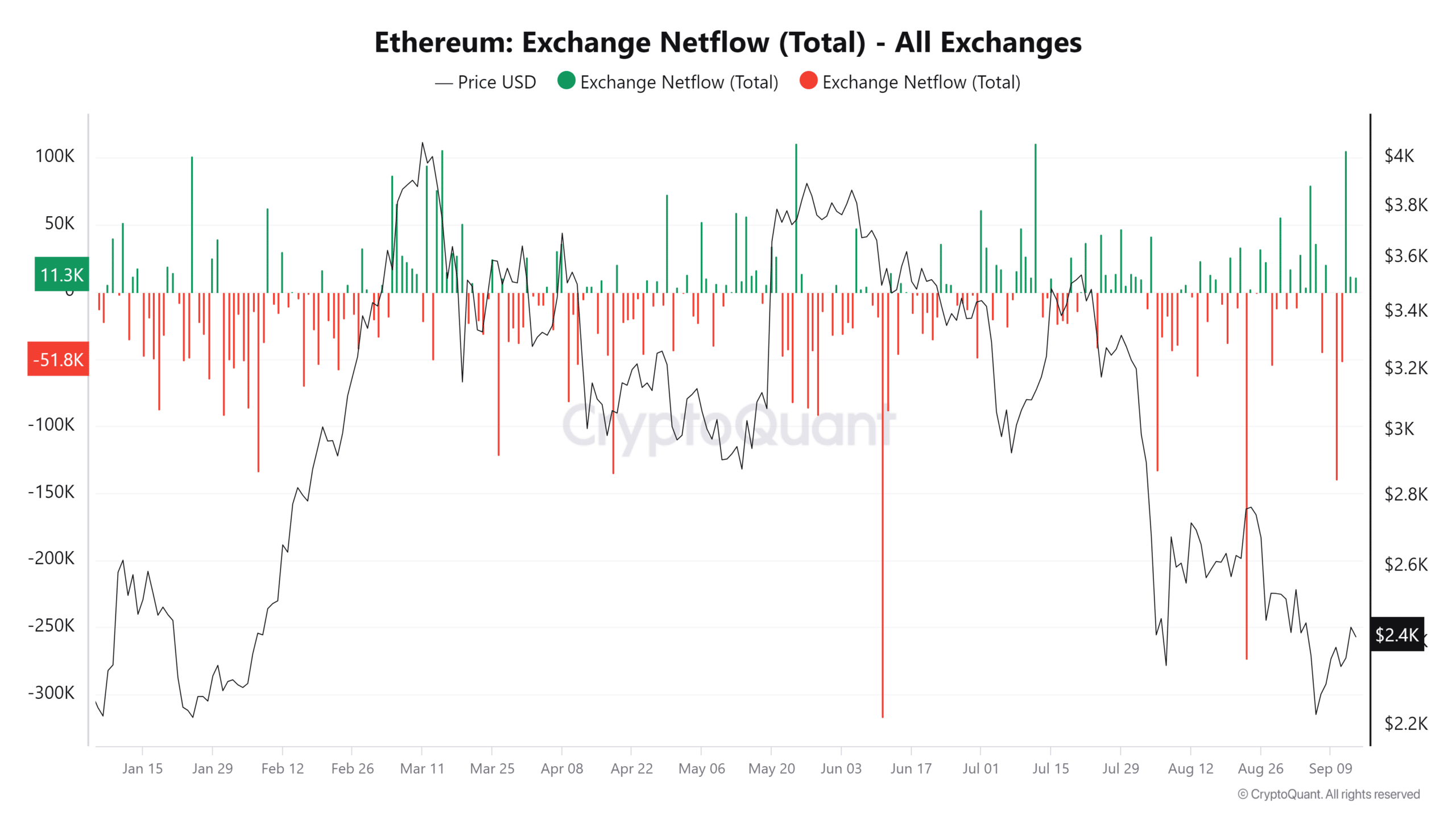

During its last trading session, Ethereum’s price saw a decent move, but the real highlight was the spike in its exchange reserves. In fact, data pointed to a noticeable hike in ETH being moved to exchanges – A sign that some holders might be eager to sell.

On the contrary, the netflow data revealed that buyers managed to balance out the flow with enough demand to absorb the incoming supply. This equilibrium between buyers and sellers allowed ETH to close the trading session on a positive note.

Ethereum reserves spike

An analysis of the Ethereum exchange reserve on CryptoQuant revealed a significant spike over the last 24 hours.

On 13 September, the volume of the ETH reserves stood at around 18.6 million. However, it has since surged to approximately 18.755 million, marking an increase of over 100,000 ETH within a day. This is the first time in almost a month that the exchange reserves have seen such a significant volume.

It also indicates that more traders have moved their ETH to exchanges over the aforementioned period.

Source: CryptoQuant

This spike typically suggests that traders are preparing to sell, as moving assets to exchanges often signals intentions to liquidate holdings. Here, the price trend may have influenced this action, with traders potentially seeking to capitalize on recent gains.

Additionally, their actions likely contributed to the price fluctuations, adding to the pressure on Ethereum in the short term.

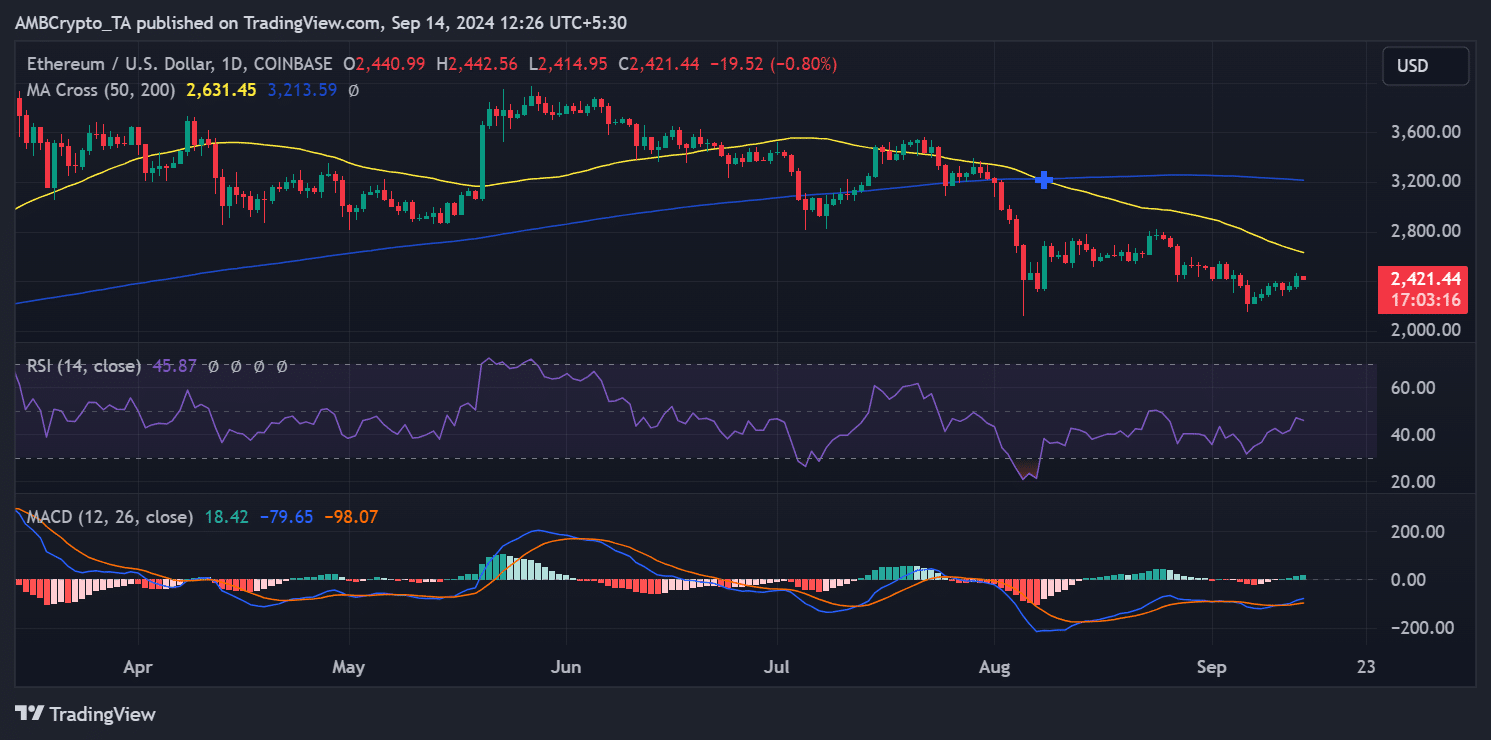

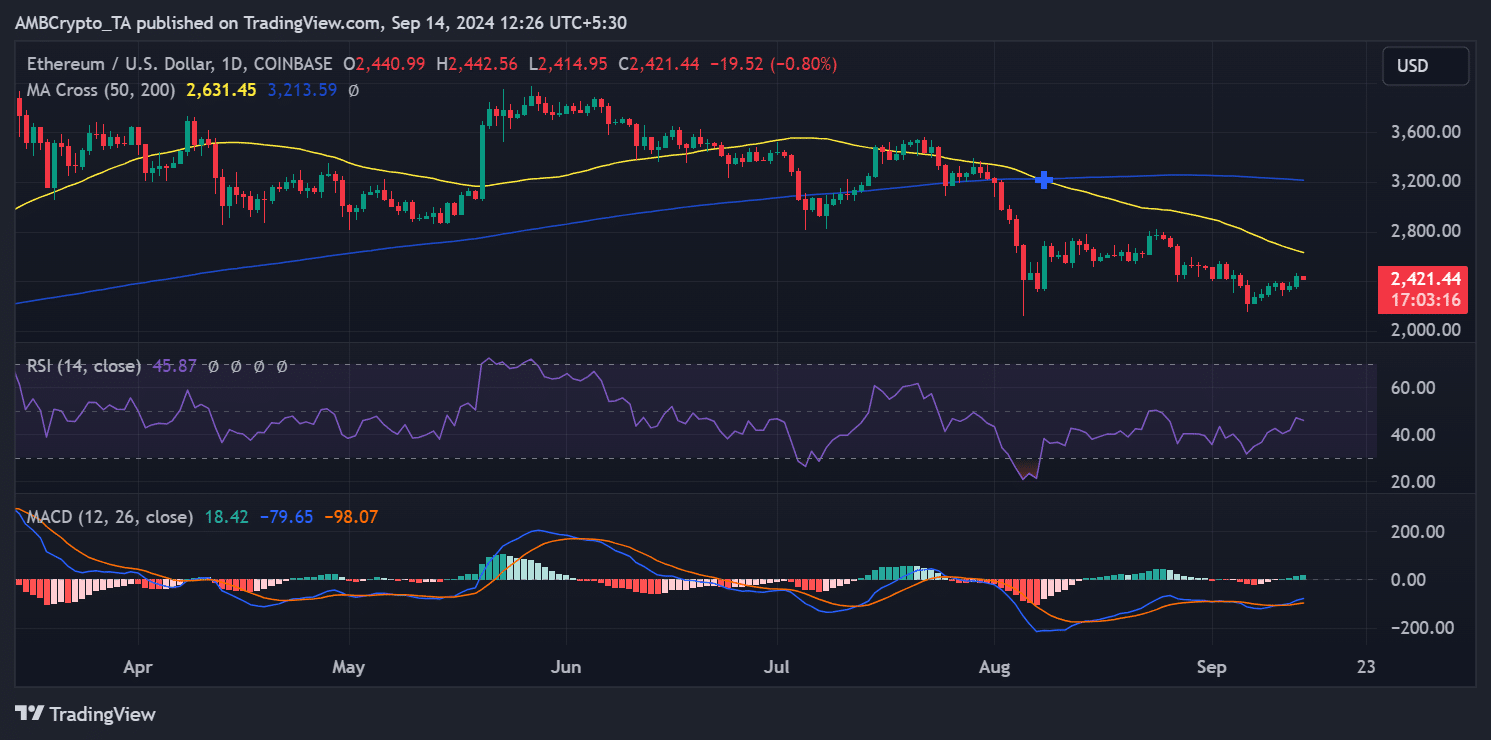

ETH pulls near its neutral line

An analysis of Ethereum’s daily price trend from the last trading session revealed a significant upward move.

ETH opened at approximately $2,361 and closed at around $2,440, gaining by over 3% during the session. This movement marked the first time in over a week that ETH revisited the $2,400 price level.

The price hike likely triggered the spike in exchange reserves as traders moved ETH to exchanges for potential profit-taking.

Source: TradingView

However, the fact that the price ended higher suggests that there were more buyers than sellers, balancing the inflow of ETH to exchanges. The surge in demand helped absorb selling pressure. This allowed the price to close positively.

Despite this, the Relative Strength Index (RSI) remained near the neutral line, indicating a larger bearish trend. At the time of writing, ETH had lost some of the gains from its previous session and was trading at around $2,420.

This pointed to a minor pullback following the upward movement. However, Ethereum’s ability to hold near the $2,400 level could be a positive sign for bullish momentum in the near term if buyers remain active.

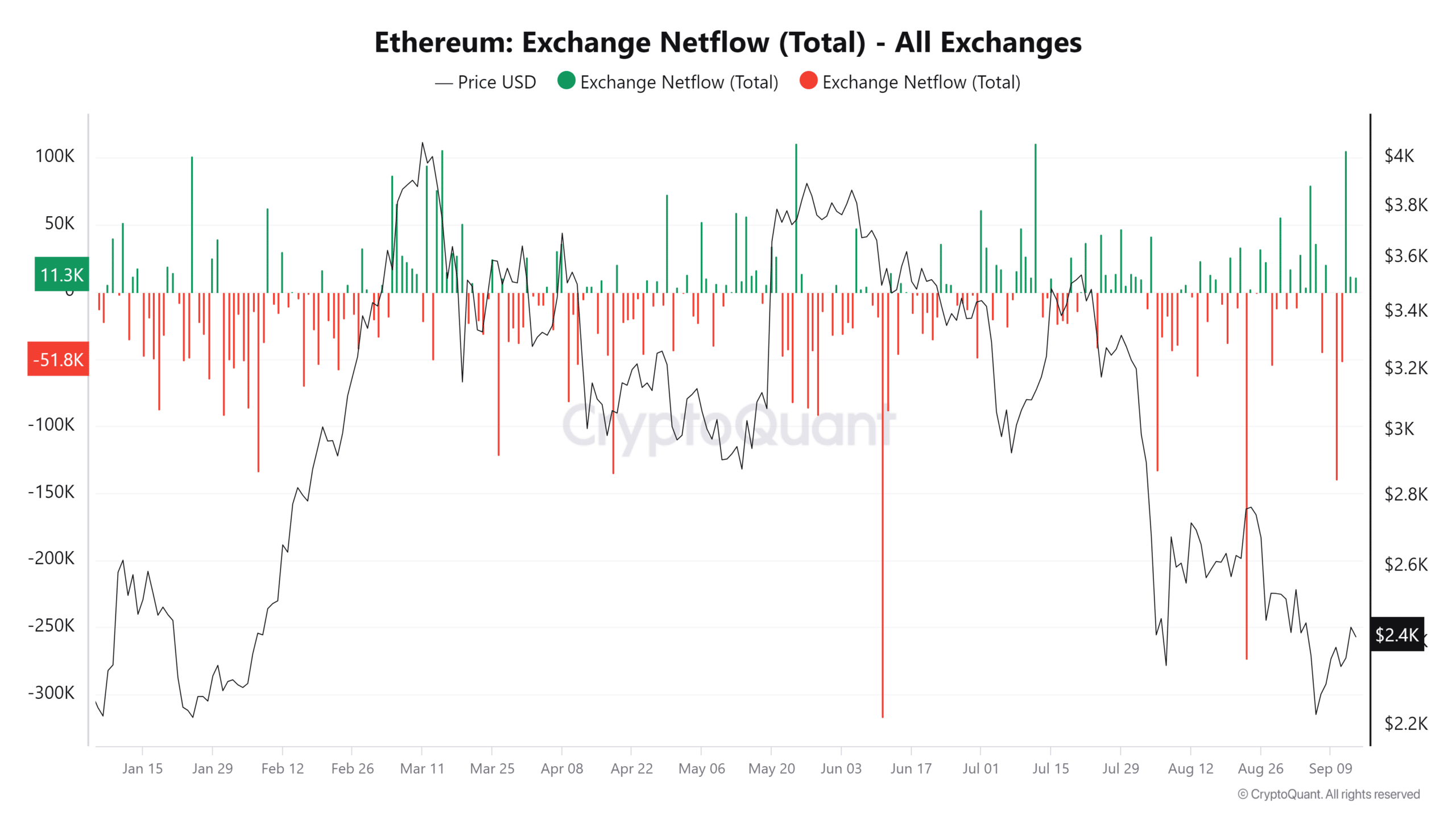

Ethereum netflows flash positive, but…

An analysis of Ethereum’s netflows during the last trading session revealed positive netflows of over 12,000 ETH, according to CryptoQuant.

Positive netflows mean that more ETH was sent to exchanges than withdrawn, suggesting that more traders have been selling their holdings. However, considering the significant spike in exchange reserves, this might appear relatively low.

Source: CryptoQuant

However, a closer look at the data revealed that while there was an increase in ETH deposits, withdrawals, likely by buyers, were on the higher side too. This means that exchanges saw nearly balanced inflows and outflows, with buyers withdrawing ETH as fast as sellers were depositing it.

– Read Ethereum (ETH) Price Prediction 2024-25

This netflows trend is a sign that despite the hike in ETH moving to exchanges, buying interest was strong enough to absorb the selling pressure, nearly offsetting the deposits.

This balance between buyers and sellers helped ETH maintain its price levels, even as it noted fluctuations in the market. The relative balance in netflows is a positive sign for Ethereum’s price stability in the short term.