- In a key development, one whale moved $19.54 million worth of ETH to Kraken.

- Market sentiment remained divided, with conflicting signals from key indicators.

Despite a brief period of turbulence on the 25th of November, Ethereum [ETH] has demonstrated resilience, posting a daily gain of 1.38%.

This recovery contributes to an impressive weekly increase of 9.85%, underscoring the market’s current bullish momentum.

Yet, despite these gains, caution persisted. Subtle bearish signals remained in play, with the potential to drive ETH lower if broader market conditions deteriorate.

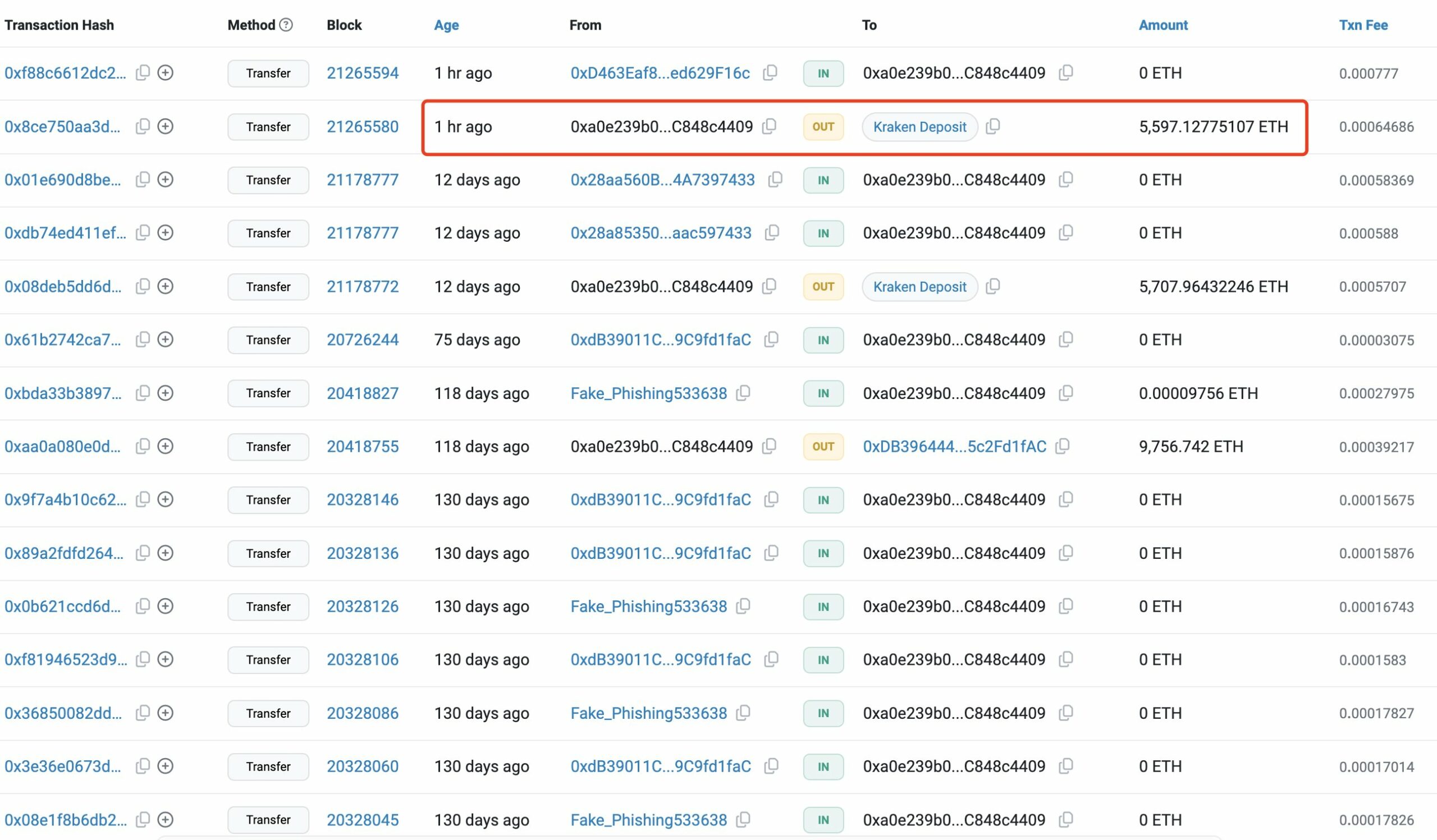

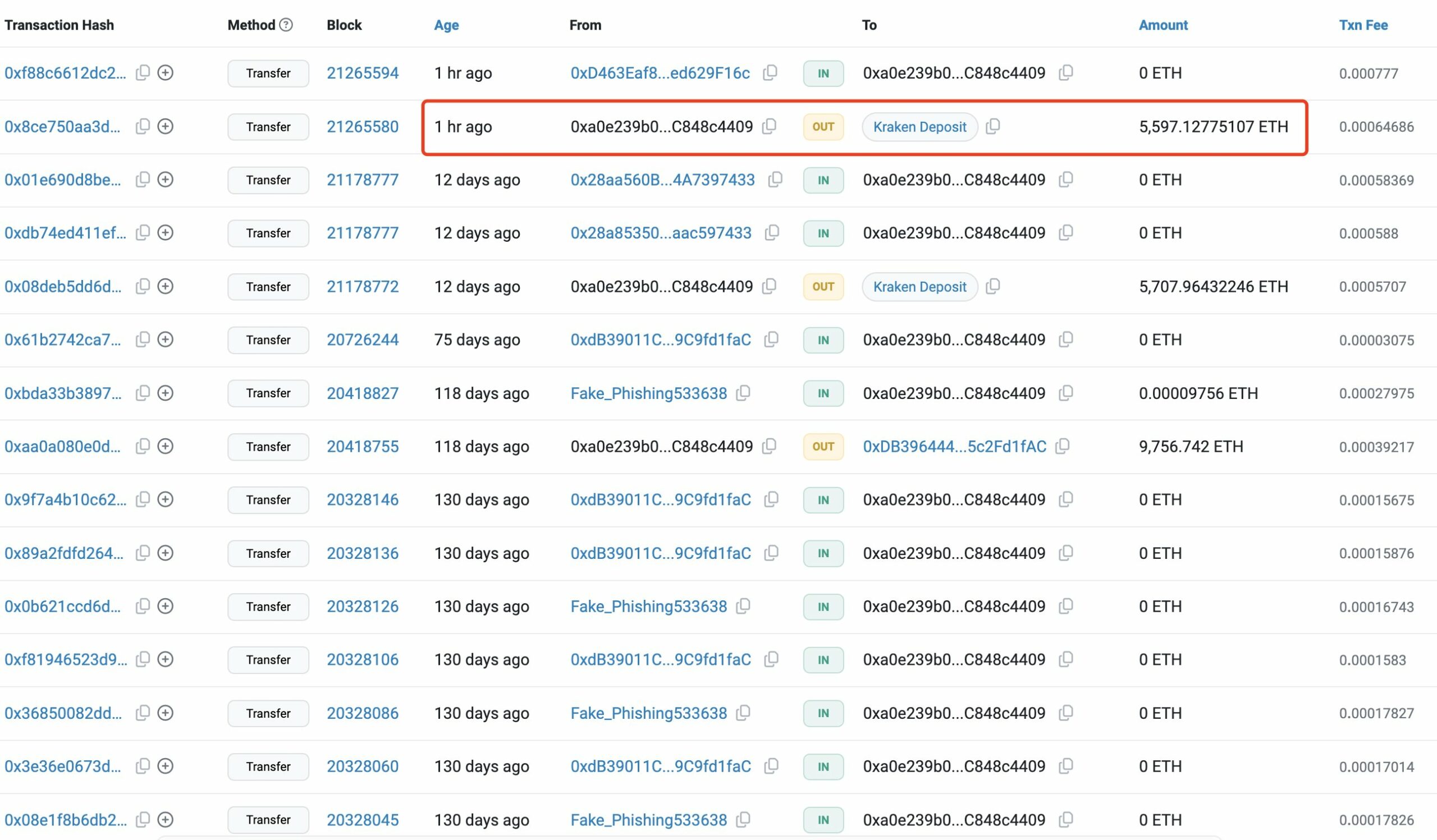

Whale transfers ETH, potentially triggering a price drop

According to data from Lookonchain, a whale wallet associated with ETH Devcon recently moved 5,597 ETH—worth $19.45 million—into the cryptocurrency exchange Kraken.

Source: X

The transaction came shortly after ETH briefly reclaimed the $3,500 level. Such movements are typically seen as bearish, as large inflows to exchanges often signal intentions to sell, whether for profit-taking or due to declining market confidence.

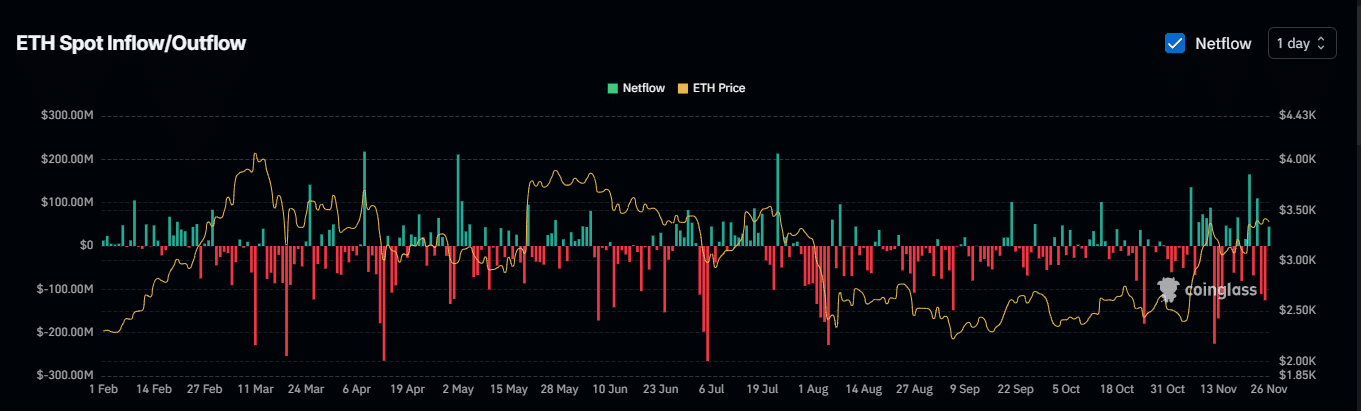

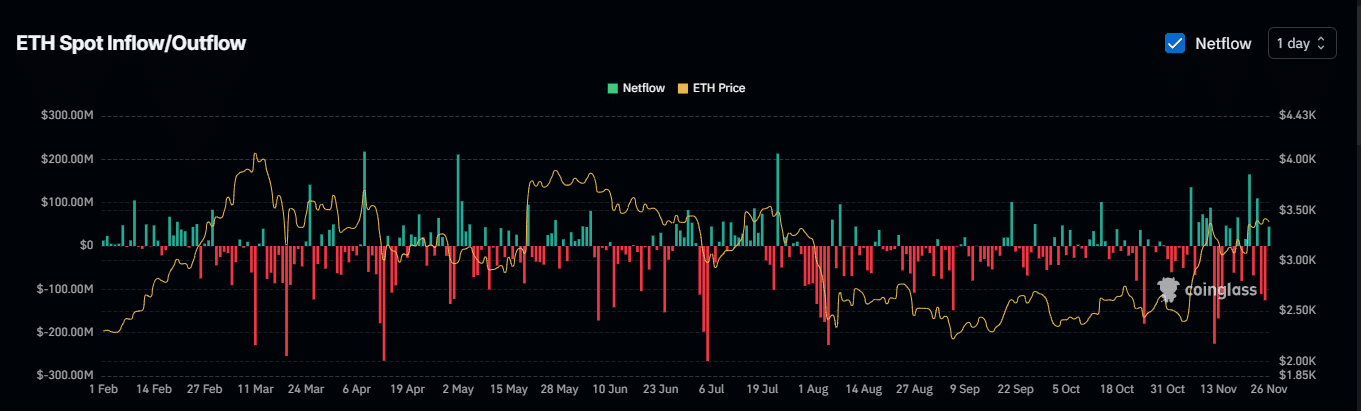

AMBCrypto found the overall Exchange Netflow provides a different perspective on ETH’s potential move.

Market participants align with whales

Exchange Netflow, which measures the flow of assets in and out of exchanges, is a key indicator of market sentiment.

Positive Netflow typically signals bearish sentiment as assets move into exchanges for potential selling, while negative Netflow reflects bullish sentiment, indicating withdrawals for holding.

On the 25th of November, Netflow was negative, with $125.17 million withdrawn from exchanges—a bullish signal that outweighed whale activity.

However, the Netflow has since turned positive, with $53.96 million moved back to exchanges.

If this trend continues, it could increase selling pressure on ETH, suggesting that market participants were now leaning toward selling rather than holding.

Source: Coinglass

ETH’s next move is unclear

At press time, market sentiment remained divided. On the bearish side, $52 million in long positions were liquidated, reflecting significant losses as the market moved against bullish traders—a clear sign of selling pressure.

Read Ethereum’s [ETH] Price Prediction 2024–2025

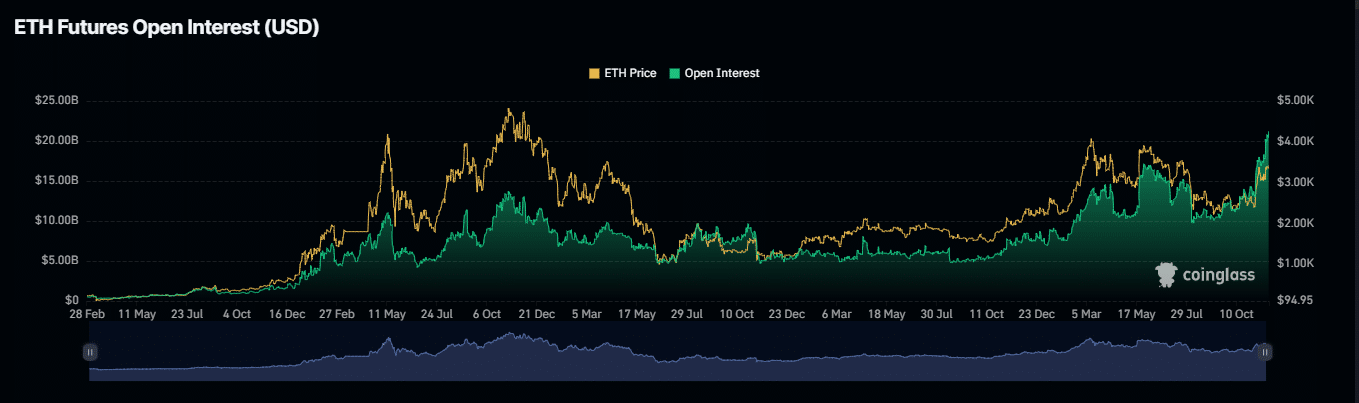

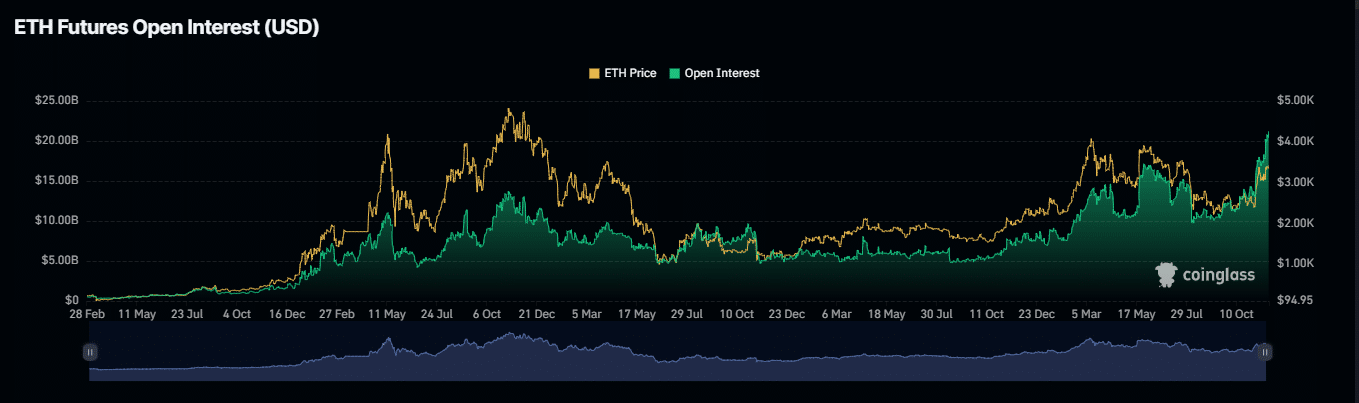

Meanwhile, Open Interest hit a bullish peak, reaching $21.44 billion—the highest in two years. This surge suggested a growing number of long derivative contracts, signaling optimism for a potential price increase.

Source: Coinglass

Until these opposing signals converge, ETH’s price direction will remain uncertain.