- XRP failed to react to the development despite its fundamental deflationary impact.

- Demand for the token decreased but the liquidations levels suggested a price increase.

RippleX, the open developer platform of Ripple [XRP], announced that the ‘fixAMMOverflowOffer’ amendment has gone live. According to the post, the development meant that the AMM had resumed functionality on the XRP Ledger (XRPL).

For the unfamiliar, the AMM stands for Automated Market Maker. On the XRPL, it serves as a smart contract for enhancing liquidity for assets on the ledger. It also adds a deflationary effect for XRP.

Difficulties addressed

AMBCrypto’s assessment of the ledger showed that ‘fixAMMOverflowOffer’ v2.1.1 had been enabled. Hence, the network might be able to handle large synthetic AMM offers which was previously a challenge.

Despite the upgrade, XRP’s price stalled immediately after the update. In fact, 12 hours later, it fell further down, on the back of Bitcoin’s own depreciation.

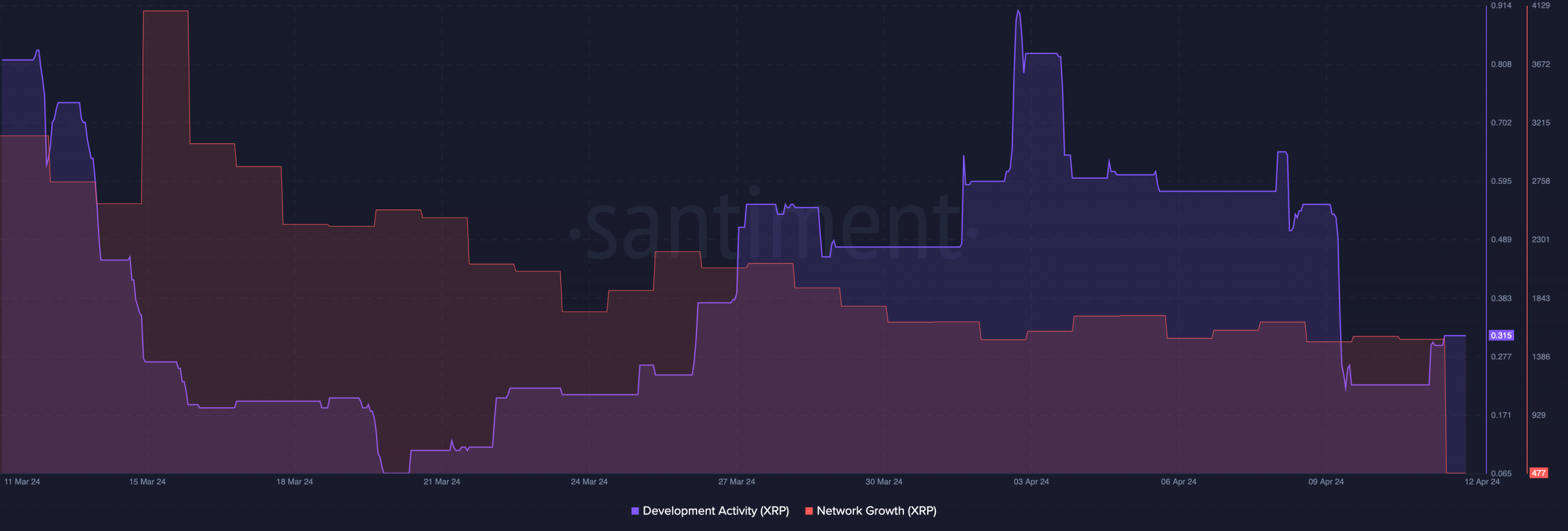

Besides that, it seems that the upgrade did not have much effect on Ripple’s development activity. According to Santiment, development activity on the network dropped.

This implied that developers were not doing much with respect to polishing the network. Should this reading continue to decrease, XRP’s price will be affected, with the altcoin dropping below its press time price of $0.54

On the other hand, if development activity improves, the token could have a chance at recovering. Like development activity, another metric at an underwhelming state was network growth.

Source: Santiment

XRP still isn’t a top choice

Network growth tracks the number of new addresses interacting with a network. If the metric increases, it means that adoption is increasing as new entrants are making their first transactions.

However, that was not the case with XRP. At press time, network growth declined, indicating low traction. In a case where this metric increases, the demand could spur XRP in the upward direction.

But being in a similar state like it was as of this writing, or worse might cause the price to tap lower spots. Apart from these metrics, AMBCrypto also analyzed the liquidation levels.

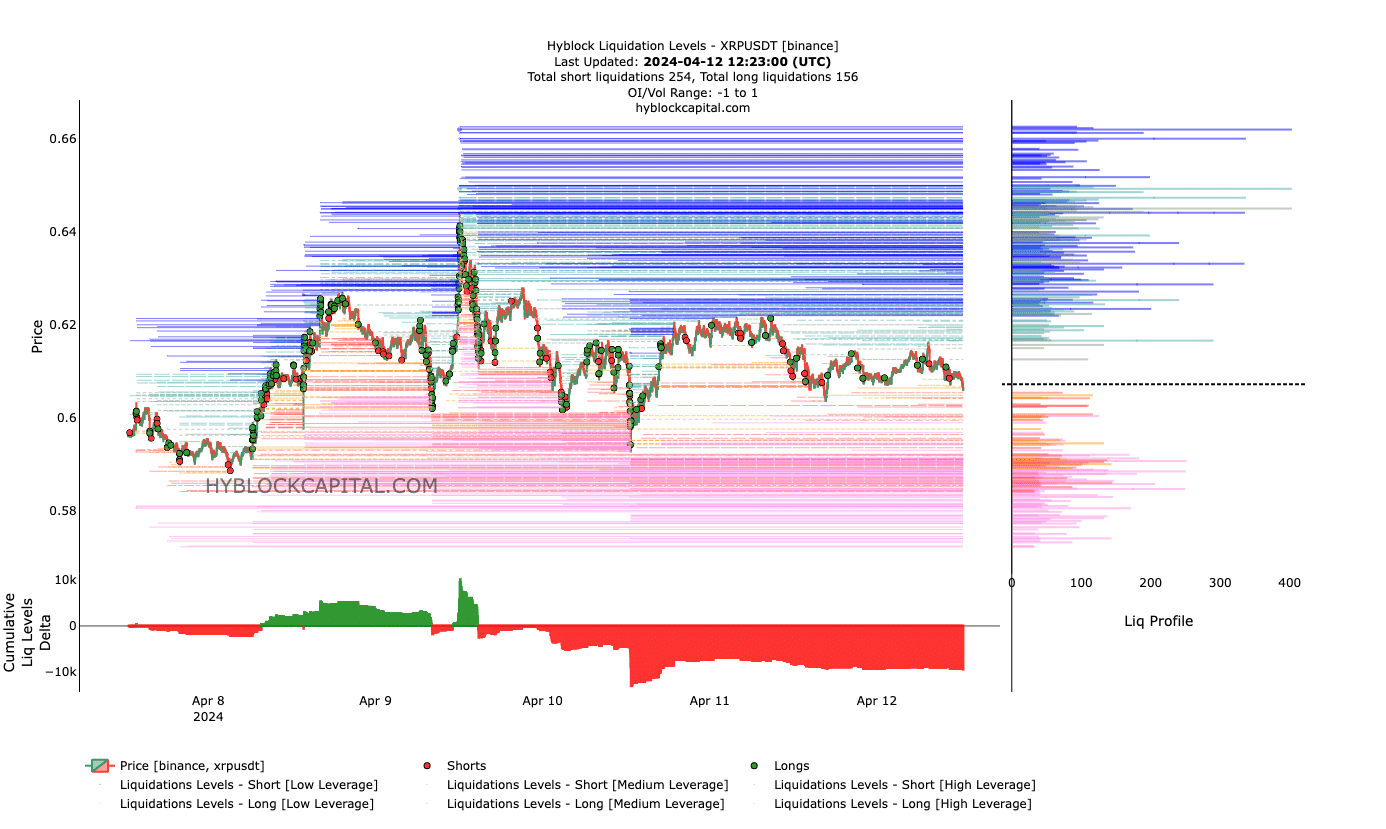

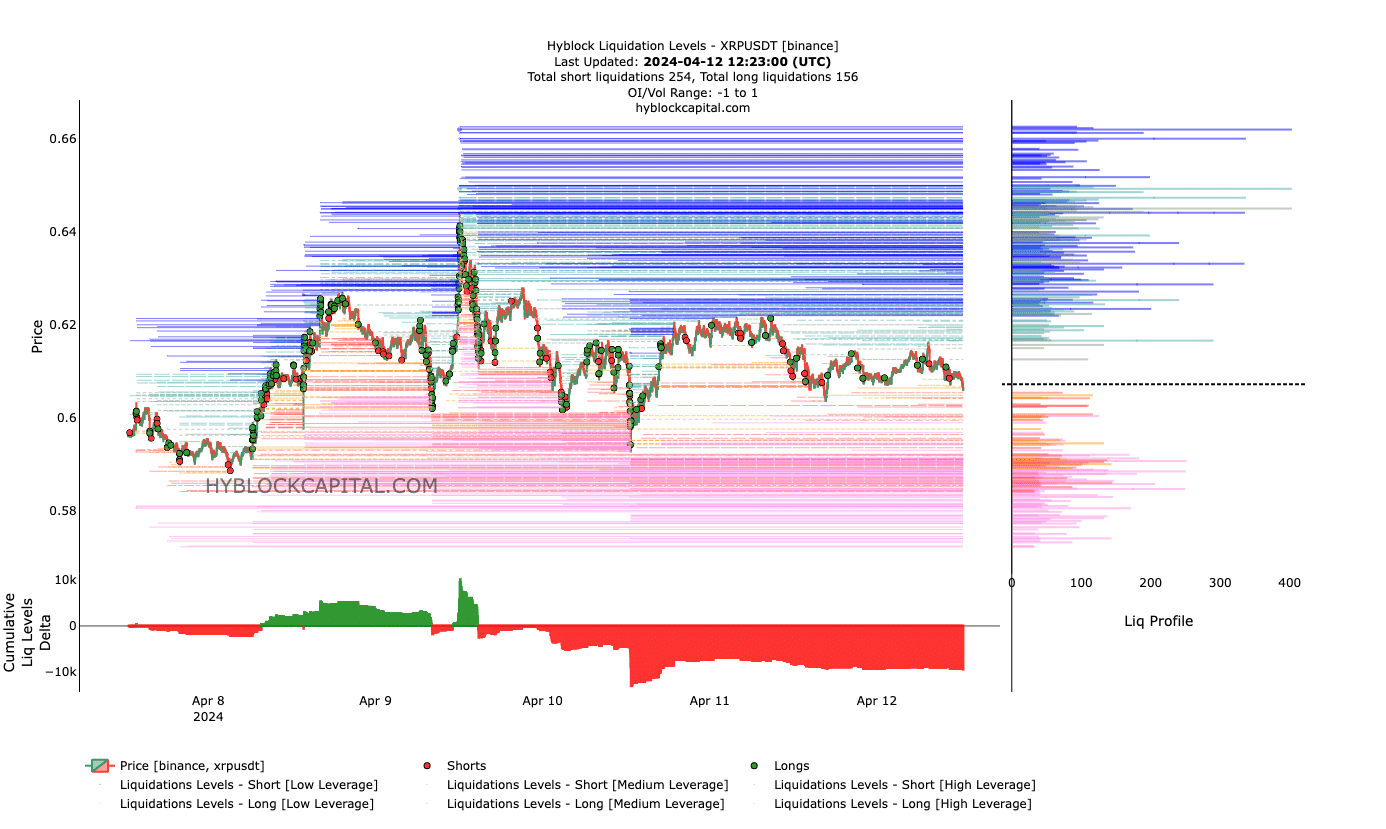

Liquidation levels are predicted price levels where large liquidation events might happen. At press time, XRP lacked a high amount of liquidity between $0.60 and $0.61.

If this remains the same, then longs or shorts liquidations might be minimal around these points. But if the token moves higher, and rises between $0.63 to $0.67, many positions might be wiped out.

Source: Hyblock

In addition, the Cumulative Liquidation Levels Delta (CLLD) displayed signals that favored longs. As of this writing, the CLLD was negative, suggesting that there were more shorts liquidations than longs.

Read Ripple’s [XRP] Price Prediction 2024-2025

For XRP’s price, the spike in the negative direction offered a bullish bias. As long as the CLLD remains negative, then XRP might have a higher chance of an increase.

But if the condition changes, the token might trade sideways in the short term.