- Fantom crypto outpaces ETH, SOL, and AVAX with a 60% surge.

- The surge was fueled by Fantom’s expanding DeFi ecosystem and renewed market optimism.

Fantom [FTM] has been one of the standout performers in the cryptocurrency market this week, surging by a remarkable 60% and pushing its market cap above $3 billion. This sharp rally has caught the attention of investors and analysts alike, especially as it coincides with a broader wave of renewed optimism in the crypto space.

But while the overall market’s recovery plays a role, FTM’s dramatic rise raises an important question: what’s behind this sudden surge in its value?

FTM’s explosive rally: Key drivers behind the surge

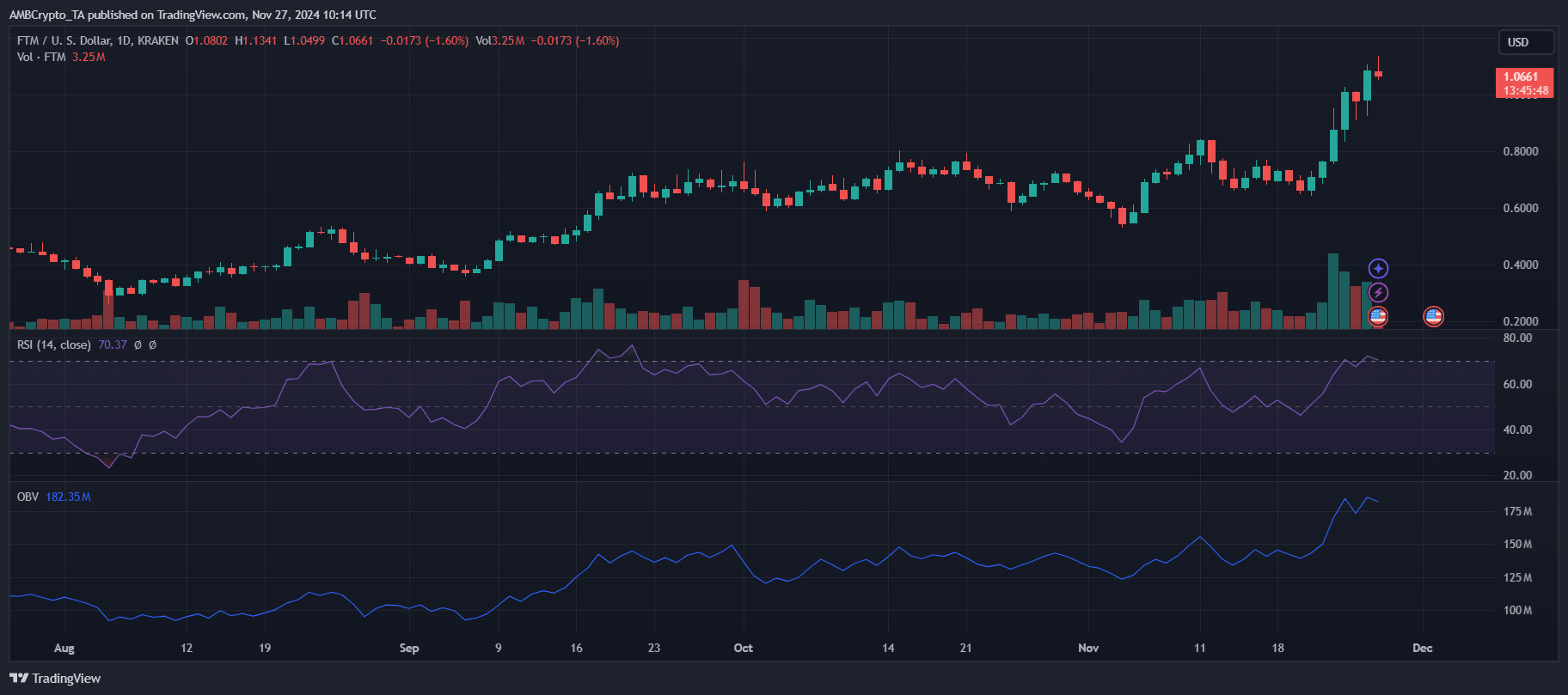

Fantom’s 60% surge this week has positioned it as one of the market’s top performers, with its price breaking past the $1.07 mark. A sharp uptick in trading volume and market participation has fueled this rally, supported by a spike in investor interest.

The RSI on the daily chart, at 70.93, indicates FTM is now in overbought territory, reflecting strong buying momentum. Meanwhile, the OBV’s steady climb to 182.37M signals consistent accumulation.

Source: TradingView

The rally is largely attributed to Fantom’s growing DeFi ecosystem and recent ecosystem updates, which have rekindled market confidence.

Additionally, broader market recovery and rising altcoin interest have amplified the upside. However, with RSI approaching critical levels, the possibility of short-term corrections cannot be ruled out.

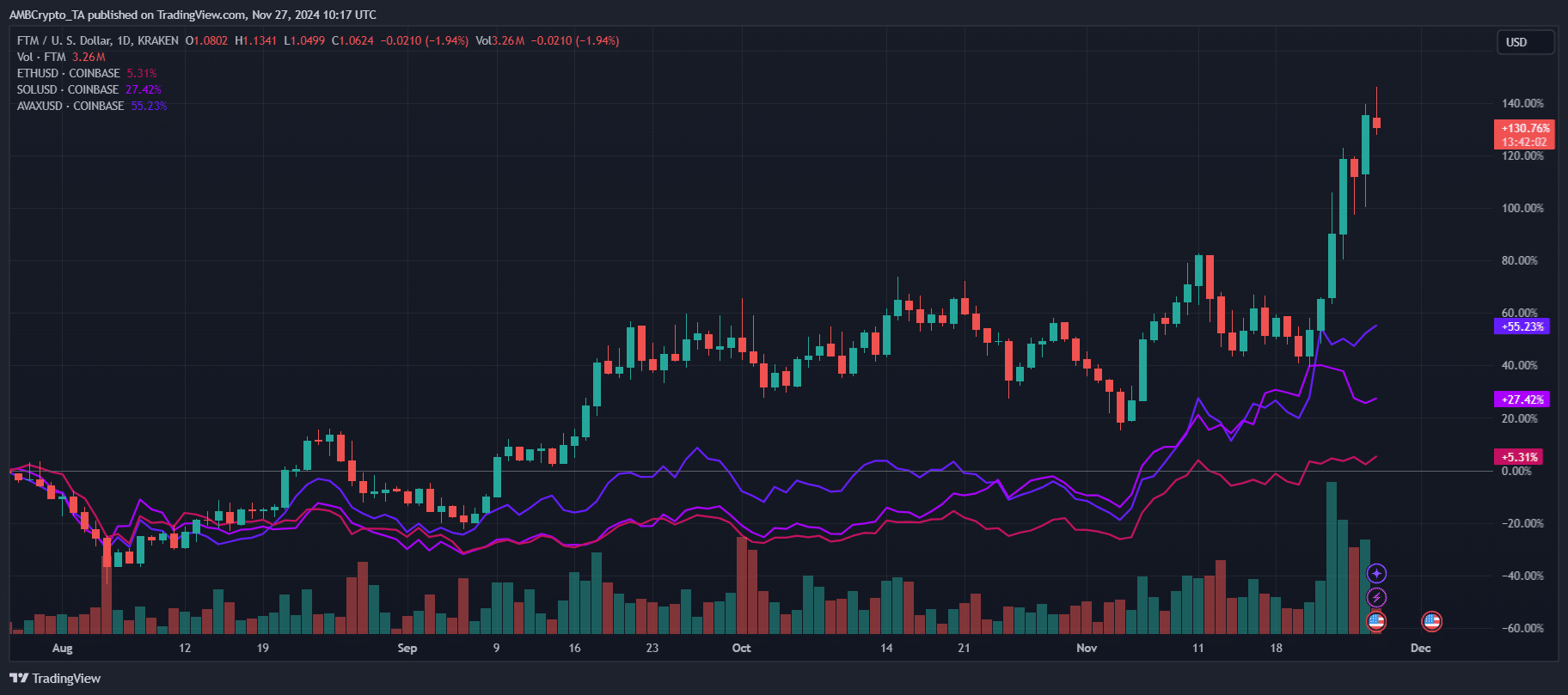

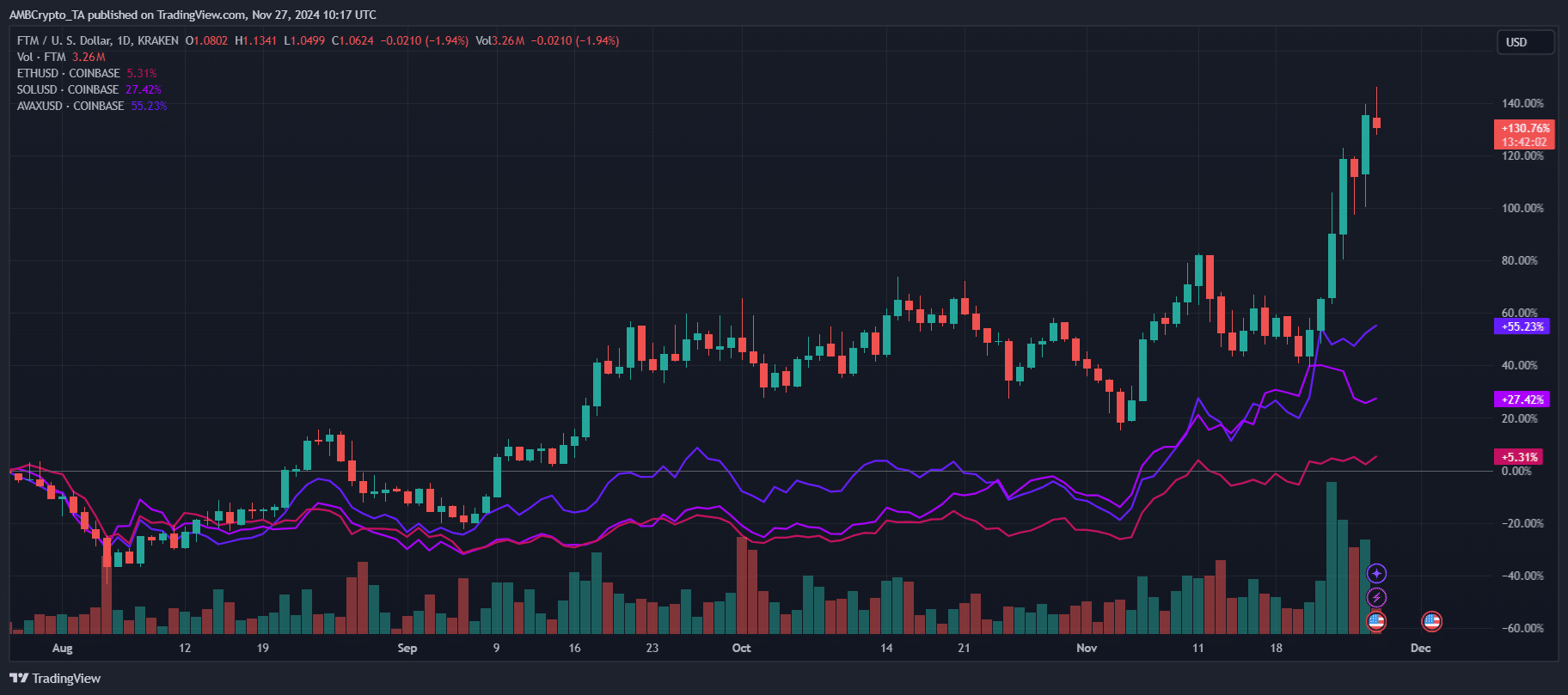

FTM outshines competitors: ETH, SOL, and AVAX

Fantom’s recent rally of 130.91% far outpaces its competitors, reflecting a robust recovery in its ecosystem. Comparatively, AVAX has gained 55.48%, SOL 27.18%, and ETH a modest 5.29%, emphasizing FTM’s dominance in the altcoin resurgence.

Source: TradingView

FTM’s surge is underpinned by significant ecosystem developments and increasing DeFi adoption, while AVAX and SOL have shown resilience but lacked comparable momentum. Ethereum’s slower performance highlights its focus on scalability and institutional upgrades rather than short-term price action.

This divergence underscores FTM’s appeal as a high-risk, high-reward asset amid the broader market recovery. However, sustained outperformance will hinge on Fantom’s ability to maintain ecosystem growth and attract long-term institutional interest.

Is FTM’s surge a long-term trend or a temporary phase?

While Fantom’s explosive rally reflects strong market interest and ecosystem growth, its sustainability remains uncertain. The overbought RSI suggests potential for short-term corrections, and long-term adoption will depend on continued ecosystem expansion and increased developer and user engagement.

Read Fantom’s [FTM] Price Prediction 2024–2025

Broader market trends, such as Ethereum’s dominance and competitors like AVAX and SOL recovering, could challenge FTM’s momentum.

For this to evolve into a lasting trend, Fantom must capitalize on its current gains by solidifying its position in DeFi and attracting institutional capital. Otherwise, this rally risks being another fleeting phase in the volatile crypto market.