- Algorand saw a breakout past a month-long range

- Lack of spot bidding after the breakout may be a sign of weakness from the bulls

Algorand [ALGO] managed to break out of its month-old range formation. It followed in the footsteps of Bitcoin [BTC], which noted a sharp dump to $99.7k on Monday. A few hours later, it recovered to hit $108k, before falling to $101.2k – All within 32 hours.

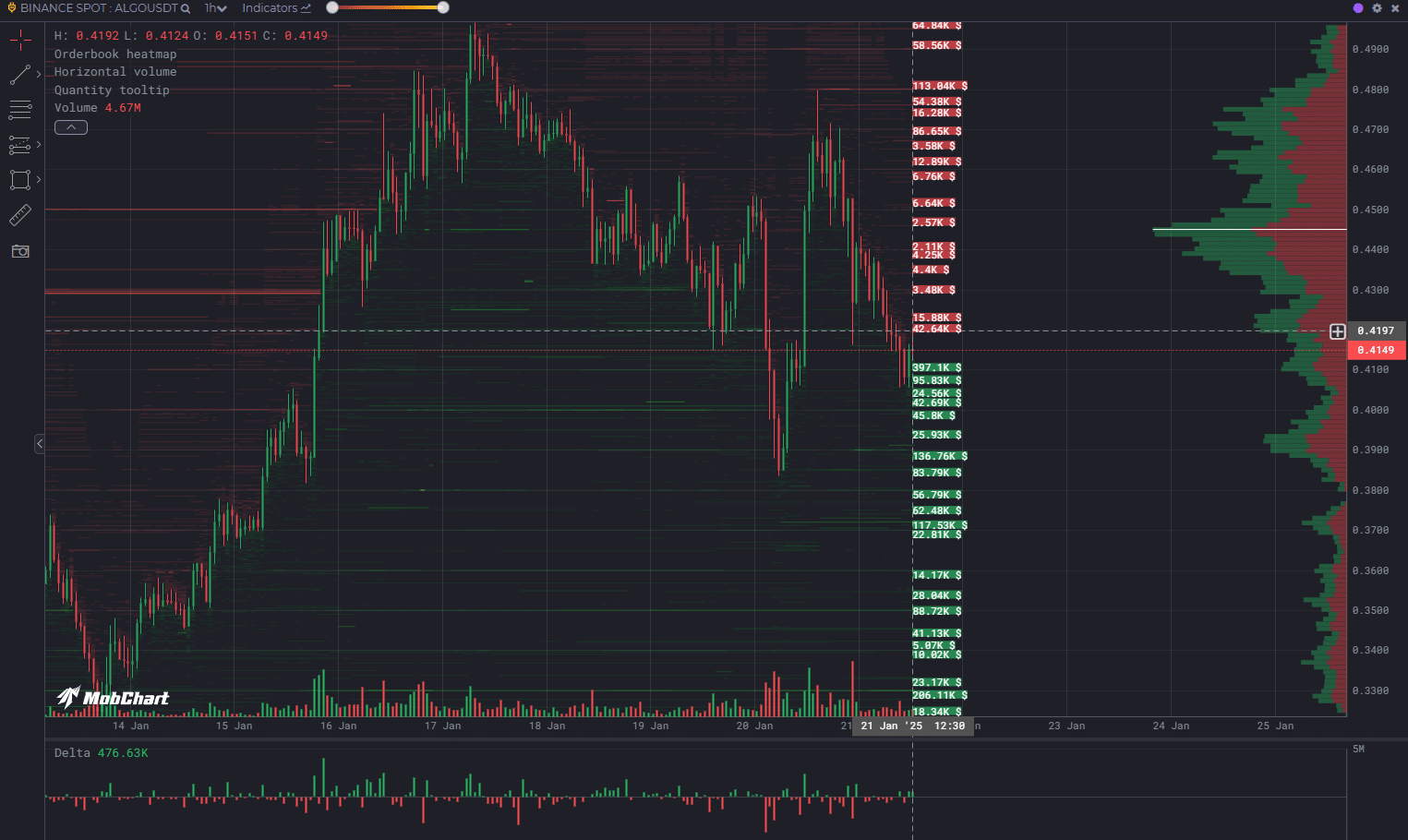

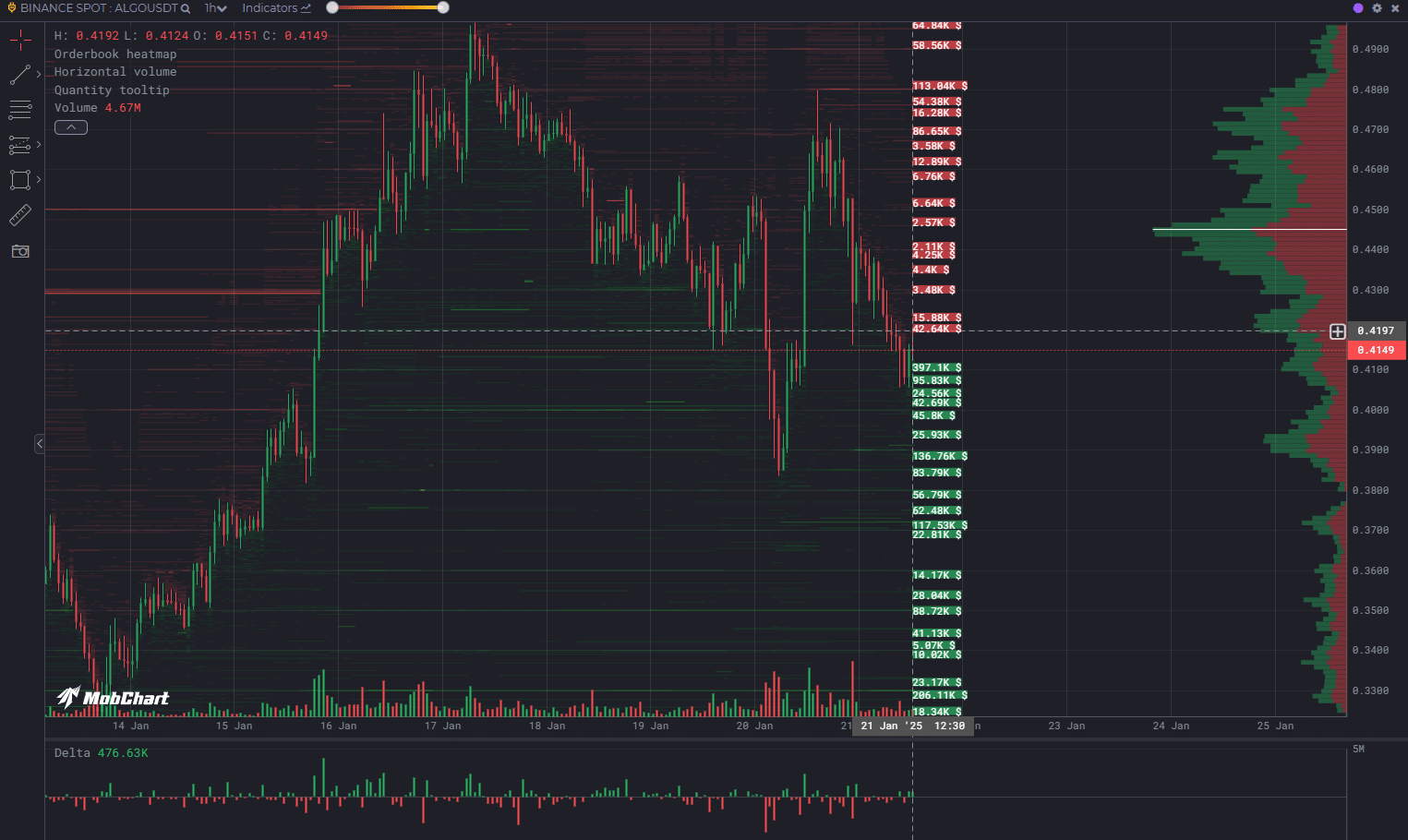

Source: ALGO/USDT on TradingView

Short-term BTC volatility saw ALGO teeter just above the range highs at $0.42. The OBV has not set a new high, and the trading volume has only minorly picked up over the past week. Can Algorand investors expect a strong rally following the breakout?

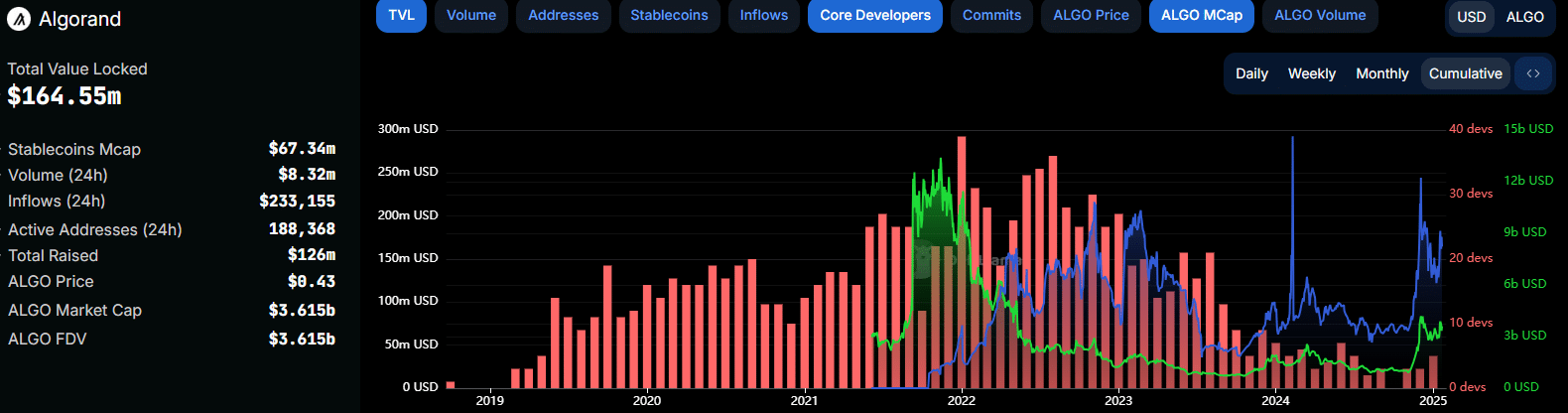

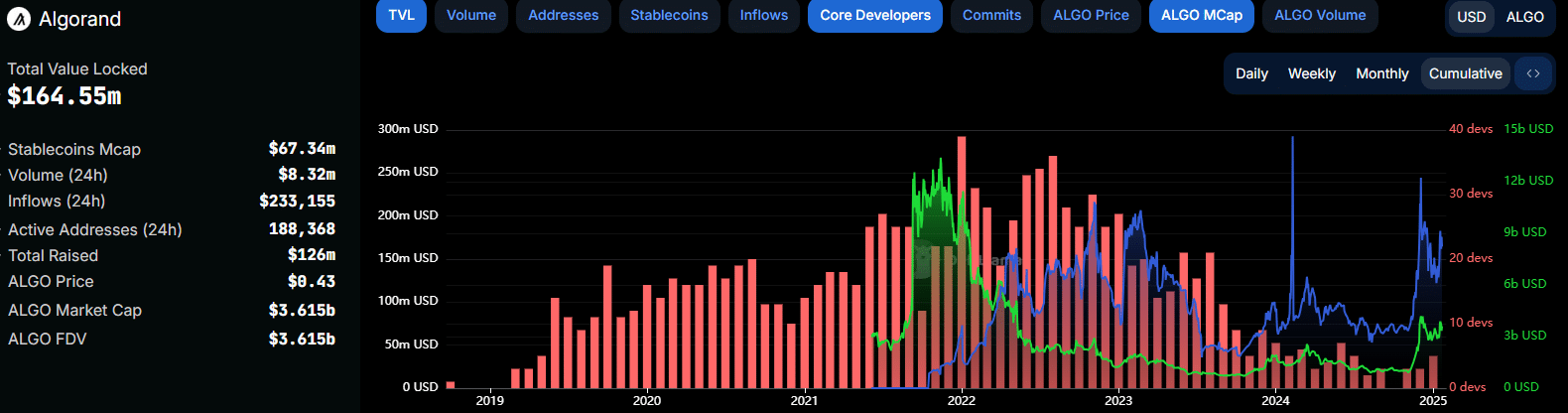

Algorand’s TVL picks up pace, but is it enough?

Source: DefiLlama

At the time of writing, the Layer 1 chain had $164.55 million in Total Value Locked (TVL). The data showed that the TVL has more than doubled from the $70 million-level it was at back in October 2024. This hike came alongside rising prices, which could have boosted visibility and stirred participants into action.

However, over the last two years, the core developer count fell from 39 to just 5. Sometimes, that is just how the cookie crumbles. A fall in innovation and reduced development activity can negatively affect the ecosystem and community engagement as well, which can lead to reduced user activity.

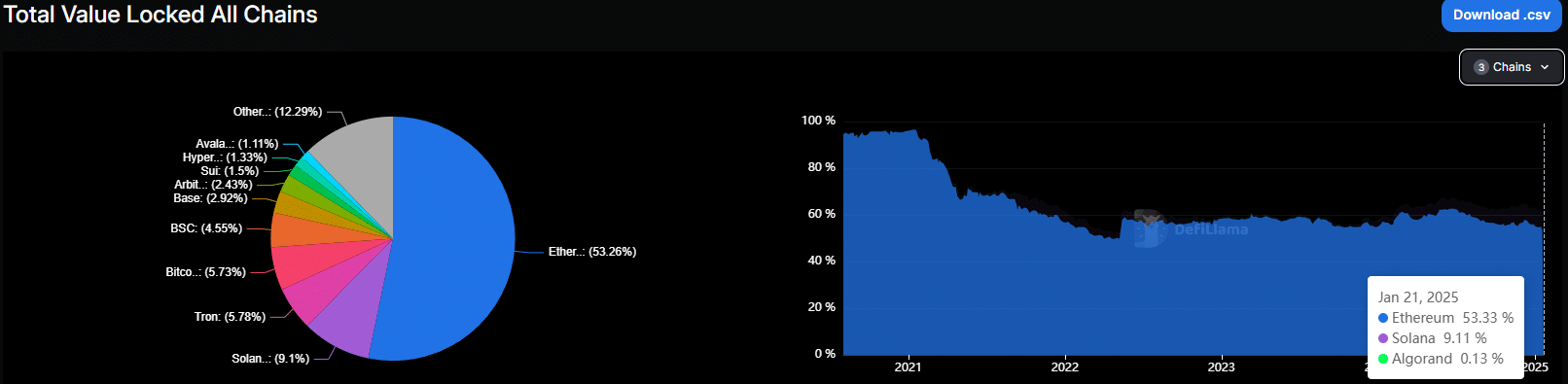

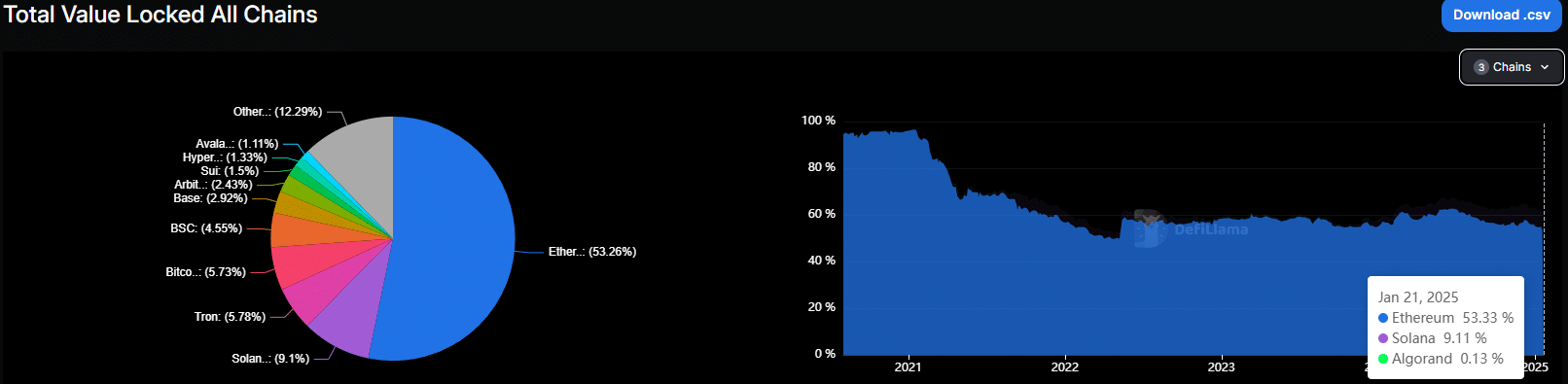

Source: DefiLlama

A TVL comparison of ALGO and the industry’s leaders revealed it only possessed 0.13% of the industry-wide TVL.

Algorand has never been one of the larger players in DeFi, and has failed to make gains in this sector in recent months. Meanwhile Solana [SOL] made some ground on Ethereum [ETH].

Source: MobChart

On the price action front, there were fresh limit buy orders at $0.42 and $0.39. These were the closest support levels with sizeable limit orders clustered around.

The $0.37 and $0.33 levels further south were the next targets, should Algorand drop below $0.39.

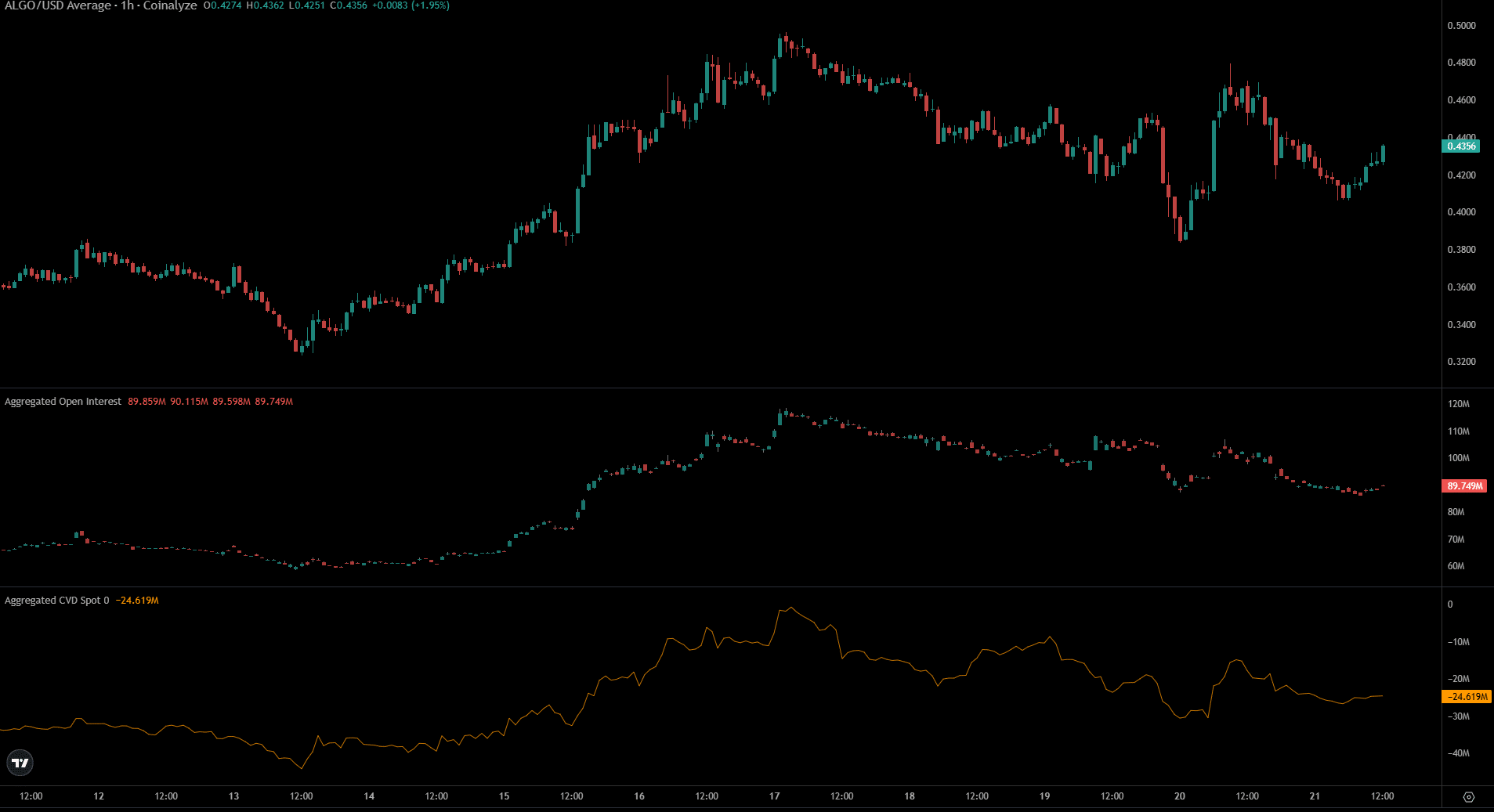

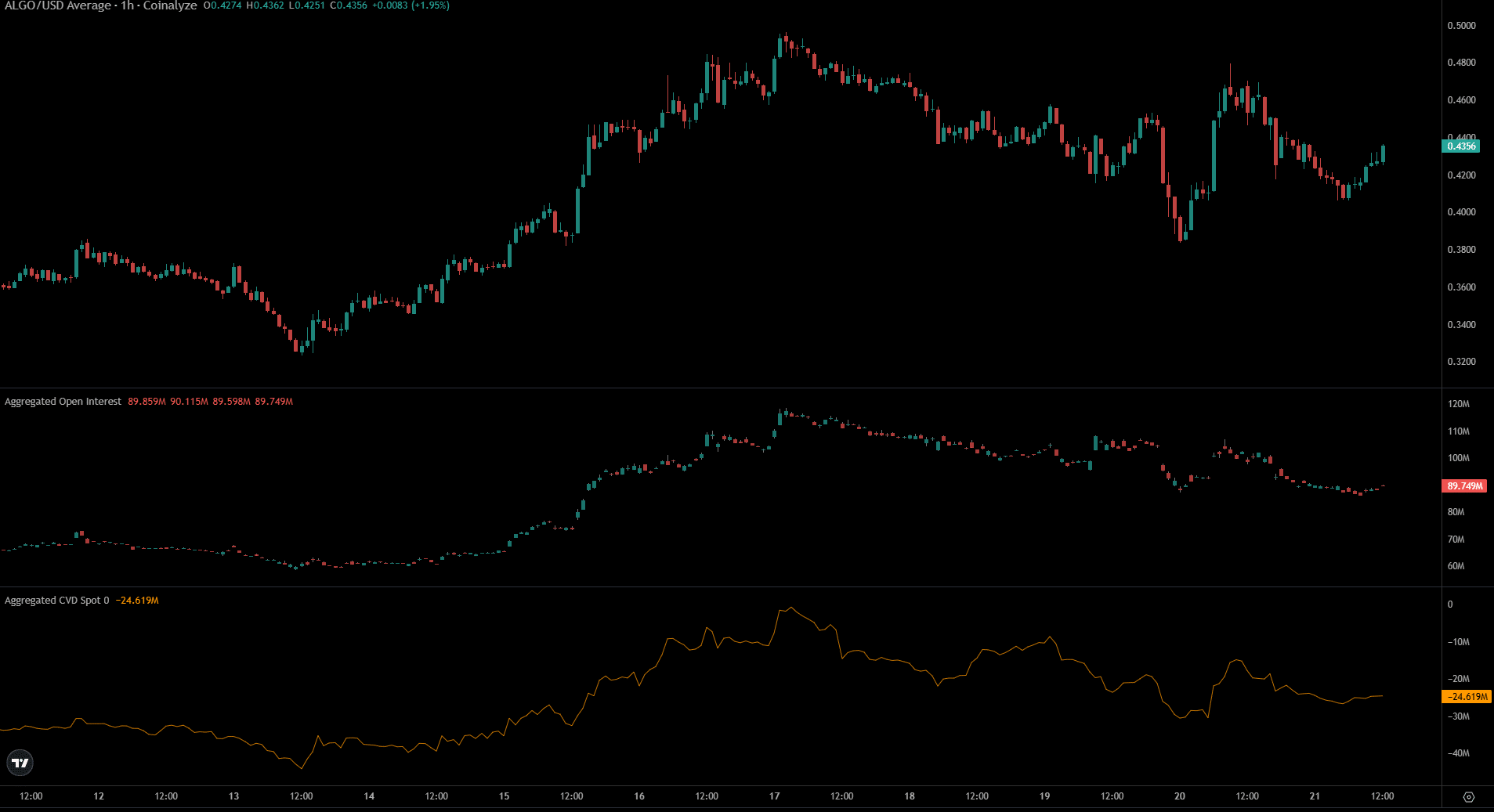

Source: Coinalyze

However, it seemed unlikely that it would. The 3-day price chart outlined the strong support the range highs at $0.42 would likely serve as. Additionally, the volatility of the last 24 hours has hunted the liquidity around the range high.

Is your portfolio green? Check the Algorand Profit Calculator

Finally, data from Coinalyze underlined the downtrend of both the Open Interest and the spot CVD over the last 24 hours. This lack of bidding in the spot and derivatives markets may be a concern for the bulls.