- BNB, at press time, seemed to be retracing to a critical support level at $491

- Price action and metrics suggested a potential bullish continuation

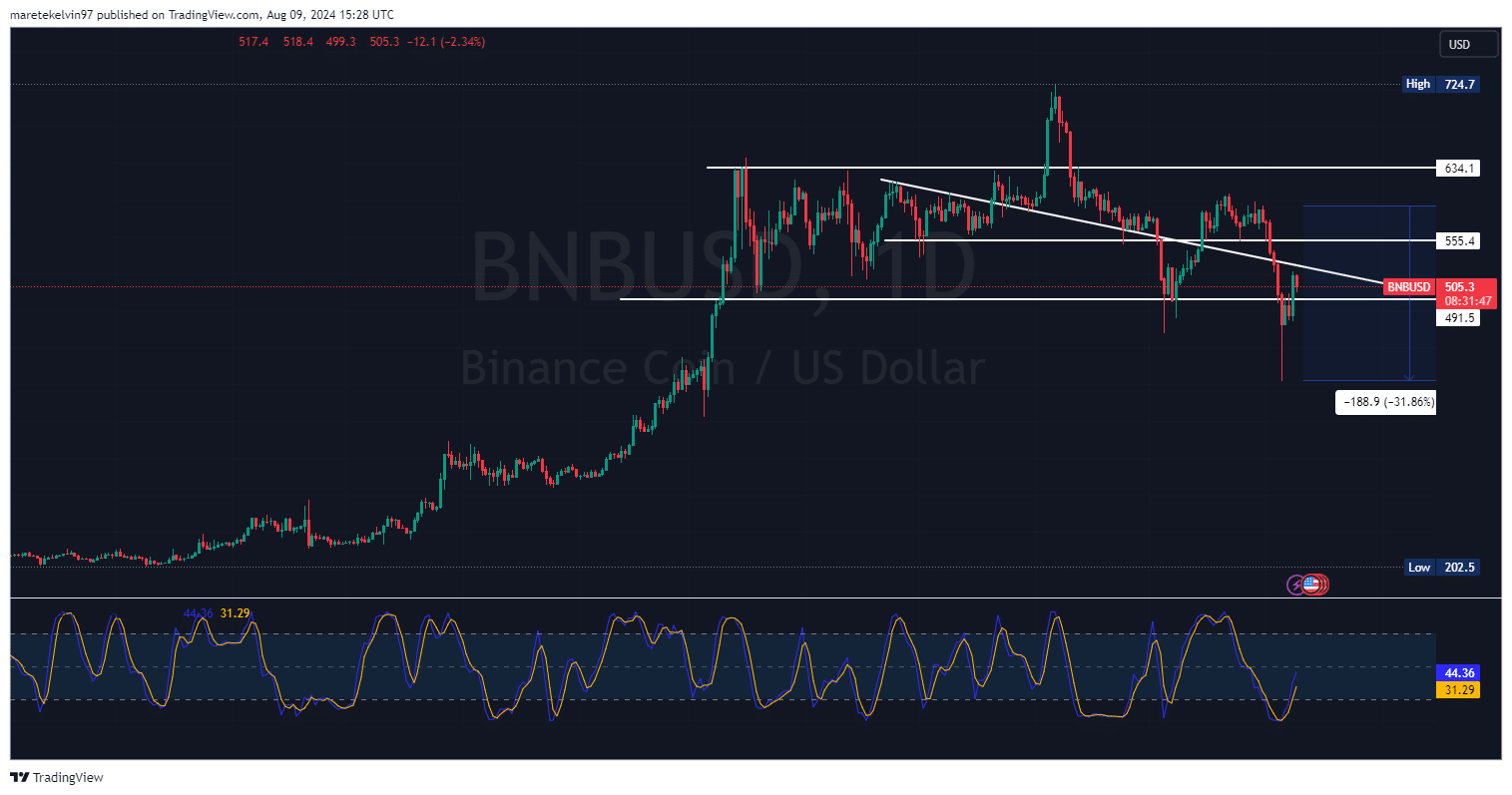

Binance Coin (BNB), at the time of writing, seemed to be retracing towards a key support level at around $491. This level has acted as a solid base for bull reversals in the last three months. And yet, BNB’s price action suggested that the rally may continue. The support level is vital though since it has been tested several times too.

Potential for bullish continuation

BNB price’s approach of its support zone at $491.5 could propel it into an upward trend if held in a strong enough manner. Such a pullback would be in line with broader bearish market structure trends.

Source: TradingView

Additionally, the Stochastic Relative Strength Index indicated an oversold zone. This suggested that most investors are now in a ‘wait and see’ situation, waiting to trade the most recent dip.

Net flows and liquidation insights

Adding to BNB’s present market position, the inflows and outflows data for BNB on exchanges disclosed underlying sentiment. Usually, a surge in outflows indicates accumulation, which means that traders expect the prices to hike on the charts.

However, inflows could suggest selling pressure too. In fact, Net flow data flashed mixed signals, with recent outflows suggesting potential accumulation around the $491 support level.

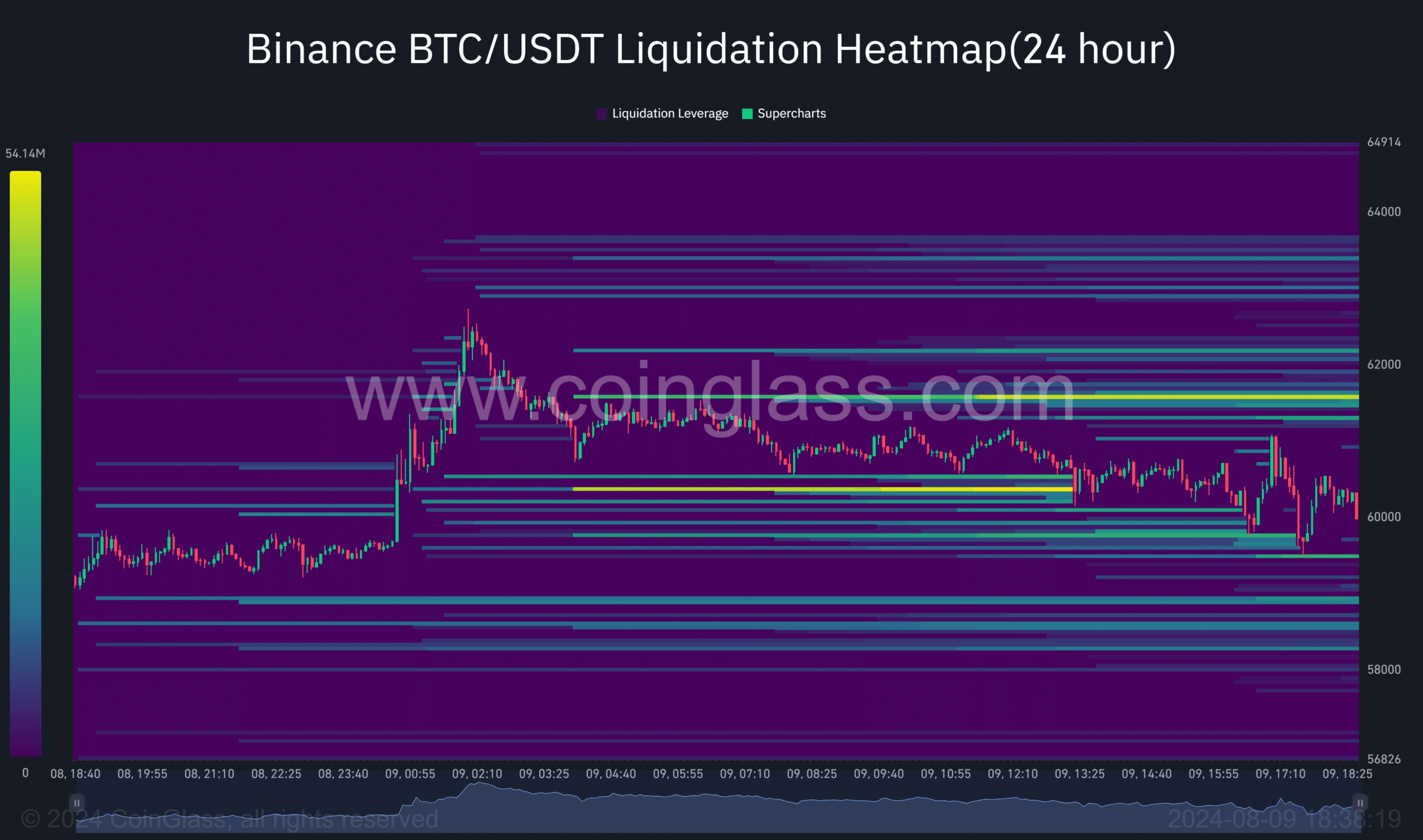

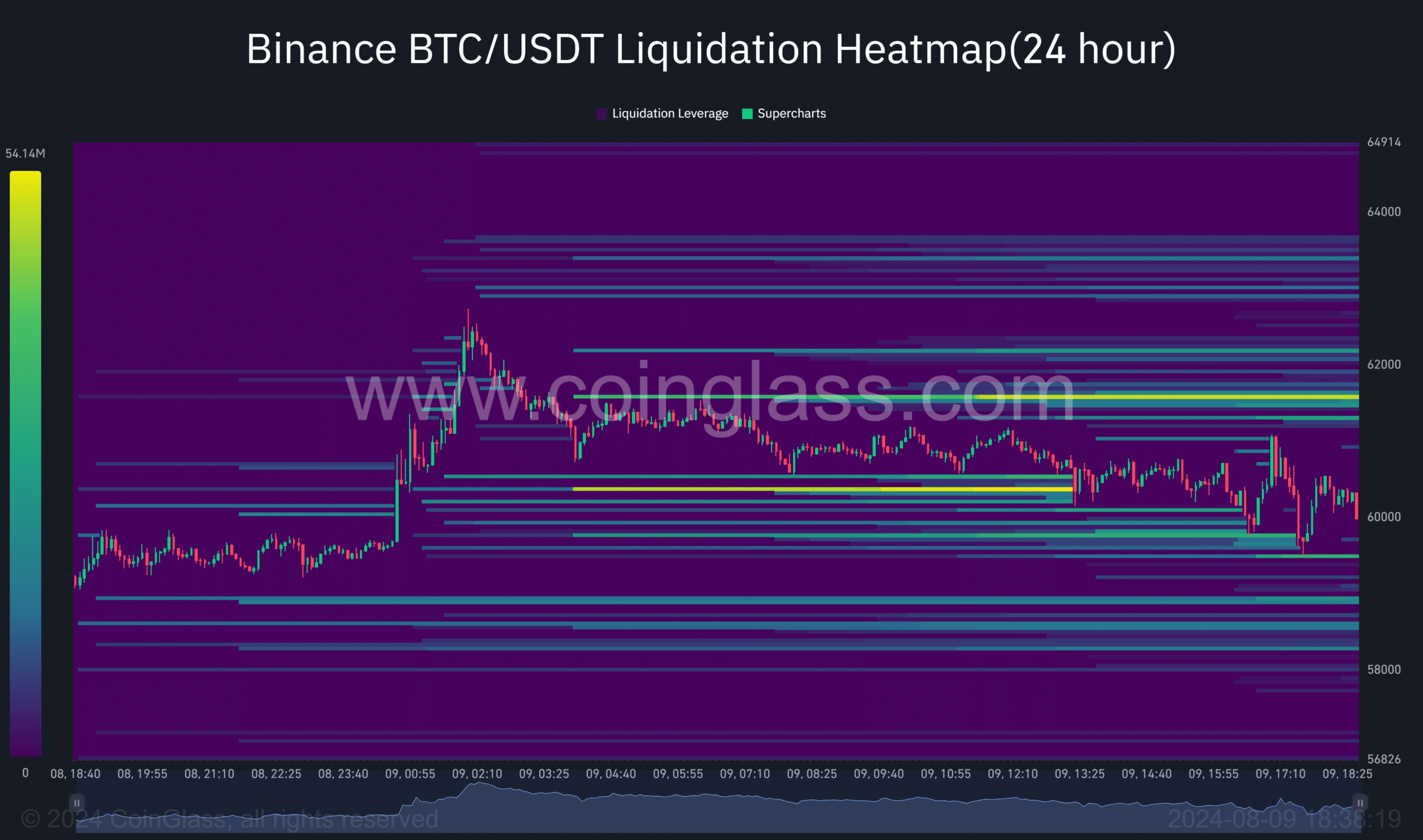

Source: Coinglass

Adding to the aforementioned net flows, AMBCrypto’s analysis of liquidity data from Coinglass highlighted areas of high liquidation pressure, often leading to volatility spikes.

Coinglass’s heatmap also underlined dense areas of liquidations by price that could produce major price swings either way. This intensified liquidation could indicate a possible trend change, as margin calls are observed too.

Source: Coinglass

What is next for BNB?

BNB has now gone past the major support level at $491. However, the chances of a reversal remain strong. Even so, investors are watching for signs of potential future bullish moves.

Simply said, BNB is at a very critical determination point right now. With extreme liquidation levels and overbought technical indicators, it could still see a potential reversal.