- ONDO’s funding rate crash and price action pointed to a possible breakout above $1.60

- Technical indicators and institutional interest signaled bullish momentum, despite bearish network activity

Ondo [ONDO]’s funding rate has fallen to an extraordinary level of over -60%, creating a rare opportunity where exchanges are paying traders to go long. This can be seen as a sign of heightened short interest, which often precedes explosive price movements when bullish momentum builds.

At press time, ONDO was trading at $1.22, marking gains of 3.63% over the last 24 hours. Therefore, could this be the moment ONDO takes off and delivers significant returns for its holders?

ONDO’s price action hints at a potential breakout

Analyzing ONDO’s price action revealed that it has been hovering near $1.22, just below a descending trendline that has capped gains since December. This level is pivotal, as breaking above it could pave the way for a move towards the $1.60 resistance.

Additionally, ONDO seemed to be forming a higher low at the $1.19 support – Alluding to a gradual build-up in buying pressure. If bulls can push ONDO above the trendline, it may trigger an 80% uptick in price.

Source: TradingView

Does the MVRV ratio imply a reversal is near?

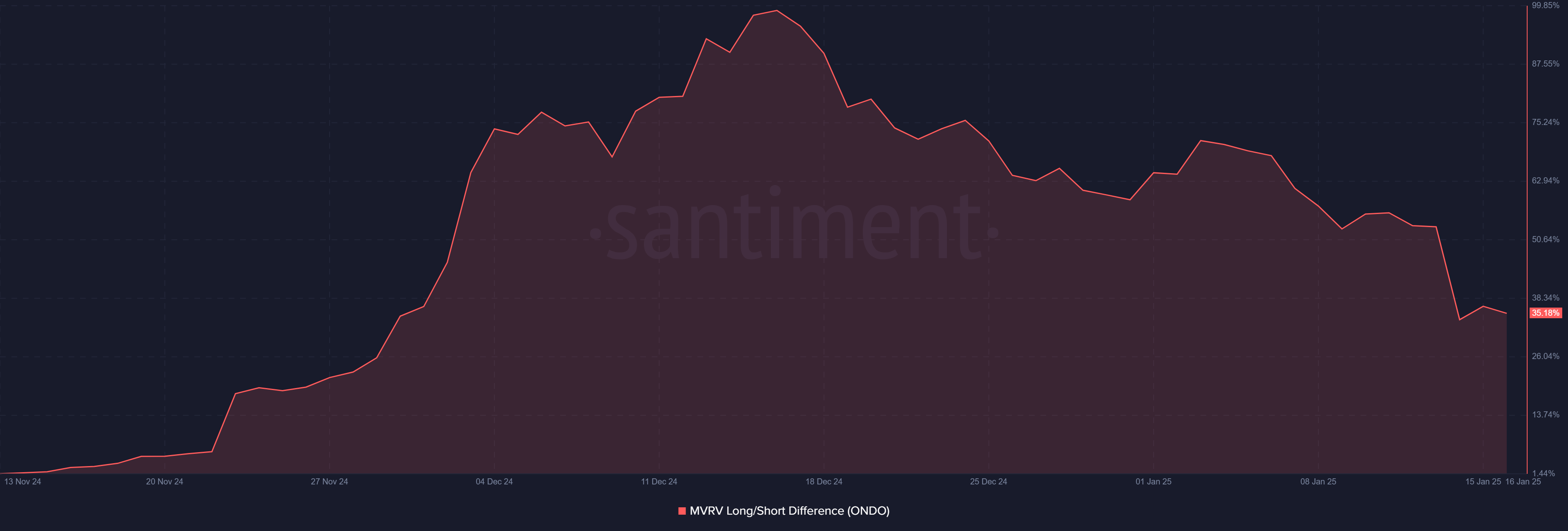

The MVRV long/short difference had a reading of 35.18%, signaling that short-term holders are in profit. Historically, such elevated readings can sometimes precede corrections as investors take profits.

However, this metric also suggested that ONDO’s price remains under pressure from profit-taking. Therefore, the timing of a reversal depends on whether buyers can sustain momentum or not.

Source: Santiment

Large transactions and growing institutional interest

ONDO’s large transactions have reached 182.2 million in volume over the last 24 hours, with sentiment turning 1.35% bullish. This marks a steady uptick in interest, especially in light of the fact that a 7-day high of 695.18 million ONDO in volume was recorded recently.

Therefore, this accumulation may indicate that larger players are preparing for a major move. Will this rising liquidity translate into sustained price growth?

Source: IntoTheBlock

Technical indicators signal potential momentum shift

At the time of writing, the Parabolic SAR indicator sat below $ONDO’s price, reflecting a shift towards bullish momentum. Furthermore, the RSI was at 42.63, just above oversold territory – A sign that ONDO may be undervalued.

Taken together, these indicators hinted at a potential price reversal if buying pressure continues to climb. However, breaking key resistance levels remains critical for a bullish confirmation.

Source: TradingView

Price DAA divergence raises questions

Finally, ONDO’s price divergence with daily active addresses sat at 65.66%, reflecting a mismatch between network activity and price.

While this may indicate overextension, it also highlighted the potential for renewed activity if the trend reverses itself. Additionally, sustained buying momentum could mitigate this divergence and propel ONDO into its next bullish phase.

Source: Santiment

Read Ondo Finance’s [ONDO] Price Prediction 2025–2026

Is ONDO ready for a breakout?

Based on its press time metrics and technical indicators, ONDO appears poised for a breakout in the short-term. The bullish momentum from the funding rate, large transactions, and improving technicals all seemed to point in that direction.

If ONDO can break the $1.60 resistance, it is likely to trigger a major rally. Therefore, ONDO may indeed be ready for a potential breakout, provided buying pressure sustains itself.