- Whales withdraw $3.05M PENGU and $3.29M from Binance and Bybit, respectively

- If PENGU breaks below $0.035, it could turn bearish

The recent withdrawal of $3.05 million worth of Pudgy Penguins (PENGU) from Binance can be seen as a sign of significant accumulation by whales.

This activity, coupled with another major transfer from Bybit, pointed to growing confidence among large holders. In fact, such movements often precede price surges as whales can influence market sentiment strongly.

Source: Solscan

By consolidating large amounts of PENGU, these whales could potentially control supply dynamics, contributing to upward price pressure. As more whales engage, the perceived value and demand for PENGU may rise, fostering a bullish outlook for its near-term market performance.

This strategic accumulation highlighted a pivotal moment, one that could lead to enhanced valuation of Pudgy Penguins in the market.

PENGU performance and prediction

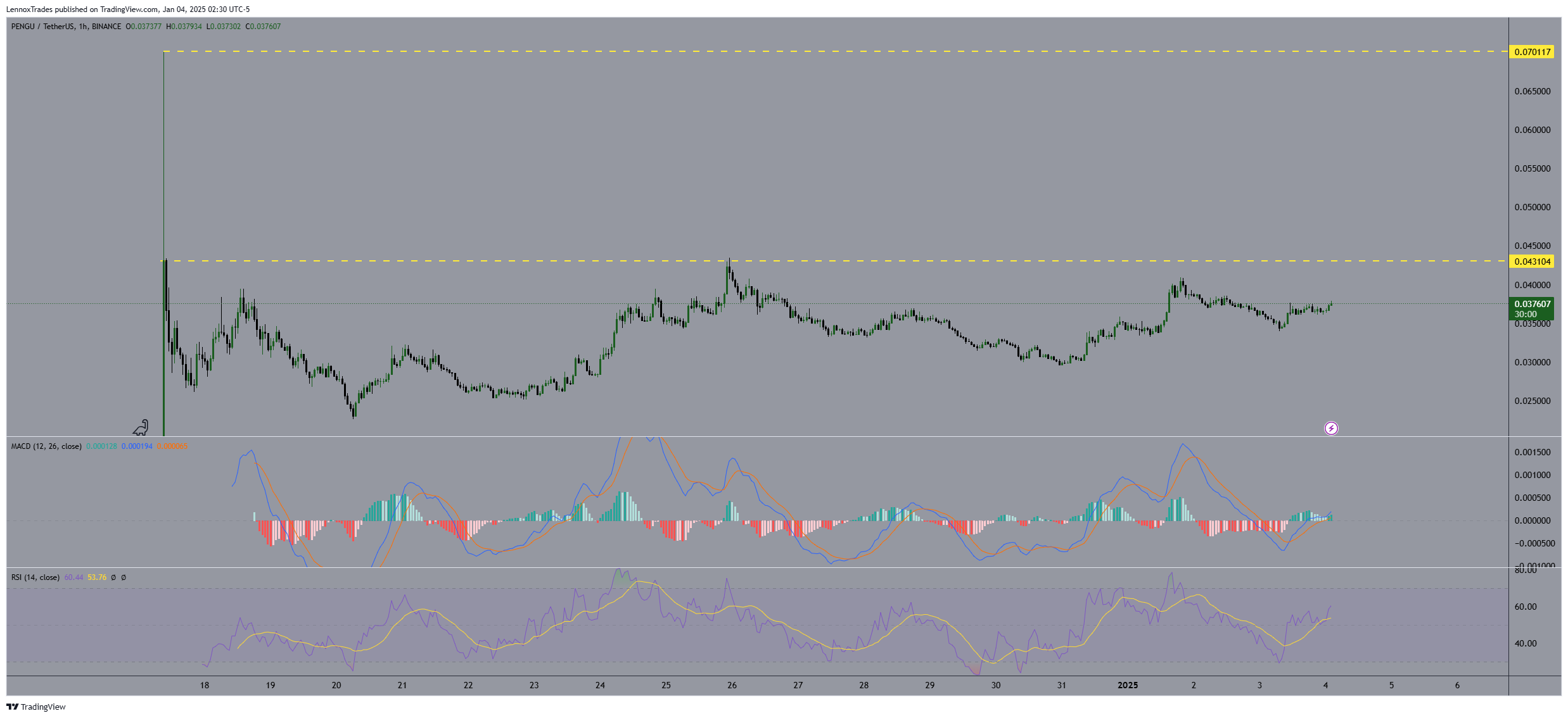

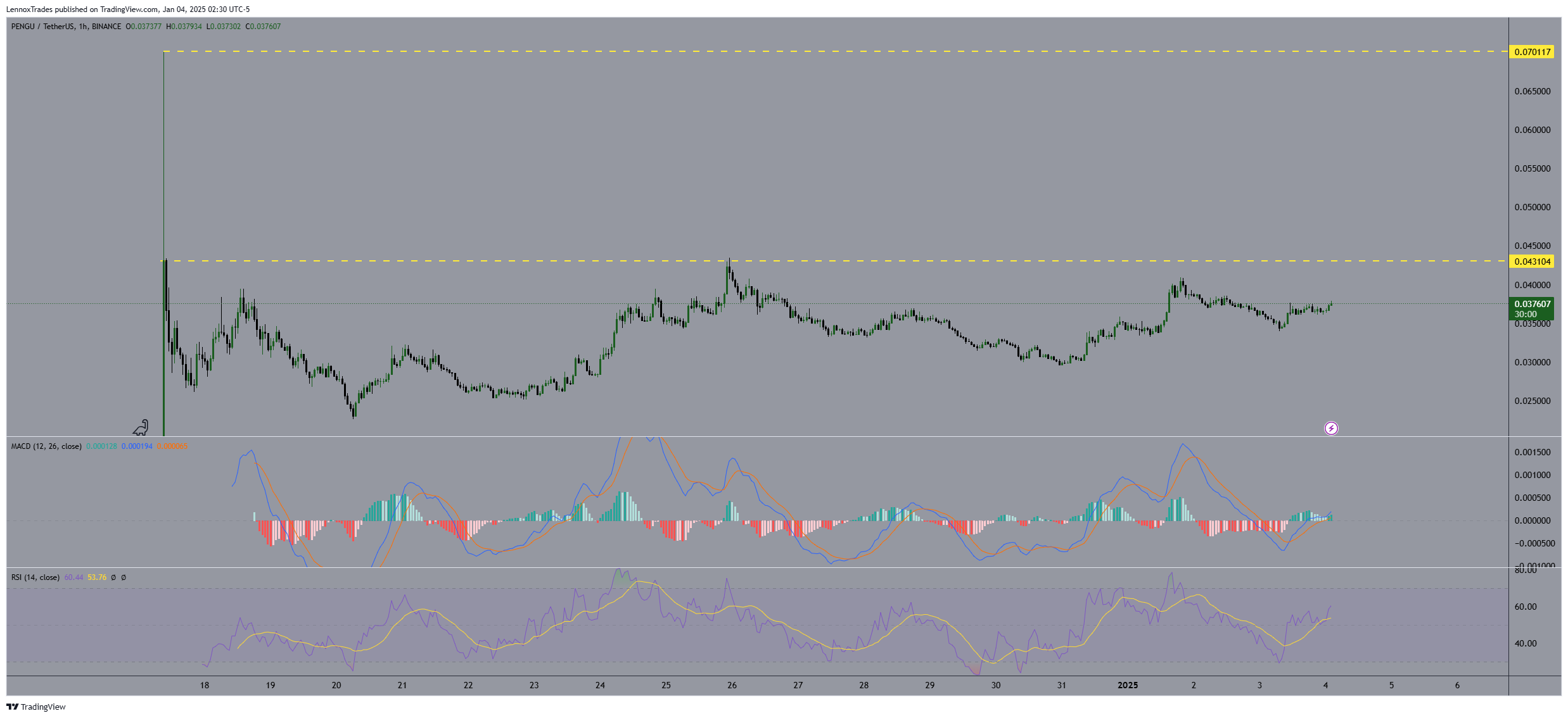

A look at its press time performance revealed that PENGU has been up by over 3% in the last 24 hours, while its daily volume decreased by over 5%. PENGU’s price chart also alluded to resilience as the altcoin entered the market strongly, peaking sharply at $0.07017 before a significant pullback.

It then established a solid base at $0.035, where it mostly fluctuated before starting a slow climb – Indicating a consolidation phase that may lay the foundation for future rallies.

The RSI climbed above the midpoint – A sign of growing buyer interest. The MACD backed this bullish outlook, displaying a crossover that pointed to potential ongoing upward trends.

Source: Trading View

At press time, PENGU was hovering near a crucial support level at $0.035487. If this level fails, the price might drop towards the first target point at $0.043 and possibly, the second at $0.070. This suggested PENGU had rebounded from its initial volatility. It could even exceed its original market cap.

However, if the support remains intact, a rebound above the $0.036921 resistance is plausible for Pudgy Penguins. This could fuel a 98% rally past the ATH.

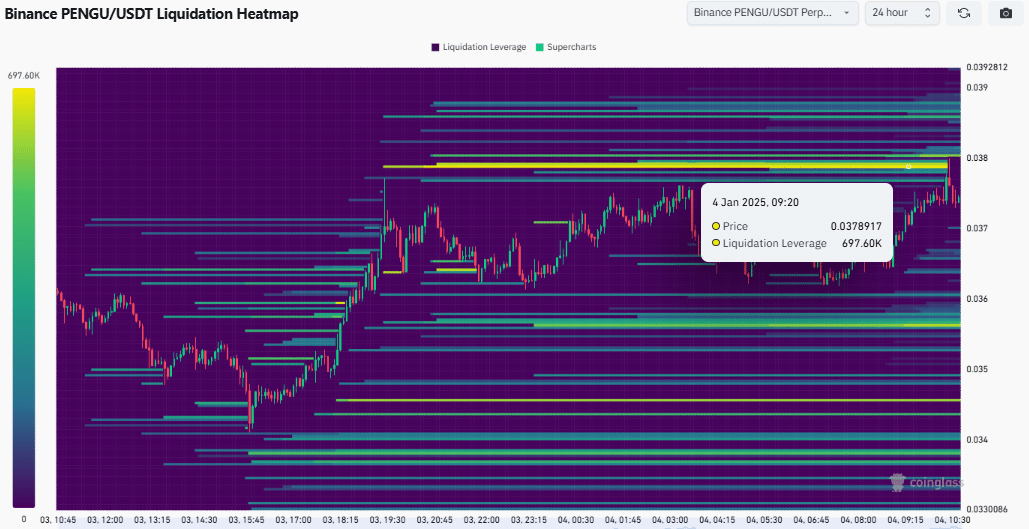

Liquidation heatmap

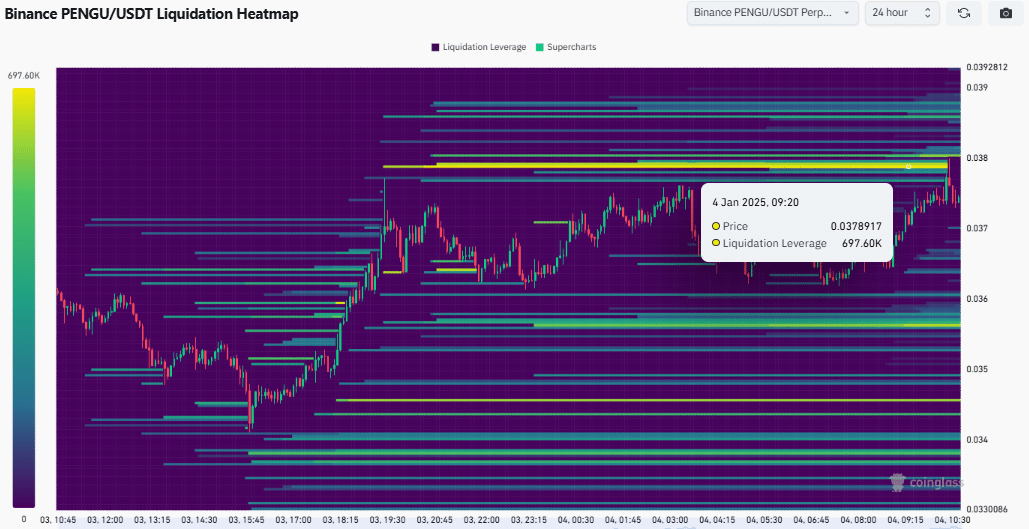

Additionally, the liquidation heatmap for PENGU showed concentration of leveraged positions vulnerable to liquidations at $0.038. These positions mean that around 697.60K PENGU may be at risk if the price dips slightly below this level.

If PENGU breaches this support, a sharp decline could trigger further sell-offs due to cascading liquidations, adding downward pressure on the price.

Source: Coinglass

Conversely, sustaining above this level could stabilize PENGU’s market and act as a foundation for future gains, suggesting a potential rebound if buy support solidifies.

This delicate balance highlights the pivotal role of liquidation thresholds in influencing short-term price movements and market sentiment for leveraged assets.