- LDO has surged by 5.67% over the past 24 hours.

- Lido DAO whale scooped 2.72 million LDO tokens worth $4.9 million.

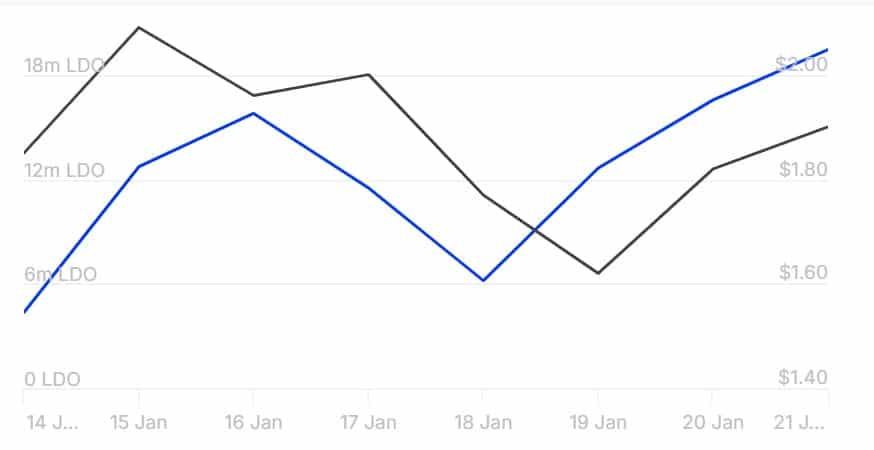

Over the past three days, Lido DAO [LDO] has made significant gains on its price charts. Over this period, it has surged from a low of $1.55 to a high of $2.00.

Since hitting $2, Lido DAO has made a slight pullback. As of this writing, it is trading at $1.84. This marks a 5.67% increase on daily charts. It has also gained 2.45% on weekly charts and 8.49% on monthly charts.

With sustained gains across the charts, investors have turned optimistic. This positive perception is more prevalent among whales, who have started accumulating.

Lido DAO’s whale activity spikes

According to SpotOnChain, a dormant Lido DAO whale has woken after a year to spend $5 million. This whale has accumulated 2.72 million LDO tokens worth $4.9 million over the past day.

When a whale decides to add its holdings, it signals market confidence and bullish sentiments.

Source: IntoTheBlock

Whale activity was rising in the broader LDO market, evidenced by a surge in large holder inflow. This inflow has spiked from 12 million tokens to 19 million, with more capital inflows than outflows.

As a result, large holders’ netflow has remained positive over the past seven days. This market trend implies that large holders are confident in the market and are taking the opportunity to accumulate.

Any impact on LDO Charts?

As expected, increased whale activity has positively impacted LDO. This demand by whales has created a higher buying pressure, which is driving prices up.

Source: Tradingview

The rising demand is validated by a bullish crossover on LDO’s Stoch RSI. A bullish crossover here suggests that buyers have taken control of the market, while sellers are losing momentum.

This implies that investors are buying, which reflects bullish sentiment.

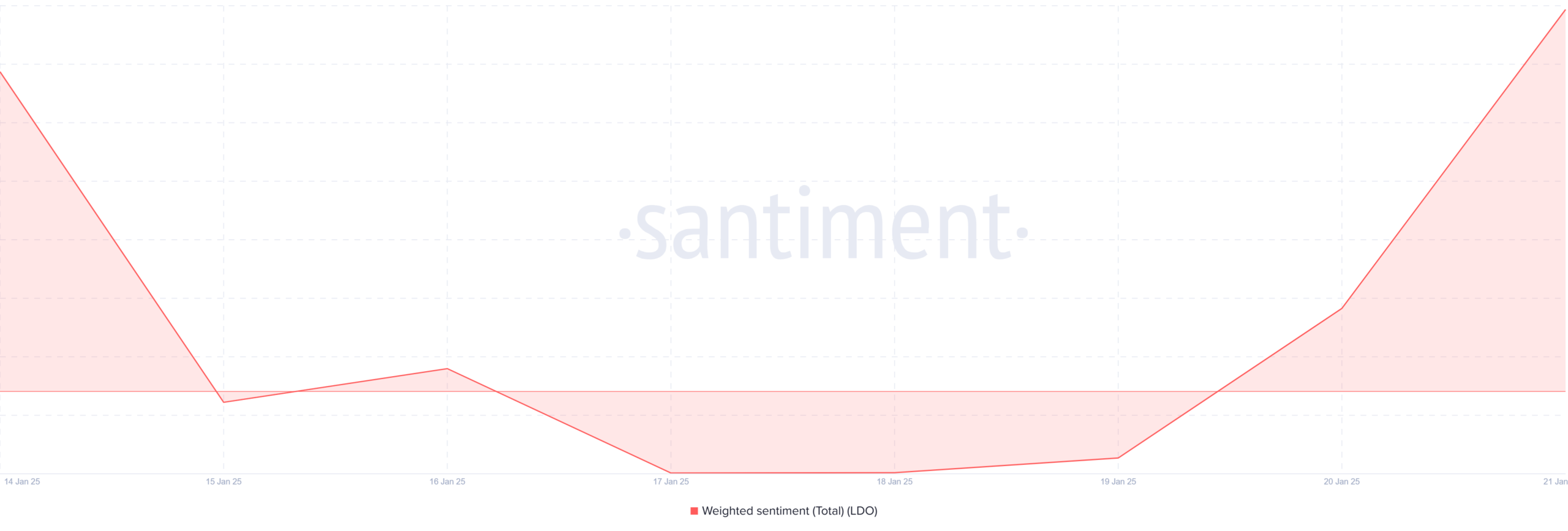

Source: Santiment

As such, all market participants turned bullish; this shift in market sentiment is evidenced by the fact that LDO’s Weighted Sentiment turned positive two days ago after staying negative most of the week.

Source: Santiment

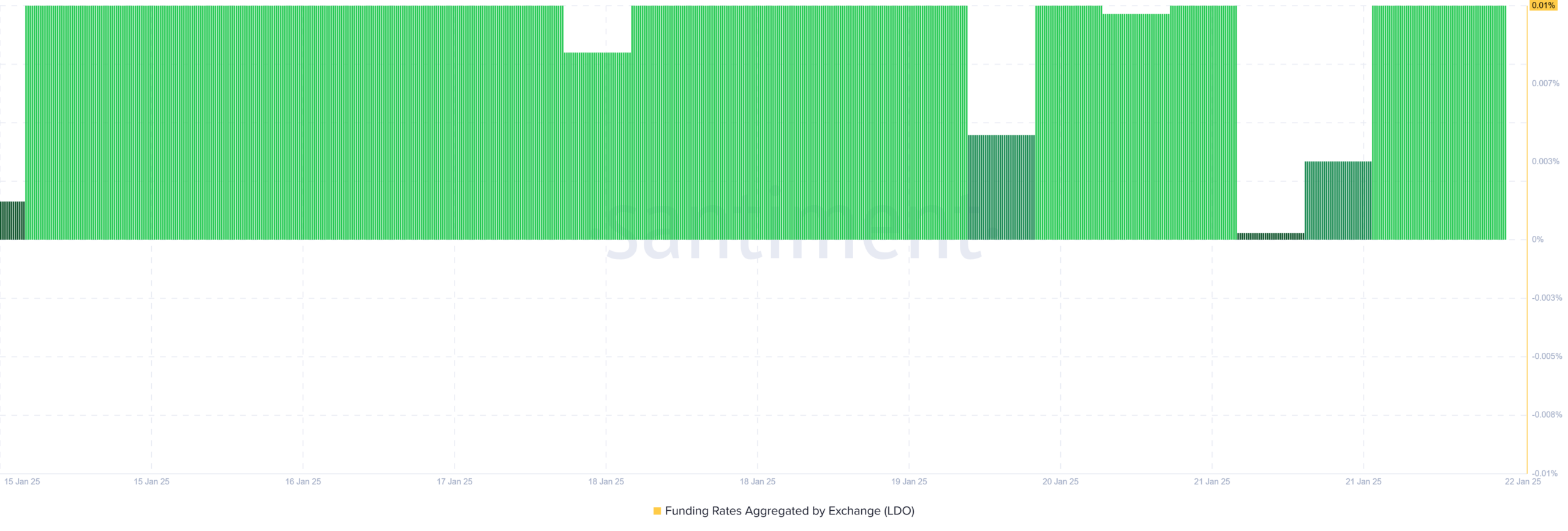

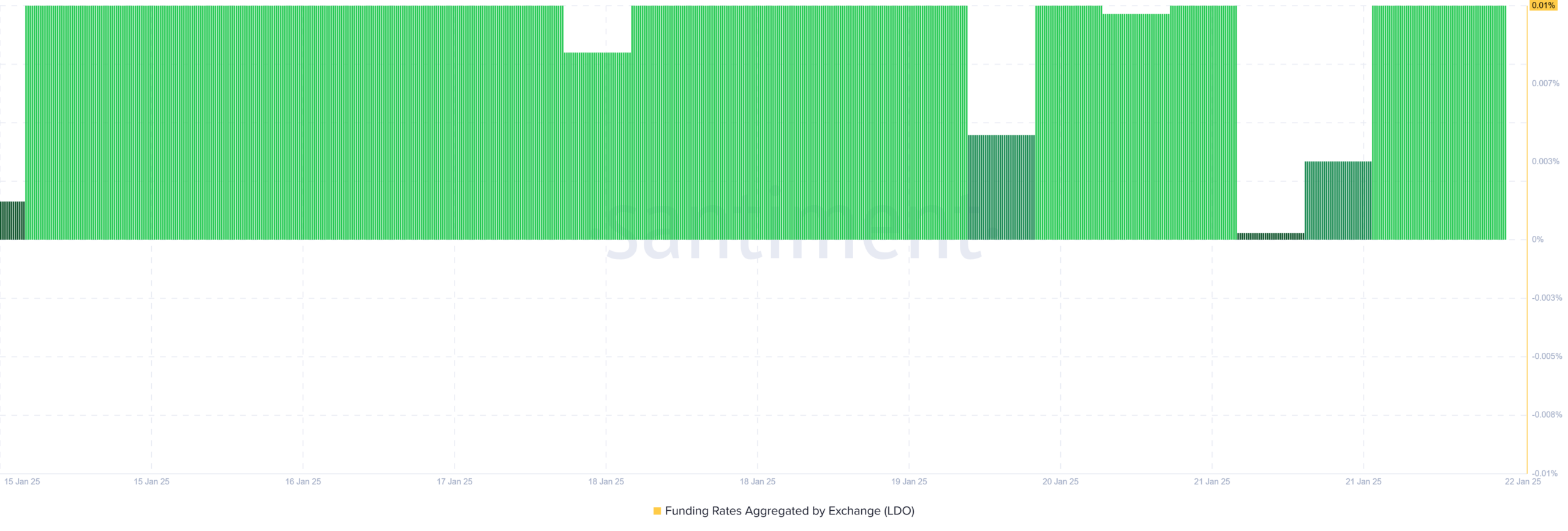

This market bullishness is further supported by a rising demand for long positions. This can be seen through a positive a Funding Rate across all exchanges.

LDO’s Funding Rate has remained positive over the past week, signaling strong demand for long positions.

Source: Santiment

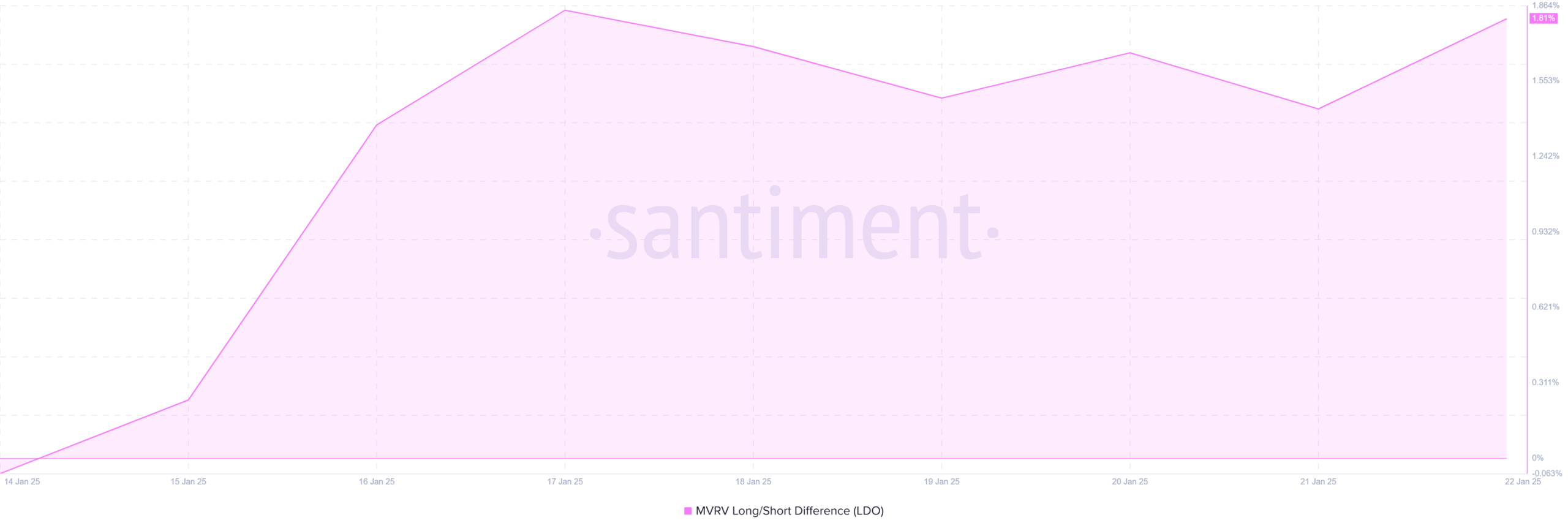

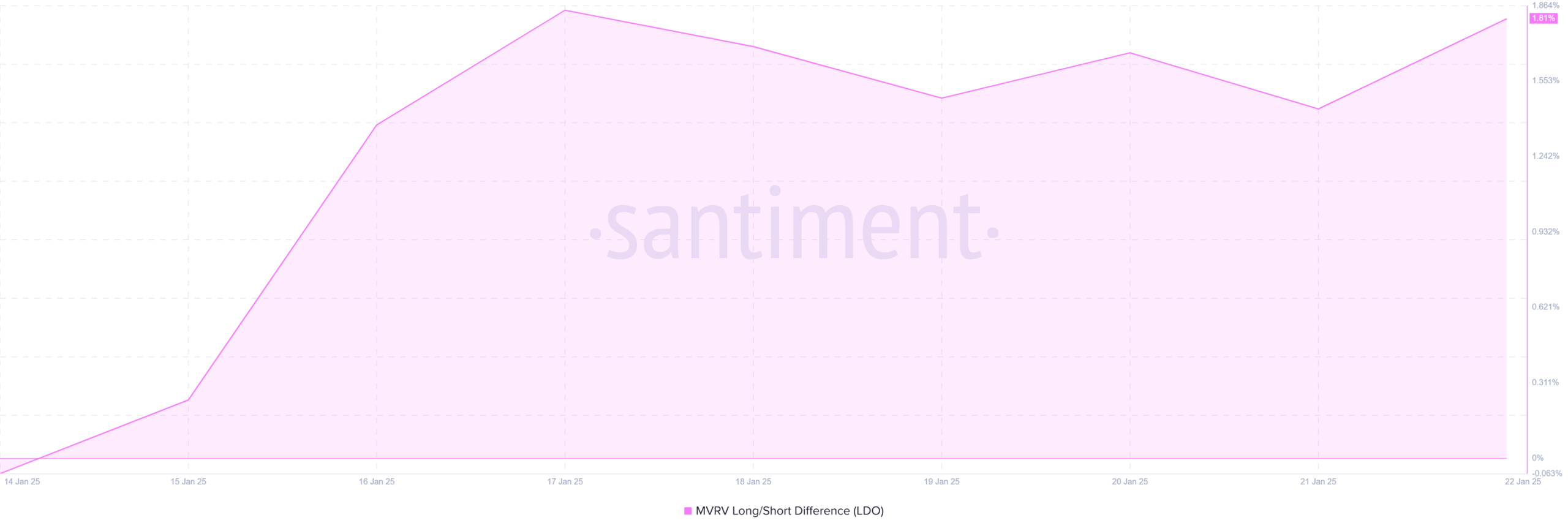

The Lido DAO’s MVRV Long/Short Difference has turned positive after being negative earlier in the week.

A rising MVRV Long/Short Difference indicates that long-term holders’ profit margins are increasing while they continue to hold. This behavior reflects market confidence as they expect profits to rise further.

Read Lido DAO’s [LDO] Price Prediction 2025–2026

Whales are actively accumulating LDO, while retailers remain bullish. With all market participants showing optimism, Lido DAO could gain more on its price charts.

If the current trend holds, LDO will reclaim $2 and attempt the $2.1 resistance level. If the trend fails, a correction will follow, dropping the altcoin to $1.65.