- Sentiment and momentum around MANEKI crypto were bullish.

- The lack of accumulation in recent weeks was a worry for bulls.

MANEKI [MANEKI], the beckoning cat memecoin on the Solana [SOL] network, saw a 62.15% rally in the past four days. Since the 14th of October, the token is up 32% and counting.

At press time, the indicators reflected bullishness.

Yet, Bitcoin [BTC] has reached a resistance zone around $66k. MANEKI bulls also contended with the supply zone at $0.00756.

Caution is better than FOMO for now

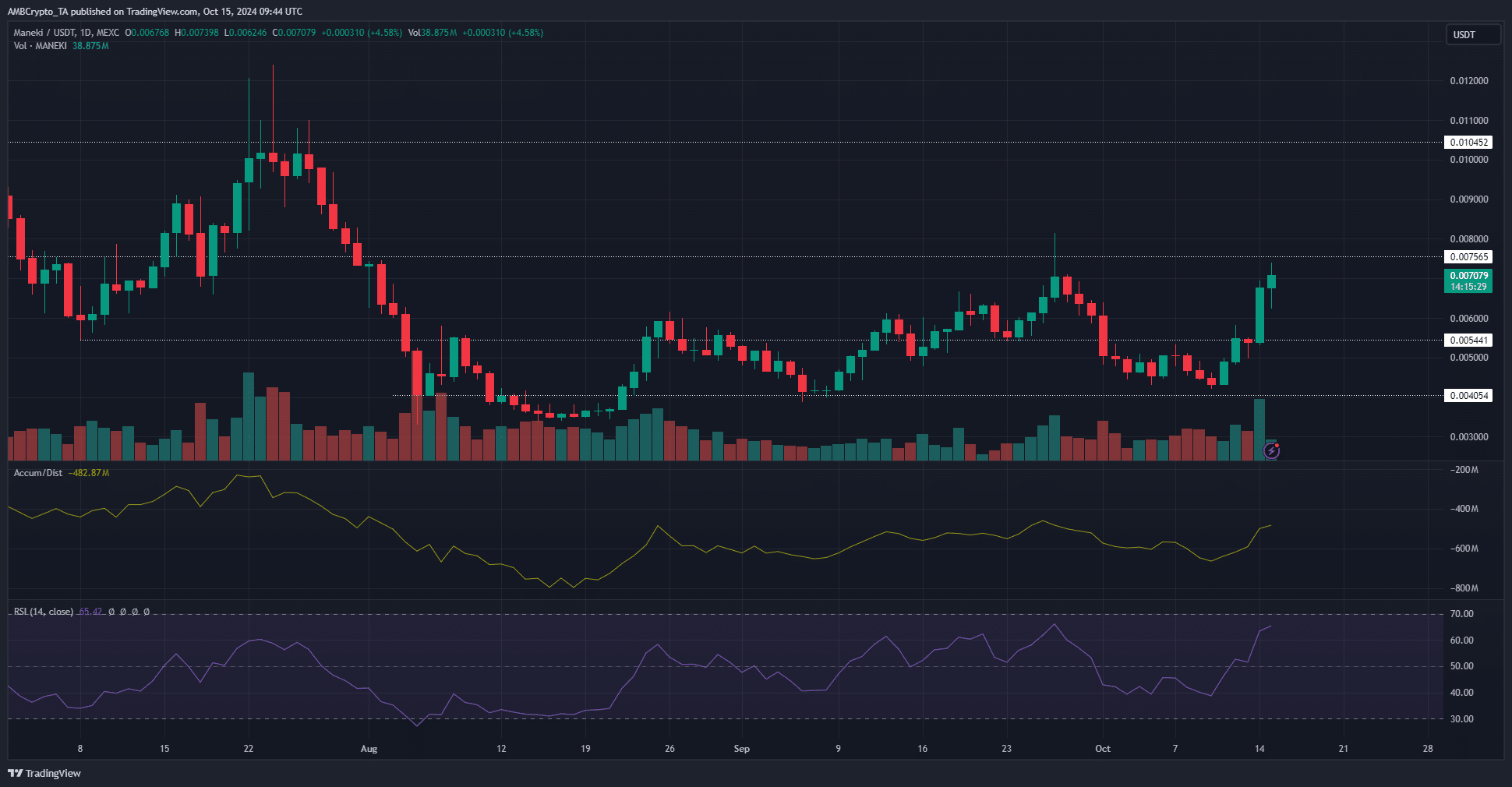

Source: MANEKI/USDT on TradingView

The daily market structure for MANEKI was bullish. The breach of the $0.054 resistance last weekend saw this former supply zone flipped into a demand zone. From there, a large rally ensued on Monday.

The bullish push of the past two days brought the price to the threshold of the $0.0075 resistance level. On the 27th of September, this level rebuffed MANEKI bulls.

It is possible that a similar scenario would play out once more, as the A/D indicator failed to make new highs even though MANEKI was at a significant resistance.

This showed that the buying pressure likely wasn’t high enough for a sustained rally, despite the bullish momentum of the past few days.

Market expectations are more tempered

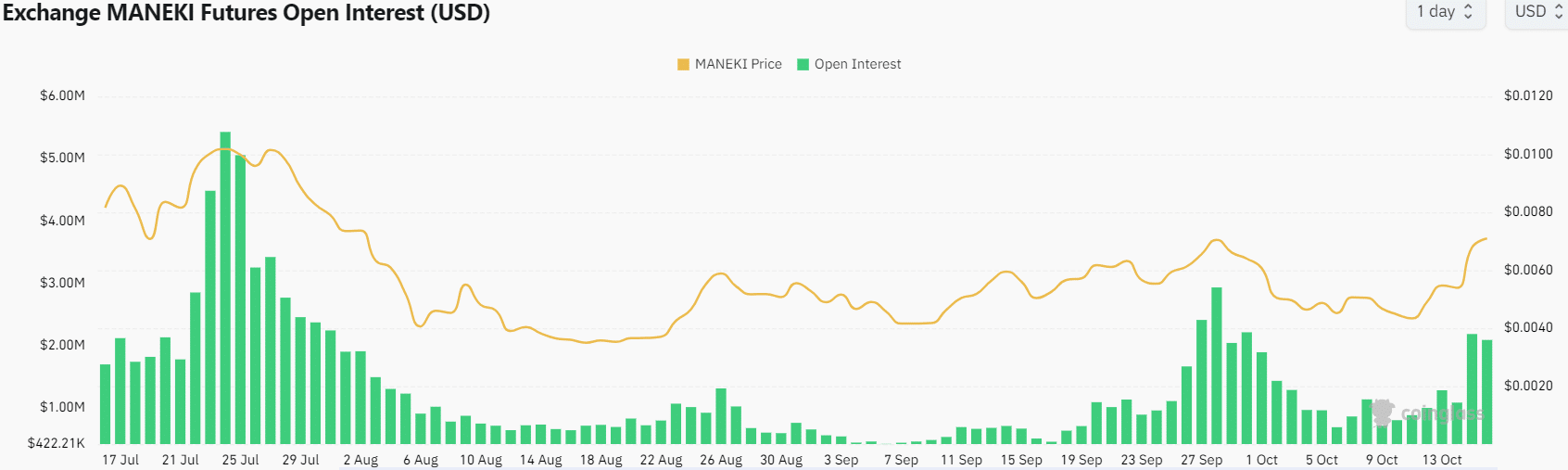

Source: Coinglass

Like the price, the Open Interest also approached the highs it made toward the end of September. However, the OI was almost $1 million lower than three weeks ago.

Is your portfolio green? Check out the MANEKI Profit Calculator

This suggested that the bullish speculators were fewer.

The A/D indicator and the OI chart together showed market misgivings about a sustained MANEKI rally. Hence, traders could book profits and be prepared for a potential reversal.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion