- 9% spike propels MEW to record highs.

- Liquidation risks loom as MEW tests $0.0130 resistance zone

With its market cap soaring past $1 billion, Cat in a dogs world [MEW] has emerged as a standout performer in the cryptocurrency market. A sharp 9% surge in the last 24 hours pushed the token to $0.01218, sparking widespread interest.

Can MEW’s bullish trajectory carry it beyond $0.012 and toward the $0.02 psychological level?

Cat in a dogs world technical analysis

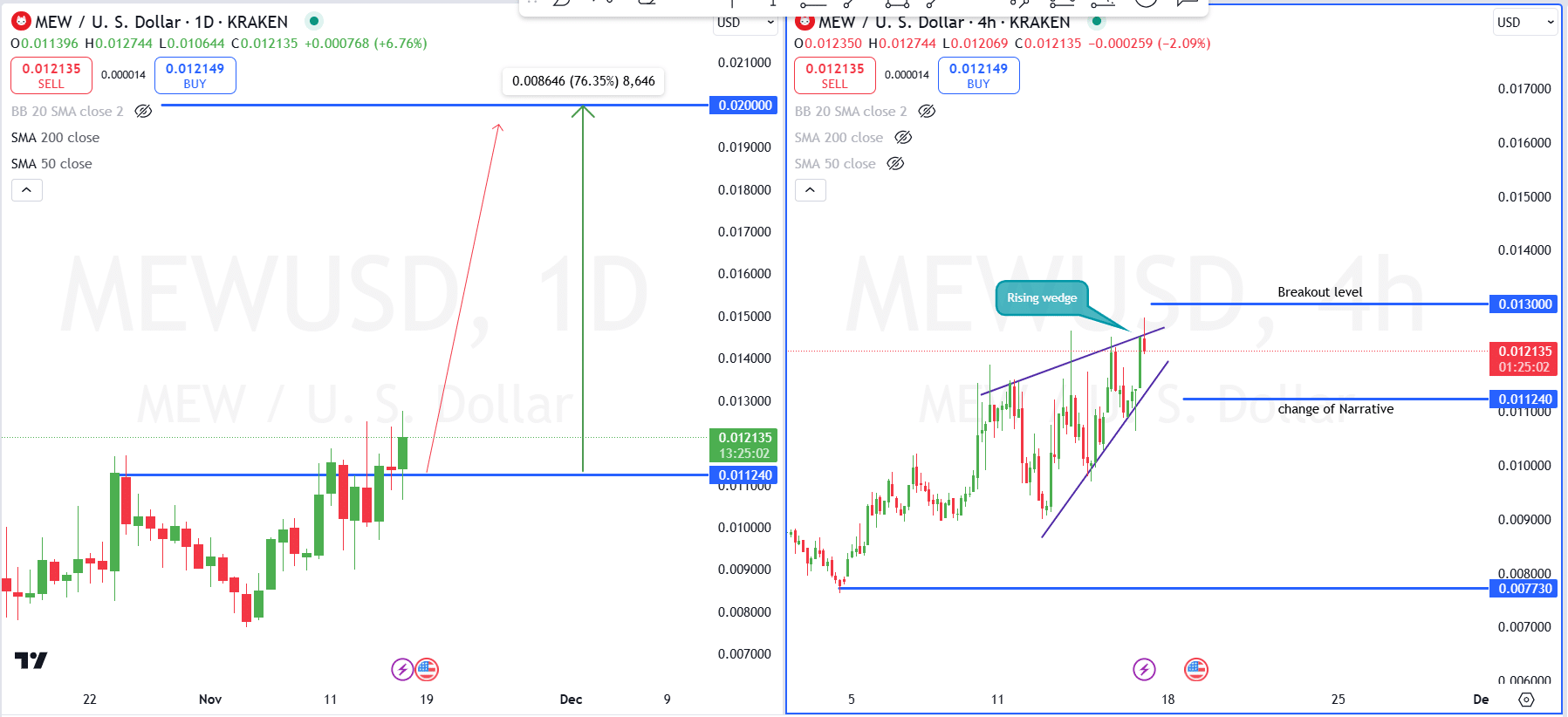

In the daily chart, MEW showcases strong bullish momentum, trading firmly above the $0.011240 support level. The recent surge has propelled the price closer to the key resistance at $0.013, with a path to the psychological milestone of $0.02.

If the momentum sustains, MEW could achieve a 76.35% gain, making this breakout a pivotal moment for further growth.

Source: TradingView

On the 4-hour chart, MEW presents a rising wedge pattern, a structure often linked to bearish reversals. The price is testing the crucial $0.013 breakout level, which now serves as a strong resistance.

Failure to clear this level could result in a pullback toward the $0.011240 support zone. However, a decisive breakout above the wedge pattern would signal a continuation of the upward trend, invalidating the bearish scenario.

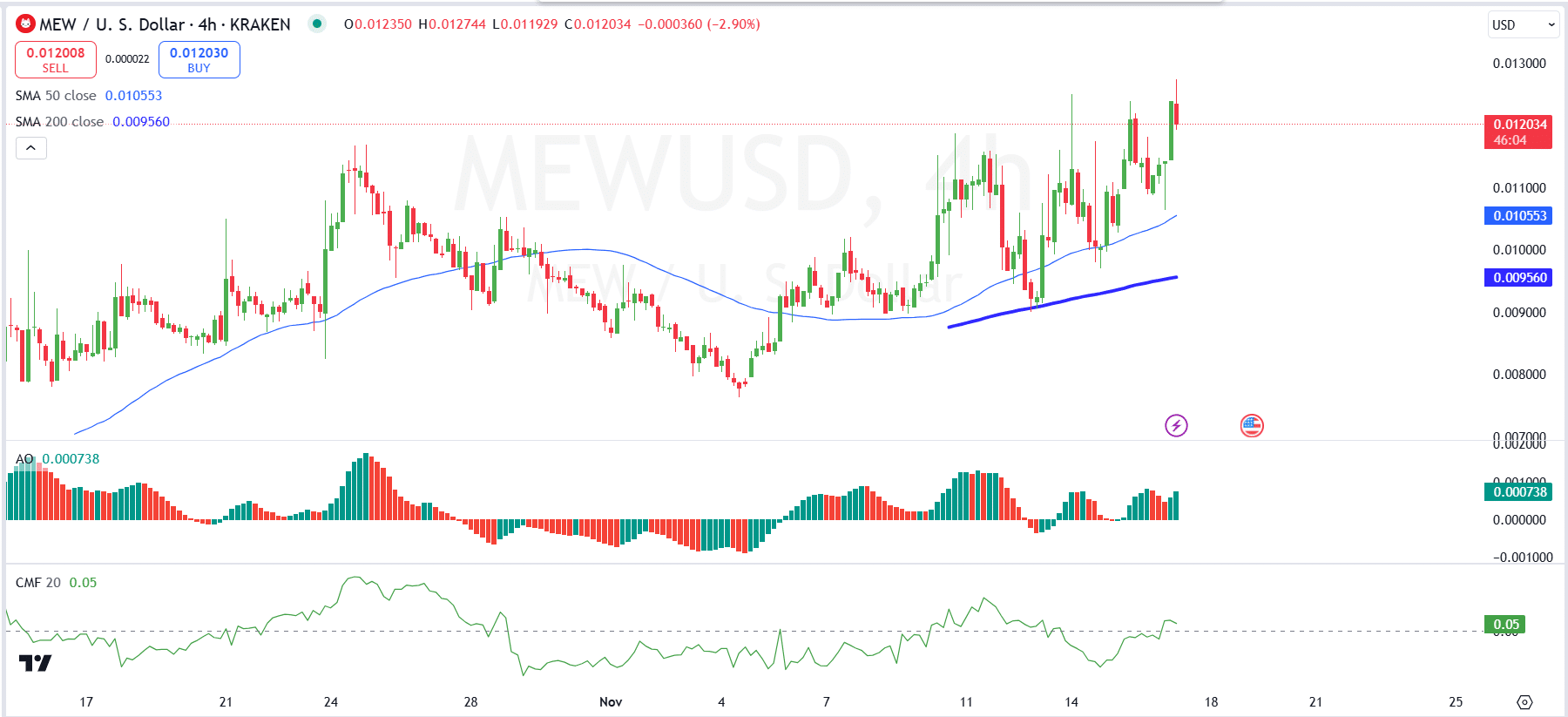

The price trades well above the 50-day SMA and the 200-day SMA, confirming a strong bullish trend with the 50-day SMA acting as immediate short-term support.

Source: TradingView

The Awesome Oscillator (AO) is showing green bars above the zero line, which indicates bullish momentum is gaining strength. The increasing size of the green bars suggests that buying pressure is accelerating.

The Chaikin Money Flow (CMF) currently stands at a positive 0.05, indicating that there is a strong inflow of capital into the asset. A positive CMF reflects that buying activity outweighs selling.

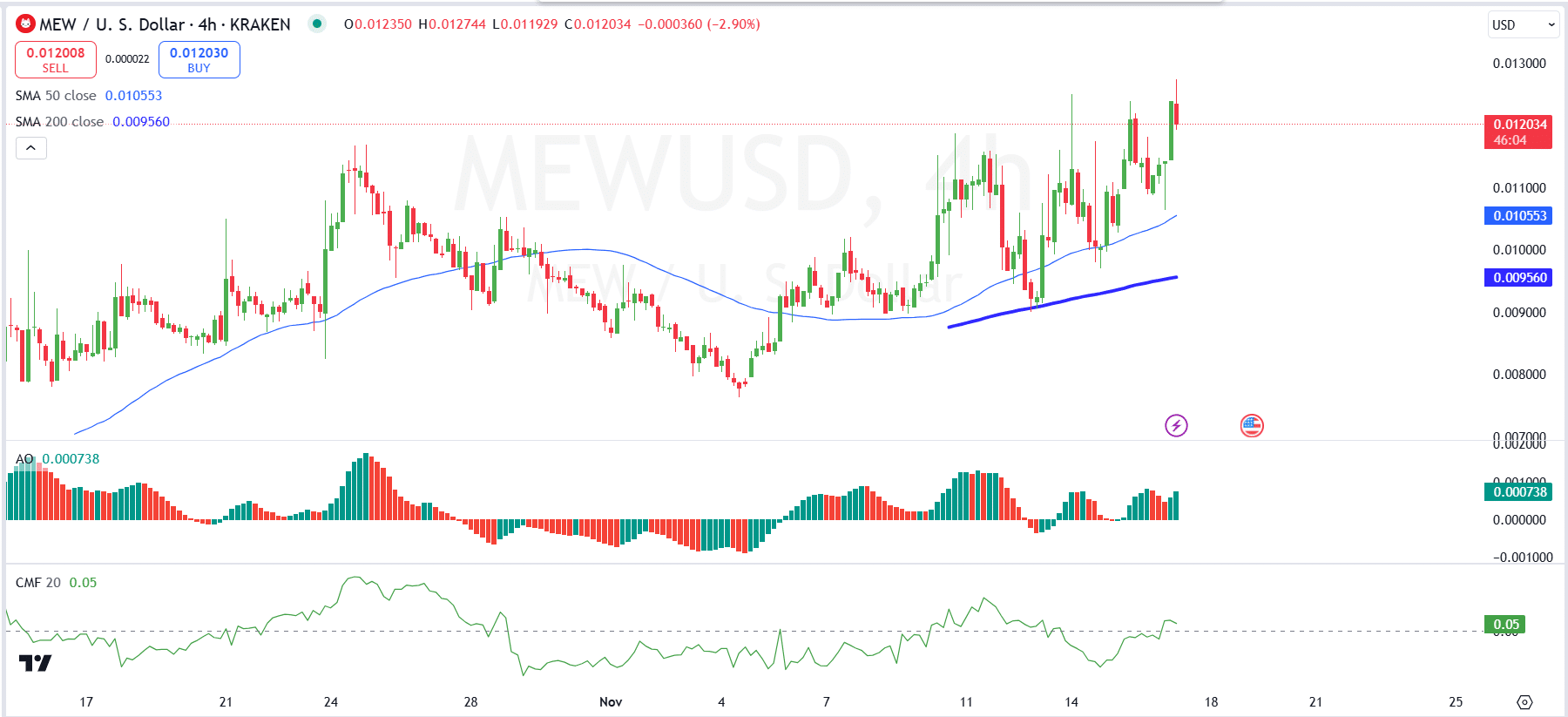

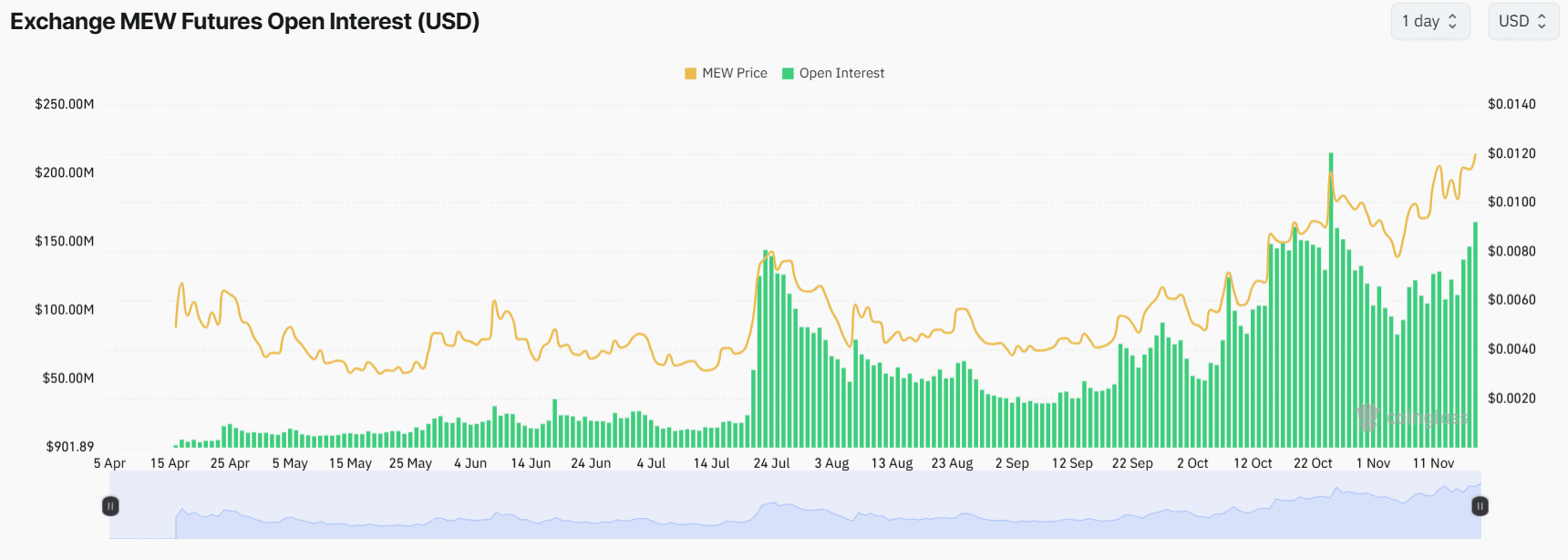

MEW open interest doubles in two weeks

Since the 5th of November, open interest has surged from approximately $82 million to its current level of $164 million, reflecting an impressive increase of over 100%.

This sharp rise in open interest underscores growing trader activity and increasing capital allocation toward MEW futures, signaling heightened speculative interest. In late July and October, spikes in open interest accompanied price rallies, showing strong trader engagement during bullish phases.

Source: Coinglass

However, these periods were followed by pullbacks in both price and open interest, likely due to profit-taking or reduced speculative enthusiasm. The synchronized rise in both price and open interest since early November indicates renewed market confidence.

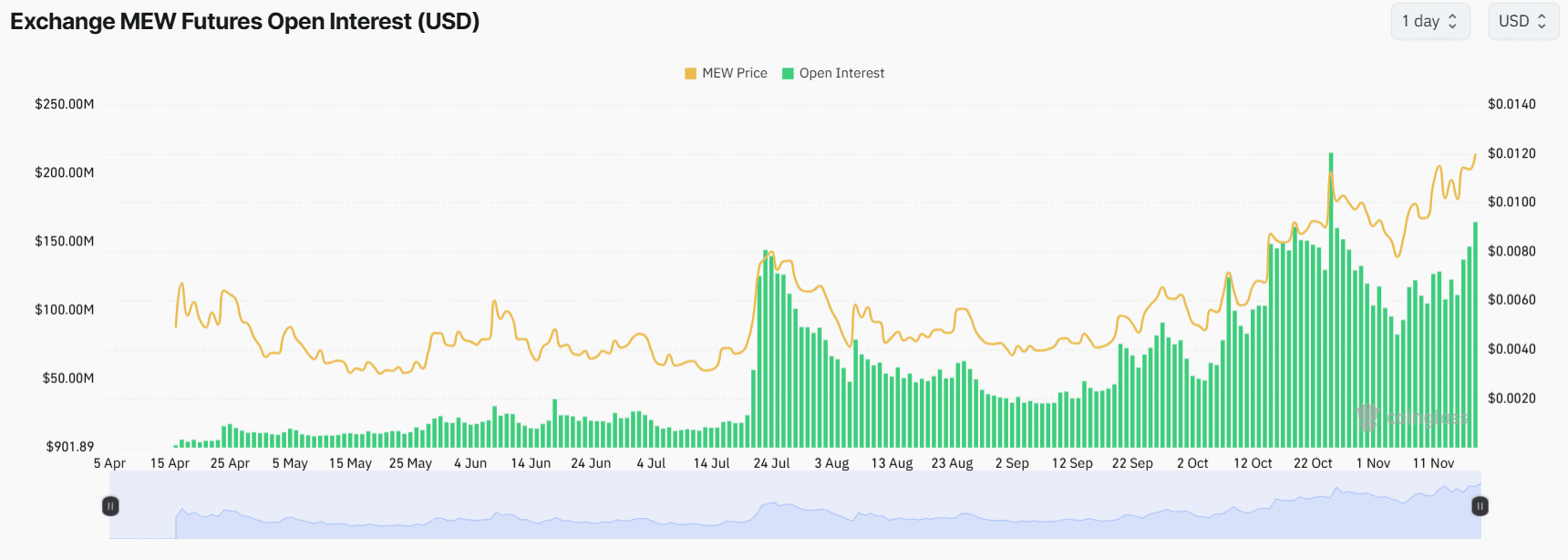

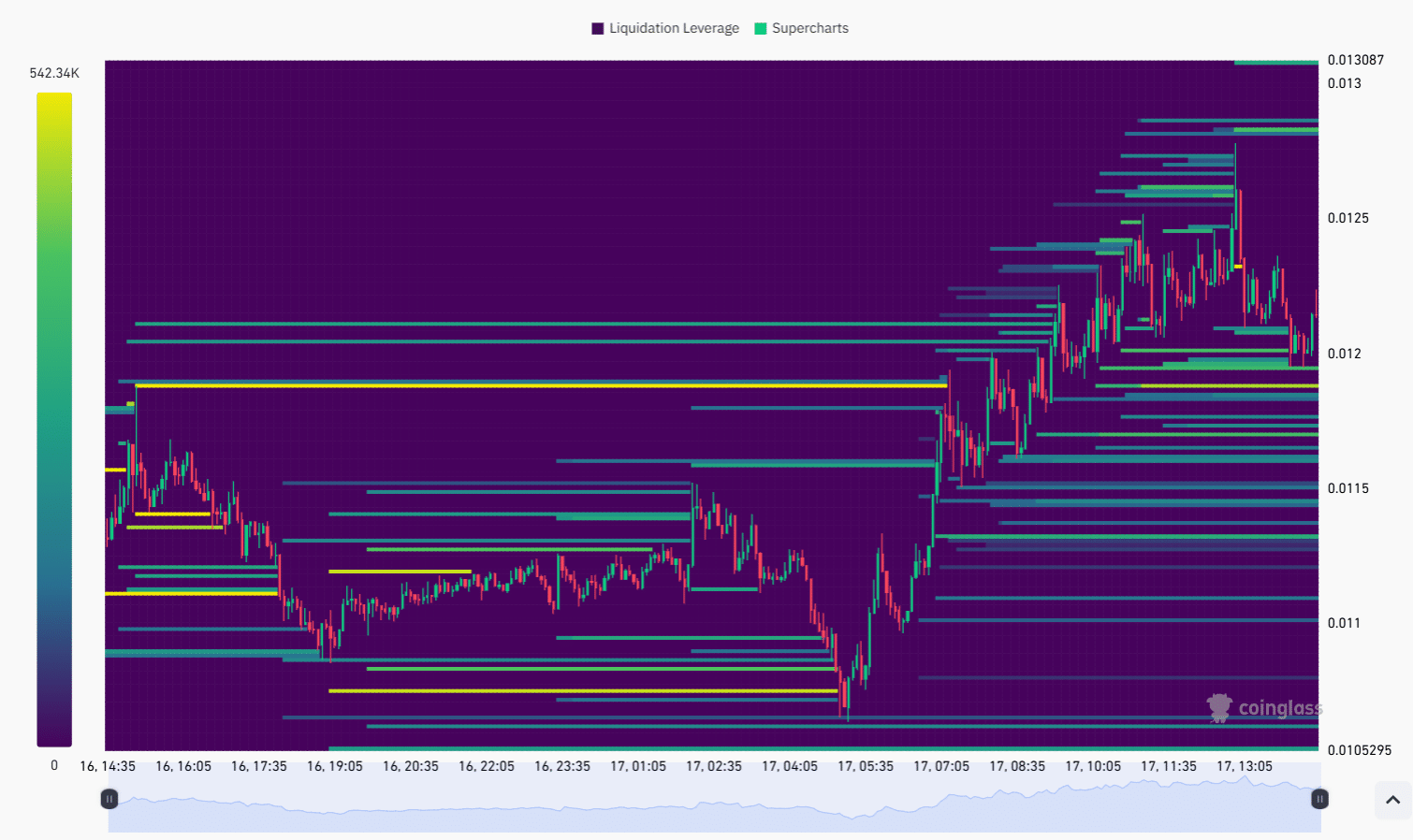

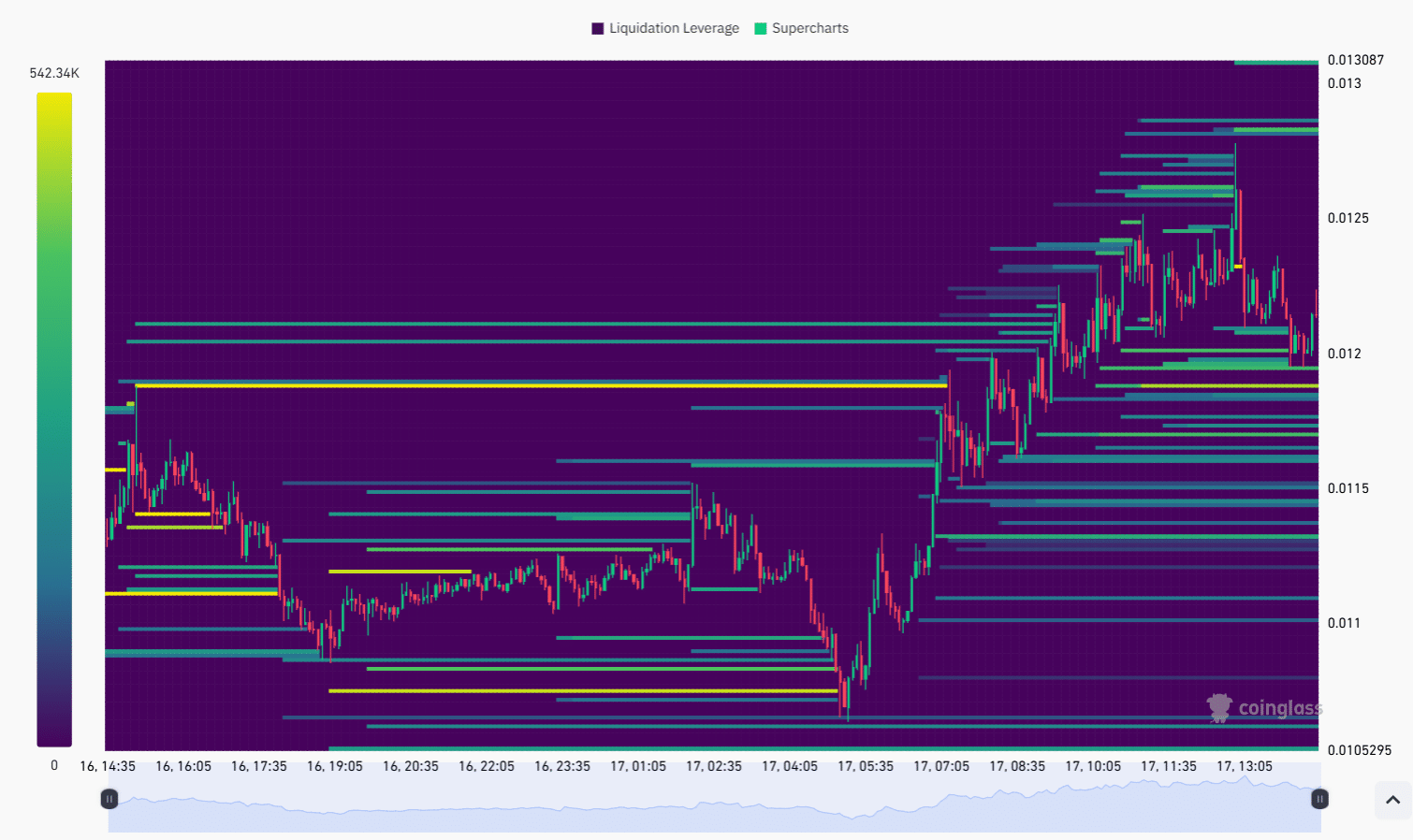

MEW liquidation levels spike near $0.0130

The chart reveals significant liquidation activity (yellow bars) between $0.0120 and $0.0130, indicating that leveraged long positions are clustered around these resistance zones.

Source: Coinglass

The concentration of liquidations suggests that traders holding bullish positions are vulnerable to a potential price reversal if the upward momentum falters.

Leverage levels (green/blue bars) also rise sharply near these zones, reflecting strong bullish sentiment but increasing the risk of cascading liquidations in the event of a pullback.

Realistic or not, here’s MEW’s market cap in BTC’s terms

The recovery from $0.0110, where earlier liquidations occurred, shows the market absorbed selling pressure and regained bullish momentum.

However, the current buildup of leveraged positions near resistance highlights the importance of breaking $0.0130 to sustain the uptrend.