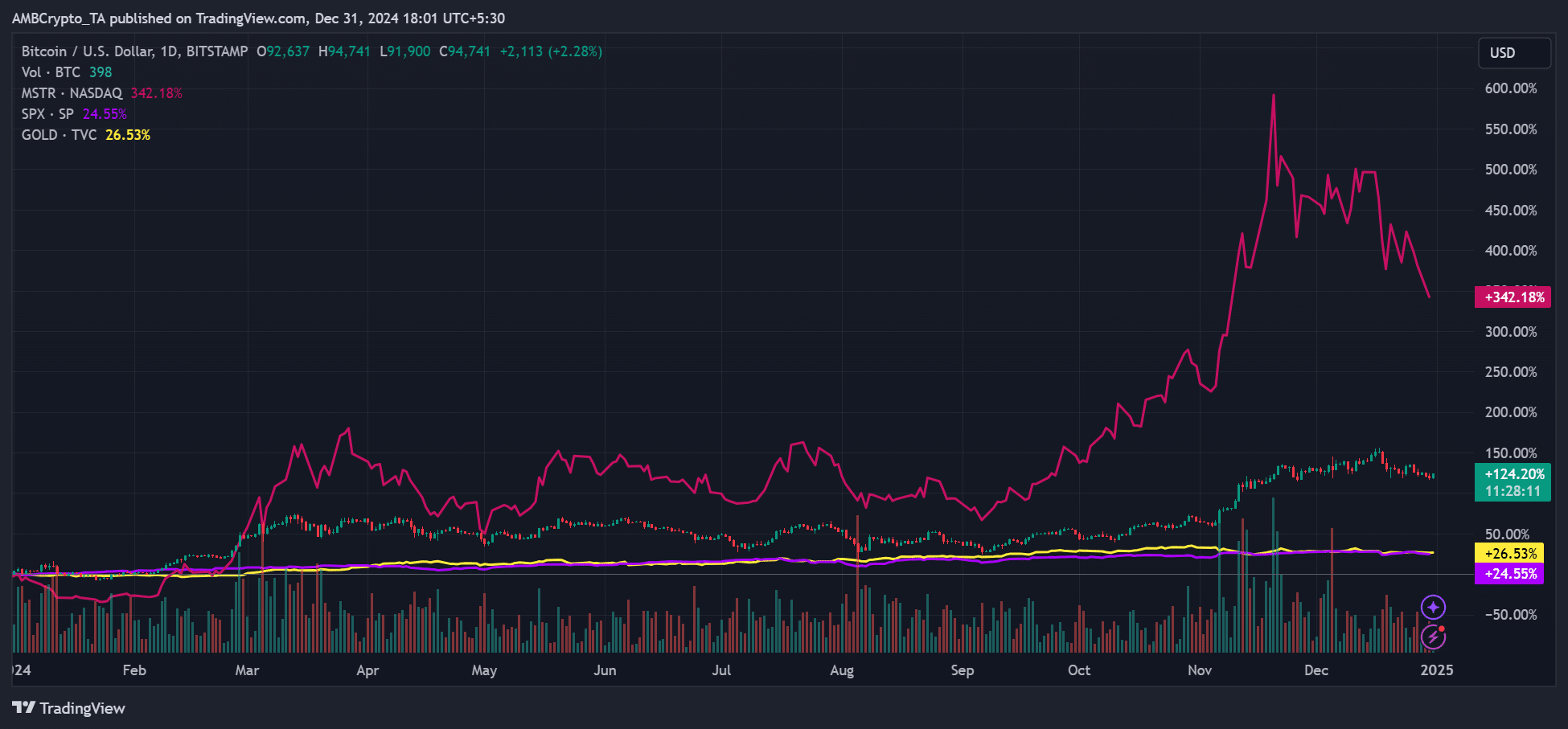

- MicroStrategy’s MSTR saw 342% yearly gains compared to BTC’s 122%.

- However, ongoing BTC weakening could drag MSTR lower in January.

MicroStrategy purchased another 2,138 Bitcoins ($209 million) at the end of the year, bringing its overall holdings to 446.4K coins, worth over $41 billion.

The pioneer in the BTC corporate treasury now holds 2.12% of the total BTC supply, and the primary beneficiary has been MSTR shareholders.

On a YTD (year-to-date) basis, MSTR logged 342% gains, while BTC logged 122% over the same period.

Source: BTC vs MSTR performance, TradingView

That meant MSTR investors outperformed their BTC counterparts by nearly 3x in 2024. Interestingly, both assets eclipsed gold and US stocks (S&P 500) which tapped 26% and 24% yearly gains, respectively.

So, what’s next for BTC and MicroStrategy in 2025?

The firm plans to expand its equity issuance program to 10 billion MSTR shares to accelerate its BTC buying spree. Most analysts believe this could pump BTC’s value.

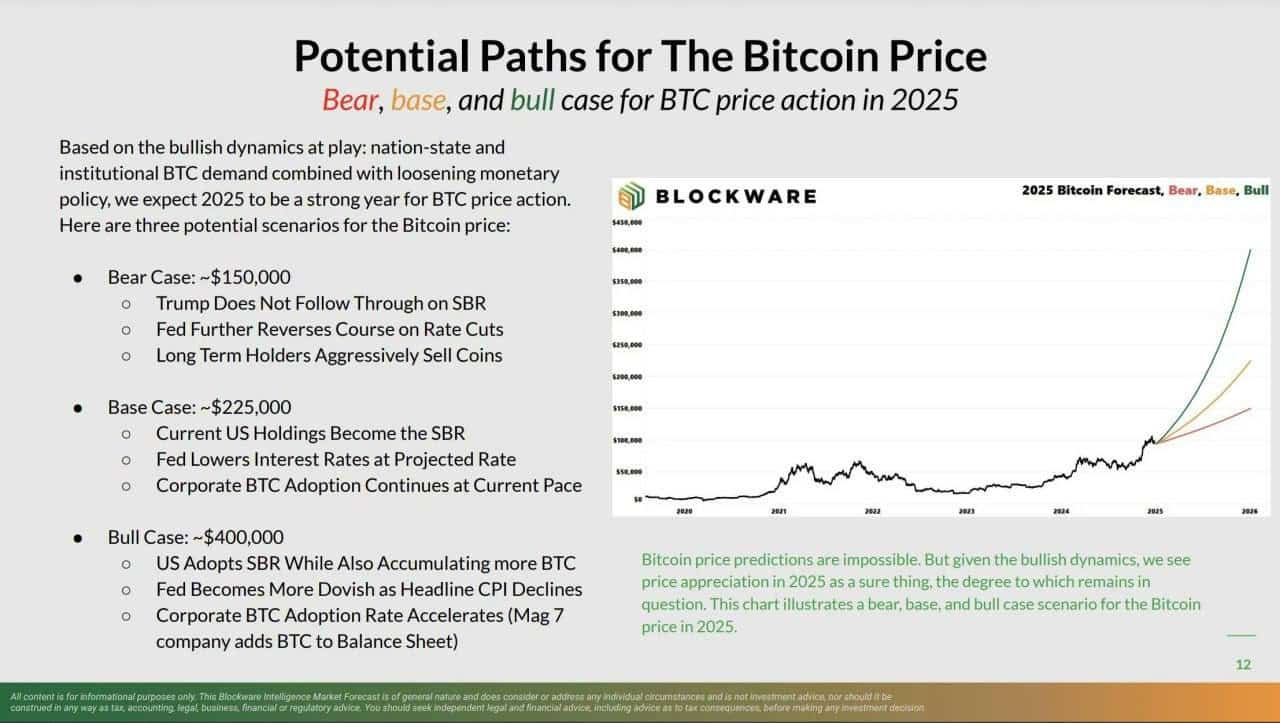

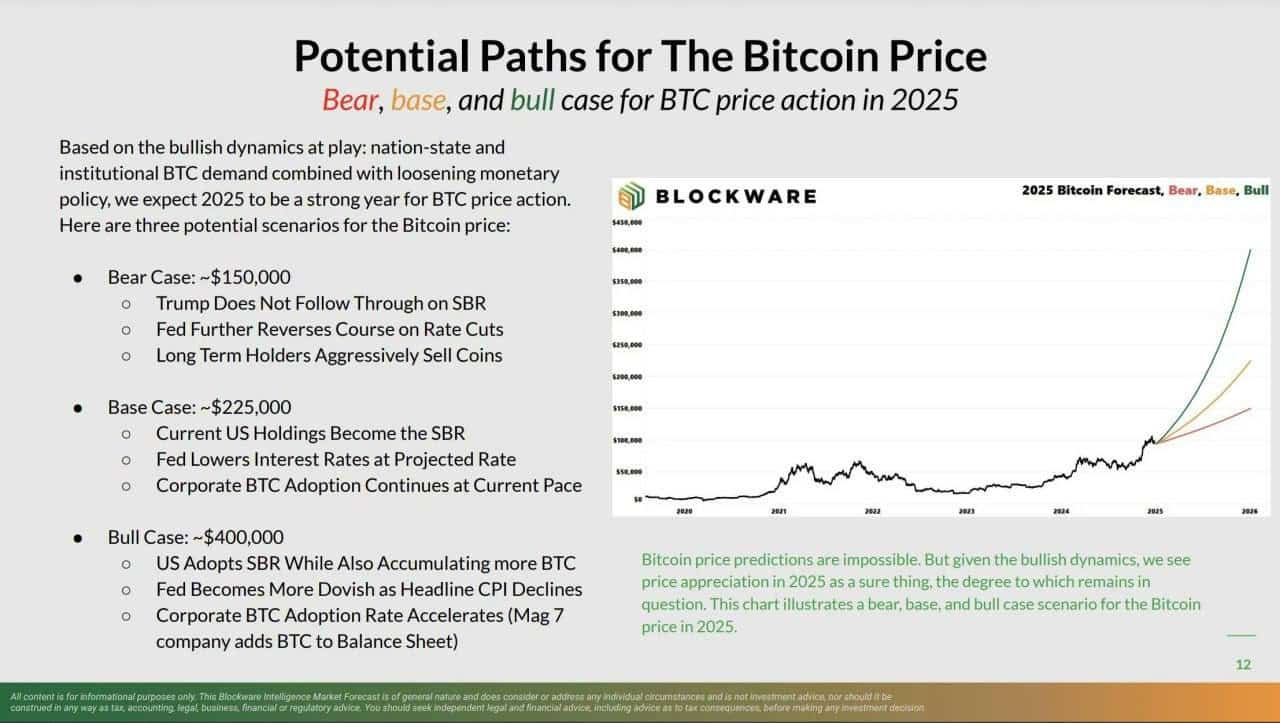

In fact, Blockware projected that BTC could hit $225K or $400K in 2025 if BTC corporate treasury adoption accelerates alongside the creation of a US BTC strategic reserve.

Source: Blockware

However, according to the Blockware team, BTC could only reach $150K in a ‘bear case’ scenario.

However, QCP Capital predicted that BTC could remain muted into January, citing seasonality trends. If so, MSTR’s short-term gains could be capped until the market recovers.

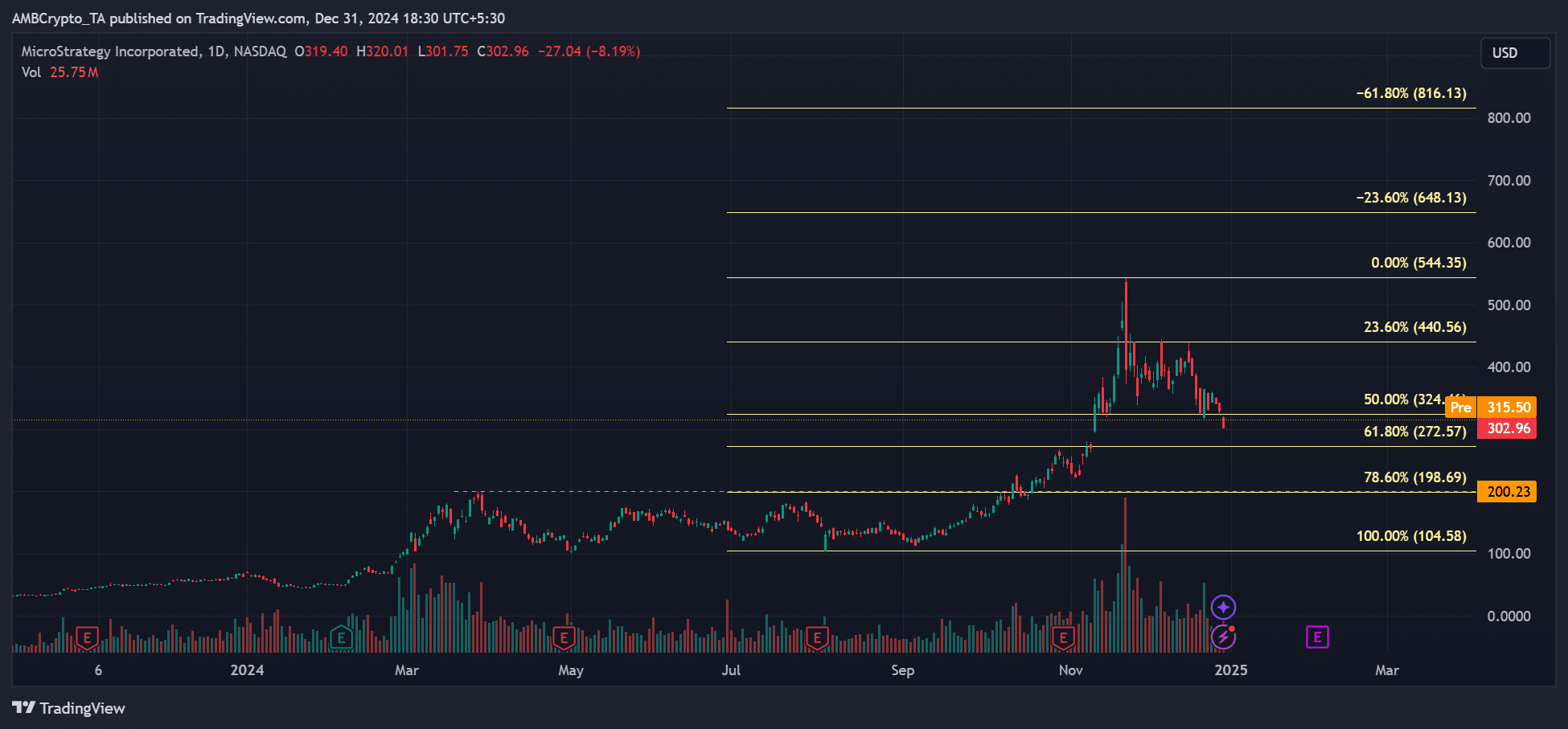

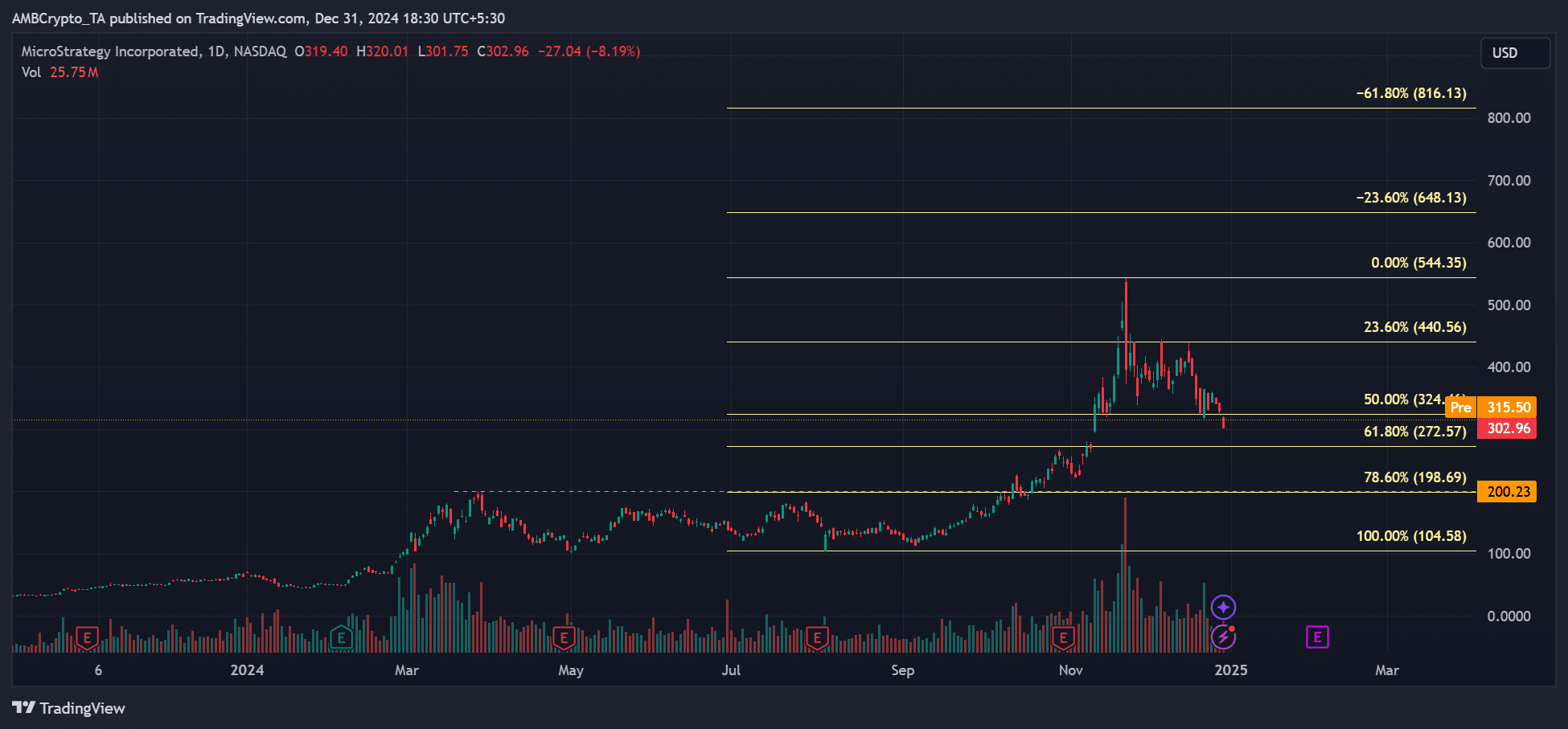

In the meantime, MSTR was down 45% from its recent peak of $543 and was defending $300 at press time. This followed BTC’s sharp decline from $108K to $92K.

Any further weakening could offer discounted buying opportunities for MSTR, especially if the market recovers in January.

Source: MSTR, TradingView