- NEAR traded at $5.79 at press time, gaining 12% in seven days with $712M daily trading volume and $7B market cap.

- Futures Open Interest dropped 5% while TVL hit $260M, signaling steady ecosystem activity despite volatility.

NEAR Protocol [NEAR] has gained 12.33% in the past seven days, trading at $5.79 with a 24-hour volume of $712.5 million.

Despite a 0.97% decline over the past 24 hours, the price range has remained between $5.54 and $5.99, showcasing consolidation after recent bullish momentum.

NEAR Protocol’s circulating supply of 1.2 billion tokens values its market cap at $7.05 billion, placing it among top-performing assets.

The asset’s recent rally follows a historical pattern of cyclical price action, with the price previously reaching highs near $7.50–$8.00 and finding support near $3.00–$3.50.

Analyst Michaël van de Poppe noted that a breakout above key resistance could lead to further gains, with traders identifying potential accumulation zones around $4.25–$5.00 for the next bullish leg.

Source: X

Consolidation and potential upside?

The daily chart for NEAR/USDT showed mild bearish pressure as the price pulled back from resistance near $6.00 to its press time level.

Meanwhile, the Relative Strength Index (RSI) was at 61.45, indicating that the asset remained in bullish territory but showed signs of weakening momentum.

Source: TradingView

The MACD indicator reflected a bullish crossover, with the MACD line above the signal line and positive histogram bars. However, shrinking histogram size suggested reduced momentum, aligning with the recent pullback.

Analysts suggested that maintaining the $5.50 support zone was critical for buyers to sustain upward momentum, while breaking below this level may trigger further consolidation.

Futures market activity shows slight decline

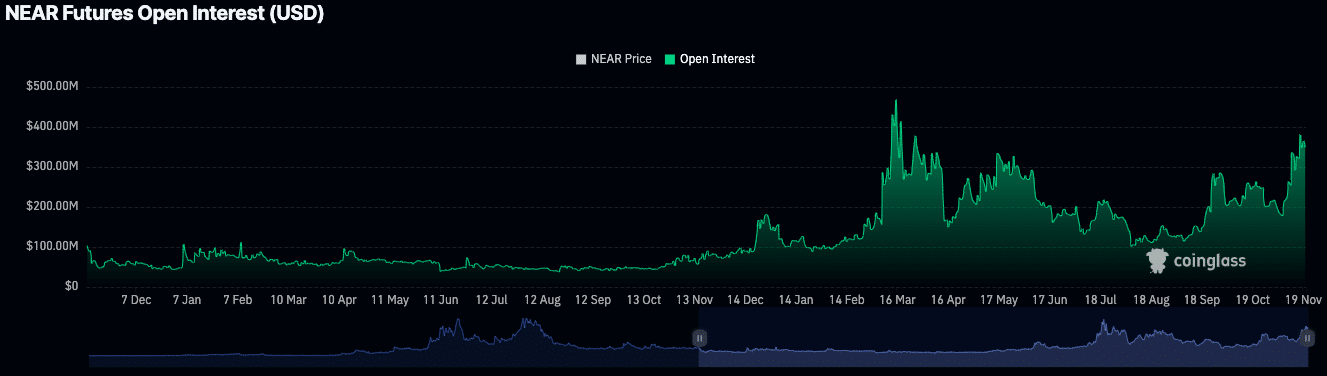

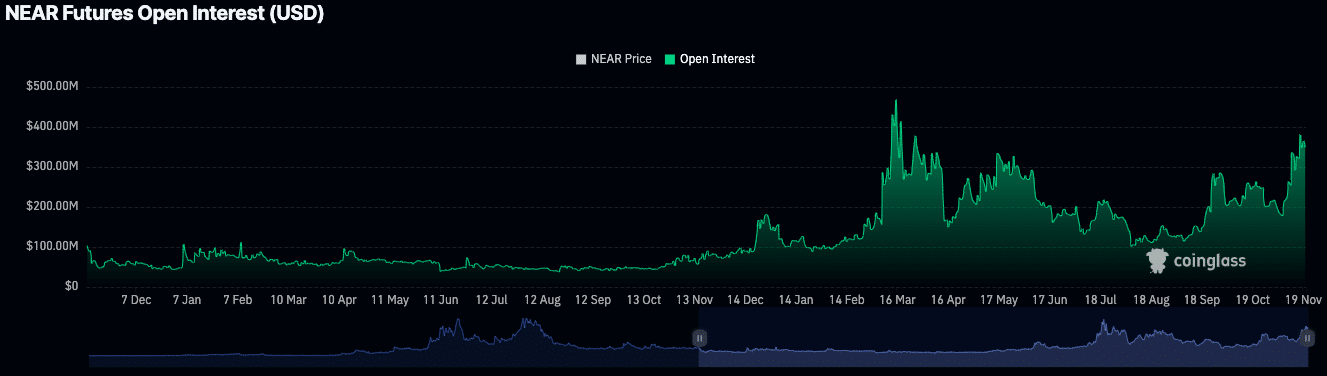

NEAR Protocol’s Futures market showed a 5.03% decline in Open Interest, at $345.50 million at press time, according to Coinglass.

This slight decrease followed heightened market activity earlier in the month, indicating a potential slowdown in speculative interest.

Source: Coinglass

Trading volume also decreased by 19.30%, settling at $597.67 million, but Open Interest remained higher compared to previous months.

This suggested that traders remained engaged with the asset, even as short-term profit-taking reduced activity.

Steady ecosystem growth

On-chain data from DeFiLlama showed NEAR’s Total Value Locked (TVL) at $260.05 million, with stablecoin market capitalization reaching $677.77 million.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

Over the past 24 hours, the platform generated $23,430 in fees and revenue, highlighting continued activity within the ecosystem.

These metrics demonstrate a steady development of NEAR Protocol’s decentralized finance infrastructure.