- PEPE has recently broken its long moving-average.

- It is one of the highest gainers for the week.

PEPE has recently taken center stage in the memecoin market, achieving one of the most significant gains among its counterparts over the past week.

Data from CoinMarketCap showed that PEPE was one of the top gainers of the week. It has seen over 25% increase in the last seven days, making it the 14th biggest gainer.

This uptrend made it the second-biggest gainer among memecoins.

As traders turn their attention to its impressive rally, a closer look at price levels, daily active addresses, and other indicators can provide insight into what lies ahead.

Charting PEPE’s bullish case

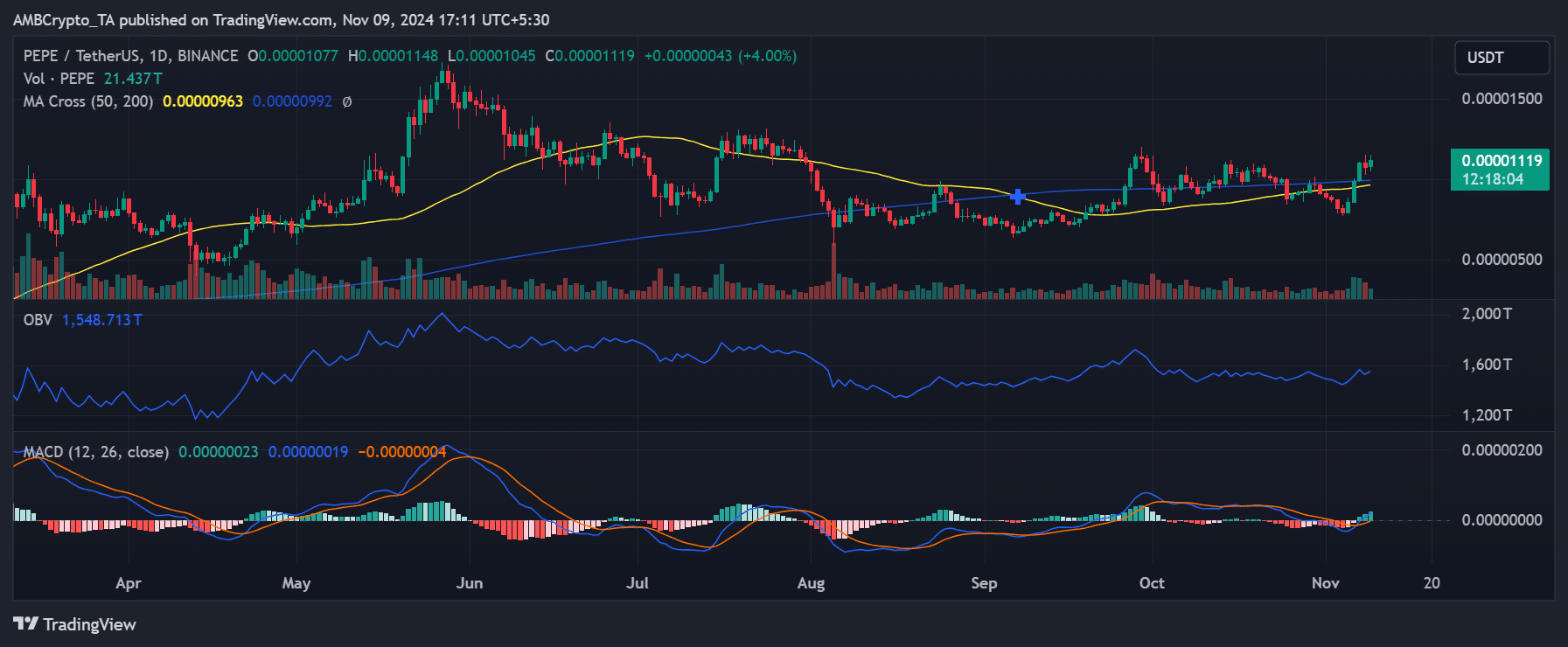

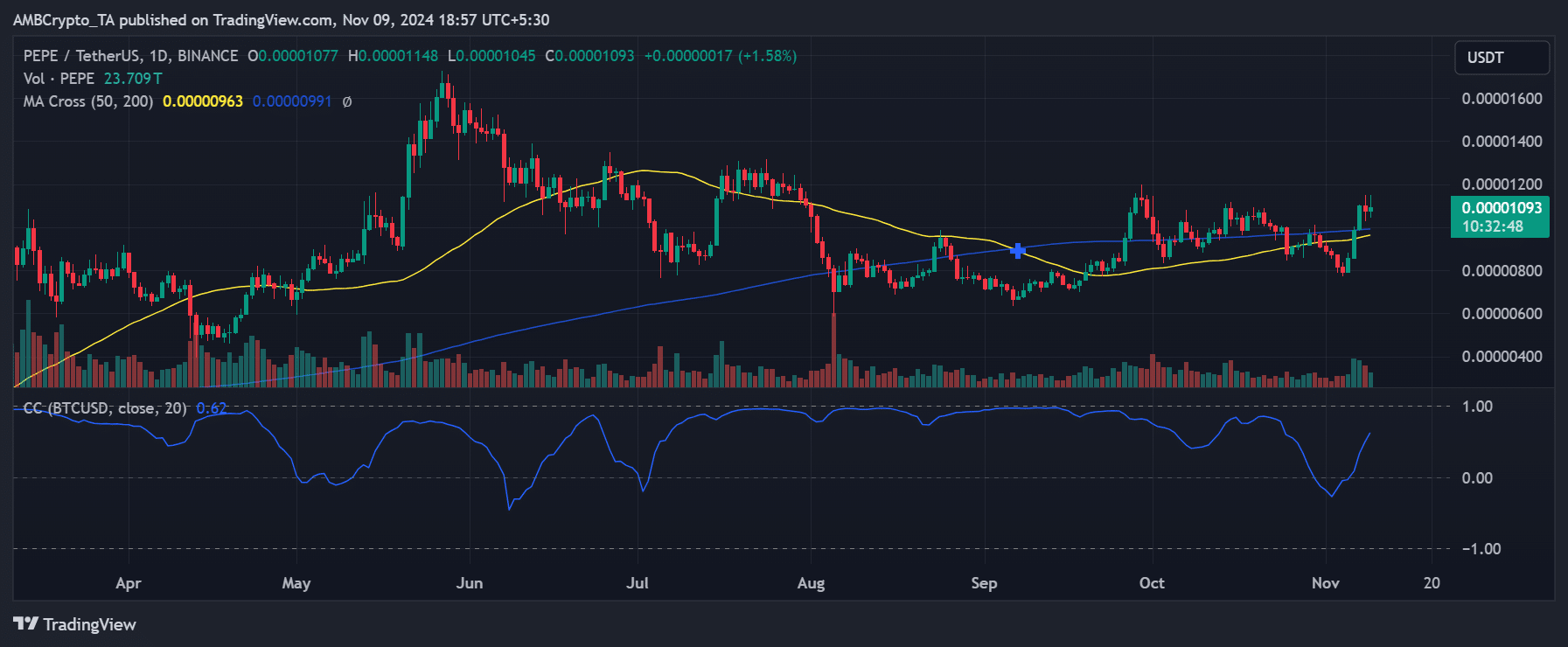

PEPE’s price has shown remarkable strength recently, climbing from $0.00000090 to its press time level of around $0.00000112.

This was a key support level around the $0.00000100 mark, where the price found footing before this rally.

With PEPE trading above both the 50-day and 200-day moving averages at approximately $0.00000096 and $0.00000099, respectively, these levels were crucial indicators of bullish momentum.

Source: TradingView

The MACD (Moving Average Convergence Divergence) showed a positive crossover, signaling continued upward momentum, while the On-Balance Volume (OBV) line has trended upward, reflecting strong buying interest.

Should it maintain support above $0.00000100 and keep the MACD in bullish territory, it may continue to attract buyers aiming for the next resistance level around $0.00000115.

Bearish signs emerge as well

While PEPE’s recent surge was promising, caution may be warranted as the price approaches potential resistance.

Notably the RSI (Relative Strength Index) was nearing overbought territory, suggesting a correction could be on the horizon.

Historically, when its RSI reaches these levels, a pullback to support around $0.00000100 often follows as traders take profits.

A key resistance level for PEPE lies at $0.00000115, where the price previously faced selling pressure.

If PEPE struggles to break above this resistance, it could signal a short-term top, potentially prompting consolidation or a retest of lower support levels.

For traders, the $0.00000100 support level is worth watching, as a breakdown below this level might indicate a trend reversal.

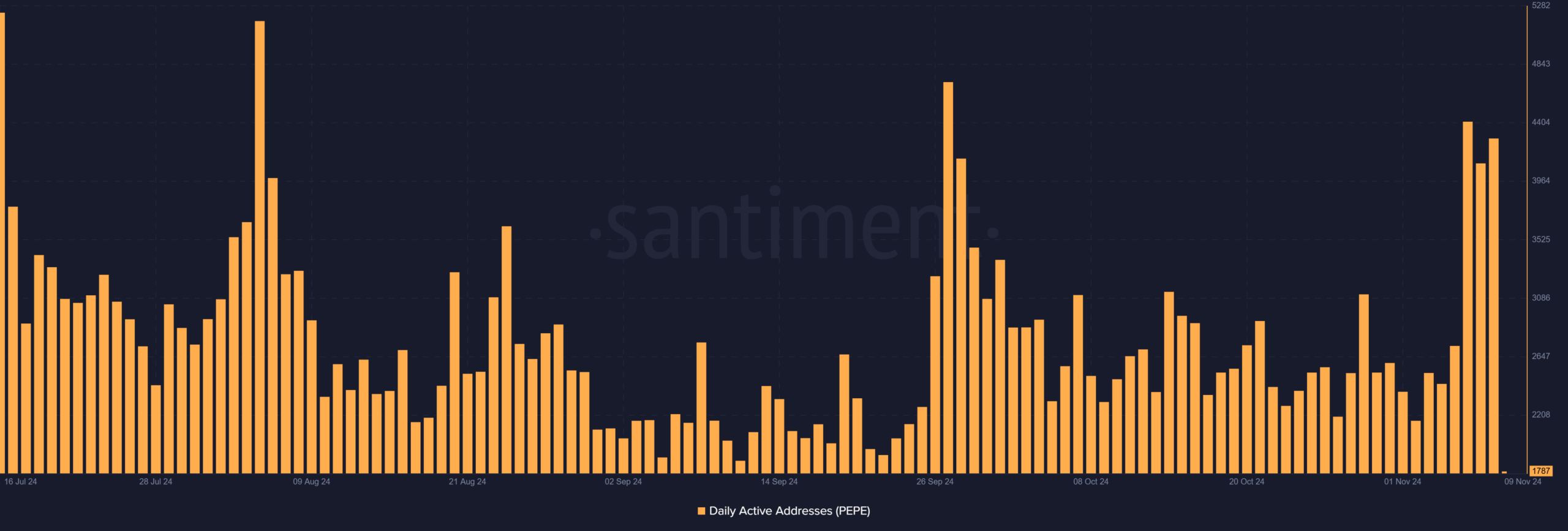

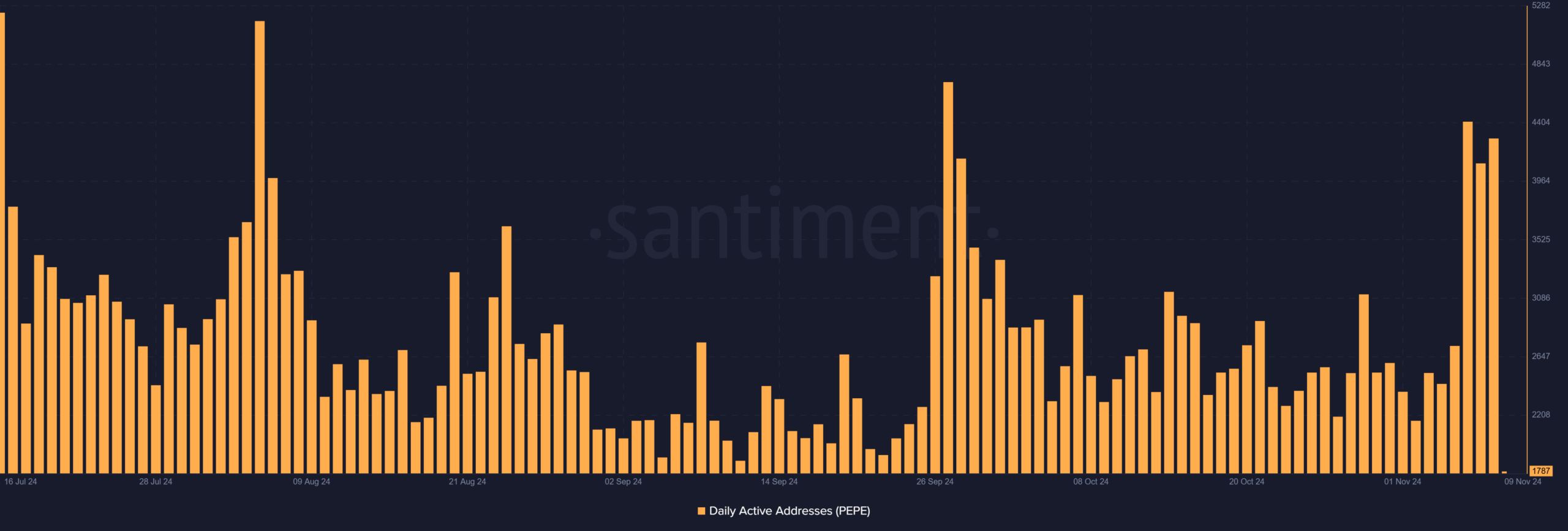

Daily active addresses

PEPE’s daily active addresses have shown a notable increase, with a surge in activity coinciding with the recent price rise.

Daily active addresses climbed from around 3,500 to nearly 5,000 in the last few days, suggesting renewed interest in the token.

Historically, spikes in daily active addresses for PEPE have supported price rallies, indicating genuine interest rather than speculative hype.

Source: Santiment

If PEPE can sustain this high activity level, it may continue to build momentum toward breaking resistance at $0.00000115.

However, should daily active addresses dip significantly, it could signal waning interest, potentially leading to a pullback toward the $0.00000100 support level or even lower.

A sustained increase in addresses could reinforce the case for continued gains, but a decrease might indicate a return to prior price levels.

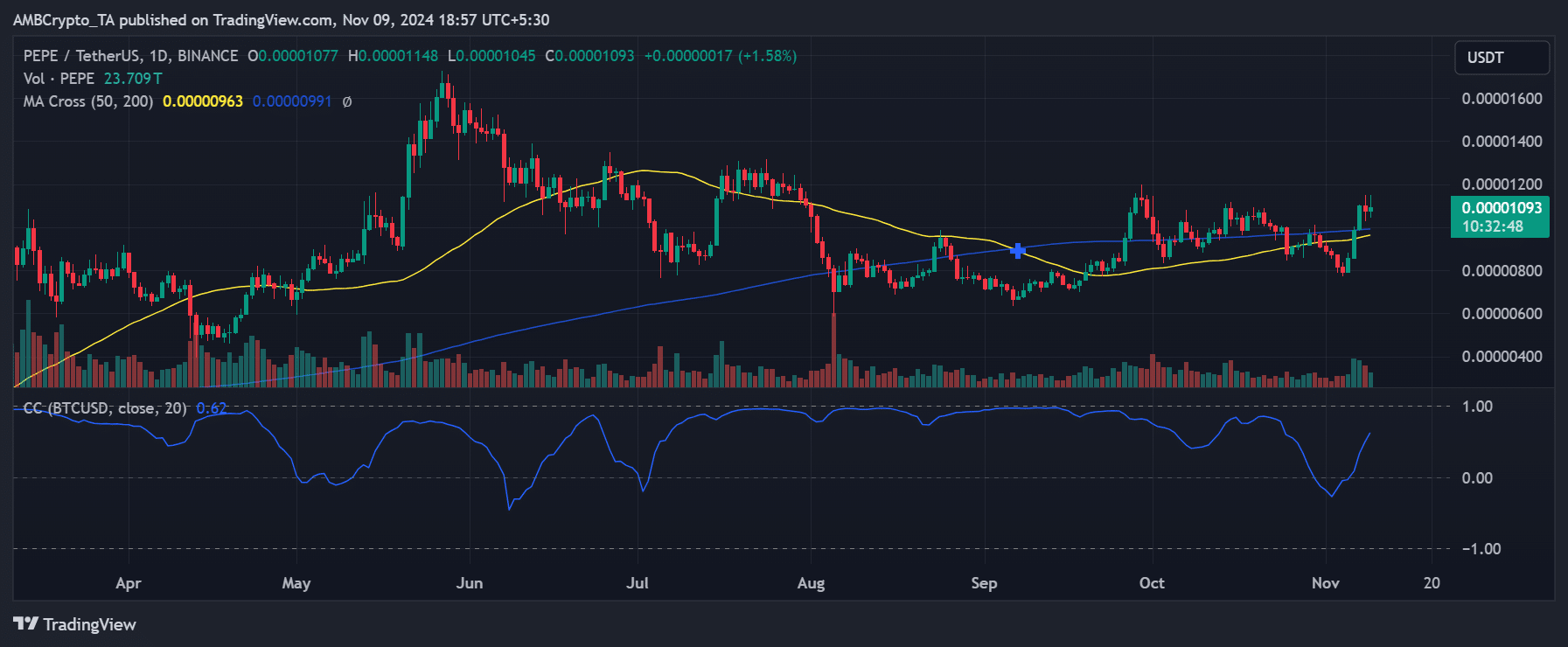

PEPE’s correlation with Bitcoin

The Correlation Coefficient indicator here measures the strength of the relationship between PEPE and Bitcoin (BTC), shown by values between -1 and +1.

A value close to +1 suggests that PEPE’s price tends to move in the same direction as Bitcoin, while a value near -1 indicates an inverse relationship.

Source: TradingView

Realistic or not, here’s PEPE market cap in BTC’s terms

Currently, the coefficient reads -0.62, meaning PEPE is moderately inversely correlated to BTC. This implies that when Bitcoin rises, PEPE tends to decline, and vice versa.

However, the inverse correlation was not strong, indicating that while there was some opposing movement, PEPE may still exhibit independent price behavior.