- Three PEPE whales have been spotted buying a total of 689.79 billion PEPE worth $4.3 million from TornadoCash.

- PEPE is showing signs of a potential rebound, with the TD Sequential indicator flashing a buy signal on the daily chart.

There was enormous movement in the Pepe [PEPE] market as three whale wallets—0x7A7D, 0x9212, and 0x7779—bought an aggregate 689.79 billion PEPE tokens for $4.3 million, funded through TornadoCash, a protocol for privacy.

Wallet 0x7A7D bought a top $2.72 million (1,413.4 WETH) for 437.7 billion PEPE, followed by 0x9212, who bought $1 million for 158.58 billion PEPE, and then 0x7779 bought 93.51 billion PEPE for $574,000.

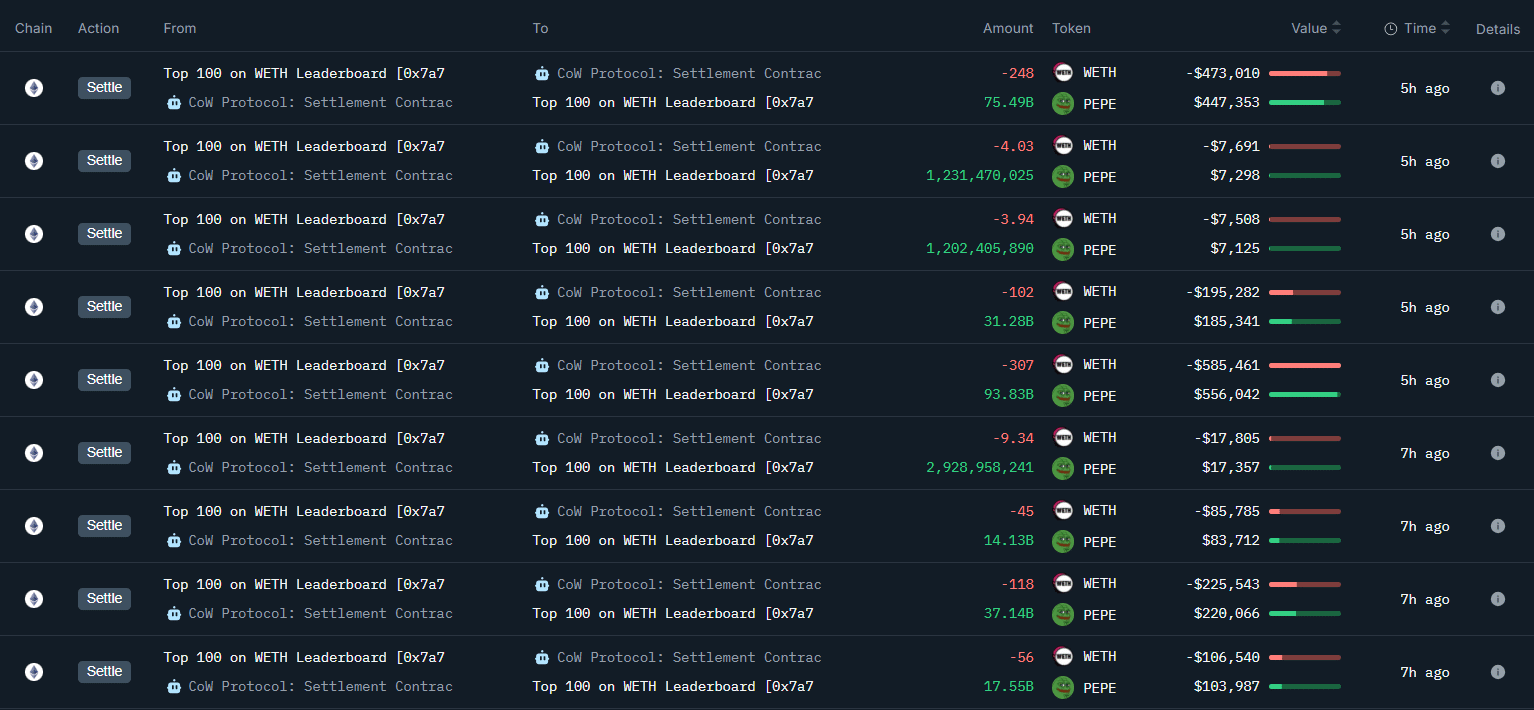

The number of “Settle” transactions of the Cow Protocol Settlement Contract worth between 4.6 and 143.13 WETH, which caused PEPE’s value swing from losing $106,540 to making $556,042.

Source: OnChain Lens

The monumental buys indicated the whales’ enormous confidence in PEPE’s potential to rebound. Such buying pressure tends to drive prices upwards by reducing supply in sight and firming up sentiment.

As the price is also rebounding, this pair has the potential to build positive momentum, which would bring in more investors and keep its price going higher even higher in the short term.

PEPE’s price action and number of large transactions

Looking at the TD Sequential indicator, it triggered a buy on the daily chart, which is a potential reversal sign. The daily’s close at $0.00000597 was +4.74% higher and is a bullish pressure sign.

The $0.00000525 low is a sign of price exhaustion, and both of these together add weight to the reversal thesis.

If the bulls enter, the memecoin can jump to $0.00000620, with a breakout pending at $0.00000640–$0.00000660.

Source: X

Rejection here, however, can lead to consolidation between $0.00000540 and $0.00000580. A breakdown of $0.00000525 will negate the buy signal, with further selling to $0.00000495.

Volume and momentum indicators could signal traders the power of this setup.

However, large PEPE trades have been trending relatively flat since February 2025, trading in the 400–600 trade range before recently falling to 278 trades on the 11th of March.

The recent 7-day high of 304 trades is low activity, and the recent 7-day low of 122 trades was a slowdown. As transactions by volume rise, more whale activity can drive PEPE above $0.00000060.

Source: IntoTheBlock

Inactivity or falling below 200 transactions can limit price action to hold PEPE at $0.00000068 or lower. A sudden drop in transactions can drive prices to $0.00000060, a bearish demand signal.

Reversal is still susceptible to new interest from the large holders.