- Bitcoin’s 129% YTD gain was driven by halving and macroeconomic factors.

- Analysts predicted further gains, but challenges like altcoin dominance and market corrections remained.

Bitcoin [BTC] has had an exceptional 2024, achieving a remarkable 129% year-to-date gain, driven by a series of pivotal events, including the April halving and the outcome of the U.S. Presidential election.

With the cryptocurrency now approaching the $100,000 mark, all eyes are on Bitcoin’s next move. Analysts are optimistic, with many predicting further gains as market conditions continue to evolve.

As Bitcoin rides this wave of momentum, the question remains: will it break through the $100K threshold and push even higher?

Bitcoin’s post-halving surge

Bitcoin’s 2024 halving in April significantly reduced miner rewards, cutting new BTC issuance to 3.125 BTC per block.

Historically, halvings trigger supply shocks that bolster price momentum over the following months. True to form, Bitcoin surged by over 85% since April, crossing $95,000 in December.

This rally has been fueled by a mix of macro and sector-specific factors. Bitcoin’s status as “digital gold” gained further appeal amid inflation concerns and geopolitical instability, drawing institutional investors.

Additionally, renewed retail interest and the U.S. Presidential election, which brought crypto-friendly policies into focus, bolstered optimism.

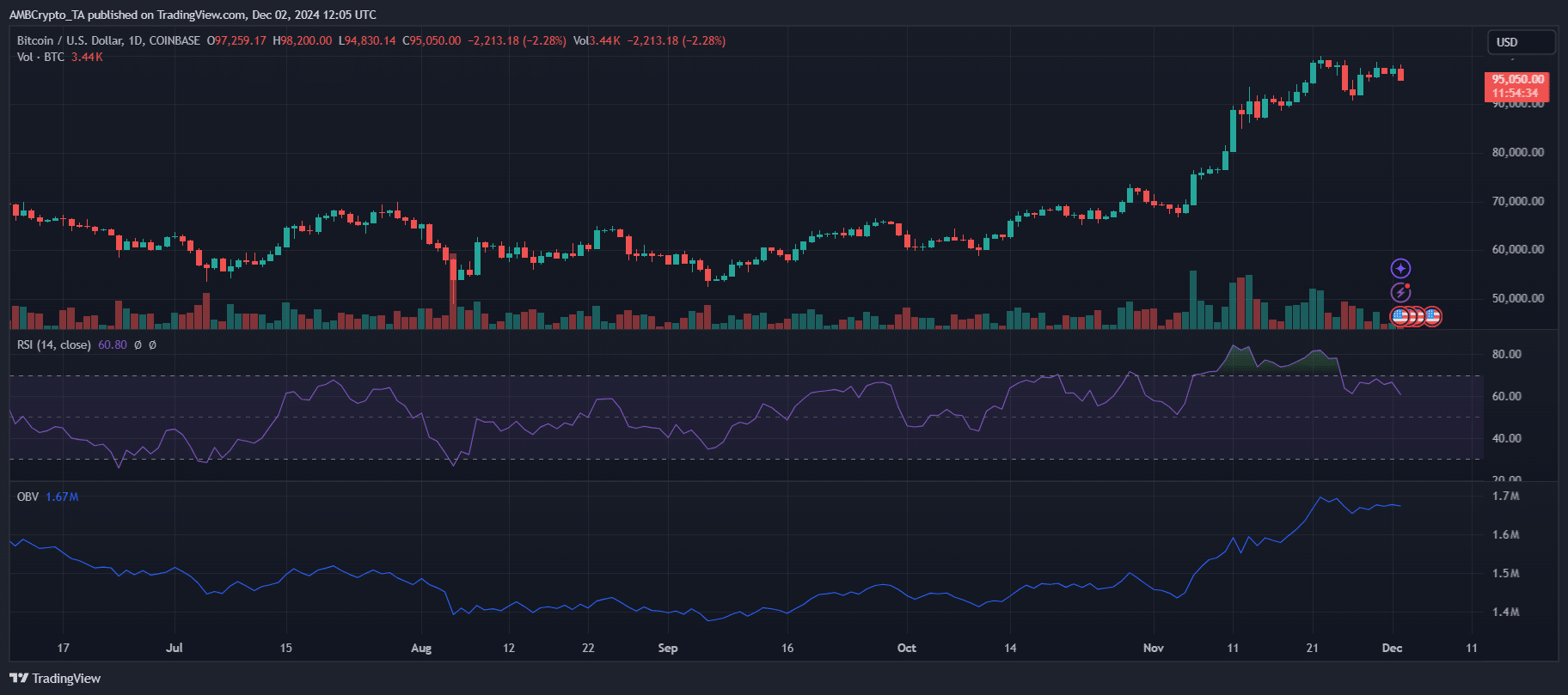

Source: TradingView

The chart shows a steady uptrend supported by strong on-chain metrics, such as rising active addresses and growing open interest in BTC futures.

However, the RSI near 61 suggests the asset is nearing overbought territory, signaling potential short-term consolidation.

The $100K threshold and shifting market dynamics

Bitcoin’s march toward $100,000 remains a defining narrative for the market. On the 22nd of November, BTC briefly touched $99,000 before retreating to the $96,000-$98,000 range.

Meanwhile, Bitcoin Futures on the Chicago Mercantile Exchange (CME) crossed $100,200 twice within a week by the 29th of November, fueling speculation that spot prices could soon follow.

While breaking $100K is largely psychological, it represents a critical milestone for market sentiment as well.

Despite Bitcoin’s gains, dominance fell to 56.1% on the 30th of November, as investors rotated into altcoins, suggesting the onset of a potential altcoin season.

This drop in dominance indicates profit-taking among Bitcoin holders and renewed interest in higher-risk assets, signaling a diversification of market focus.

Bitcoin’s immediate trajectory depends on whether the psychological $100K barrier becomes a reality, alongside its ability to maintain dominance amid rising altcoin activity.

What lies ahead for Bitcoin?

Bitcoin’s trajectory pointed to further growth, with analysts like Raoul Pal forecasting a local top of $110,000 by early 2025 and a potential peak in late 2025.

Macro factors like the April halving and institutional adoption continue to bolster long-term bullish sentiment. However, risks such as regulatory changes and broader market corrections could temper gains.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As altcoins gain momentum, Bitcoin’s dominance may face additional pressure, signaling a diversifying market.

Whether Bitcoin breaches the $100K psychological barrier and sustains its upward momentum will depend on renewed buying pressure and broader crypto market trends.