- Judge Jackson dismissed SEC’s claims that secondary sale of Binance coins qualified as securities.

- However, she allowed the SEC to pursue claims associated with Binance’s BNB staking program.

In a decision issued late Friday, a Federal judge has allowed the majority of a lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against Binance [BNB], the world’s largest cryptocurrency exchange, to proceed.

Judge’s orders

Judge Amy Berman Jackson of the District Court for the District of Columbia issued a ruling that allows most of the SEC’s charges against Binance to proceed.

These charges include violations related to the initial coin offering and ongoing sales of BNB, their BNB Vault and staking services, as well as a failure to register and potential fraudulent activity.

This decision is a blow to Binance, as it suggests the court believes the SEC has a strong case regarding these specific offerings and actions.

However, the judge did grant Binance and its founder, Changpeng Zhao, dismissal of charges tied to secondary sales of BNB and their Simple Earn program.

This lawsuit originated last summer when the SEC accused Binance, Binance US, and Zhao of offering unregistered securities and financial services within the U.S.

This case is part of a larger trend, as the SEC has brought similar charges against other major cryptocurrency companies like Coinbase, Kraken, and most recently, Consensys and MetaMask.

These actions highlight the growing regulatory scrutiny surrounding the cryptocurrency industry.

Comparisons in the past

The Judge referenced previous court rulings that carefully distinguish between investment contracts which are considered securities and the underlying tokens themselves.

This distinction aligns with the Supreme Court’s definition of a security.

It’s important to note that this SEC case is separate from the criminal charges brought against Binance founder Changpeng Zhao by the Department of Justice and Treasury Department, for which he is currently serving a 4-month sentence.

Additionally, the judge, like others, rejected arguments that the SEC lacks authority due to the “major questions doctrine.”

This doctrine requires clear Congressional authorization for agencies to regulate significant industries, but crypto’s relative novelty presented a legal gray area.

Is your portfolio green? Check out the BNB Profit Calculator

By rejecting this argument, Judge Jackson strengthens the SEC’s ability to pursue enforcement actions in the cryptocurrency space.

How is BNB doing?

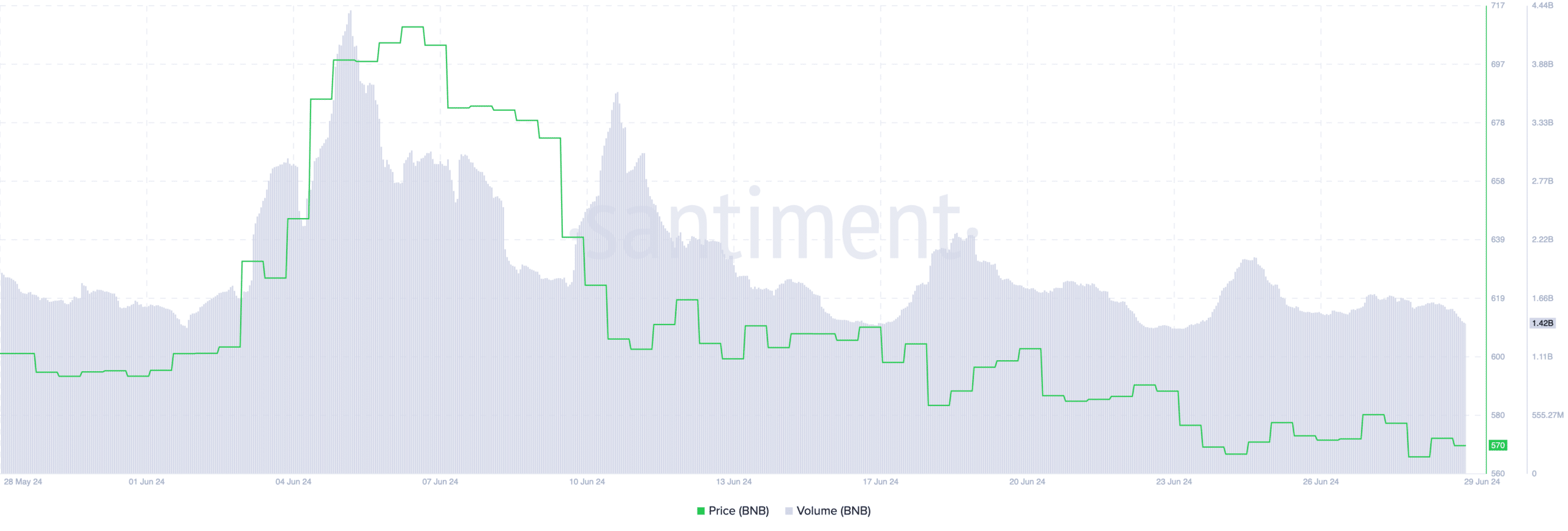

At press time, BNB was trading at $574.38 and its price had grown by 0.53% in the last 24 hours. The volume at which it was trading at had decreased by 10.47%.

Source: Santiment