- SHIB has surged by 4% in the last 24 hours.

- Metrics indicate a potential price reversal.

Shiba Inu’s [SHIB] price was at a crossroads. Investors are wondering whether a price reversal is approaching, or if the popular memecoin will continue its bearish rally. SHIB has surged by 4% in the last 24 hours. This suggests that bullish momentum is slowly building.

However, the broader picture suggests a more concerning trend. SHIB has dipped by over 38% since 30th May. This contrast between short-term and medium-term SHIB performance has left investors questioning SHIB’s next move.

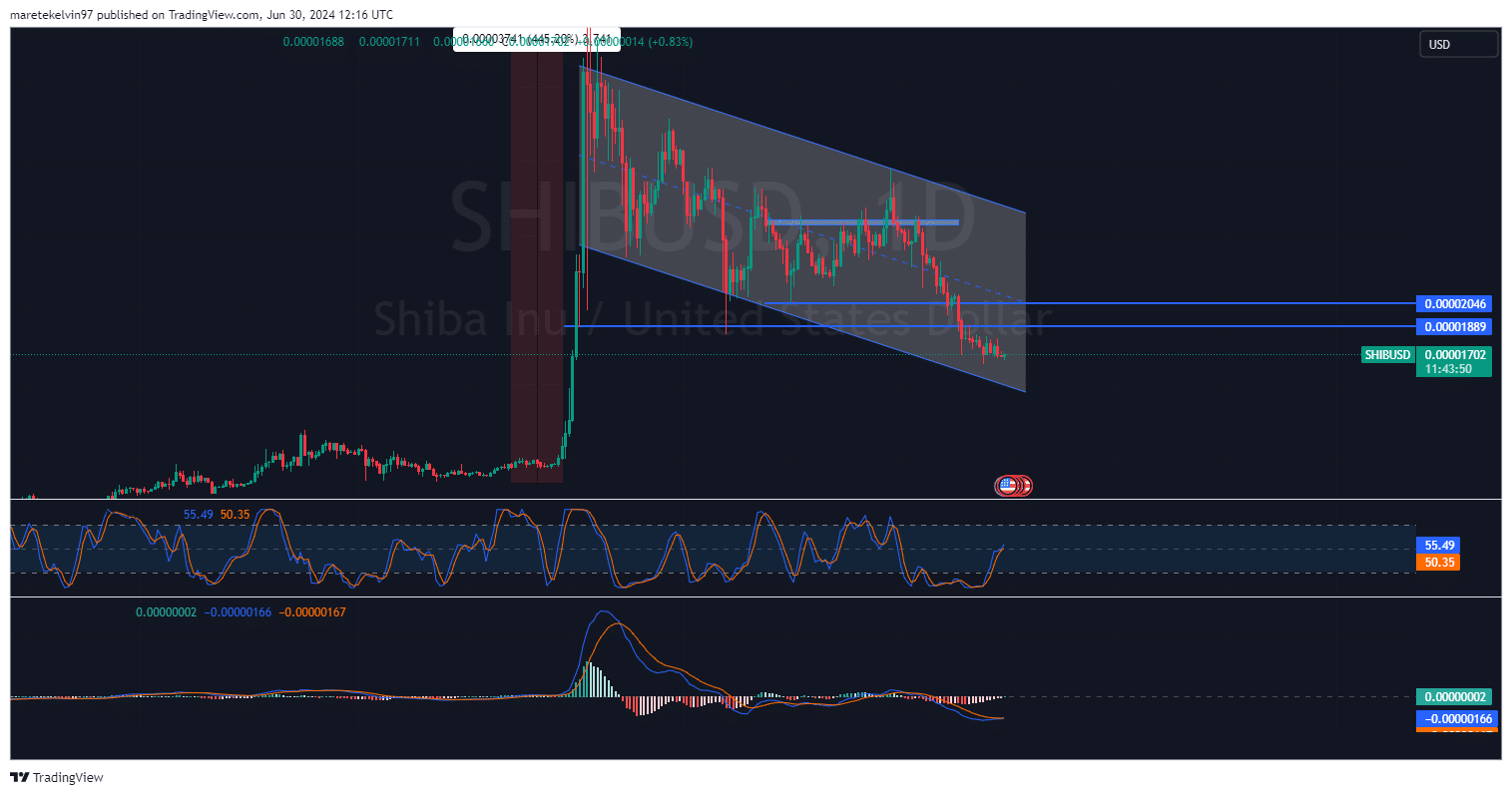

As of writing, SHIB was priced at $0.00001741, up 0.5% in the last seven days. Its trading volume dipped by 38.34% to $135.50 million at press time.

This indicates a market with no or less activity, or put it simply, the market is in a “wait and see” situation.

Source: TradingView

The Relative Strength Index (RSI) hovers near oversold territory, suggesting a potential bounce may be on the horizon. The MACD indicator indicates fading bearish momentum, which also signals a potential reversal.

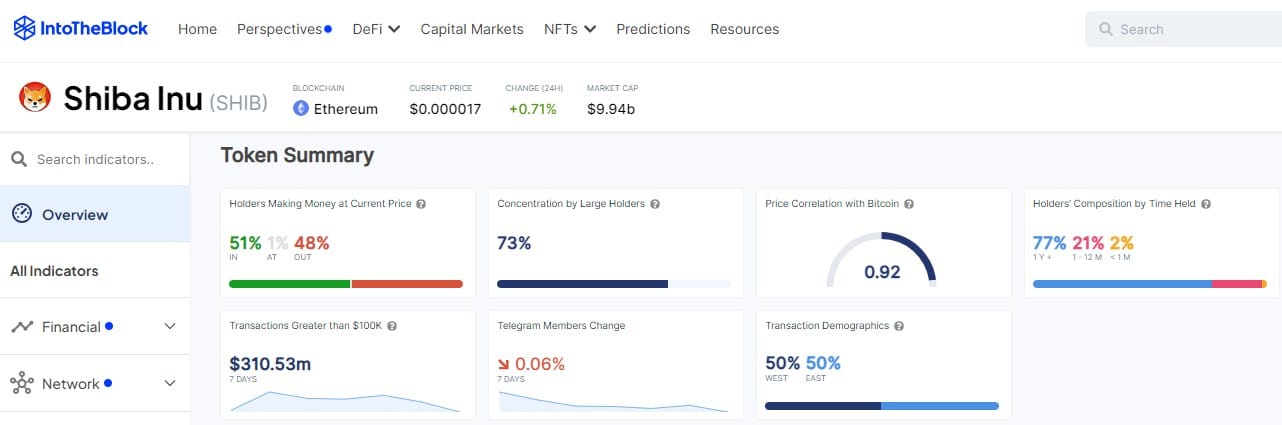

Holder composition signals potential support

The IntoTheBlock data indicates that the majority of Shiba Inu holders maintained their positions over the past 12 months. This suggests a strong foundation against further price drops.

With 77% of addresses being long-term holders, this “diamond hands” chance could help establish a vital support level.

Source: IntoTheBlock

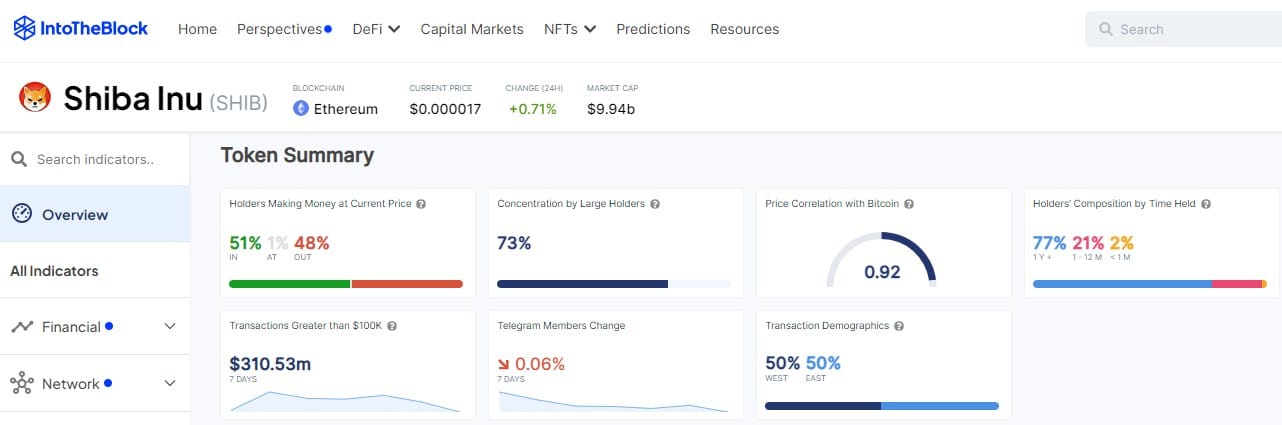

Long-term trend considerations

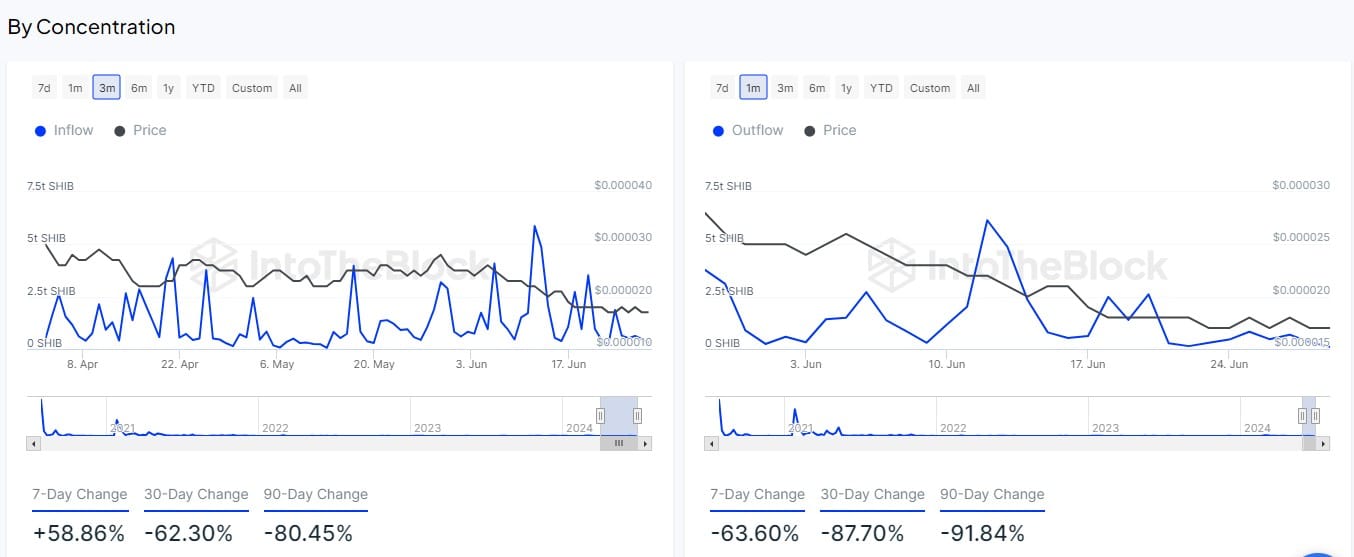

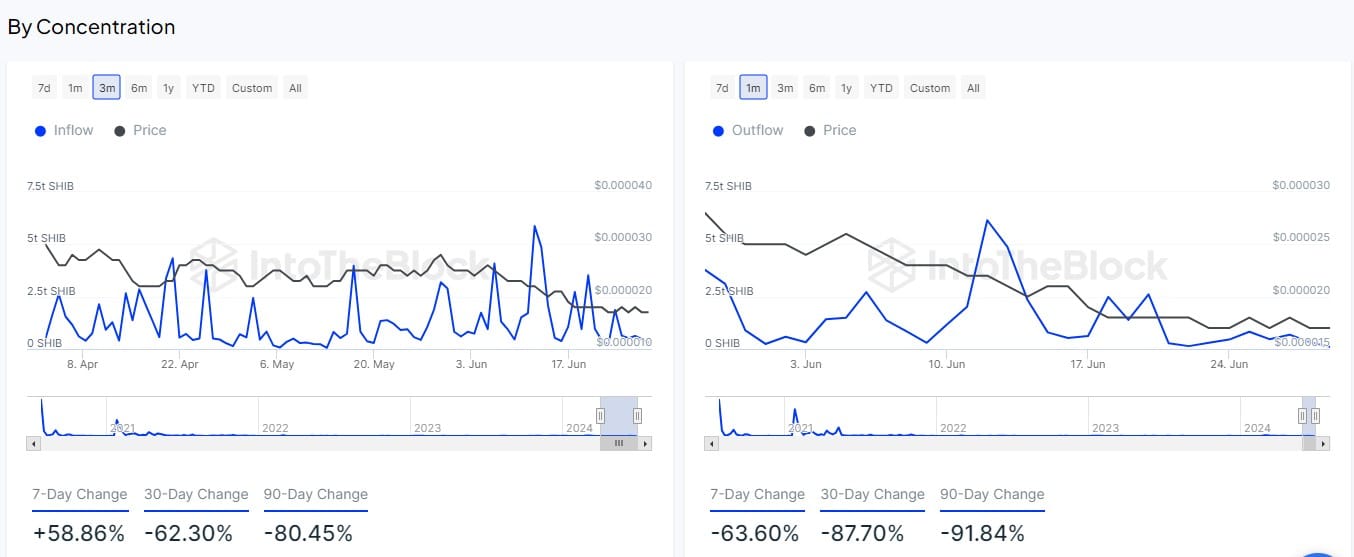

According to IntoTheBlock data, the 90-day change shows an 80.45% decrease in inflows and a 91.84% reduction in outflows.

These metrics indicate a significant overall reduction in SHIB trading activity over the past three months, which could be attributed to broader market conditions or waning interest in the token.

Source: IntoTheBlock

AMBCrypto further analyzed Coinglass data to evaluate the market direction. The long position investors were in control despite the market lacking a notable direction.

Source: Coinglass

The combination of increased short-term inflows and decreased outflows creates a potentially bullish scenario for SHIB in the immediate future.

This liquidity and price action indicator suggests that buying pressure is currently outpacing selling pressure. This could lead to upward price movements if the trend is maintained.