- Market analyst notes that the decision by “whales,” to purchase 28,717 SOL was driven by the bullish accumulation phase.

- Exchange netflow data for SOL also signaled a bullish run, suggesting increased investor confidence.

Solana [SOL] has upheld its bullish trajectory on both daily and weekly charts, recording price increases of 2.10% and 11.97%, respectively.

This strong price trend, coupled with proactive staking by whales, and technical formations, suggests that Solana is ready for a notable price rally in the upcoming trading days.

Whale staking of SOL could spur market rally

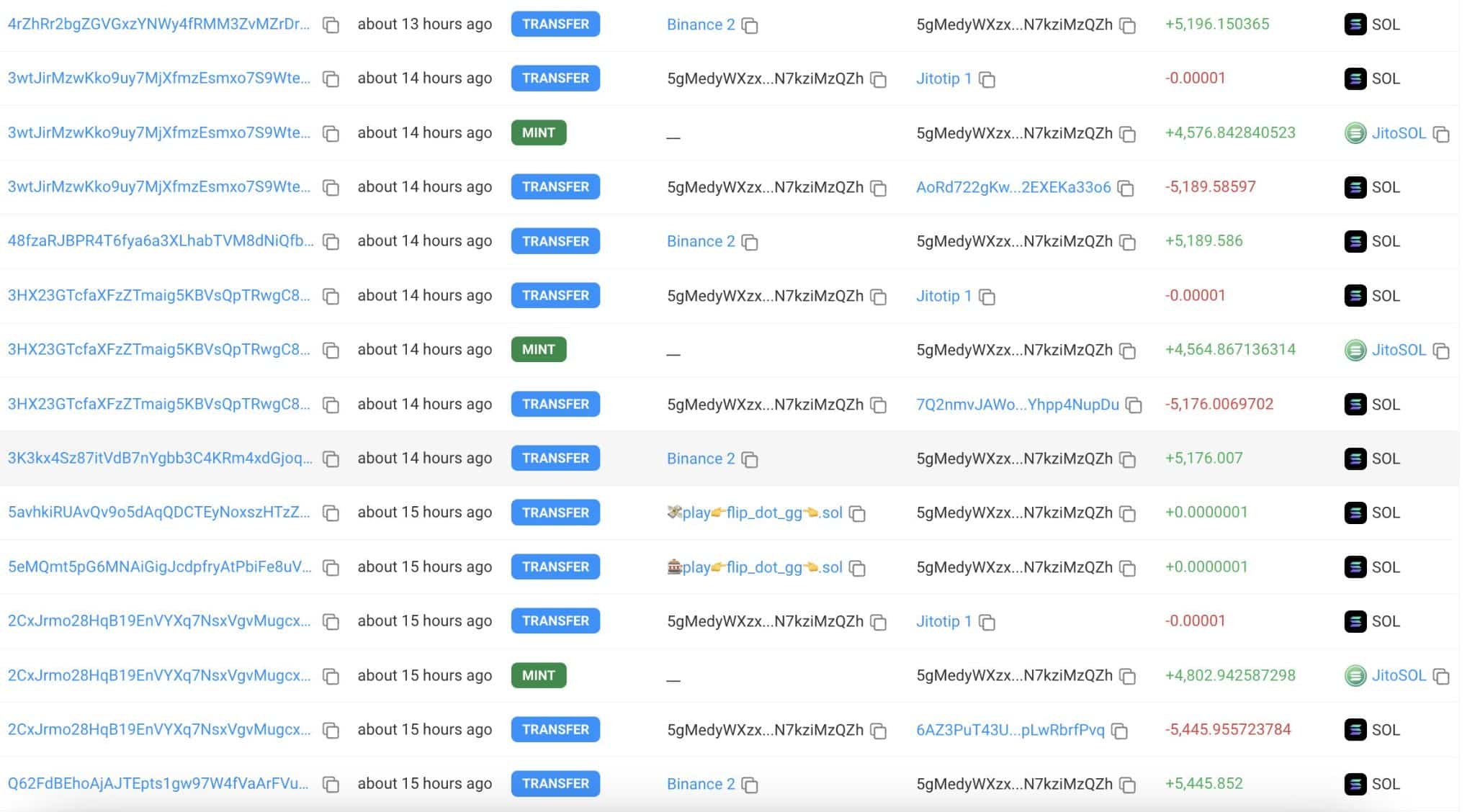

New insights from Lookonchain reveal that a whale has recently purchased and staked a substantial amount of Solana (SOL), totaling 28,717 units worth $4.56 million.

Source: X

Staking involves the whale locking up their SOL in a wallet to support the operations and security of the Solana blockchain network. This activity not only earns them rewards, typically in the form of additional SOL tokens but also signals growing confidence in the market.

Such major actions—purchasing and subsequently staking cryptocurrency—suggest that whales are optimistic about the market’s future, effectively reducing the supply of SOL in circulation and potentially leading to a market rally.

Anticipated SOL rally on the horizon

Crypto analyst Ali believes that the recent SOL price accumulation phase has remarkably influenced whales’ investment decisions.

An accumulation phase is a strategic market period during which investors systematically purchase assets—SOL in this instance—especially when prices are low, aiming to build a substantial position before an expected price increase.

According to Ali’s analysis, as SOL exits this accumulation phase, it is poised to experience a huge price surge, potentially increasing by 33.15% and returning to trading above $200 in the near future.

Source: X

AMBCrypto has identified recent market activities that align with the expected upward trend.

More bullish signals emerge

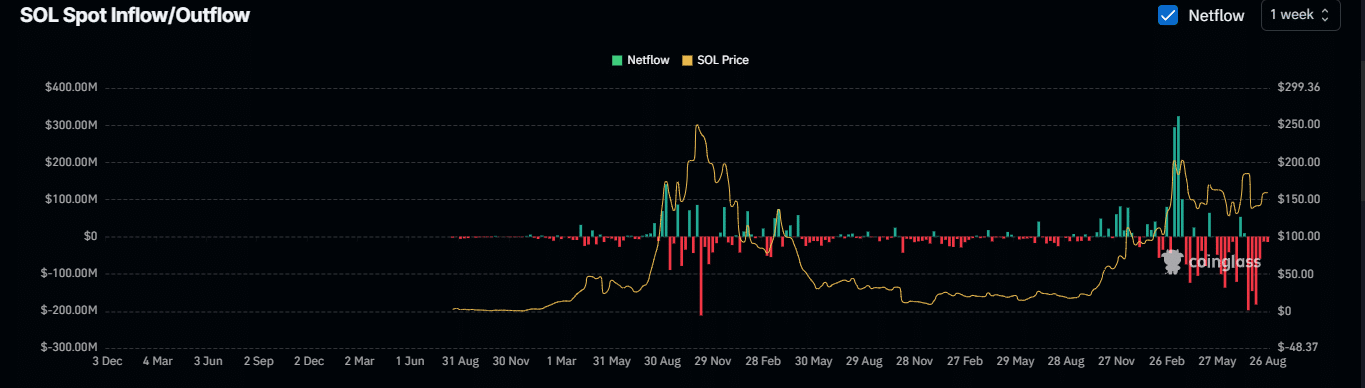

A detailed analysis of the exchange netflow—a metric in cryptocurrency trading that measures the difference between the volume of cryptocurrency entering and exiting exchanges—indicates a bullish outlook for SOL.

According to Coinglass, SOL’s exchange netflow was a negative $14.62 over the past 24 hours. Further investigation by AMBCrypto reveals that since July 22, the exchange flow has consistently been negative, indicating a steady decline in SOL’s availability on exchanges.

Source: Coinglass

This pattern suggests increased buying pressure, as more cryptocurrency is being withdrawn than deposited.

Is your portfolio green? Check the Solana Profit Calculator

Additionally, the open interest (OI) in SOL has been steadily rising, giving a sign that trading activity and interest among retail traders are on the upswing.

If this upward trend continues, SO should reach new heights, and this can further be accelerated by external factors such as a drop in Bitcoin dominance.