- SOL ETF approval odds jumped to 87% after CME SOL Futures debut.

- Analyst predicted that SOL price could be range-bound for weeks or months.

On the 17th of March, the CME (Chicago Mercantile Exchange) debuted the much-awaited Solana [SOL] Futures trading, a move analysts viewed as great for ETF approval odds.

The exchange offers two SOL Futures products: a standard futures contract representing 500 SOL and a ‘micro’ alternative with 25 SOL for every contract.

Solana ETF odds

According to Mathew Sigel, head of digital assets research at VanEck, it was a ‘step closer’ for the likely U.S. spot ETF greenlight. He stated,

“One sizable step closer to a SOL ETF.”

However, Sigel quickly pointed out that while the CME Futures wasn’t necessary for ETF approval, it would still boost its odds.

“There is no need for CME futures to exist to list an ETF; that was a Gensler psyop. But it still helps.”

On the prediction site Polymarket, the odds of SOL ETF approval in 2025 jumped from 81% to 88% after the launch.

That said, the debut made SOL the third cryptocurrency to trade on CME Futures after Bitcoin [BTC] and Ethereum [ETH]. For his part, Giovanni Vicioso, CME Group’s head of cryptocurrency products, said,

“As Solana continues to evolve into the platform of choice for developers and investors, these new futures contracts will provide a capital-efficient tool to support their investment and hedging strategies.”

SOL’s likely price range

Despite the bullish updates, SOL’s price could remain stuck in a range in the medium term. According to crypto trader, Cryp Nuevo, SOL could fluctuate between $120 — $175 if BTC holds above $77K.

“We’ll probably spend some weeks or even a couple months ranging here between $120-$175 if BTC keeps holding the 1W50EMA $77k.”

Source: X

In fact, Nuevo cautioned that downside risk couldn’t be overruled, especially a dip below $100 if Bitcoin dominance climbed higher to 63% and above.

“It feels quite fragile at the moment, in the way that if BTC.D pumps to 63%-64% at the same time as BTC drops back to $77k, then SOL could easily take out that low and even show <$100 for some hours/couple days.”

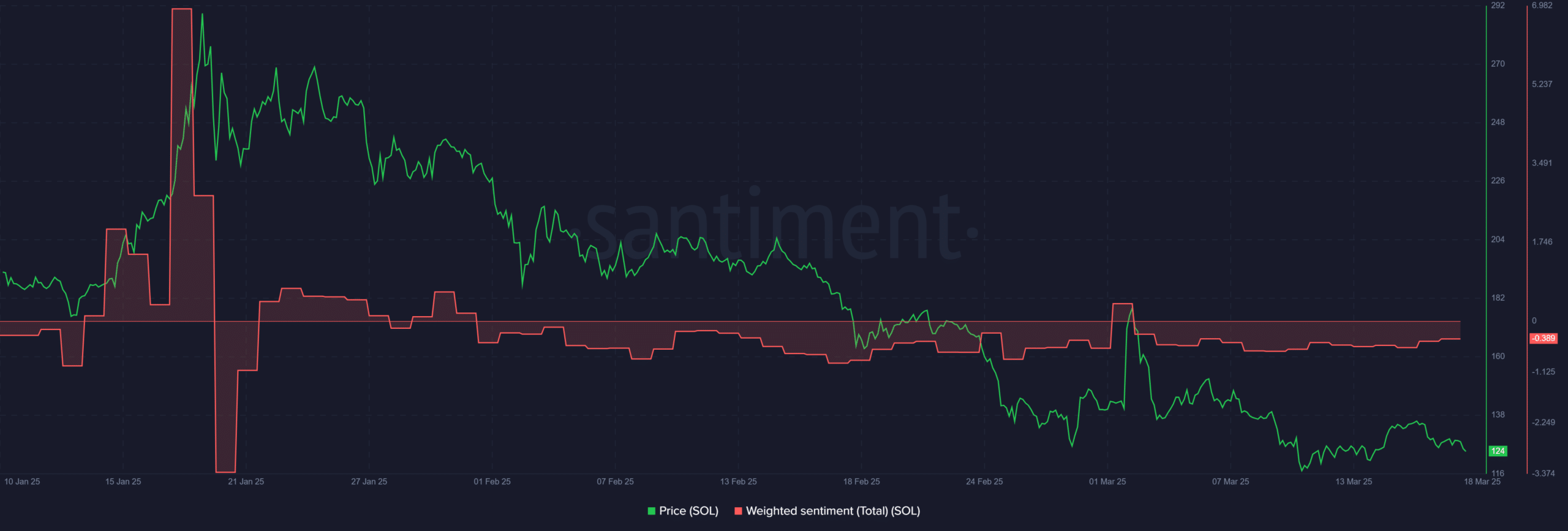

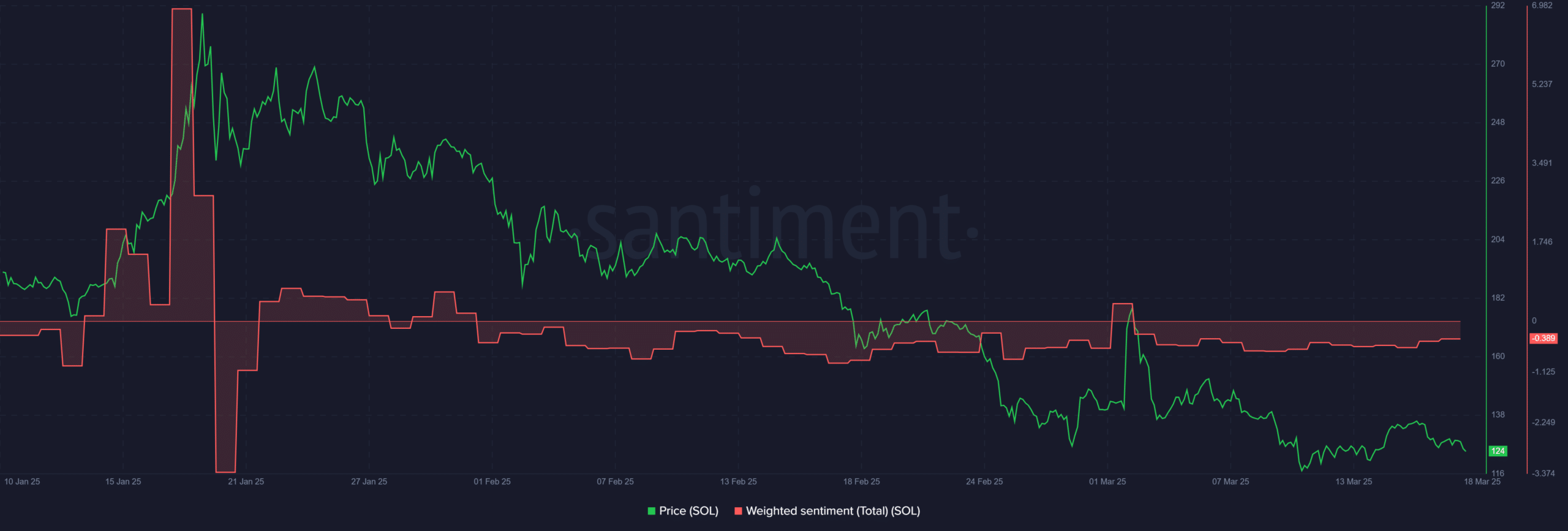

Source: Santiment

The bearish grip in SOL markets was also evident by the weighted sentiment, which has been overly negative for most of Q1 2025.

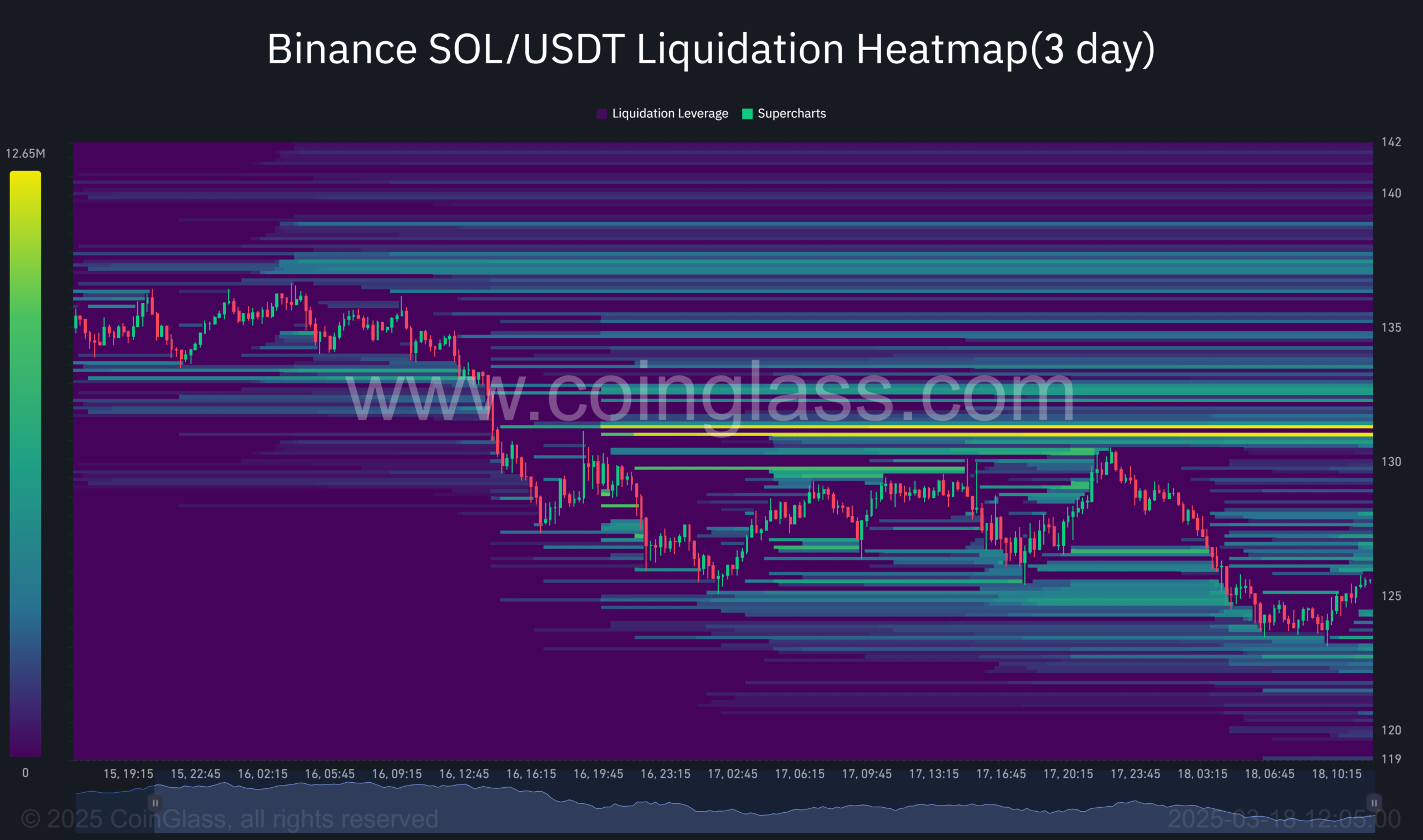

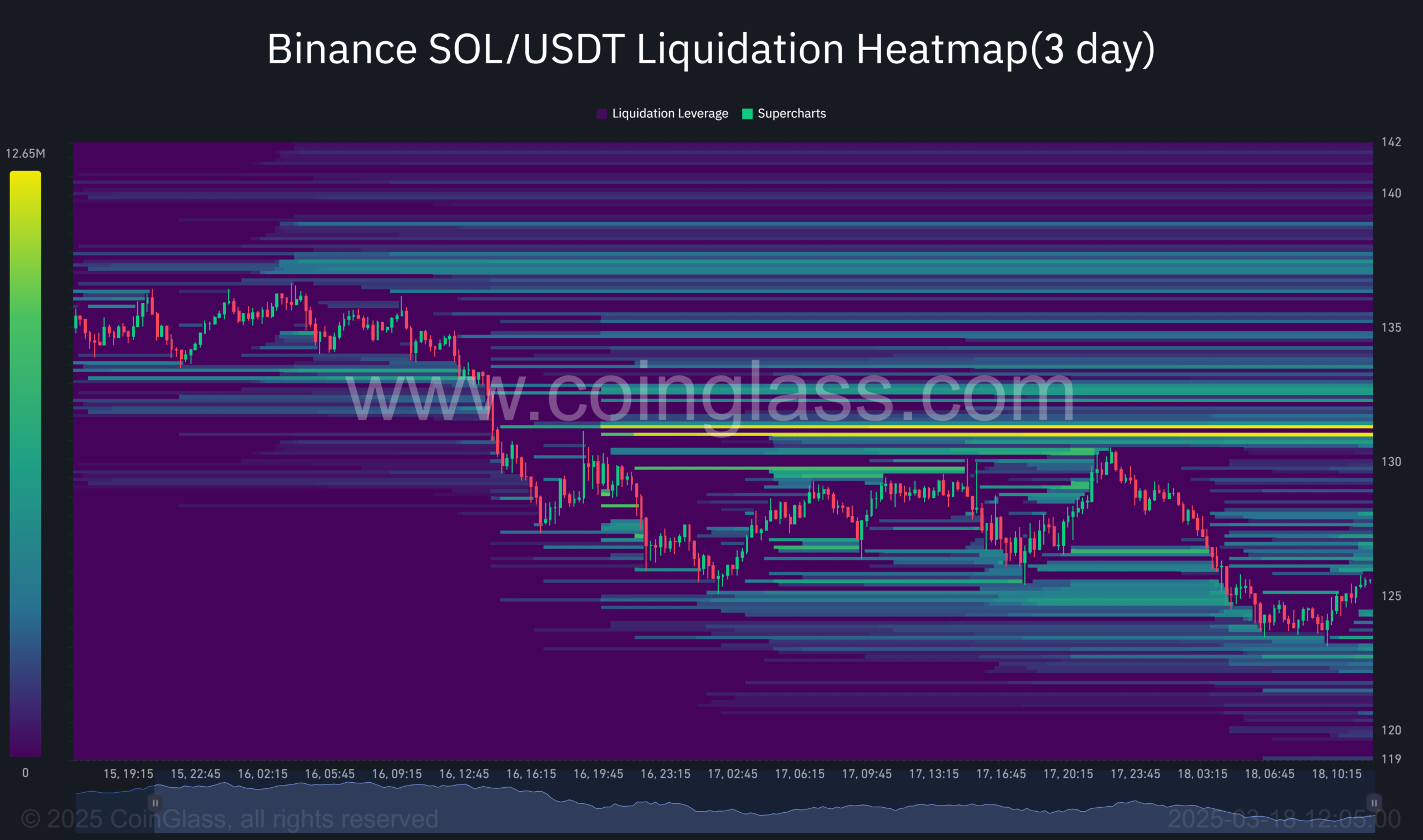

Meanwhile, considerable liquidity was above $130 (bright yellow area) as traders opened shorts around the level. This could attract price action in the short term in case of a liquidity-driven pump.

Source: Coinglass