- Hopes of Solana ETFs deferred to 2025 following reports that recent applications could be turned down.

- A recap of SOL price action and Solana on-chain activity as TVL soars to new highs.

The Solana [SOL] community has been eagerly waiting to join the ETF hype train with multiple companies filing with the SEC. However, fresh reports suggest that Solana ETFs might not be launched this year.

Solana was the next obvious choice after successful Bitcoin and Ethereum ETF launches. Multiple companies including VanEck, Bitwise, Grayscale Investments, 21Shares and Canary Capital were among the first to file for Solana ETFs.

A recent report revealed that the U.S SEC disclosed to at least two of the applicants that it intends to reject the applications. The report mentioned that the reason for the planned rejection was the ambiguity around Solana asset classification, especially concerns that it could be a security.

What are the implications on SOL price action?

Historically, the hype around Bitcoin and Ethereum ETFs led to excitement around their price action days before launch. However, once the ETFs were launched, prices dipped, indicating that ETF approvals are usually buy the rumor, sell the news type of events.

ETF applications being rejected will likely not have an impact on price. However, the impact especially in the long term would have been an influx of institutional liquidity, potentially pushing SOL prices higher in the subsequent months after approval.

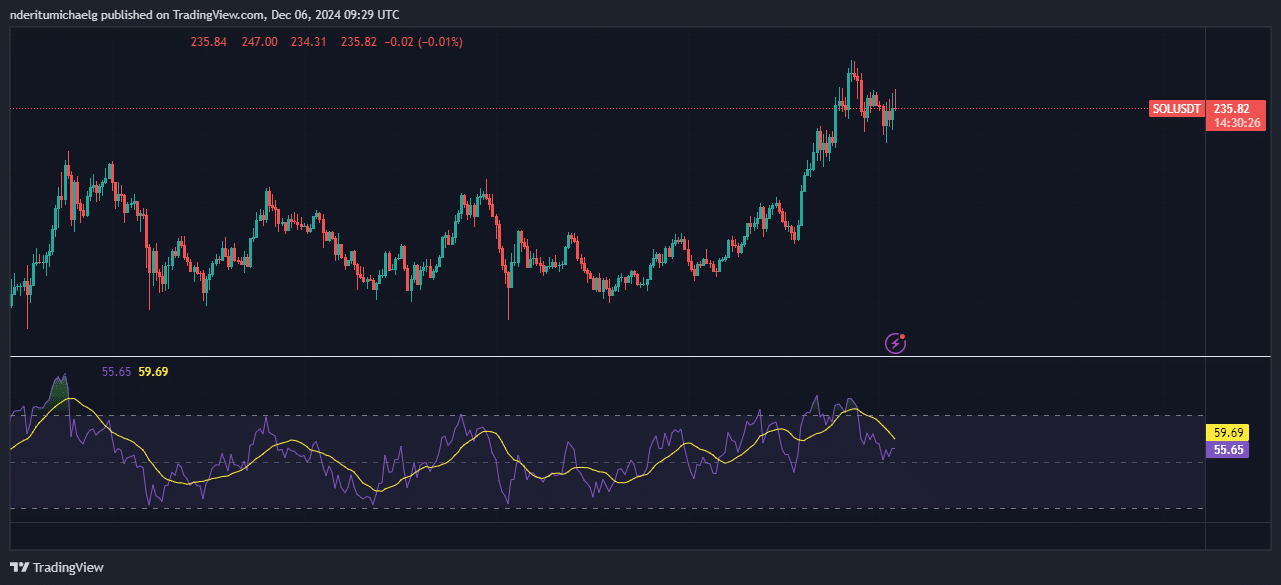

SOL has already achieved robust upside this year judging by the fact that it has recently been trading comfortably above $200. Its latest retracement after soaring to a new high, indicates some profit taking occurred recently. It exchanged hands at $235.88 at press time.

Source: TradingView

SOL will likely regain prices above $200 if market sentiment remains bullish in December. There is also the possibility that it could even push higher in the event of strong demand resurgence.

On the other hand, capitulation could result in intense sell pressure. In which case price could dip as low as $157 before retesting the next major support level.

Solana maintains robust on-chain performance

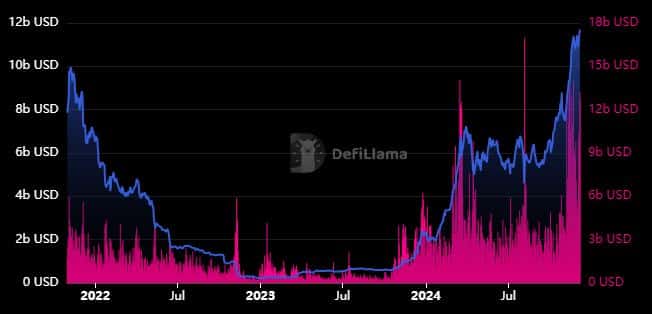

Although price recently slowed down, the network maintained positive momentum in other key areas. For example, its TVL just clocked a new ATH of $11.69 billion.

Source: DeFiLlama

Read Solana’s [SOL] Price Prediction 2024–2025

Solana on-chain volume soared as high as $5.88 billion in the last 24 hours. This underscores healthy network activity that Solana continued to cultivate.

Speaking of network activity, transactions on the network have been steadily growing in Q4. For context, daily transactions on the network were in the 40 million range and have since soared above 50 million transactions.