- Toncoin was trading just below the critical resistance level at $6.8.

- The magnetic zones overhead are likely to pull prices higher.

Toncoin [TON] holders had a reason to celebrate after the news broke recently that the coin secured clearance to be listed on Binance, the largest crypto exchange by trading volume.

A recent report noted that the Open Network [TON] saw robust network activity.

Long-term holders have been selling and indulging in some profit-taking. However, on-chain metrics also showed increased supply outside of exchanges, meaning that TON has bullish potential.

TON bulls knock on the doors of a crucial resistance level

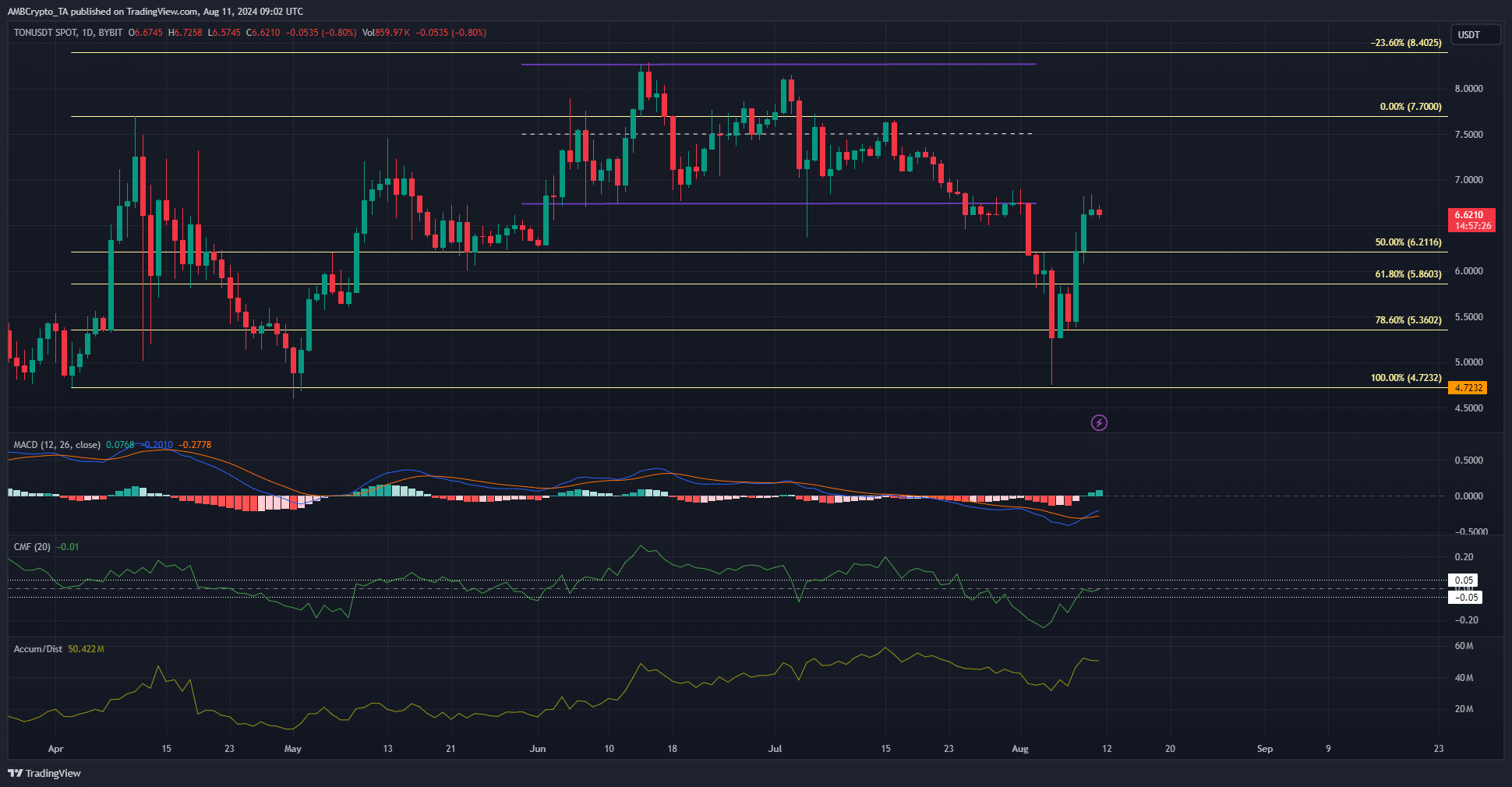

Source: TON/USDT on TradingView

The 1-day chart showed that TON was extremely quick to recover all the losses it saw when Bitcoin [BTC] plunged from $67k to $49k. Toward the end of July, TON fell below the range lows (purple) at $6.75.

At press time the market price was $6.62. It is expected that the token would consolidate for a few days before bursting past the $$6.8 resistance zone. This was because of the trading volume during the recovery from $4.75 in the past week.

The A/D indicator jumped higher to reinforce this bullish possibility. However, the CMF was still not above +0.05, showing that buying pressure needs to be consistently high to drive a rally.

This could take a few days. The MACD formed a bullish crossover below the zero line, indicating weak bearish momentum overall.

The market structure was also bearish, but a daily session close above $6.89 would flip this bullishly.

More hints that Toncoin is ready for a rally

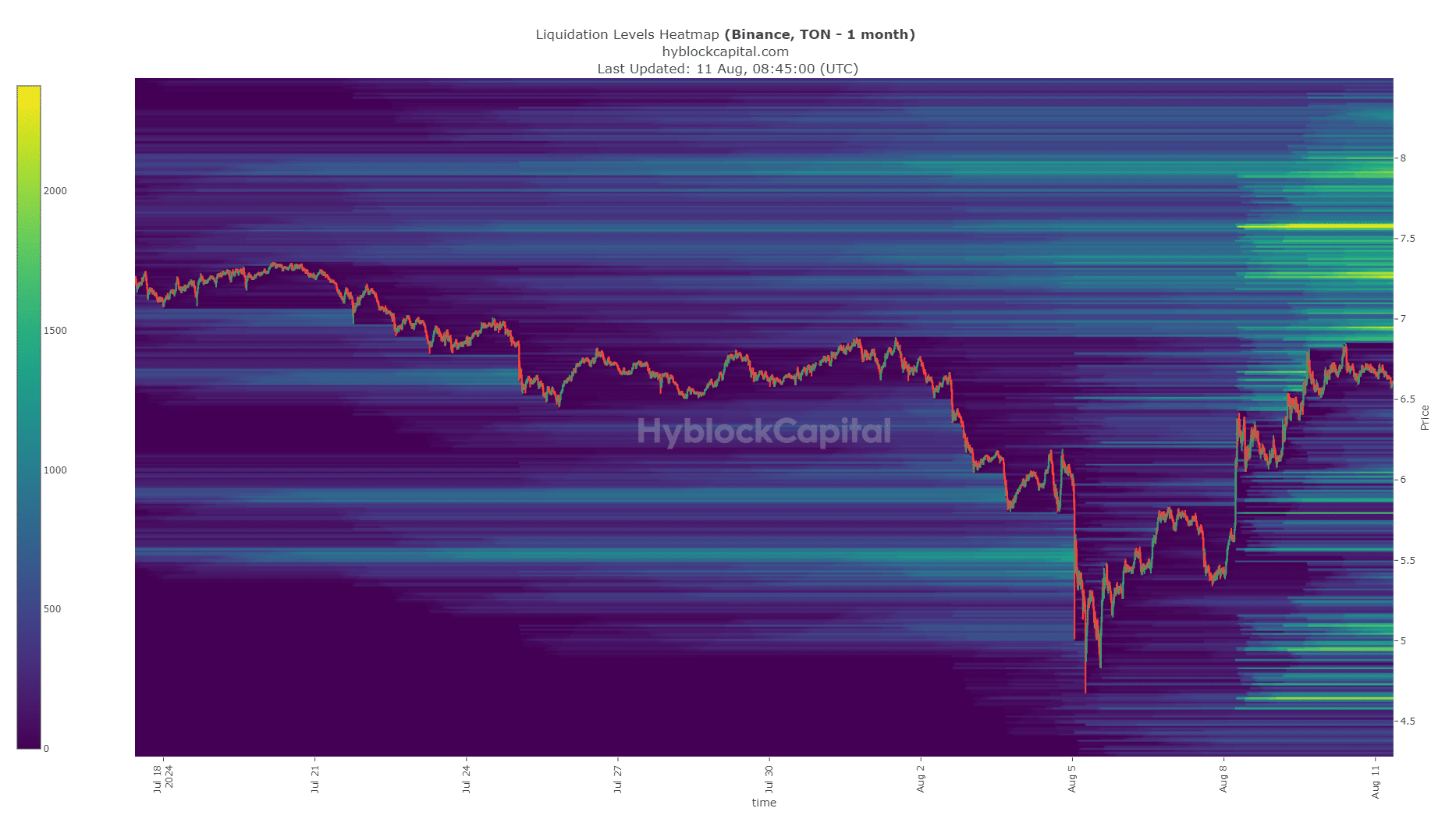

Source: Hyblock

AMBCrypto noted that there were sizeable liquidity pools at and above the $7 mark. The %6.94, $7.27, and $7.6 levels are the next liquidity targets for TON.

Is your portfolio green? Check the Toncoin Profit Calculator

Buyers can capitalize on a bullish structure breaks and use these levels to take-profits at.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion