- TRON’s price is at a crucial support level, which could signal a breakout or a correction

- Market sentiment and institutional activity could play a big role in TRON’s next move

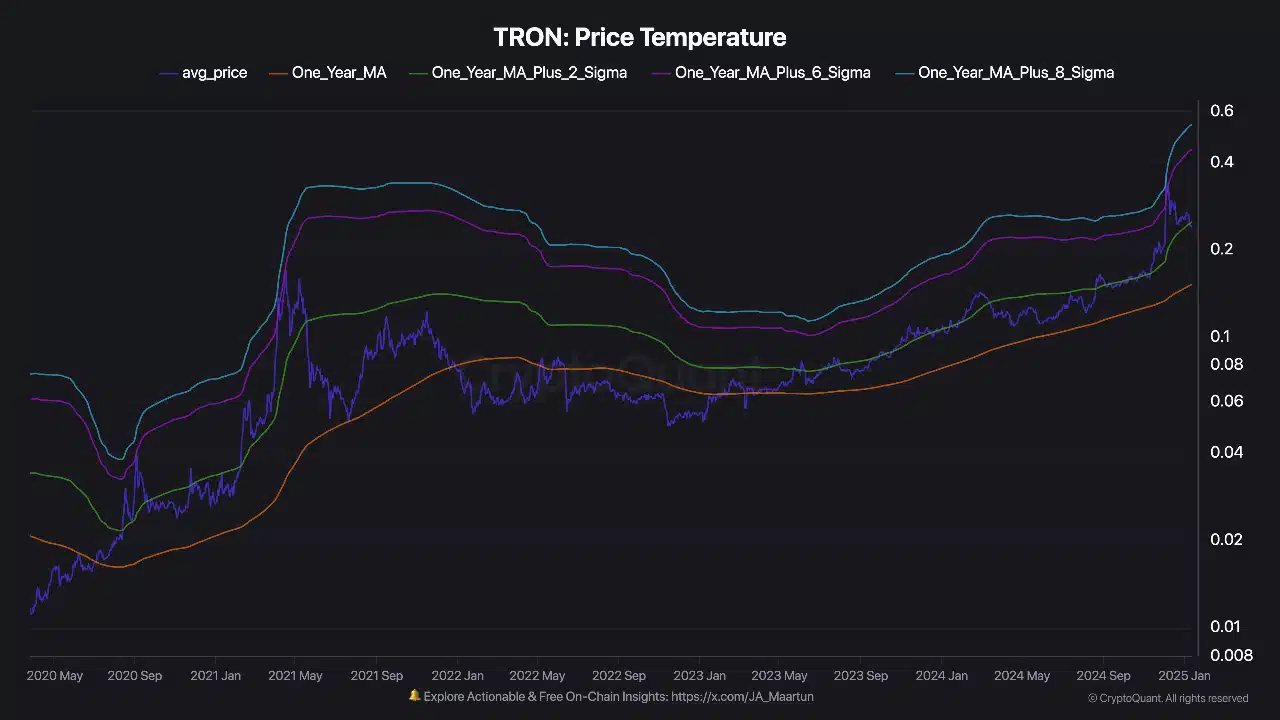

TRON finds itself at a crossroads, hovering just above its 1-Year MA +2 Sigma level, a key threshold that has historically marked the tipping point for major price reversals and a psychological battle for bulls and bears alike.

As TRON edges closer to testing this crucial support, the question on every trader’s mind is whether history will repeat itself. Or is the market now bracing for an unprecedented breakout?

Trader psychology plays a major role here, with fear of a breakdown often prompting selling, while the fear of missing out (FOMO) drives buying. Social media and crypto forums amplify these emotions, creating momentum around key technical levels.

How TRON reacts to the $0.25-level or retraces back to $0.15 depends largely on market sentiment.

TRON: Price levels and trader sentiment

Source: Cryptoquant

In previous cycles, this battle between bulls and bears has been pretty evident. For TRON, institutional investors may be interpreting the current setup as a signal for accumulation, while retail traders wait for confirmation.

Additionally, an MACD analysis revealed that TRON spent two weeks in an oversold zone before reverting back to neutral – A move often followed by upward momentum.

Read Tron’s [TRX] Price Prediction 2025–2026

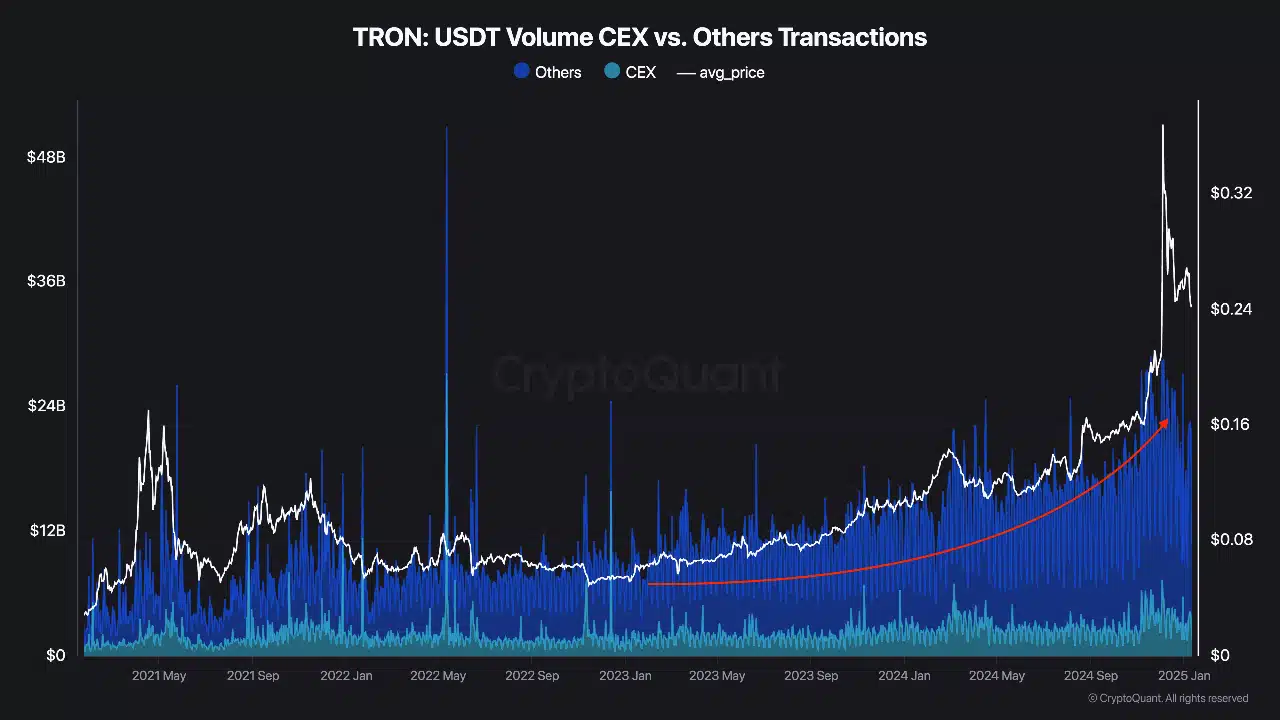

What does TRON’s history suggest?

Source: Cryptoquant

TRON’s historical behavior at key technical levels offers valuable insights into potential future scenarios. If TRON holds above the $0.25-level, it may enter a bullish phase, with a possible price target of $0.30. However, a breakdown could see it retesting the 1-Year MA at $0.15.

Beyond technicals, TRON’s ecosystem growth offers additional optimism too. USDT volume on TRON increased significantly from $8 billion in early 2023 to $27 billion by the end of 2024, indicating rising activity and capital flow. This growth could lend support to TRON’s price stability and future potential.