- TRUMP token’s upcoming 40 million token unlock may trigger selloff amid fragile market sentiment

- Price has dropped 89% since launch, with an uncertain outlook ahead of April 18

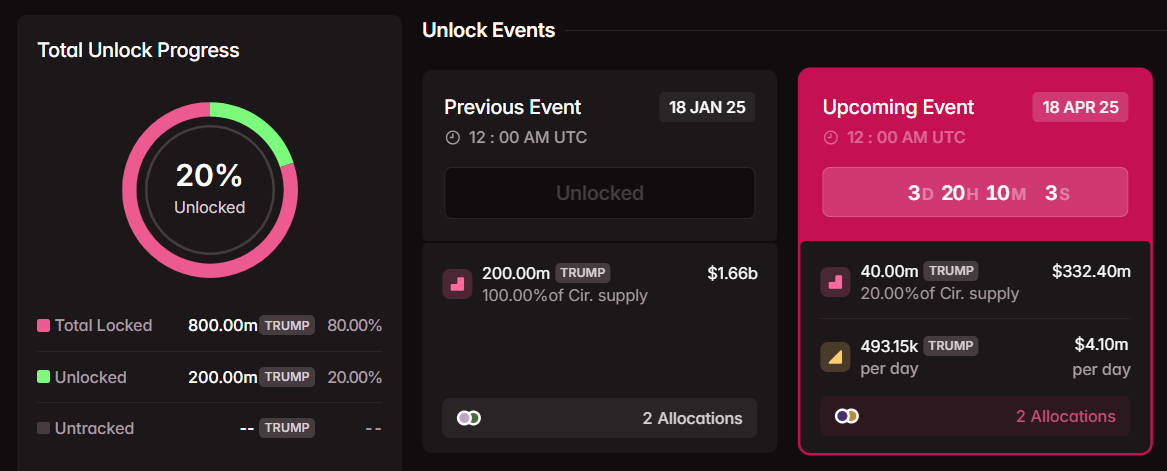

The countdown has begun for one of the most high-stakes token unlocks in memecoin history. On the 18th of April, the Official Trump [TRUMP] token is set to release 40 million tokens into circulation, worth roughly $330 million at current prices.

That’s 20% of the total supply, mostly allocated to insiders. For a chart that’s been bleeding since launch, this event could be the spark that either resets the narrative or deepens the decline.

Insider allocations raise red flags amid heavy unlock

With only 20% of TRUMP’s total supply currently circulating, the upcoming unlock of 40 million tokens represents a massive 20% increase to that float – all in one go.

Scheduled for the 18th of April, the $332 million unlock has investors on edge, particularly since the newly released tokens are split across insider allocations.

Source: Tokenomist

Historically, such unlocks have often resulted in increased selling pressure. With TRUMP already significantly below its peak, market sentiment remains fragile.

The daily release of 493K tokens, equating to nearly $4.1 million in potential sell-side pressure, exacerbates concerns. If confidence weakens further, this unlock could act as a catalyst for a more severe downturn.

TRUMP price outlook

The TRUMP token’s price has been in a prolonged downtrend, hovering around $8.43 at press time after a brief bounce.

This marks a staggering 89% decrease since its launch. RSI remains weak at 38.90, signaling continued bearish momentum and lack of strong buying pressure.

Source: TradingView

Meanwhile, the MACD has just crossed into positive territory, but the signal remains faint and unconvincing. Despite a minor uptick, price action is still consolidating near recent lows, indicating market hesitation.

The trading volume also appears thin, suggesting a lack of conviction from bulls. Without a clear breakout or shift in sentiment, any rally may be short-lived – especially with a major unlock event looming.

The past unlocks paint a cautionary tale

Token unlocks linked to insider allocations are known for causing price drops, especially during periods of weak market sentiment.

Historically, large-scale releases, such as those from Aptos and Arbitrum, have flooded the market with excess supply. This oversupply often overwhelms demand, leading to price declines.

In memecoin markets, where liquidity is limited, and hype cycles are highly volatile, the effects are typically more pronounced. TRUMP’s unlock follows these trends, making a post-unlock selloff likely.