[ad_1]

- UNI’s charts flashed strong bullish momentum after breaking out of a descending channel with rising volume

- Positive on-chain metrics and falling exchange reserves could serve altcoin well

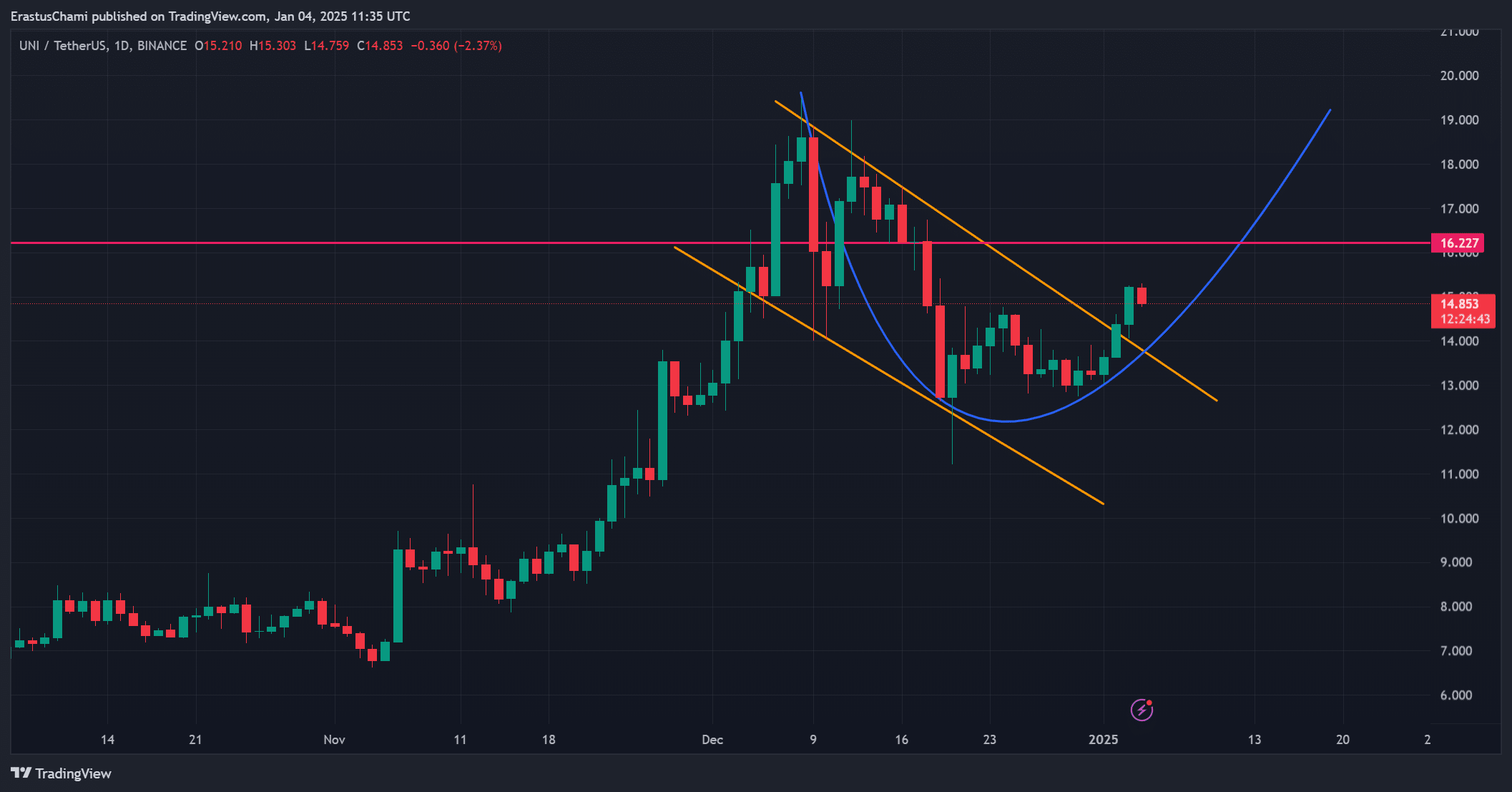

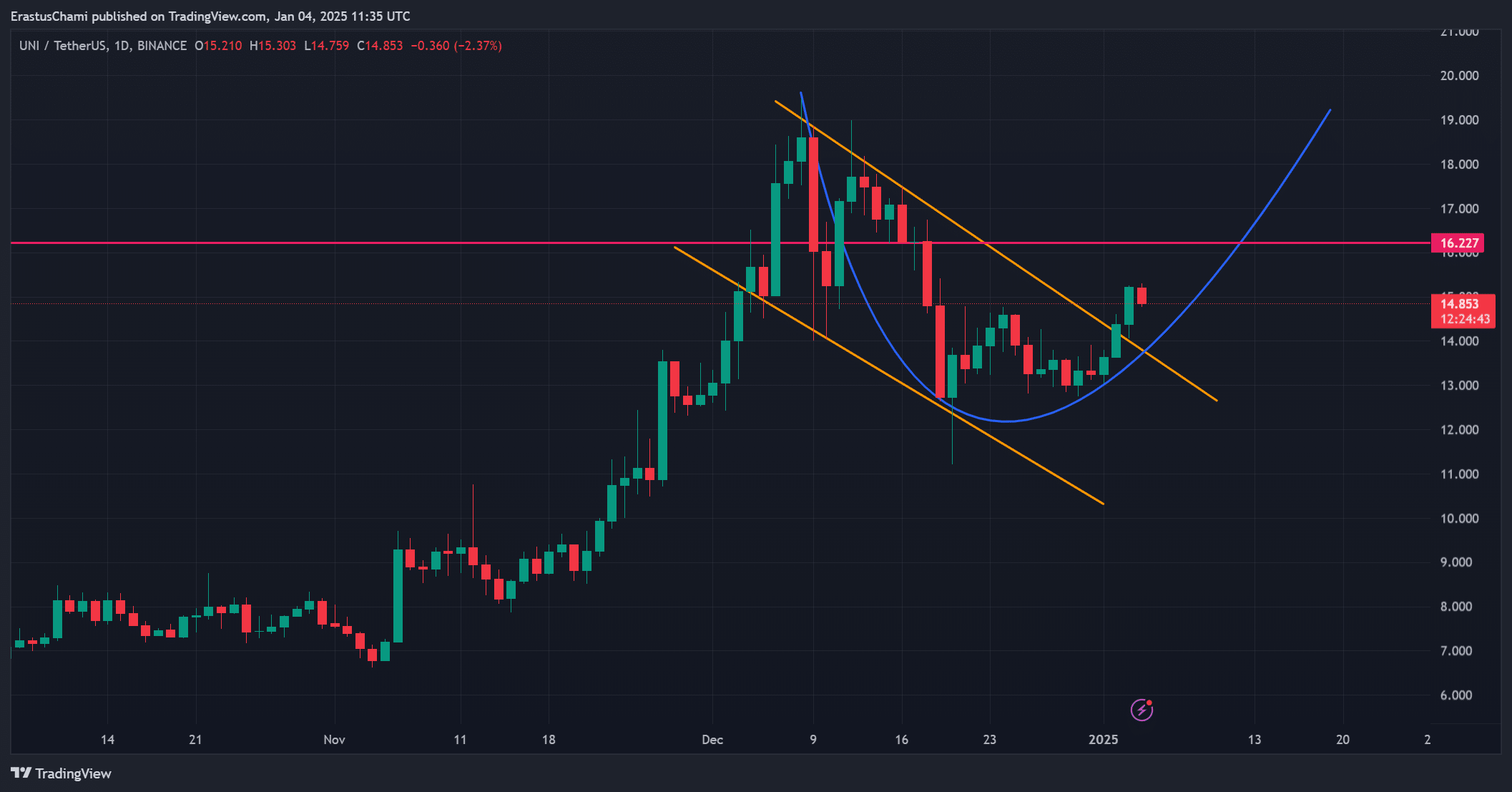

Uniswap [UNI] is in the news today after it broke out of a descending channel after weeks of consolidation, showing clear signs of a potential trend reversal. Trading at $14.85 following gains of 2.32% at press time, the token has attracted significant attention with its rounded bottom pattern – A sign of bullish momentum.

Additionally, UNI’s 24-hour trading volume surged by 30.48% too, highlighting rising market interest. Therefore, the question remains – Can this momentum lead to sustained gains or not?

UNI price analysis highlights key resistance

UNI’s price movement underlined growing optimism among traders as it confirmed its breakout from the descending channel. In fact, the rounded bottom pattern on the charts further supported the possibility of sustained momentum.

Additionally, the token’s trading volume spike seemed to reinforce confidence, signaling heightened activity in the market.

Worth noting, however, that the $16 resistance level will be crucial in determining whether UNI can continue its rally or face temporary setbacks. Hence, traders must monitor this key level closely.

Source: TradingView

On-chain signals show growing investor confidence

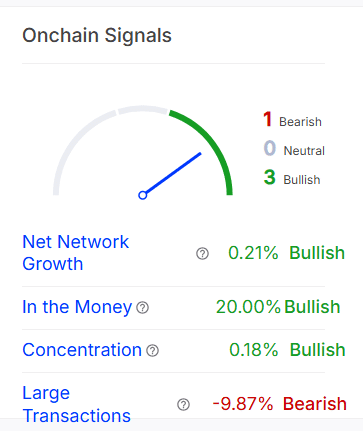

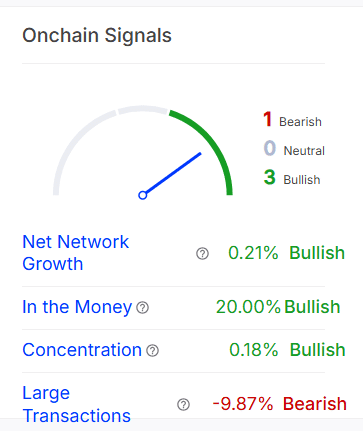

On-chain metrics provided further evidence of bullish momentum for UNI. With 20% of addresses currently “in the money,” investor sentiment remains strong. Additionally, net network growth rose by by 0.21% – A sign of steady adoption.

Concentration levels have also risen by 0.18%, reflecting accumulation by large holders. However, large transactions declined by 9.87%, suggesting some institutional caution.

And yet, despite everything, overall on-chain data supported UNI’s potential for further growth.

Source: IntoTheBlock

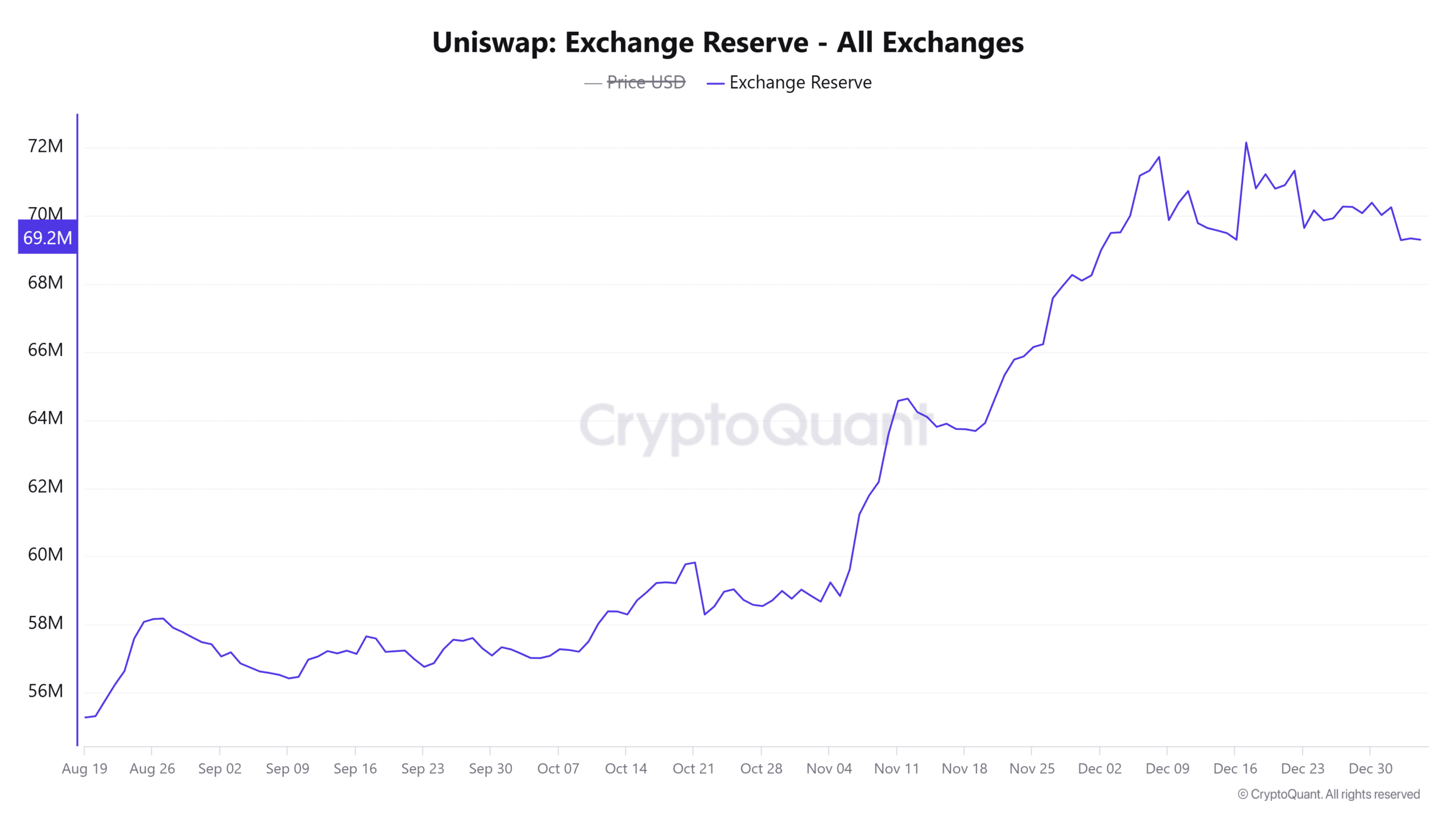

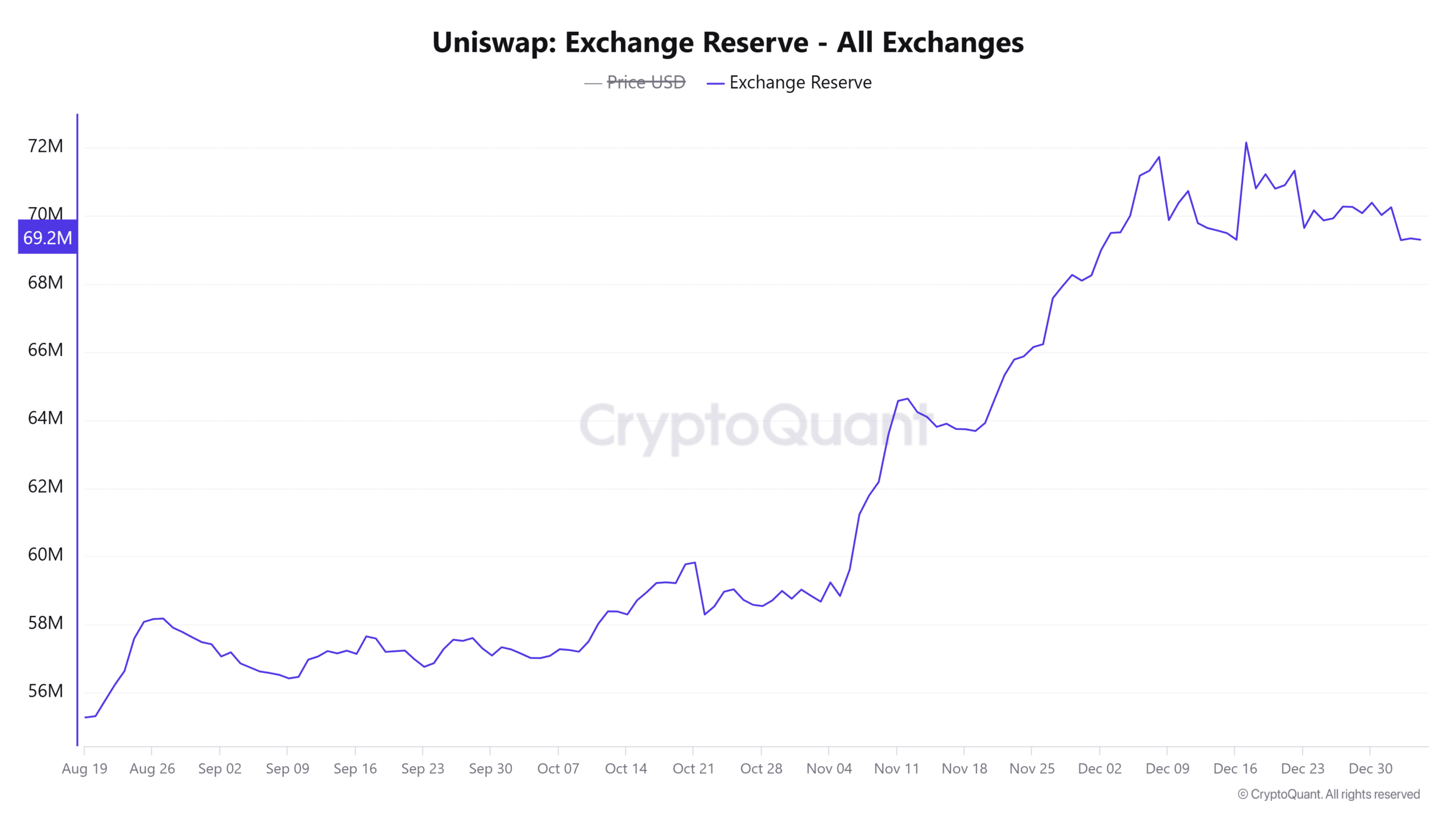

UNI exchange reserves hint at falling selling pressure

At press time, UNI’s exchange reserves stood at approximately 69.2996M, following a slight fall of 0.07% in the last 24 hours. This indicated that more holders are transferring tokens off exchanges, reducing immediate selling pressure.

Additionally, this trend seemed to imply growing confidence in holding the token, rather than short-term profit-taking. However, unexpected changes in reserves could alter market sentiment. Hence, closer observation is warranted here.

Source: CryptoQuant

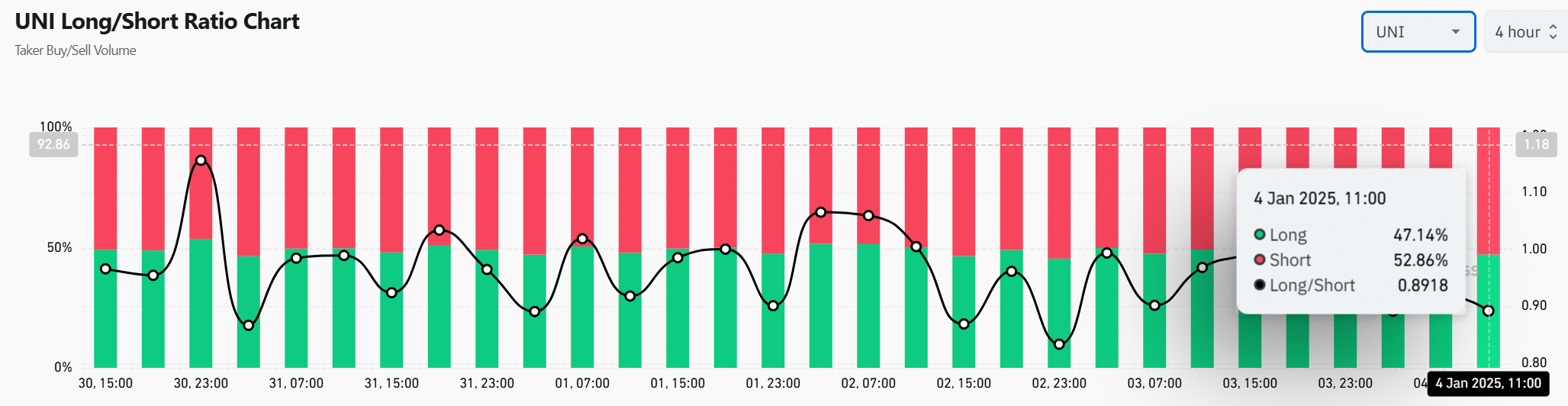

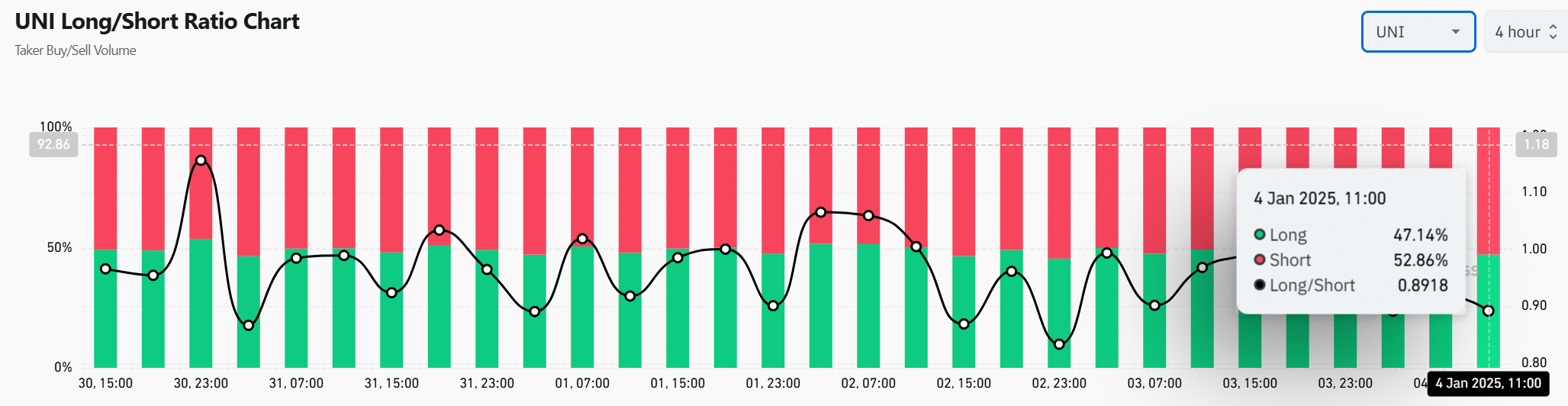

Traders divided as long/short ratio reveals a split

Finally, the long/short ratio indicated mixed sentiment, with 52.86% of traders shorting UNI and 47.14% holding long positions. However, this slight short bias could result in a short squeeze if bullish momentum accelerates.

Also, the upcoming price action near $16 will likely shift market dynamics further. Therefore, traders should remain vigilant and adapt to evolving trends.

Source: Coinglass

Read Uniswap’s [UNI] Price Prediction 2025–2026

UNI has the potential to sustain its bullish momentum if it breaks the $16 resistance level.

With strong on-chain metrics and growing market interest, the outlook appears optimistic. However, traders should still watch key levels closely.

[ad_2]

Source link