- Avalanche unlocks 1.33% of AVAX’s max supply.

- Analysis say the bottom might be in.

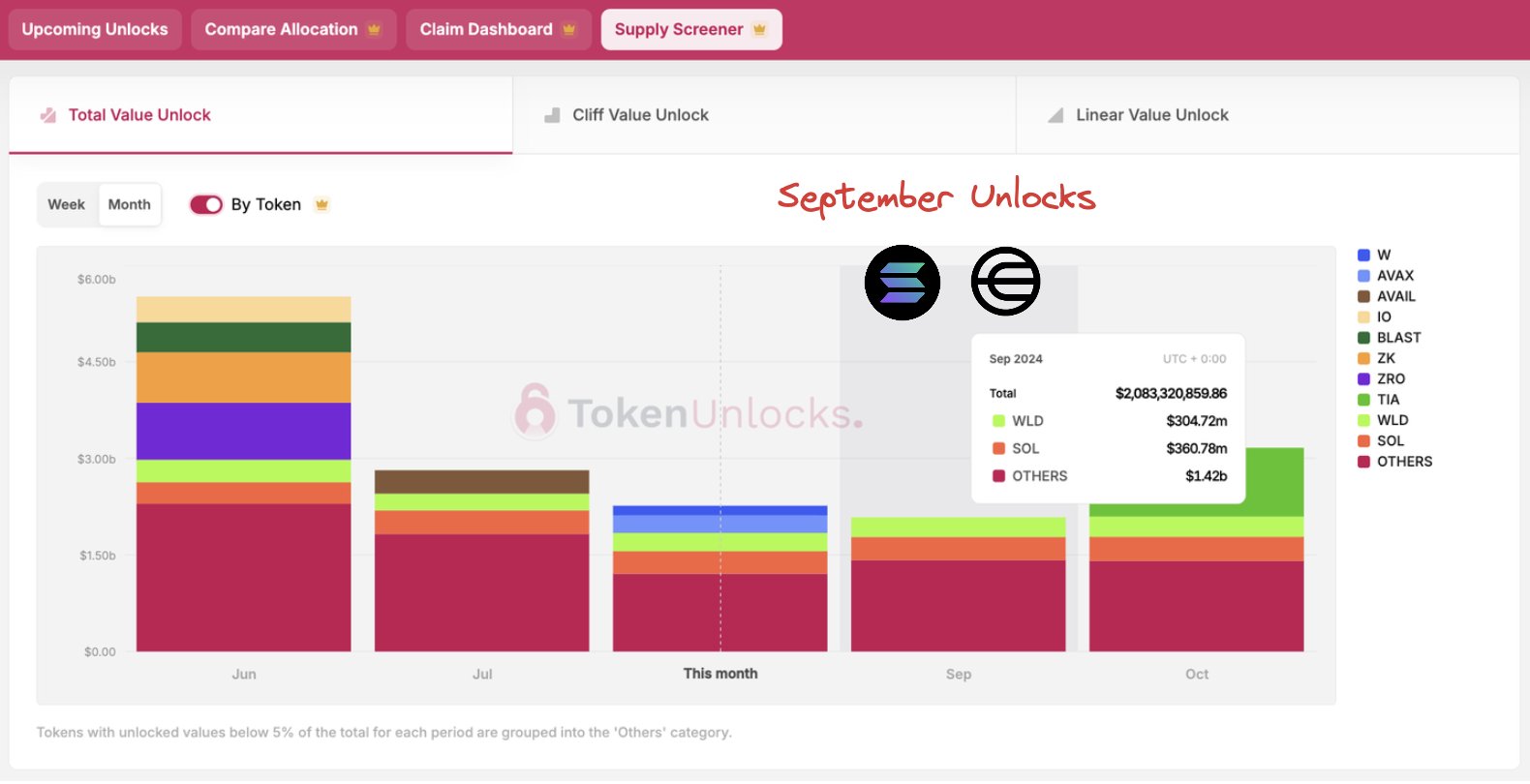

Solana [SOL], Worldcoin [WLD], and Avalanche [AVAX] led the charge for altcoin token unlocks with AVAX releasing 9.54 million AVAX tokens, representing a 1.33% of its total maximum supply.

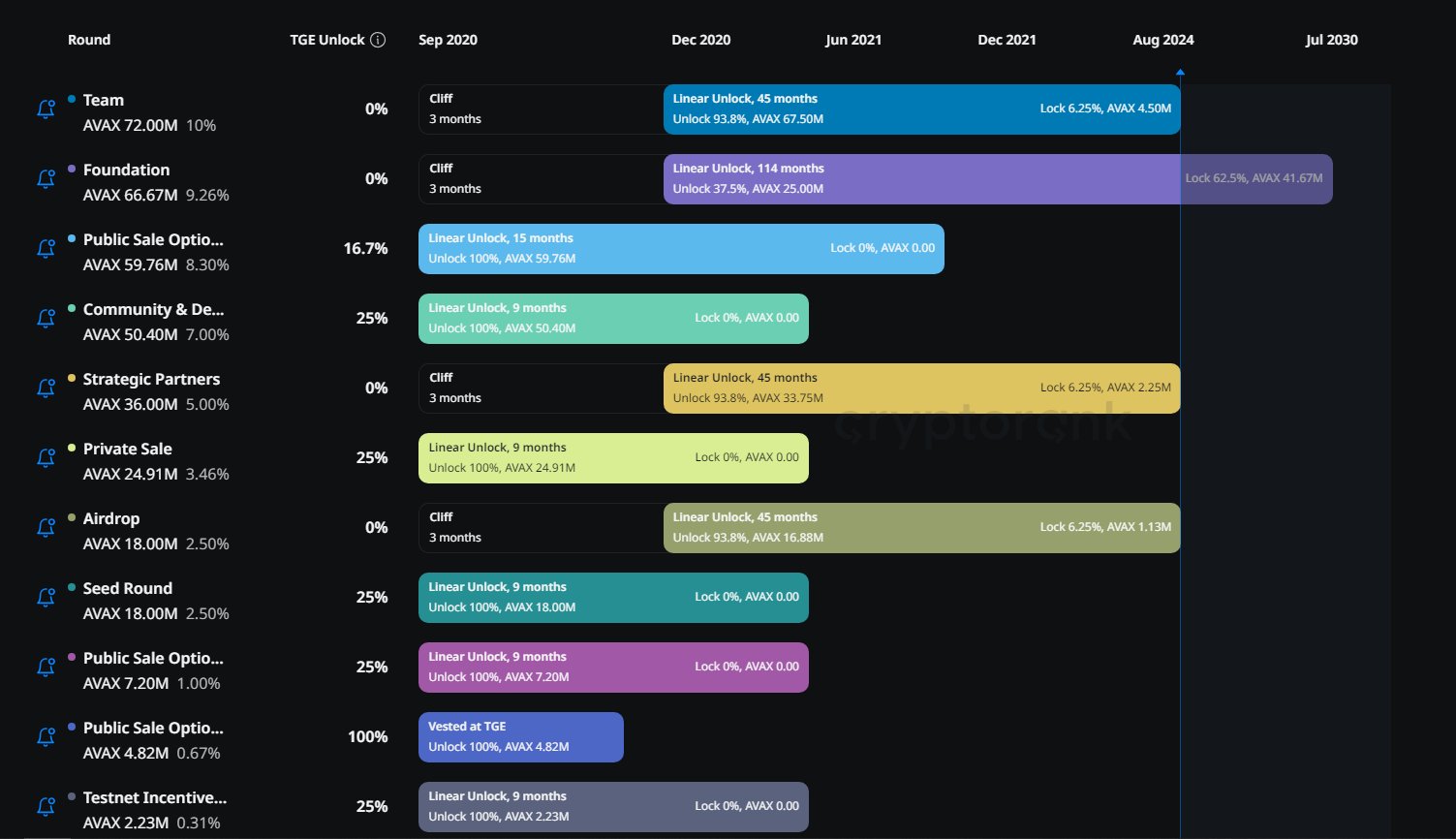

This AVAX event marks the final major token unlock, with allocations made to the Team, Foundation, Strategic Partners, and Airdrop recipients.

As the last significant unlock, many are questioning whether this influx of AVAX will inflate Avalanche’s price or stabilize it.

Source: Token Unlocks

Moving forward, Avalanche will shift to smaller, foundation-only token unlocks, releasing 1.6 million AVAX each quarter until July 20, 2030.

This reduced unlock schedule is a strategic move designed to manage supply and minimize selling pressure, potentially keeping AVAX’s price stable despite the gradual increase in circulating tokens.

This release will have significant impact on the price thus needs to be closely monitored. Historically, similar token unlocks have led to notable price movements.

Source: X

Already, AVAX is showing signs of moving higher as the overall crypto market trends upward.

Is AVAX bottom in?

From a technical perspective, AVAX appears to have found its bottom, with price action suggesting a potential upside. On the AVAX/USDT 4-hour chart, the price has reclaimed support between $22.84 and $21.06.

A close above this range by the end of the week would indicate a bullish signal, whereas falling below this band could trigger further selling pressure. The Elliott Wave analysis also shows a positive outlook for AVAX.

Source: TradingView

Falling wedge pattern

Additionally, Avalanche’s 3-day chart indicates a falling wedge pattern, which is a bullish signal. AVAX has bounced back from the lower trendline, and there is confidence that a breakout from this wedge is imminent.

If this breakout occurs, AVAX could see a rally similar to the 200% surge experienced in November-December 2023.

Source: TradingView

The controlled release of AVAX tokens could further support this potential price increase during the upcoming altseason.

The weekly confirms an uptrend

The weekly chart also confirms an uptrend for Avalanche. AVAX has not only broken out of its base but has also completed a textbook retest of the resistance that has now turned into support.

The AVAX support flip strongly confirms the uptrend, aligning with the general positive sentiment in the broader crypto market and favorable conditions for risk assets.

Source: TradingView

With the weekly candle closing bullishly, a continued bull run is anticipated for Avalanche [AVAX] in Q4 of 2024.

Is your portfolio green? Check the Avalanche Profit Calculator

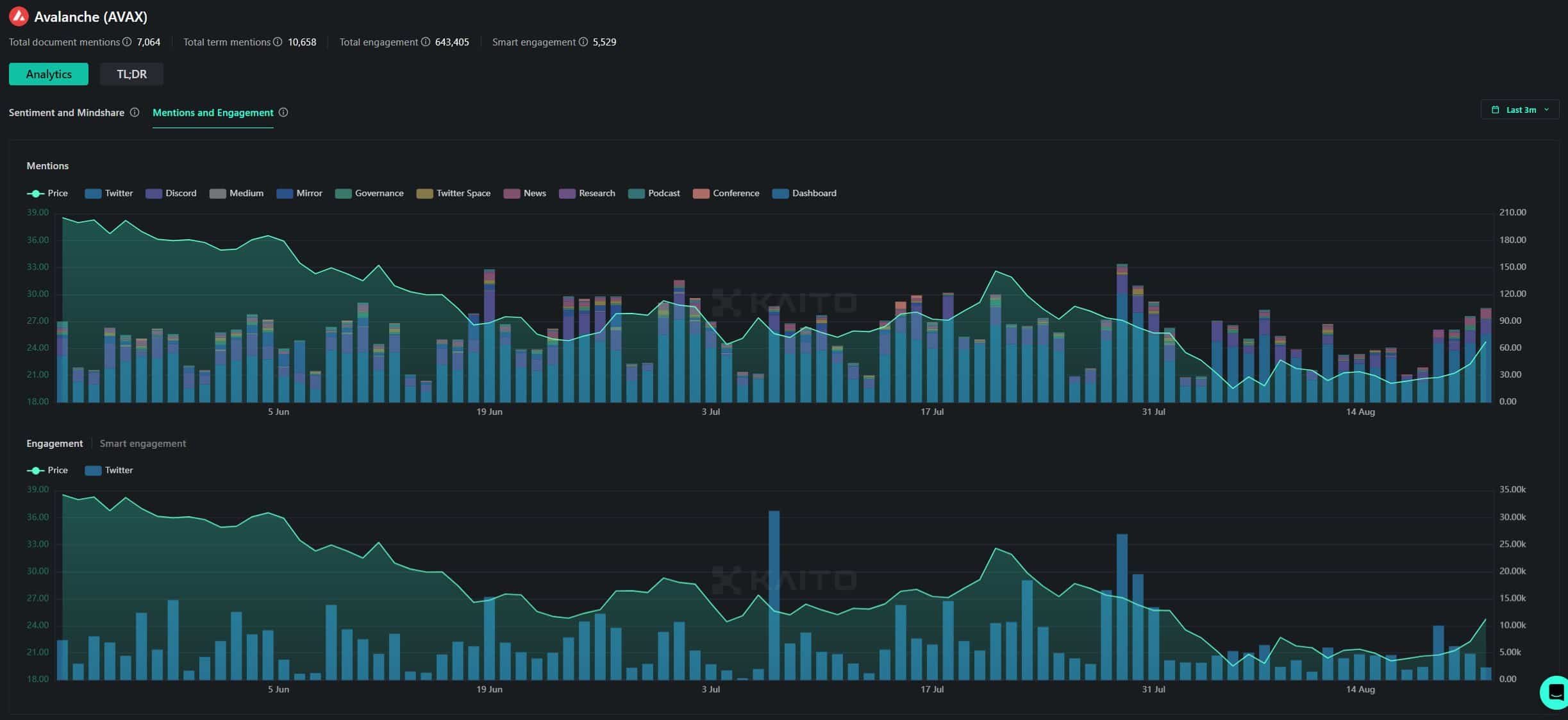

Mentions and engagement

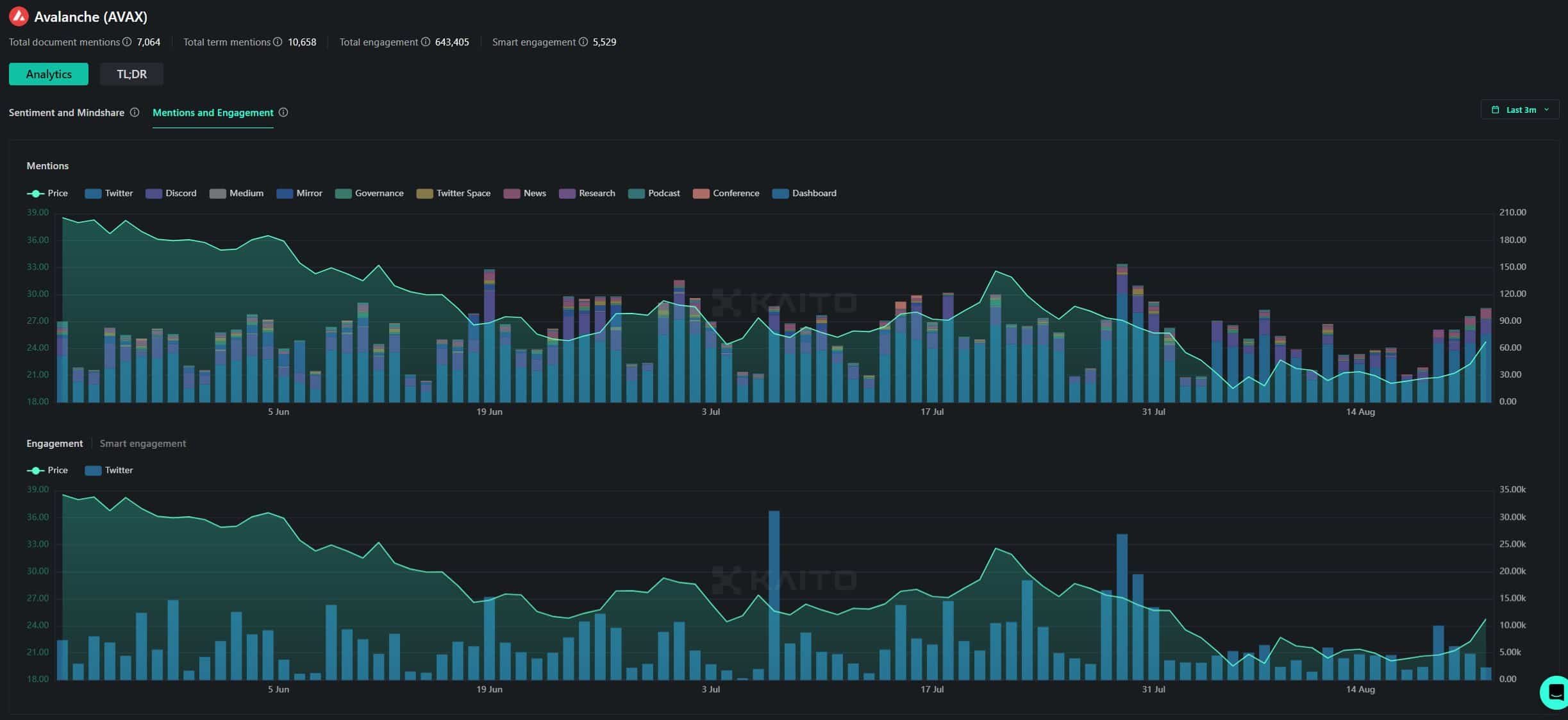

Social engagement is another crucial factor in predicting price movements, and mentions of Avalanche [AVAX] on Crypto Twitter and other platforms are on the rise.

This increased attention often correlates with price increases, suggesting that AVAX’s price may continue to move higher as it gains more visibility and interest within the crypto community.

Source: Kaito