- XLM has a lot of shorts to be liquidated, and low volatility could catch bears by surprise

- A +25% rise to $0.55 could leave bears in pain as price action set bulls to benefit

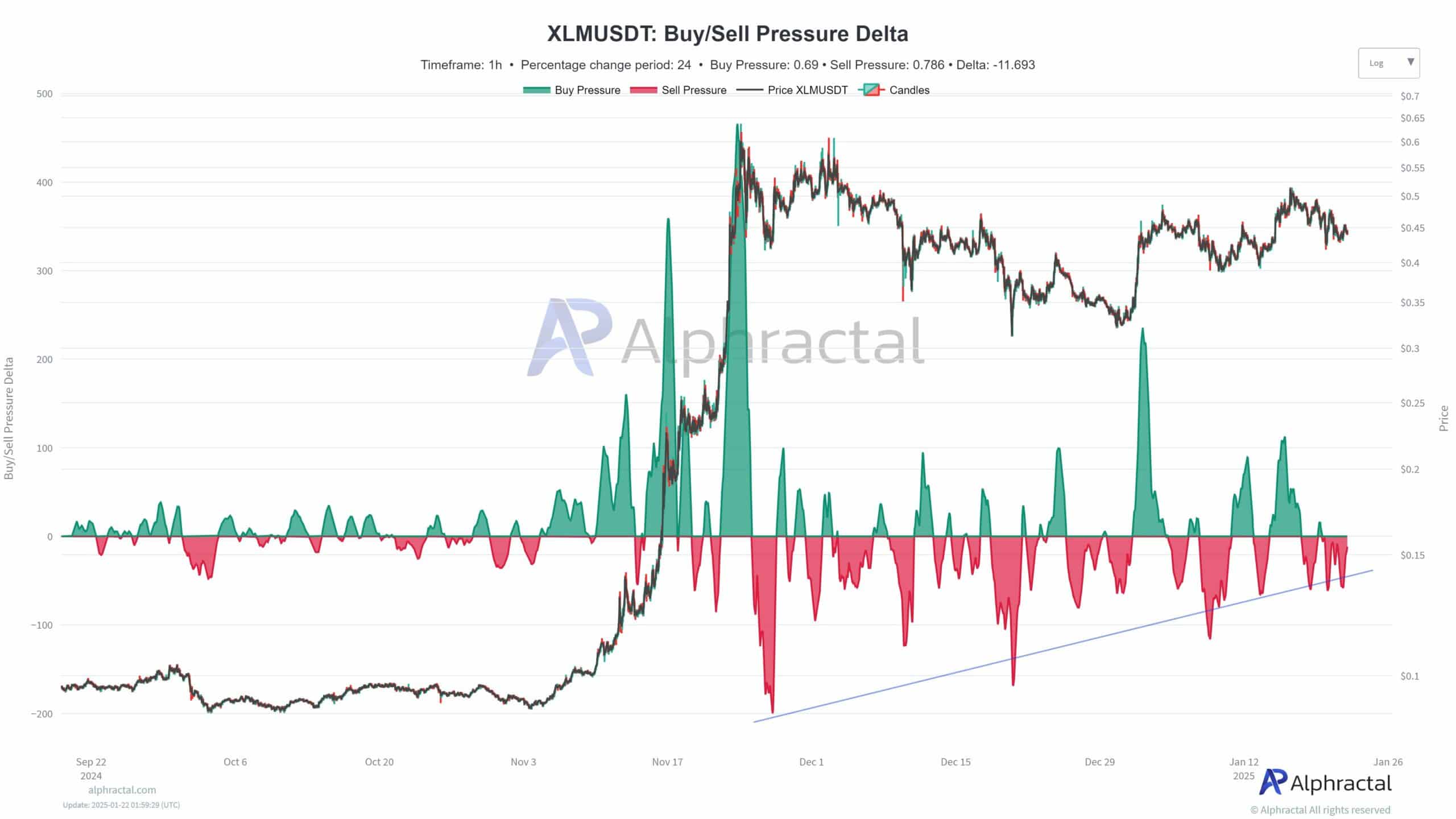

Stellar Lumens (XLM) faced significant liquidation pressure on short positions, suggesting a squeeze might be imminent. In fact, the heatmap revealed a buildup of shorts at higher prices, indicating that any sudden uptrend in XLM’s price could trigger these liquidations.

Notably, XLM’s key liquidation thresholds approached around $0.45 and higher, marking potential areas where bears might capitulate, which could propel prices upwards.

Source: Alphractal

This tension between potential price surges and existing bearish bets could catch short sellers off guard, leading to rapid price escalations if those levels are breached.

This situation indicated the volatile nature of crypto markets, where sentiment can shift dramatically – Affecting prices and trader positions swiftly. In addition, XLM’s buying pressure spikes exceeded selling pressure, indicating bullish sentiment. XLM saw a peak in November with buying pressure momentarily outpacing selling.

However, the trend seemed to be reversing as selling pressure began to slowly dominate again, hinting at a critical resistance at $0.55. This +25% uptick could leave bears in pain, making it a key battle level for bulls and bears.

Source: Alphractal

If XLM manages to breach this level, it could potentially initiate a rally, disappointing bears. Conversely, a fall below the support level of $0.398 might trigger a more significant downtrend.

The alternating patterns of buying and selling pressure suggested that XLM may be highly sensitive to trader sentiment – Leading to increased volatility. A breach of these levels could lead to significant price movements in either direction.

XLM’s price action and predictions

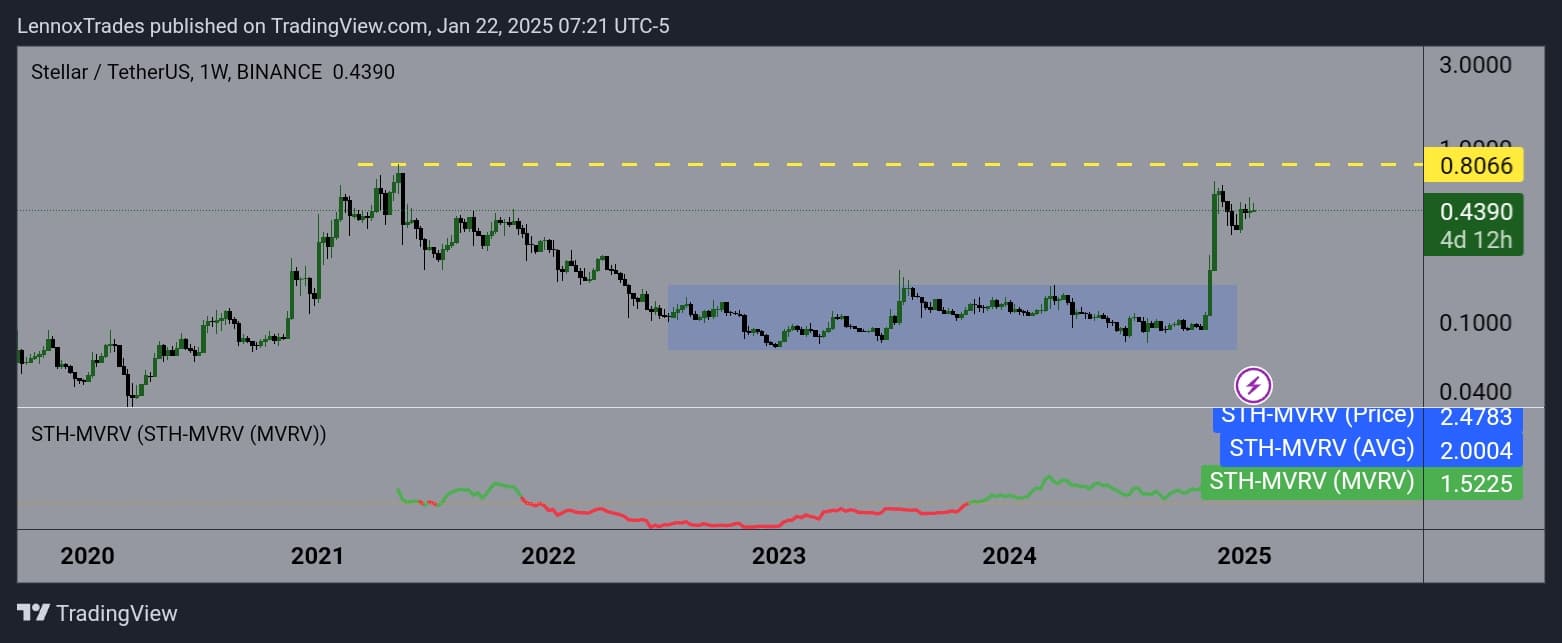

At press time, XLM’s price action exhibited bullish trend on the weekly charts, with the altcoin trading at $0.4390. XLM revealed a sharp hike from its previous levels, nearing the $0.80 resistance level which seemed key for continuation.

The strong candles breaking past the descending resistance levels suggested potential for further uptrend if the momentum continues.

The STH-MVRV at 2.48 implied that the price was significantly above the average holder’s break-even point. This hinted at overvaluation, which could prompt some investors to take profits soon.

Source: Trading View

If XLM can sustain above this trendline, it might challenge the next major resistance at $0.80. However, any reversal could see support at the lower end near $0.33. This outlook is cautiously optimistic, but traders should watch for signs of reversal due to the high MVRV ratio.

Finally, major influx peaked at around $20 million on 18 November, with subsequent high volumes influencing price fluctuations, notably during December.

The frequent shifts from net inflows to outflows suggested active trading and potential short-term speculation among investors.

Source: Coinglass

Historically, sharp inflows often precede price spikes, as seen in early December. These shifts, combined with heightened inflows, could likely push the price up temporarily.