- Per the Fibonacci and Elliott Wave analysis, XRP could reach $15 by May 2025.

- Growing adoption and reduced selling pressure could further strengthen XRP’s bullish outlook.

XRP [XRP] continues to capture attention with predictions of reaching $15 by the 5th of May 2025, fueled by Fibonacci time zones and Elliott Wave analysis.

This projection suggests a robust bullish trend, but current market dynamics demand careful evaluation.

While optimism prevails, XRP’s short-term performance underscores the need for a balanced outlook. Therefore, understanding its price action and indicators is critical for forecasting its future trajectory.

A bullish future for XRP?

According to EGRAG CRYPTO on X (formerly Twitter), Fibonacci time zones marked May 2025 as a key date, aligning with the 1.618 level, historically linked to major price movements.

The Elliott Wave analysis indicated that XRP was in Wave 4, a corrective phase often preceding substantial bullish action in Wave 5.

Historical patterns suggest that Wave 5 could see a 391% gain, combining previous waves’ performance. These metrics paint an optimistic picture, provided market conditions remain supportive.

Source: X/EGRAG CRYPTO

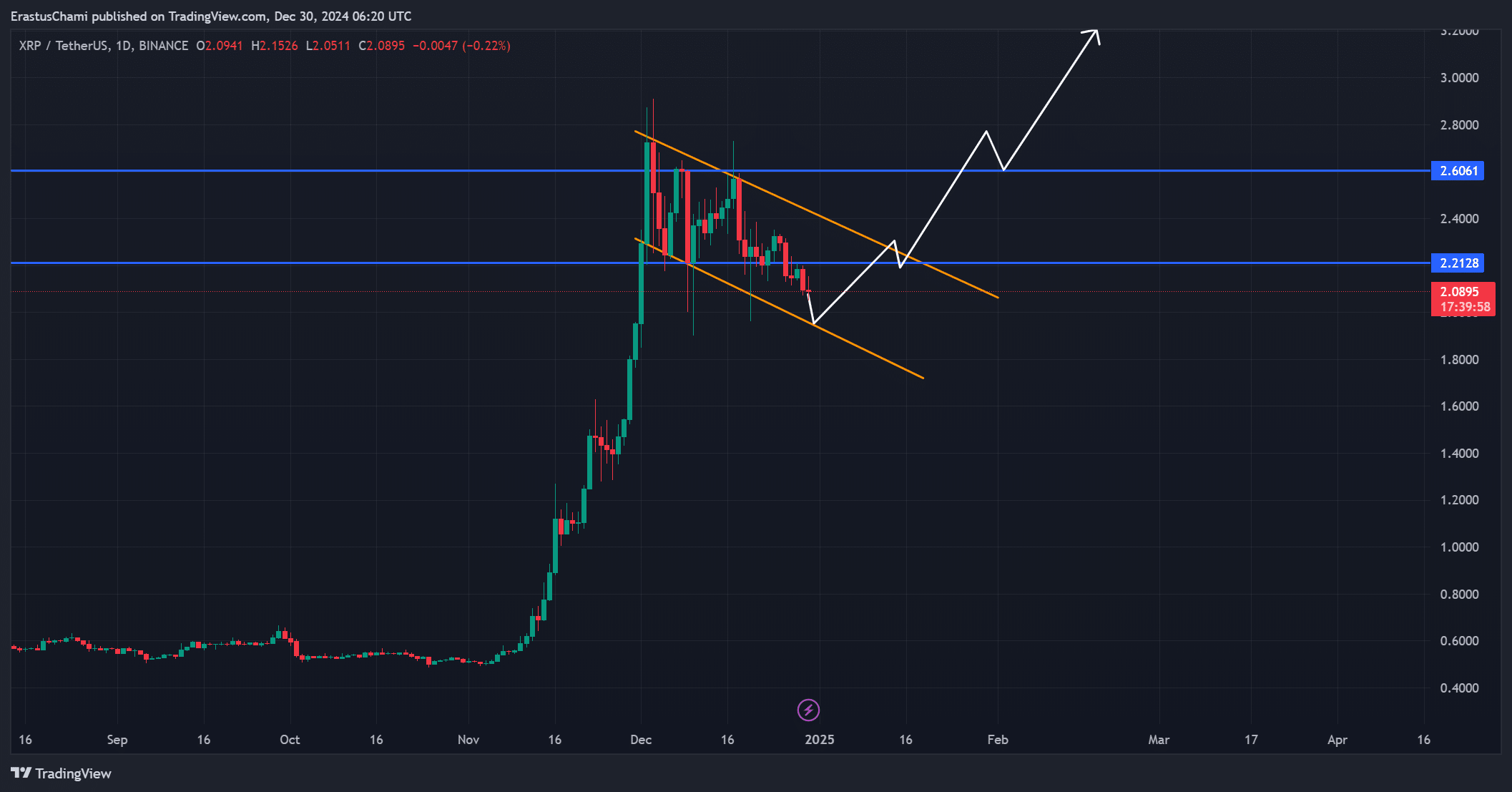

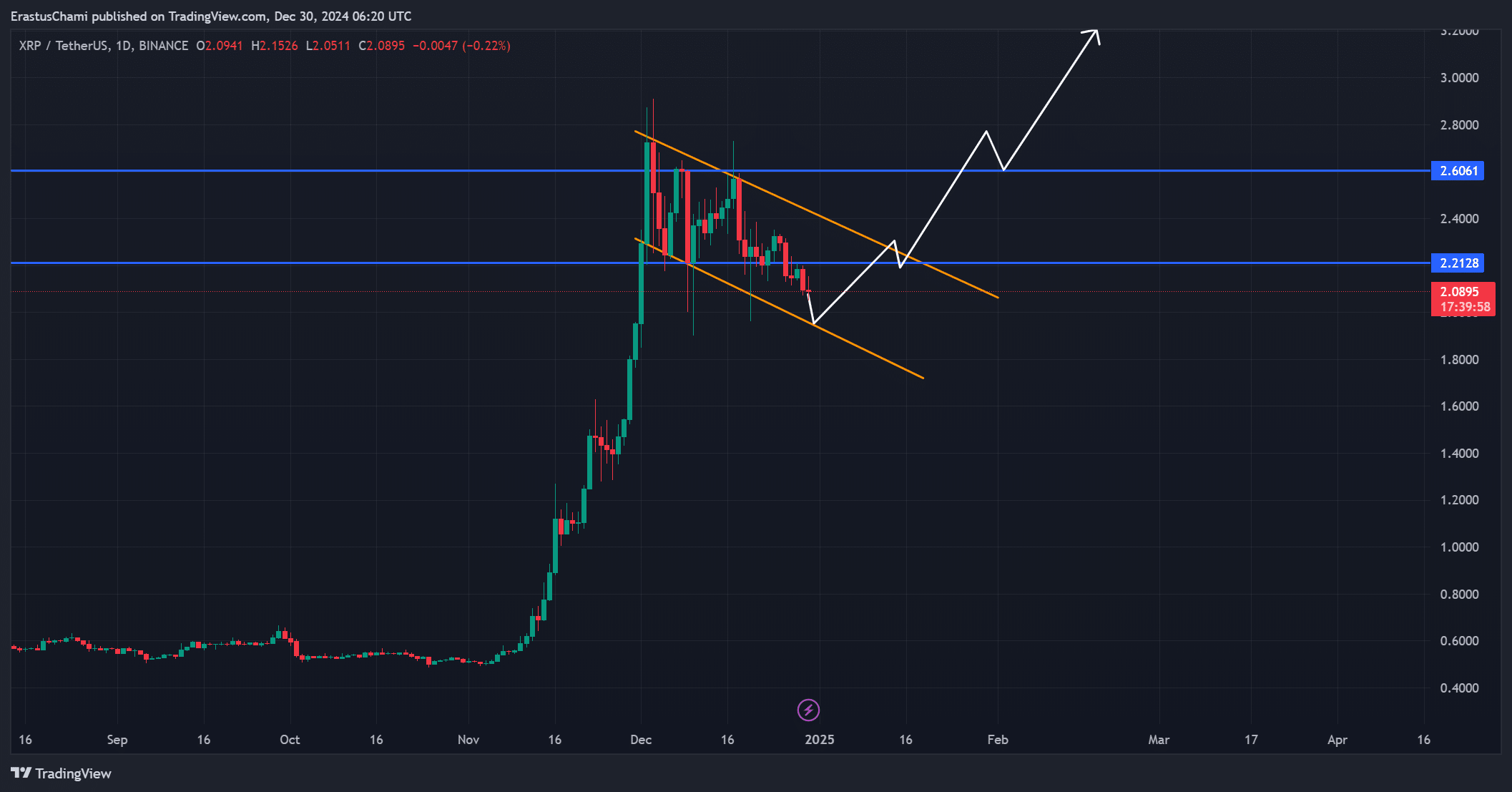

XRP price action reveals crucial levels

At press time, XRP traded at $2.09, reflecting a 4.14% daily decline. The token showed strong support around $2.05, while resistance at $2.60 could act as a pivotal breakout point.

Breaking above this resistance would likely set the stage for a long-term bullish rally. However, current price consolidation highlighted the challenges XRP must overcome to sustain upward momentum.

Source: TradingView

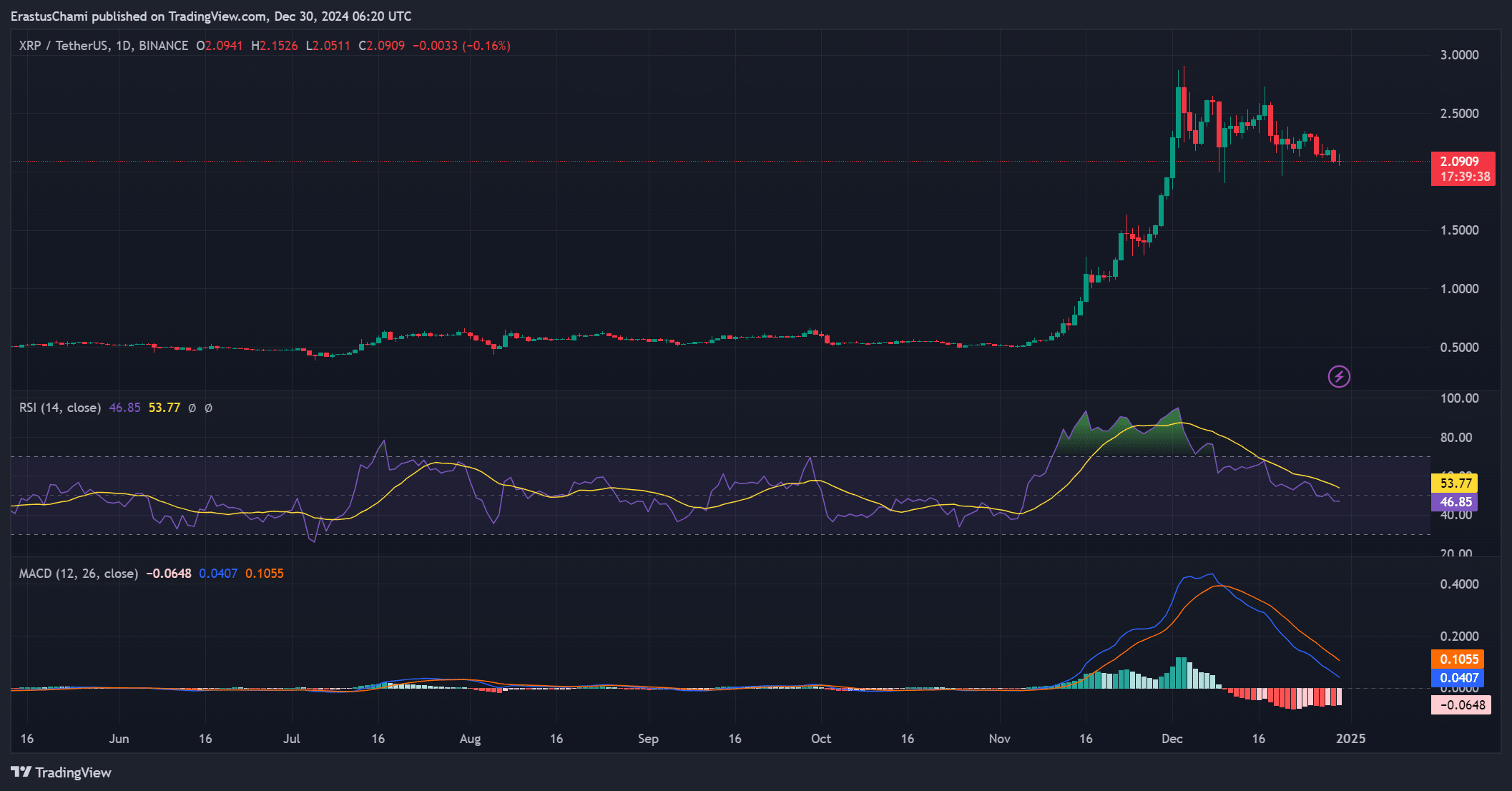

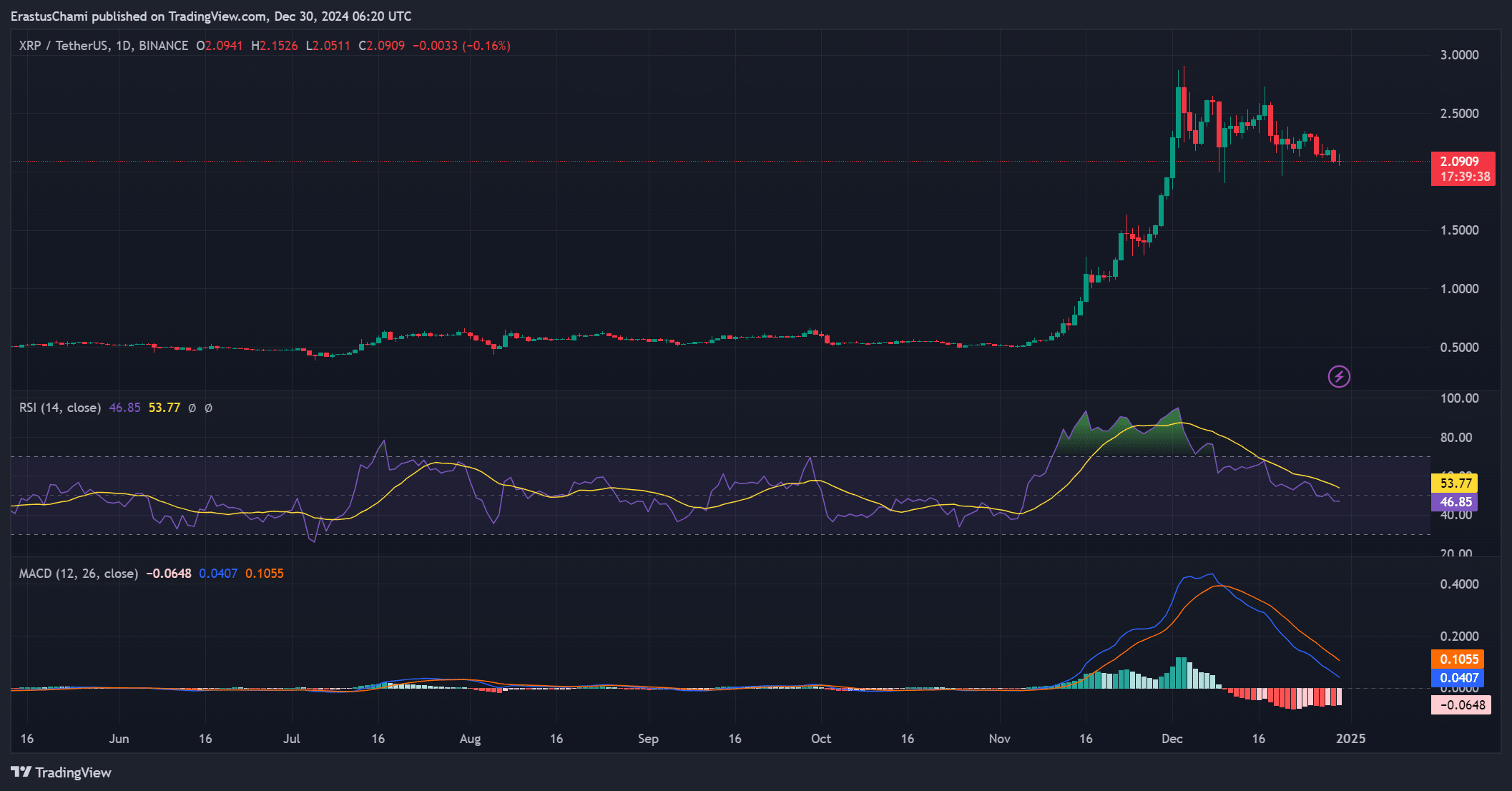

Technical indicators show mixed signals

XRP’s RSI was 53.77 at press time, reflecting neutral market momentum without overbought conditions. The MACD, however, displayed a bearish crossover, hinting at potential short-term downward pressure.

Despite these signals, the ongoing corrective phase aligned with Elliott Wave expectations. Therefore, any bullish reversal in technical indicators could confirm the start of a stronger upward trend.

Source: TradingView

XRP active addresses reflect growing adoption

The network activity remained strong, with active addresses rising by 1.16% in the past 24 hours to 37,847K. This growth indicates increasing adoption and ongoing interest in XRP’s ecosystem.

Additionally, consistent growth in network metrics reinforces long-term confidence in the token. Such fundamentals provide a solid foundation for future price appreciation.

Source: CryptoQuant

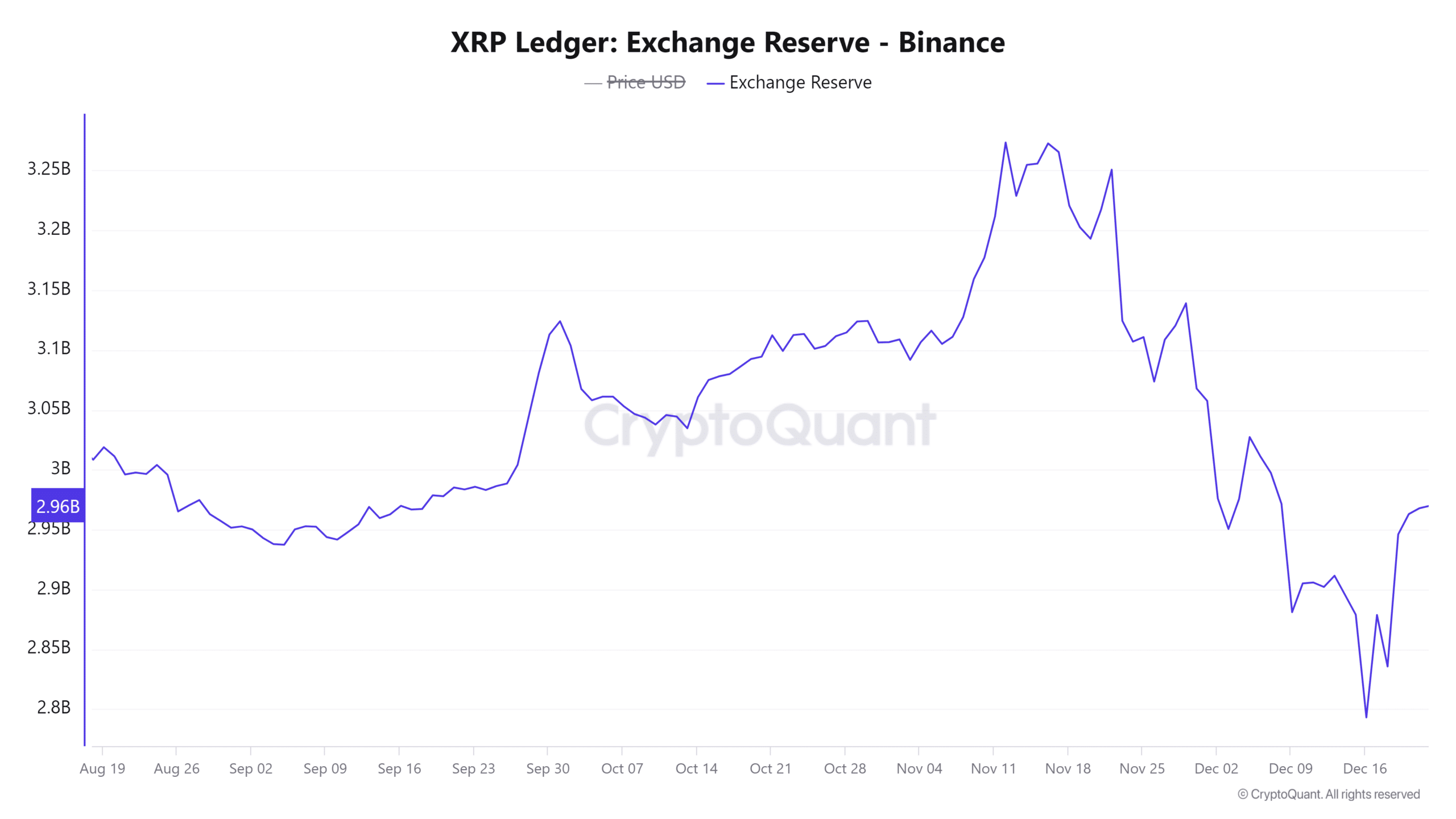

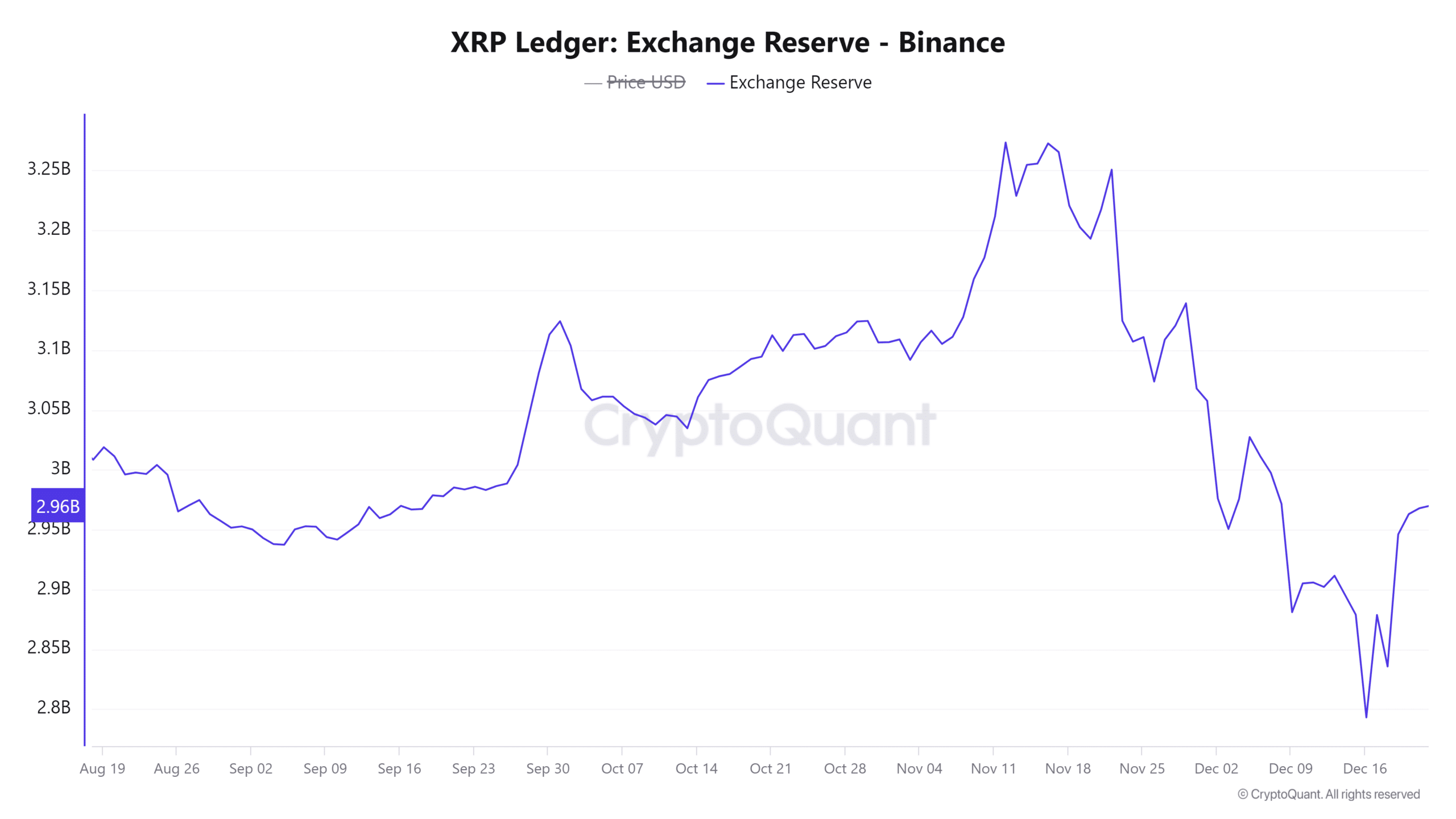

Exchange reserves signal reduced selling pressure

The exchange reserves have dropped by 0.15%, signaling reduced selling activity on exchanges. This trend suggests increased accumulation as investors transfer XRP to long-term holdings.

Lower exchange reserves often correlate with bullish sentiment, highlighting a positive outlook for XRP’s price movement. Consequently, this metric strengthens the case for a potential rally.

Source: CryptoQuant

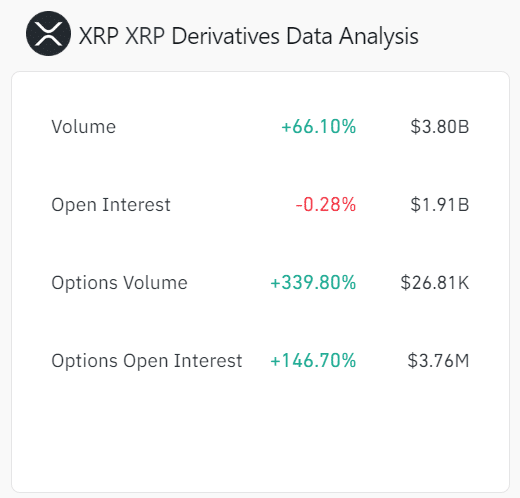

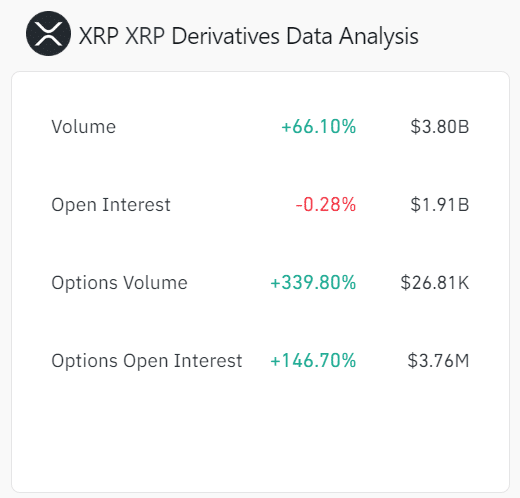

Derivatives data point to market optimism

The derivatives market shows notable increases, with trading volume surging by 66.10% and options volume up by 339.80%. Additionally, Open Interest reflected heightened investor engagement and confidence.

These numbers indicated a bullish market sentiment, which could fuel increased volatility and further price gains. Therefore, derivatives data is a critical factor to watch.

Source: Coinglass

Read XRP’s Price Prediction 2025–2026

Conclusion: Will XRP hit $15?

Based on Fibonacci, Elliott Wave analysis, and strong fundamentals, XRP could reach $15 by May 2025. However, achieving this target will require favorable market trends and continued investor confidence.

While challenges remain, the data supports optimism for XRP’s future, particularly if adoption and network activity continue to rise.