[ad_1]

- XRP surged by 12.91% over the last 24 hours

- Analyst believes a move to $11 may be likely if the altcoin breaks out beyond $2.73

Since declining to a low of $2 four days ago, XRP has made considerable gains on the charts. In fact, the altcoin climbed to hit $2.5 for the first time in 2 weeks thanks to these gains. However, despite pulling back slightly and trading at a price of $2.45 at press time, the altcoin still saw weekly gains of almost 13%.

And yet, XRP is still struggling to break out of its consolidation range. These prevailing market conditions have left analysts talking about the altcoin’s next move.

According to popular crypto analyst Ali Martinez, for instance, a potential pullback to $2.05 or a rally to $11 may be next, with Ali citing the $2.73 resistance level.

Assessing the market sentiment

In his analysis, Martinez observed that XRP is still consolidating within the pennant of a massive bull pennant pattern on the charts.

Source: AlionX

When this pattern forms, it often precedes the continuation of its previous trend.

According to Ali, although the altcoin is still in a bullish pattern, the altcoin risks a pullback. What this means is that until the $2.73 resistance is broken, a pullback to $2.05 could occur before it starts another uptrend.

Therefore, the price must first flip this level or the bullish trend will be invalidated. On the contrary, if the altcoin breaks above the $2.73-level, it can surge to a historical high of $11.

What do XRP’s charts say?

The aforementioned analysis suggested that since XRP is still stuck in a consolidation range, its next move will validate a bullish trend or invalidate it. However, when AMBCrypto looked into it, we found that XRP still has room for upside on the charts.

Especially since investors are still fairly bullish across the market.

Source: Santiment

For starters, XRP’s MVRV ratio rose over the past week to 4.66. While these levels are relatively high, it is yet to reach 7 which would mean overbought.

Historically, the altcoin’s MVRV has signaled the end of an uptrend when it reaches 6.5. For example, when XRP rallied to $2.8, its MVRV was 6.50. Also, the altcoin’s MVRV hit 15 when XRP’s price was $3.11 in 2018.

Simply put, the press time levels seemed to highlight a healthy market, with the price having some room for growth until the MVRV hits 7 at least.

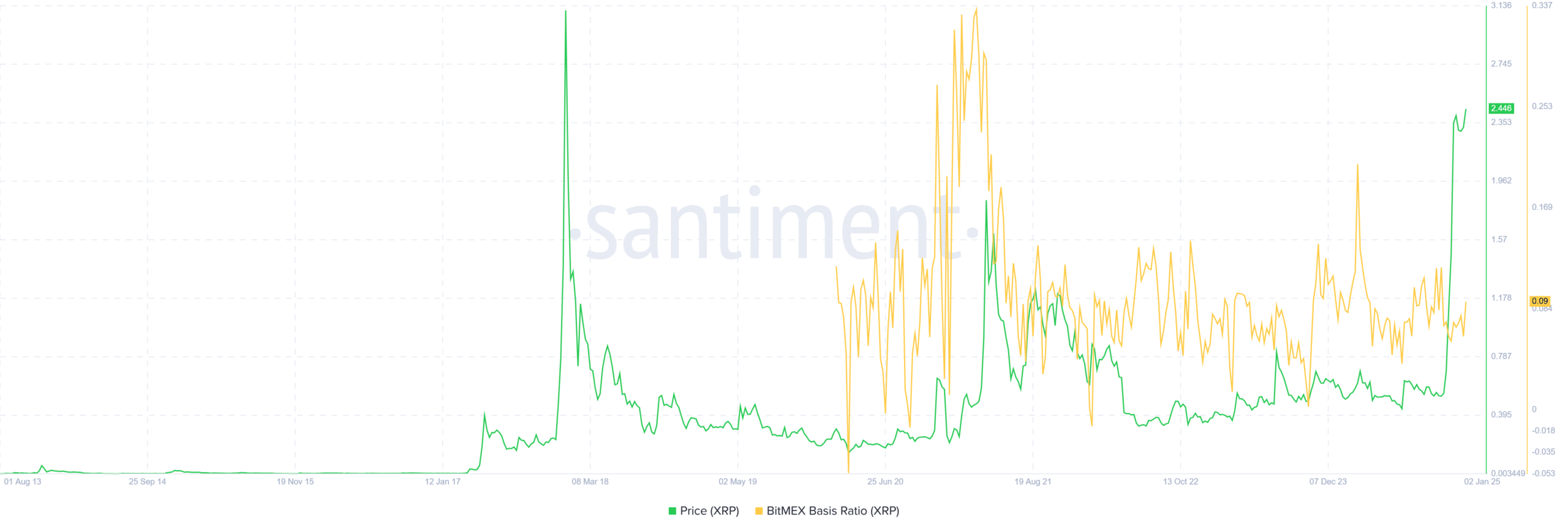

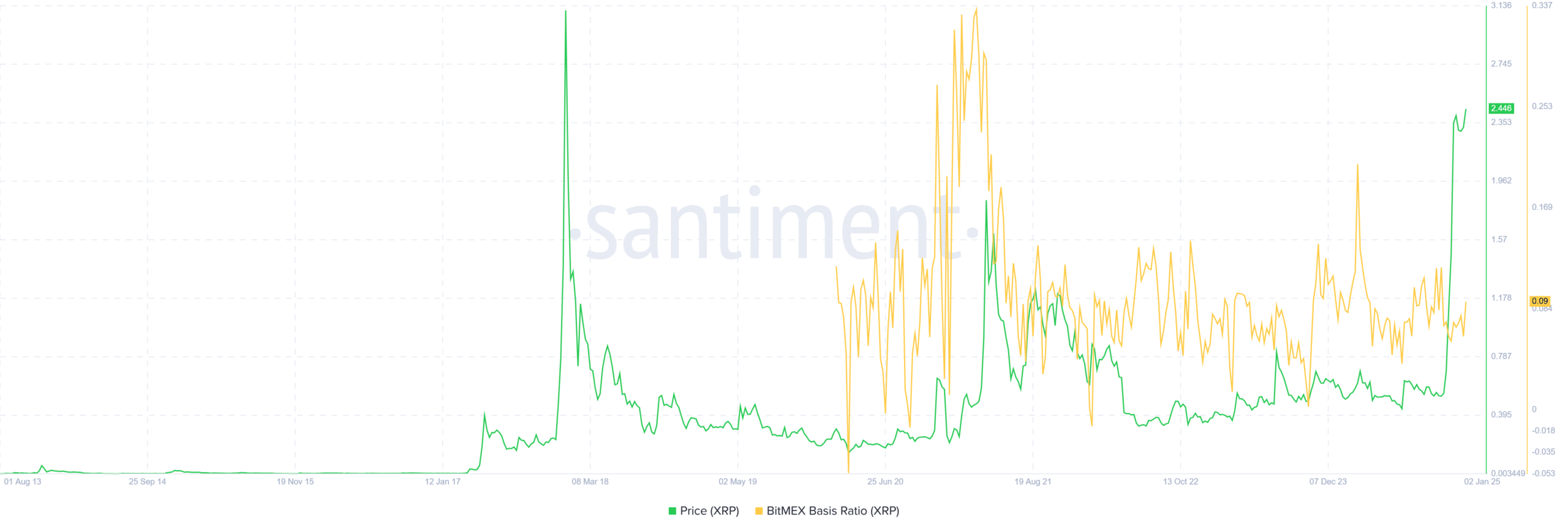

Source: Santiment

Finally, XRP’s investors have been bullish, as evidenced by a positive Bitmex basis ratio. When the basis ratio is positive, it means that there’s a high demand for long positions as investors are bullish and bet on the price to rise.

What this means is that while XRP has traded sideways over the last 2 weeks, the altcoin may be positioned for a breakout now.

A breakout from this consolidation will see XRP hit $2.88. A move above this level will see the altcoin rally to a new ATH since there’s no significant resistance above. However, if this push by bulls fail, XRP will drop to $2.

[ad_2]

Source link