- Avalanche saw a surge in user growth, signaling potential for a breakout in 2025

- Despite strong momentum, the network and altcoin remain overlooked, with whale activity and institutional interest rising too

Avalanche [AVAX] has been quietly gaining momentum, with new user sign-ups surging in Q1 2025. While the market often fixates on Ethereum’s L2 boom and Bitcoin ETFs, Avalanche’s rapid adoption has been overlooked somewhat.

In fact, history suggests that user growth often precedes major price shifts. With DeFi and GameFi activity accelerating, could Avalanche be positioning itself as the next breakout L1?

Avalanche – Numbers behind its explosive user growth

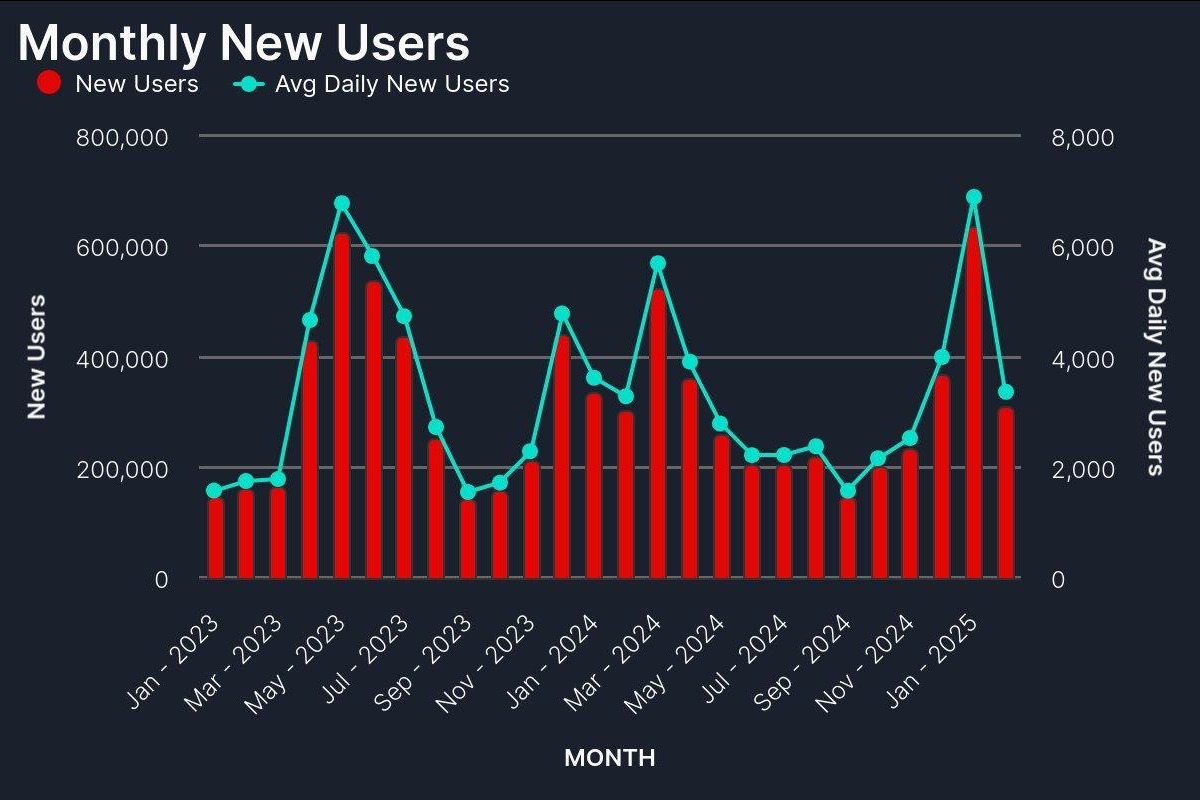

Avalanche’s new user growth has seen clear fluctuations over the past two years, with periodic cycles of rapid expansion followed by cooling-off periods. In fact, the latest surge in early 2025 was one of the strongest spikes since mid-2023. It saw monthly new users exceeding 600,000 and average daily sign-ups surpassing 6,000 at its peak.

This seemed to be in stark contrast to mid-to-late 2024, when user acquisition stagnated below 200,000 per month.

Source: X

The pattern suggested that Avalanche tends to experience bursts of adoption, likely triggered by key ecosystem developments or broader market conditions.

If this trend continues, the Q1 2025 spike could signal renewed investor and developer interest, potentially setting the stage for sustained growth.

What’s fueling this resurgence?

Avalanche’s recent surge can be attributed to a $250 million investment in December 2024, led by Galaxy Digital and Dragonfly Capital, aimed at expanding its ecosystem.

Additionally, the Avalanche9000 upgrade, launched on 16 December, reduced transaction fees by 75% – Driving a 38% hike in daily transactions and further boosting network activity. Institutional adoption has been rising too, with major players like BlackRock and Franklin Templeton leveraging Avalanche for tokenized funds.