- Updates from SOL Strategies and Galaxy reinforced a bullish long-term outlook

- However, SOL’s short-term has remained choppy amid muted retail interest

Institutional interest in Solana [SOL] has remained high, despite the token’s muted price action. On 07 March, Canadian-based SOL Strategies, a pioneer in corporate treasury through SOL, scooped up an extra 24k tokens worth $3.3M.

The firm now holds 250.7k SOL and has expanded to a comprehensive service provision in the ecosystem, including validator and staking services. According to the firm, the latest bid would boost its validator operations.

“This continued accumulation aligns with the Company’s strategy of expanding its SOL holdings to support its validator operations and long-term investment approach in the Solana ecosystem.”

According to Antanas Guoga, Chairman of SOL Strategies, the firm would buy more SOL during the “market meltdown.”

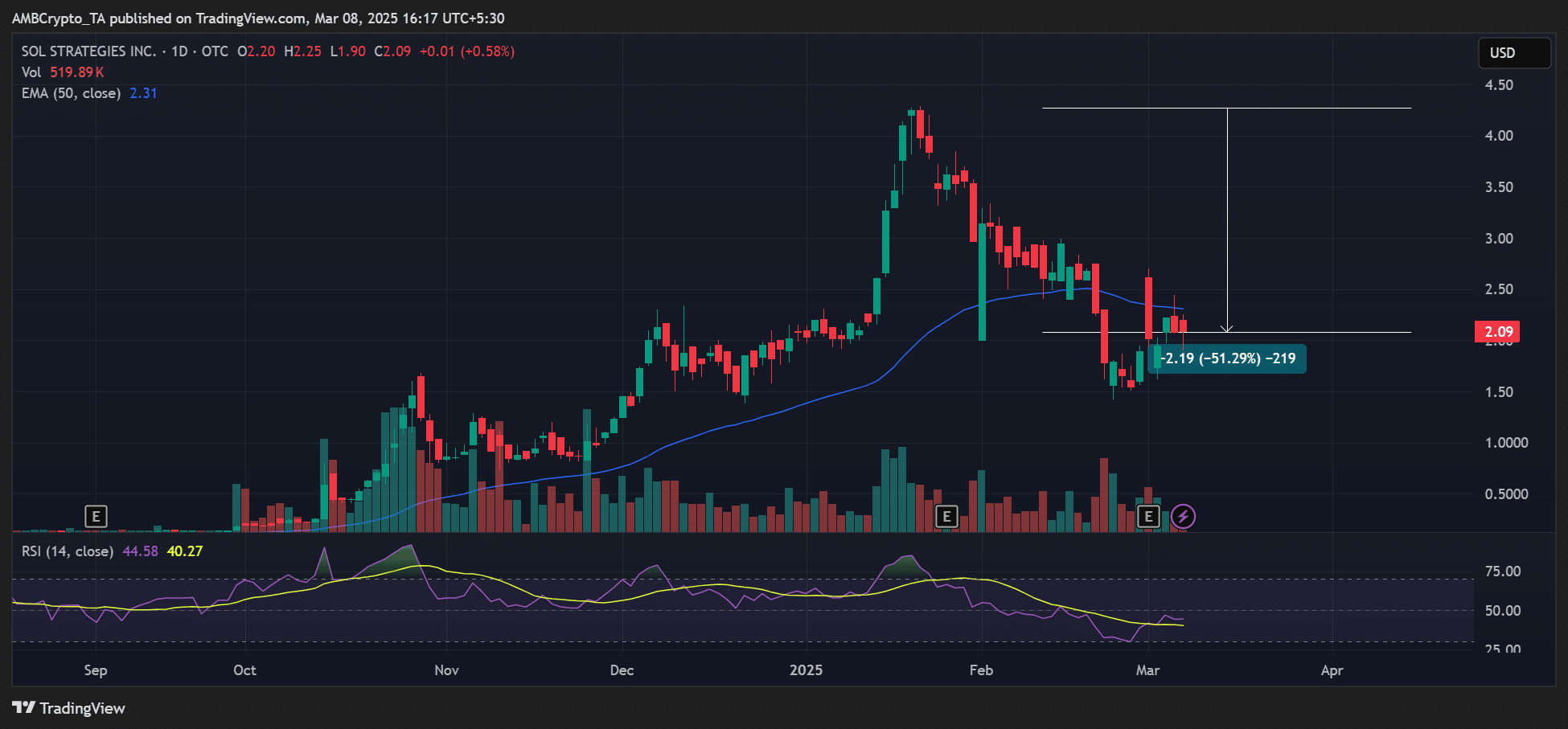

Lately, the firm’s stock (CYFRF) has been weighed down by SOL losses, dropping by 51% from $4.2 to $2. And yet, it is still recording post-U.S election gains of 156% right now.

Source: SOL STRATEGIES, TradingVIew

Galaxy stake $39M SOL

In other news, Galaxy Digital withdrew 282.5k SOL, worth $40.5M, from centralized exchanges and staked $39.15M (274,253 tokens), as per a report by LookOnChain.

Source: LookOnChain

In most cases, a hike in staking is a bullish signal and a sign of long-term confidence in the ecosystem. Simply put, large players are still positive about SOL’s outlook right now, despite the short-term whipsawing.

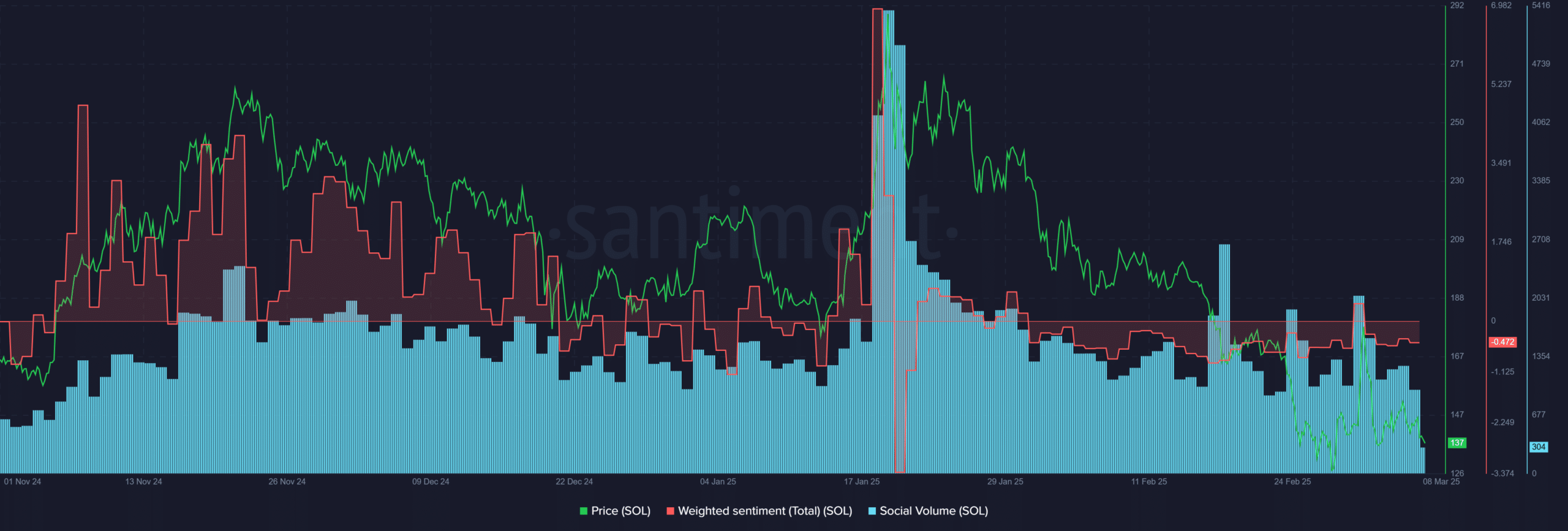

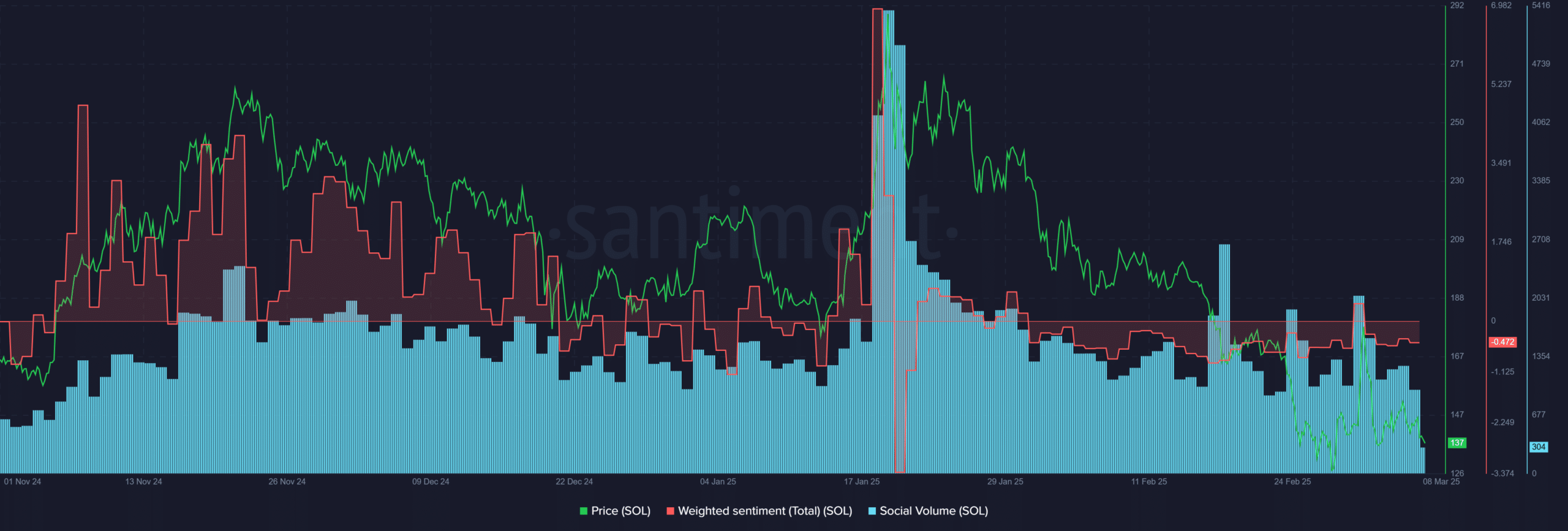

That being said, retail investors’ interest in the token has dropped significantly since the TRUMP memecoin debuted in mid-January. This was revealed by the low social volume, alongside overly weak sentiment after the LIBRA memecoin’s implosion.

Source: Santiment

Now, the sentiment briefly turned positive after the announcement of CME Futures on 1 March. However, it didn’t sustain the momentum for long. Unless the metrics flip positive, SOL’s recovery would remain elusive in the short term.

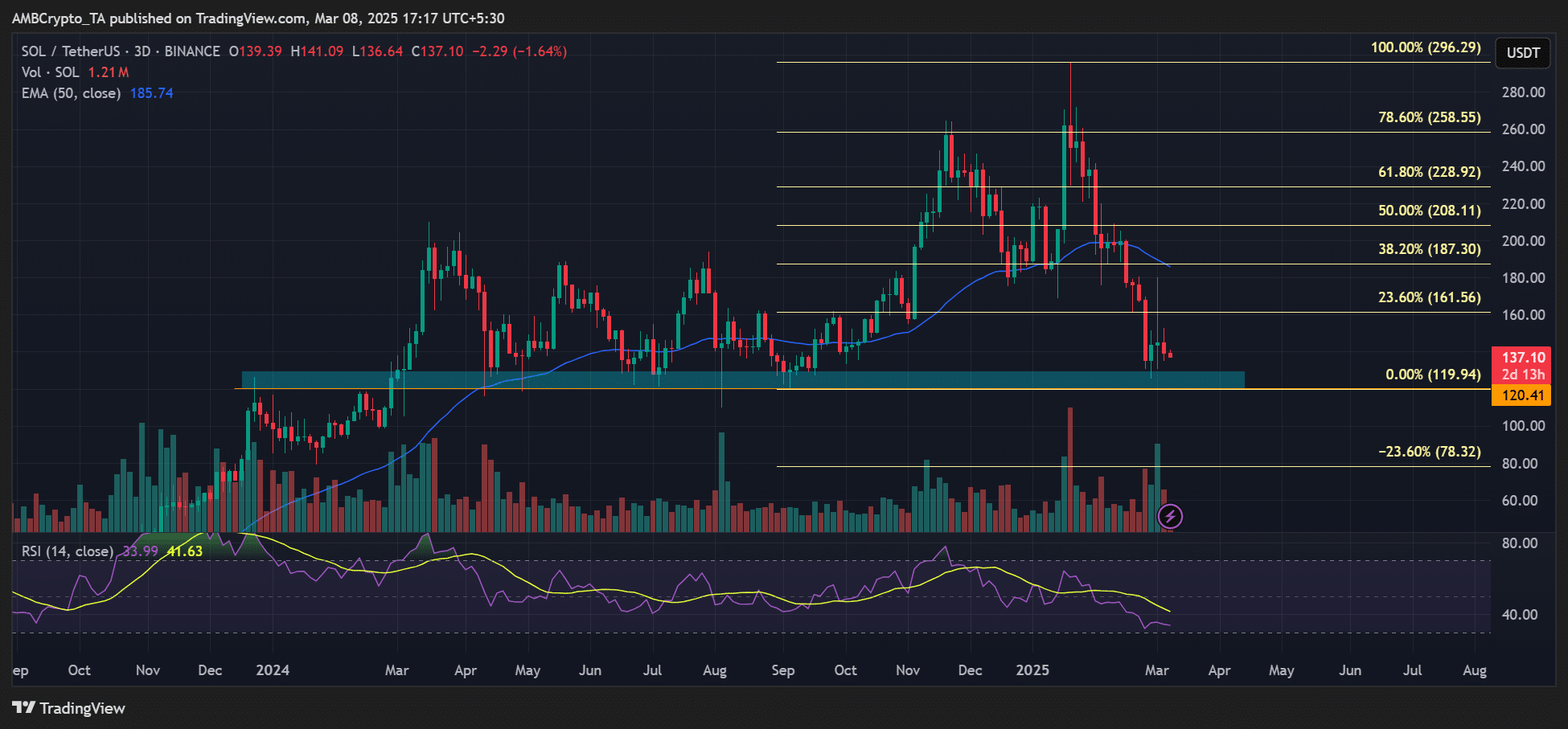

On the prediction site Polymarket, more bettors expect the altcoin to drop to $130 by the end of March. Interestingly, Options traders on Deribit are eyeing $200 for end-March Options expiry, but they are only pricing a 10% chance of SOL hitting the target.

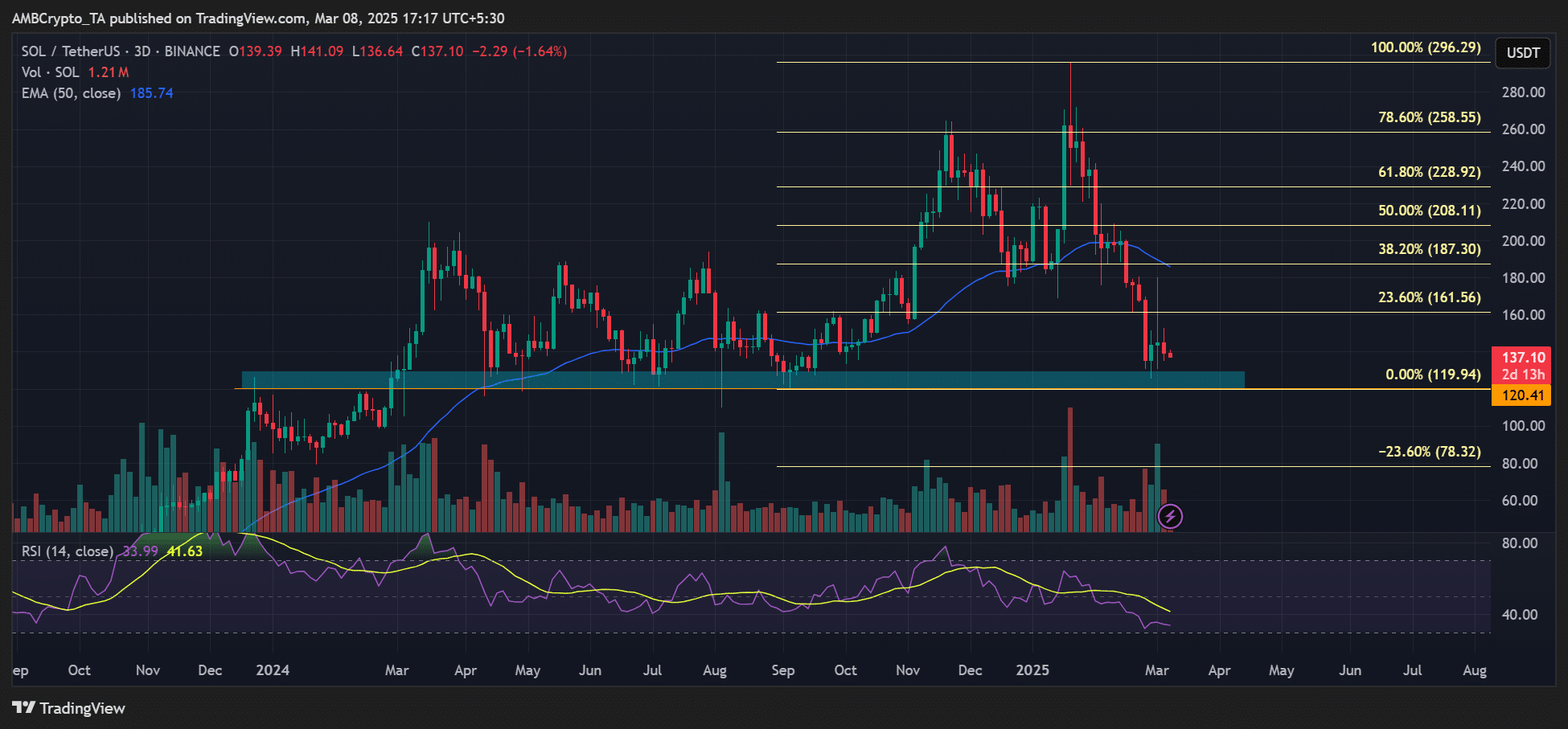

Meanwhile, the $120 price zone has remained a key support since early 2024. Bulls could attempt to defend it if downside risk extends to the level.

Source: SOL/USDT, TradingView